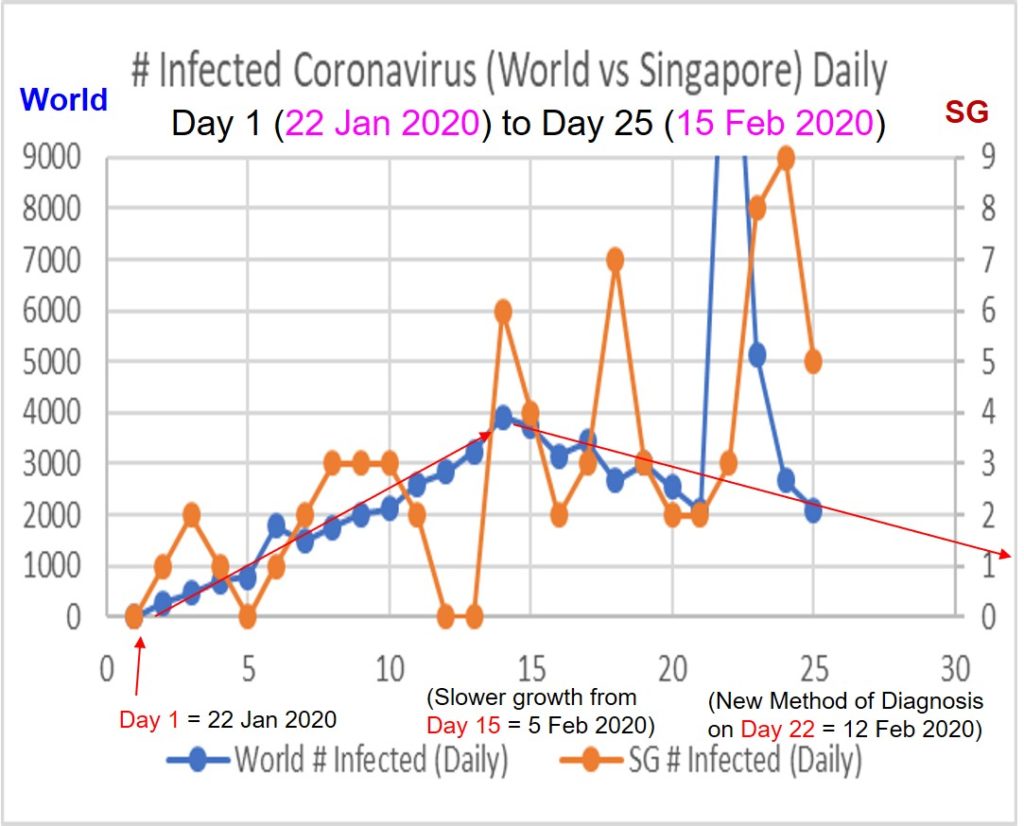

After China Hubei applied New Method of diagnosis, # cases on 12 Feb 2020 (Day 22 on chart given since monitoring from 22 Jan 2020) surged to an unbelievable number. As pointed earlier, there was no major change in actual condition, the dramatic daily difference is mainly due to one-time adjustment due to new method. However, it disturbed the earlier analysis (was downtrend nicely in # infected cases for 1 week from 15 Feb to 21 Feb 2020), therefore we need to reestablish the confidence in trend with more days of further monitoring.

Good News:

1) Based on last 3 days with New Method of diagnosis in China Hubei, the relative trend is down, implying the absolute # infected could be still a myth but more importantly the downtrend is hopeful, either using Old Method (1 week data) or New Method (3 days data).

2) In fact, the # infected cases old New Method has approached the Old Method of about 2000 daily cases, therefore it is possible to integrate both New and Old Method together but the projected peak for World (mainly for China Hubei) is extended by about 1 week from earlier 22 Feb 2020 forecast to end of Feb 2020.

China Hubei is the original source of Coronavirus started around Dec 2019, if new cases could be limited to very few (peak = 95-99% peak, may not be 0 case, there will be still a few cases each day), possible cross infection to other China cities and also to other countries will be limited. It means, each country or city, just need to focus in own measures to limit the internal spreading of Coronavirus, less worry of external import of # infected cases (eg. cruise, airline, etc).

Bad News:

1) The Good News above is based on the assumption that the reported data is true (at least within the criteria used, either Old Method or New Method) and there is no second wave of infection (eg. China Hubei may stop locked down of city when peak is reached by end of Feb, work force back to work or travel to other cities could create second surge, just need a few super spreaders to ignite the fire again).

2) There is clear divergence in growth rate between China Hubei and other cities or countries (eg. Japan, Singapore, etc). This is logical as the first case in China probably started in Dec 2019, possible to reach a peak by end of Feb 2020 (if there is no second wave) but other countries mostly have first import case from Hubei in Jan 2020 (eg. Singapore first confirmed case was 23 Jan 2020), therefore there is a time delay of about 1+ month. So, even China may have reached the peak by end of Feb 2020 (proven by slower growth rate), the high growth phase still continue in other cities and countries, therefore may take another 1+ month.

It means China is leading, both the starting, growing, slowing and ending of this Coronavirus crisis. Despite we are in Singapore or another country, monitoring of China trends would still help us to better estimate own condition.

=========================

There is a surge in # infected cases over the past 1 week in Singapore, still under high growth rate. This is similar to Technical Analysis of stock for Coronavirus: higher high and higher low with support around 2 cases. It means Singapore has to achieve lower high and also breaking support of daily cases of 2 (eg. 0 or 1) to see the first reversal signal from higher to slower growth rate.

At the moment, Coronavirus is still a mini black swan, stock market has digested the initial fear. However, it is important to monitor the development, see if mini bear could become a big bear eventually.

Under the worst case, even Coronavirus is beyond control (eg. after either locked down of cities or countries in China or Red Dorscon Alert in Singapore with no people going for work or school for a period of time), likely will become a stronger version of H1N1 which is wide spreading yearly, living in “harmony” without great fear by human, despite it is causing tens of thousands of death yearly since 2009 outbreak (even till today under “Flu Type A”) but when people hear it is flu, fear would drop due to its low fatality of 0.05%, ignoring it is wide spreading.

Coronavirus is like a hybrid of SARS and flu: more contagious than SARS but spreading less than seasonal flu; less deadly compared to SARS but more severe than common flu around. Coronavirus would continue to evolve, when more people in the world are infected, fatality would drop due to stronger immunity developed through joint effort of human (despite vaccine may or may not be available).

In short, we need to stay calm, do the right things each day, as normal as possible, life still need to go on with viruses around.

After free oneself from fear of Coronavirus (either defeat it or accept it), don’t forget to learn about investment, converting the current health crisis into new investment opportunity.

Learn Here with Free 4hr investment course by Dr Tee: www.ein55.com