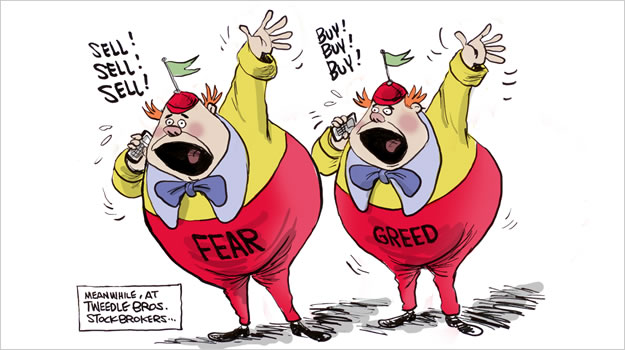

Good news continues to be bad news, affected by stock market greed and fear. Stock market is forward looking, usually moving ahead of economy. When economy is strong, stock investors forecast on next moves such as further interest hikes, therefore cautious in each move from now.

If there are 4 times of 0.25% interest rate hike = 1% increment in the next 1 year, the US interest rate would be 1.5 + 1 = 2.5%, US treasury bond yield would exceed 3%. This implies that the next 1 year would be very exciting for both stock traders and investors if they know how to position based on their personalities against the stock market greed and fear.

1) Stock Traders – Leveraging on Stock Market Greed

In the last phase of bull run, mixed of worriness and excitement, stock market may achieve an euphoric stage before ending the episode of a decade long market cycle. This is a high chance for stock traders to make some quick profits but only those who knows how to exit could keep the profits, otherwise may lose more than the earlier earning.

2) Stock Investors – Leveraging on Stock Market Fear

After the investment party (rally) is over, while waiting for global government to clean up the mess, stock market would fall significantly, resulting in the global financial crisis. The black swan would help smart investors to buy the desired global giant stocks with more than 50% discount, which would translate to tremendous capital gains in future.

A smart trader or investor would leverage the right emotion against the stock market greed and fear, creating opportunity of winning. Learn how to align your personality to profit from the stocks market greed and fear, register for free investment course by Dr Tee.