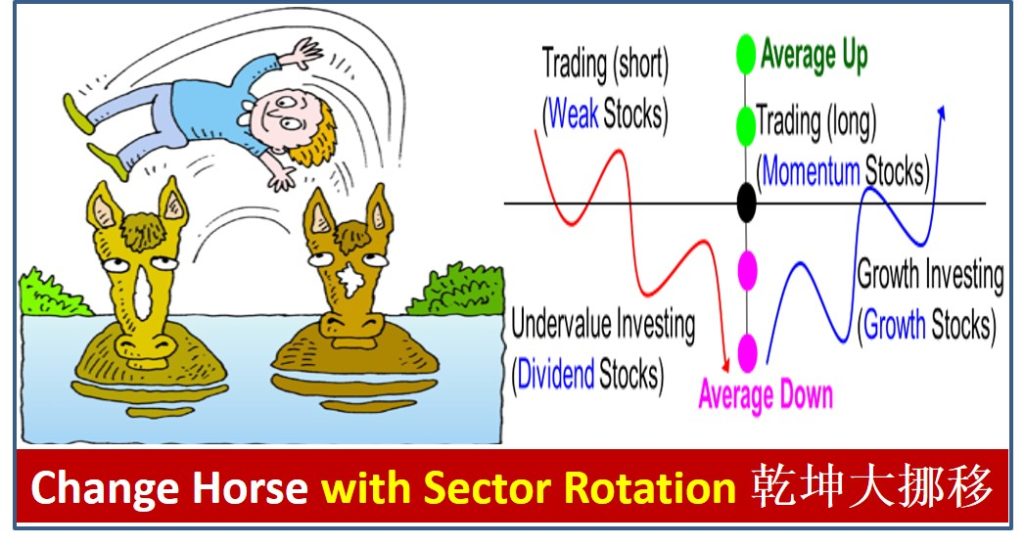

Since wind direction is changing in global stock market with sector rotation, readers may consider to “change horse” for some stocks from past momentum stocks which are losing steam (eg. Technology / Software / Glove / Healthcare benefiting from pandemic, etc) to cyclic giant stocks (eg. Bank, Casino, Hotel, Oil & Gas, Healthcare affected by pandemic, etc) which are recovering from lower optimism.

After recent US election with potential new world order (US vs world/China) by President-Elect, Joe Biden, supported by positive COVID-19 news (2 vaccines are proven to have effectiveness over 90%), global stock markets become more “greedy” and rally includes most stocks, especially for many pandemic affected sectors. It means the stock market is in transition from K-Shape recovery (uptrend vs downtrend for 2 main groups) to overall U-Shape recovery.

Growth or momentum stocks are usually suitable to average up with support of bullish economy, strong business fundamental and uptrend prices. However, when there is competition of fund, money would find its way to look for potential opportunity of quicker and higher return. Power of growth investing is with the holding power to compound the return for higher capital gains. “Buy High Sell Higher” is sustainable only if the business is growing with faster pace, supported by strong economic moat.

Cyclic stocks are usually suitable for average down with condition they are giant stocks which are temporarily affected by sector, country or global financial crisis. During low optimism period, these giant stocks could continue to pay dividend (some even with dividend yield of 5-10%, much better than bank interest rates of less than 0.5%) as bonus, when the uptrend cycle is triggered expectedly in future (with uncertain date, depending on pace of sector recovery and market wind direction of greed and fear), those who could take calculated risks could enjoy the enormous capital gains. “Buy Low Sell High” is only meaningful if supported by value investing.

Stock investors or traders may consider to rebalance stock portfolio with “Change Horse” among the sectors, diversifying over 10-20 global giant stocks with average-up or average-down strategies, aligning with own unique personalities (eg. short term trading or long term investing).

COVID19 stock crisis recovery rally may be sustainable only if there are more support by Biden after officially become US president on 20 Jan 2021. Political fight between Senate (controlled by Republican currently) and Democrat (US president & the House) may continue for 2 more years unless the last 2 Senate seats in state of Georgia (re-election in Jan 2021) could be won by Democrat, only then major decision (Eg. QE) could be passed easily.

Biden is likely more gentle in global trade policies as past Democrat presidents (eg. aiming win-win or balanced approach, not win-lose or extreme approach as Trump). This would be helpful for global stock markets (alliance and opponent of US would be more relieved). However, since Trump as set a “high standard” against China, Biden could not be too gentle in the beginning as Trump may continue to gather momentum to come back again 4 years later to run for US president again.

===================================

There are over 1500 giant stocks in the world based on Dr Tee criteria, choice of 10 Dream Team giant stocks have to align with one’s unique personality, eg. for shorter term trading (eg. momentum or swing trading) or longer term investing (cyclic investing, undervalue investing or growth investing). Readers should not just “copy and paste” any stock (What to Buy, When to Buy/Sell) as successful action taking requires deeper consideration (LOFTP strategies – Level / Optimism / Fundamental / Technical / Personal Analysis) which you could learn further from Dr Tee Free 4-hr Webinar.

Drop by Dr Tee free 4hr webinar (learning at comfort of home with Zoom) to learn how to position in global giant stocks during COVID-19 stock crisis with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Zoom will be started 30 min before event, bonus talk (Q&A on any investment topics from readers) for early birds. There are many topics we will cover in this 4hr webinar, Dr Tee can have more time for Q&A if you could stay later after the webinar, you could ask on any global and local stocks including but not limited to 30 STI component stocks:

Ascendas Reit (SGX: A17U), CapitaLand (SGX: C31), CapitaLand Integrated Commercial Trust (SGX: C38U), City Development (SGX: C09), ComfortDelGro (SGX: C52), Dairy Farm International (SGX: D01), DBS Bank (SGX: D05), Genting Singapore (SGX: G13), Hongkong Land (SGX: H78), Jardine Cycle & Carriage (SGX: C07), Jardine Matheson Holdings JMH (SGX: J36), Jardine Strategic Holdings JSH (SGX: J37), Keppel Corp (SGX: BN4), Keppel DC Reit (SGX: AJBU), Mapletree Commercial Trust (SGX: N2IU), Mapletree Industrial Trust (SGX: ME8U), Mapletree Logistics Trust (SGX: M44U), OCBC Bank (SGX: O39), SATS (SGX: S58), Sembcorp Industries (SGX: U96), Singapore Airlines (SGX: C6L), Singapore Exchange (SGX: S68), Singtel (SGX: Z74), ST Engineering (SGX: S63), Thai Beverage (SGX: Y92), UOB Bank (SGX: U11), UOL (SGX: U14), Venture Corporation (SGX: V03), Wilmar International (SGX: F34), YZJ Shipbldg SGD (SGX: BS6).

Dr Tee will cover over 20 case studies, Singapore giant stocks, eg. CapitaLand Mall Trust (SGX: C38U), Singapore Exchange (SGX: S68), Keppel Corp (SGX: BN4), Top Glove (SGX: BVA), Jardine Matheson Holdings JMH (SGX: J36), Vicom (SGX: WJP) and many others, Malaysia giant stocks, Hong Kong giant stocks and US giant stocks, both long term investing and short term trading.

There are limited tickets left for this 4hr free webinar, please ensure 100% you could join when register: www.ein55.com