DBS Bank (SGX: D05) is the largest bank in Southeast Asia, an iconic national bank of Singapore with Temasek as major shareholder (29% ownership). DBS also owns POSB, a common people’s bank in Singapore. DBS is a cyclical stock, performance depends on economic cycle and global stock market cycle, sensitive to changes in global central banks interest rates.

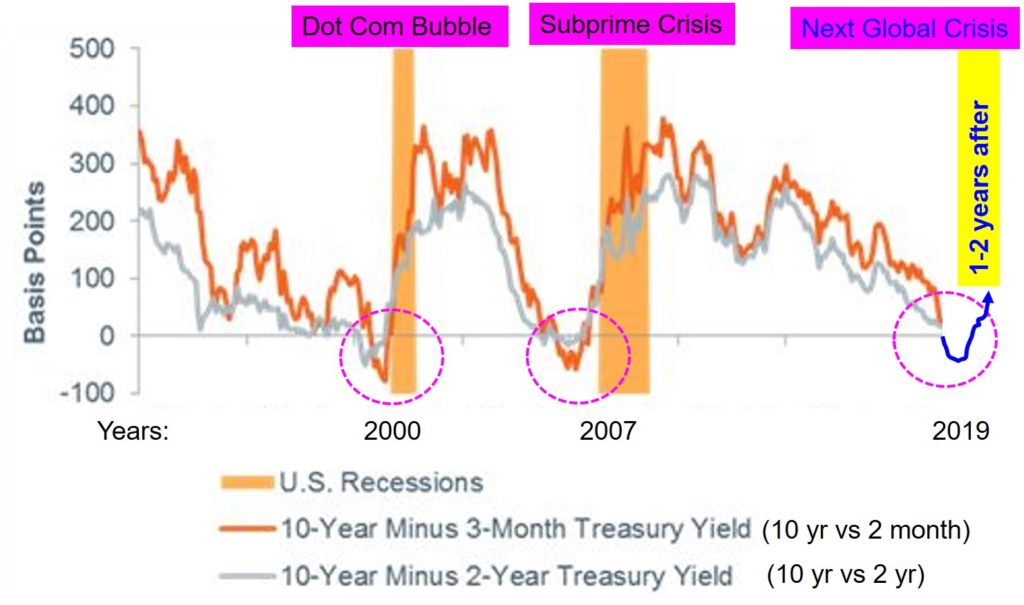

Due to Coronavirus induced stock market crash over the past 1 month, the Fed has decided to cut US bank interest rates, firstly by 0.5%, then again by another 1%, dropping to historical low of 0-0.5%, hoping to stimulate and sustain the current US economy. Global central banks include Singapore are expected to follow the footstep to lower the domestic interest rates.

In general, banks have several ways to make money, there are 2 main types:

1) Interest related income

Main revenue is through the difference of deposit (eg. 1%) and loan (eg. 2%), or the Net Interest Margin (NIM) to make money from cash in and out the bank. Usually when interest rates are at higher level (eg. over the past 5 years), NIM will be relatively higher, therefore most banks (including DBS, OCBC, UOB) would make money easily. Therefore over the past few years, there is no strong need to read the quarterly financial reports of 3 major banks in Singapore as the interest related income would be higher naturally.

However, with the downtrend US interest rates from over 2% to 0% over the past 1+ year, bank stocks have to work harder in other revenue generator to maintain the profits.

2) Non-interest related Income

Traditional banks mostly make money from interest income but modern banks also depend on investment (bank could use the cash obtained at low interest to make investment for higher return), insurance (many banks also have insurance business, eg. OCBC with Great Eastern (SGX: G07), UOB Bank (SGX: U11) with United Overseas Insurance (SGX: U13), etc), credit card (now you may understand why you may have so many credit cards issued by various banks, including DBS / POSB).

During bullish economy, investment income could be significant, therefore usually bank stocks prices following the economic cycle, especially for DBS. About every 10 years, there will be a stock market cycle induced by a global financial crisis, eg. Year 1997-1998 (Asian Financial Crisis), Year 2003 (SARS/Gulf War), Year 2008-2009 (Subprime Crisis) and potentially Year 2020 (Coronavirus Crisis?) which is still on-going, still a mini bear at the moment.

In every global financial crisis (eg. Years 1997/2003/2009), we may observe some fearful people queue up in front of DBS bank (and also other banks), worry bank may go “bankrupt”, therefore would like to withdraw the money to keep “safely” at home. As a result, DBS share prices dropped to less than $10/share in these crisis, but recovering above $10 or even $20 when people forget again several years later.

Banks usually keep only a minimum sum of cash (could be less than 10%) for regular operations, lending out most of the cash to make money. If everyone comes to withdraw money (see many years ago during Euro Debt Crisis, photo showing some elderly people crying in weaker bank in Greece, not able to withdraw money), then even the strongest bank in the world may not able to give the cash on time. Therefore, bank with strong sponsor is crucial, especially for DBS bank backed by Temasek with Singapore government with AAA credit rating supporting behind.

So, a smart way of stock investing is to wait for DBS bank share to drop to less than $10/share again during the next global financial crisis or observe any long queue in front of DBS bank to withdraw money again (not a reliable way, just a form of Personal Analysis, PA, for confirmation if needed).

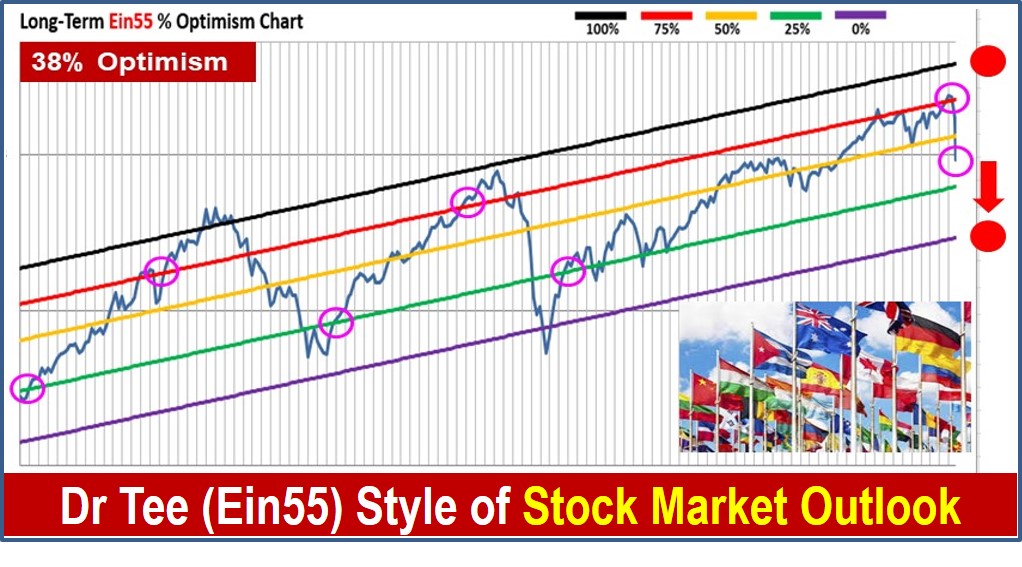

Currently DBS is about $18+, below critical $20/share support, share price is about 40% optimism, just below the fair price of $21. The Price-to-Book (PB) ratio has dropped below the historical low of 1, currently at 0.97 (about 3% discount, not much, but rarely happen to DBS). In order to buy at unfair price (may not be <$10), one has to follow optimism strategy to consider DBS bank at share price <25% Optimism, a few may even aim for 0% optimism to take full advantage of crisis as many other giant stocks.

Value investing is simple, knowing the value, then wait for the discount before buying the stock. Only difference is how much discount is sufficient may depend on individual, eg. DBS share prices at $20, $15, $10, $5 … However, when one is too greedy for the highest discount (eg. looking at historical low price which usually is not a good way as history may not repeat in this way), eg. buying DBS at $1/share, as probability is low (although not 0%). Assuming DBS may drop to $1/share, I doubt few people dare to buy the stocks then because there could be a crisis similar to the scale of 1929 Great Depression.

In short, Buy Low enough (Sell High in future for cyclic stock such as DBS), no need to buy at the lowest (else one may miss the perfect timing, totally lose the investment opportunity). A smart investor may also integrate with trading to avoid buy low get lower to buy undervalue stocks during bear market. For further risk management, one may consider 10-20 giant stocks to buy strong fundamental stocks in 10 different sectors or countries for diversification, even if DBS really go “bankrupt” one day, the potential loss is controlled within 5-10% of investment portfolio.

There are 30 Banking & Finance stocks in Singapore (an investor needs to focus only on giant stocks) with DBS Bank as the leader:

AMTD IB OV (SGX: HKB), B&M Hldg (SGX: CJN), DBS Bank (SGX: D05), Edition (SGX: 5HG), G K Goh (SGX: G41), Global Investment (SGX: B73), Great Eastern (SGX: G07), Hong Leong Finance (SGX: S41), Hotung Investment (SGX: BLS), IFAST Corporation (SGX: AIY), IFS Capital (SGX: I49), Intraco (SGX: I06), Maxi-Cash Finance (SGX: 5UF), MoneyMax Finance (SGX: 5WJ), Net Pacific Finance (SGX: 5QY), OCBC Bank (SGX: O39), Pacific Century (SGX: P15), Prudential USD (SGX: K6S), Singapore Exchange (SGX: S68), SHS (SGX: 566), Sing Investments & Finance (SGX: S35), Singapore Reinsurance (SGX: S49), Singapura Finance (SGX: S23), TIH (SGX: T55), Uni-Asia Group (SGX: CHJ), UOB Bank (SGX: U11), UOB-KAY HIAN HOLDINGS (SGX: U10), UOI (SGX: U13), ValueMax (SGX: T6I), Vibrant Group (SGX: BIP).

DBS is a good cyclic bank stock which also pay dividend consistently (currently over 6% dividend yield) if one could align with market cycle, applying optimism strategies. DBS is not suitable for growth investing (OCBC Bank (SGX: O39) could fit better). So, selection of right stock with right strategy with unique personality is key for investment success.

Instead of watching for long withdrawal queue in DBS (not a reliable investing method), smart investors may learn from Dr Tee free 4hr investment course to apply LOFTP (Level / Optimism / Fundamental / Technical / Personal Analysis) Strategies in global giant stocks (including banks stronger than DBS), knowing what to buy, when to buy/sell or how long to hold.

Register Here: www.ein55.com

You are invited to join Dr Tee private investment forum (educational platform, no commercial is allowed) to learn more investment knowledge, interacting with over 8000 members:

https://www.facebook.com/groups/ein55forum/