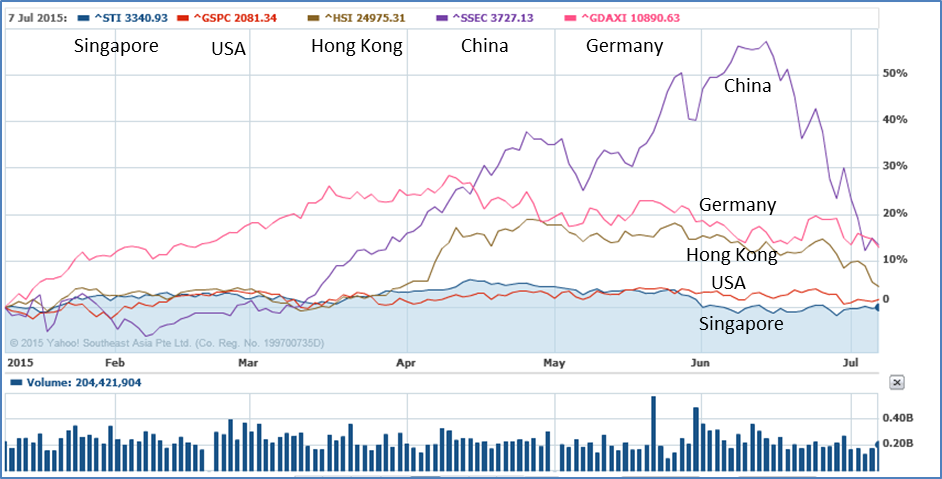

On 8 Jul 2015, I shared a newsletter when many readers were troubled by the global stock market correction (which turned out to be a mid-term low point if you compare with later second chart). Figure above shows that in the past 1 month with charts till 7 Jul 2015, global stock market encounter series of negative news, from Greece crisis, bullish turned bearish China market, to speculation of possible US interest hike, etc. As a result, most traders get worried, following herd mentality to exit or dare not enter the stock market again, especially observing more than 30% correction in China SSEC index.

After 1 week later, now (as of 15 Jul 2015) the global market has regained the confidence after Greece crisis has a new political solution, China stock market is strongly supported by the government. The figure below shows a strong rebound in global stock market. The last fearful point on 8 Jul 2015 happened to be a low valley.

“Normal” retail traders would wait for friends around them to make money first, after share price is up more than 10%, only then having the confidence to enter the stock market at relatively high price. This is happening in China stock market now, those who got burnt with earlier 30% fall, some start to try their luck again with rising price.

Similarly, when market turned bearish, most people are losing money, despite significant discount given, majority of the traders would prefer to wait. They have to pay for premium in price to exchange for confirmation in trends to overcome their fearful emotion. The mentality of buy high sell higher depends on the support of market speculation which may not be sustainable. Any major global news could potentially erase the speculated gains overnight. Since we cannot accurately predict the future, we need to always buy low sell high to put ourselves at low risk, regardless you are a short term trader or a long term investor, only difference is just the timeframe of interest: buy low sell high for 1 month or buy low sell high for 5 years.

In a bullish stock market, as long as the optimism level is not too high, every correction due to bad news is an opportunity for safe entry for mid-term trading. Investing Master, Jim Rogers’ open secret of success is “Buy Low Sell High”, but how low is considered low? The world’s richest investor, Warren Buffett, has a famous saying of “Be greedy when others are fearful”, but how fearful is considered too fearful? The Ein55 Optimism Investing Strategy developed by Dr Tee will provide the answers.