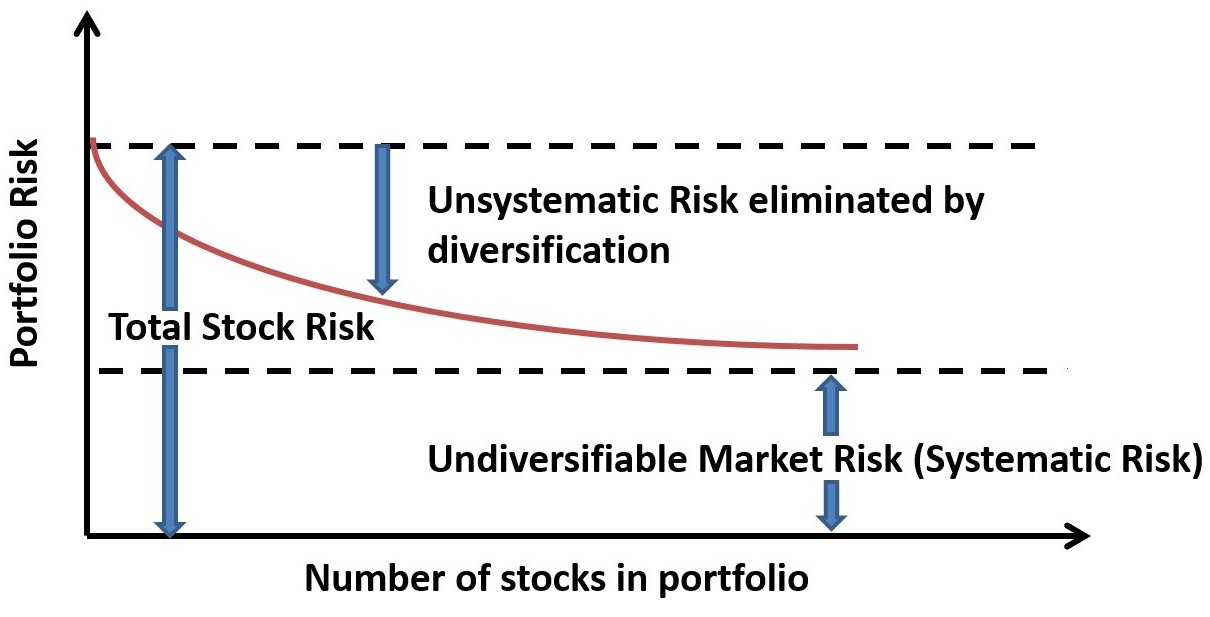

A smart stock trader or investor has to learn to manage the risks before one could achieve the goals of profit. There are 2 main types of risks for stocks, unsystematic and systematic risk.

1) Unsystematic Risk (Level 1-2)

This risk is related to specific stock/business or an industry/sector. For example, there could be an unexpected business scandal or company having difficulty to pay debt, etc, resulting in major correction in share prices which may not be reversible. Sometimes the scale could be for a specific industry, eg. Unsystematic and oil and gas crisis which affects more stocks with similar type of industry.

In general, diversification of investment portfolio with 10-20 stocks over 3 or more sectors / countries, could help to reduce the unsystematic risk significantly as each stock only contribute to 5-10% of portfolio. As a retail investor, due to lack of time for close monitoring, a portfolio of 10 stocks with strong fundamental in business will be sufficient.

2) Systematic Risk (Level 3-4)

This risk applies to entire stock market, affecting most of the countries, sectors and businesses globally. For example, global financial crisis (subprime crisis in year 2008, dotcom bubble in year 2000, etc) or regional financial crisis (Euro Debt Crisis over the past decade, Asian Financial Crisis in 1997).

In general, diversification could not help to minimize systematic risk since most of the stocks would be affected for this large scale of stock market risk at country or global level.

Instead, a smart investor could apply market optimism strategy to minimize systematic risk through capital allocation in different asset classes. When global stock market is at high optimism (over 75%), one could reduce the risk in stock market through progressive profit taking, converting the stocks into cash as short to medium term opportunity fund. When there is any regional or global financial crisis, the unsystematic risk would become opportunity to buy low.

An all rounded investor would combine these 2 key factors to improve the winning rate in stocks:

1) Formation of stock portfolio with 10 stocks with strong fundamental to reduce unsystematic risk

2) Follow optimism of global stock market to buy low sell high, going against the systematic risk.