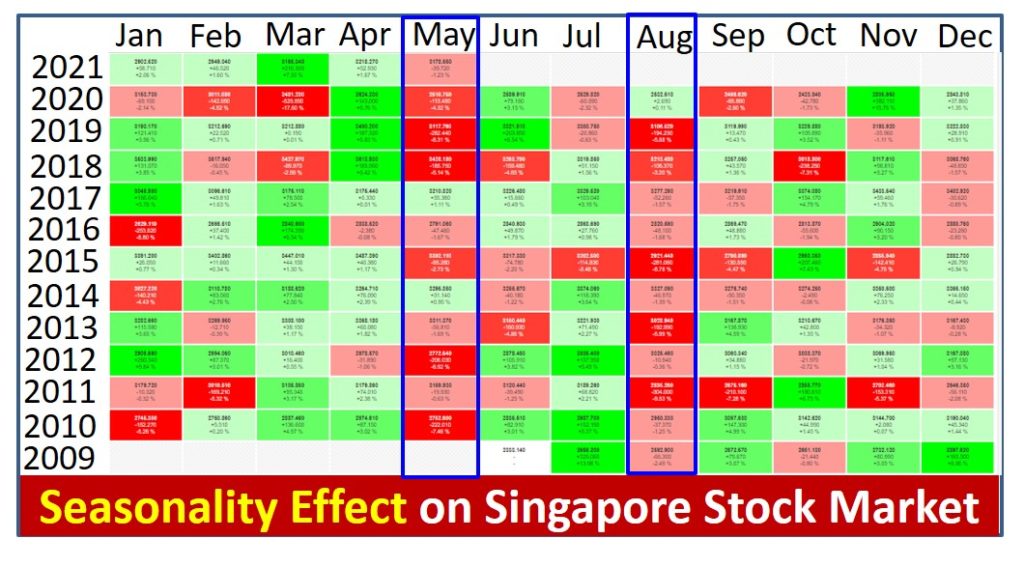

Seasonality or Monthly Effect (stock index vs month/year) is strong for months of May and August for Singapore stock market, especially 30 STI component stocks. This is mainly related to Ex-dividend dates for 30 STI in Singapore but may not apply to smaller cap giant stocks which continue to be bullish in month of May. Learn further from Dr Tee on details of this unique Singapore stock myth.

For recent May 2021, STI ends with only 1+% lower but still it is a mini “bear” month, aligning with myth of “Sell in May and Go Away“. As we could see from the Seasonality Chart (2009 June – 2021 May) for Singapore stock market, over the past 12 years, for the month of May, 10 years were down (including this month, May 2021), only 2 years were bullish. For month of August, Singapore STI index is even worse, 11 years were down, only 1 year was up (last year, 2020, mainly due to pandemic recovery).

By right, there is no logic to strong monthly or seasonality effect (occurring 10-11 times over the past 12 years, bearish for months of May and August) but Singapore stock market is unique, especially many 30 STI component stocks are dividend stocks / REITs, certain month of ex-dividend dates, price adjustment after dividend payment could be stronger than usual stock market force of the month.

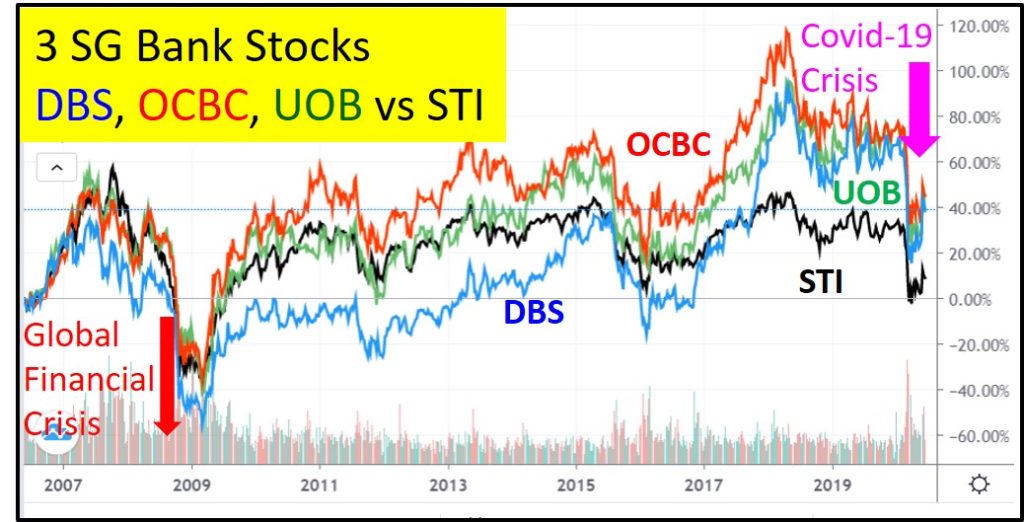

For example, out of the 6 biggest market cap STI stocks: DBS Bank (SGX: D05), OCBC Bank (SGX: O39), JMH – Jardine Matheson Holdings (SGX: J36), UOB Bank (SGX: U11), Singtel (SGX: Z74) and Wilmar International (SGX: F34) (6 stocks contributing to about 57% of STI), all 6/6 Ex-dividend in month of August while 3/6 also Ex-dividend in month of May. This may explain why Singapore stock market is nearly always bearish in the months of August and May, mainly to adjust for price after dividend payment (filling the quarterly or half-yearly dividend yield of around 1-3%), also to fulfill the global myth to “Sell in May”. MAS may adjust or lifted the 60% dividend payment cap imposed over the past 1 year for 3 major banks, this could result in strong Ex-dividend effect from Q2/2021 (starting with DBS with quarterly dividend payment), affecting more on volatility of 30 STI in coming month of August.

So, it may not be a good idea to invest in Singapore dividend stocks just before the Ex-dividend date, as the price correction (capital loss) after Ex-dividend date could be more than the dividend received. It is smarter to invest dividend stocks a few months in advance while the share price starts to recover from intermediate low due to market fear or bearish market. Alternatively, focusing on any giant stock (may or may not be dividend stocks, not limited to 30 STI component stocks) with strong price and business performance).

When there are more believers in certain myth, then it could affect the local market. Hong Kong and Japan also has similar myth, for example when movie star Adam Cheng (郑少秋) has new TV drama showing, HK share price would drop. Japan has similar related belief but influence varies.

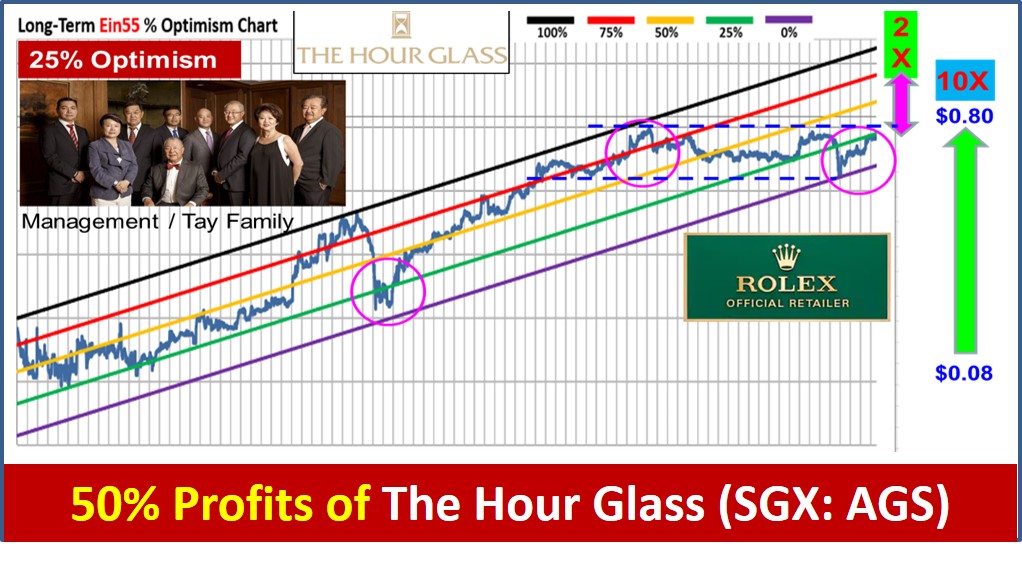

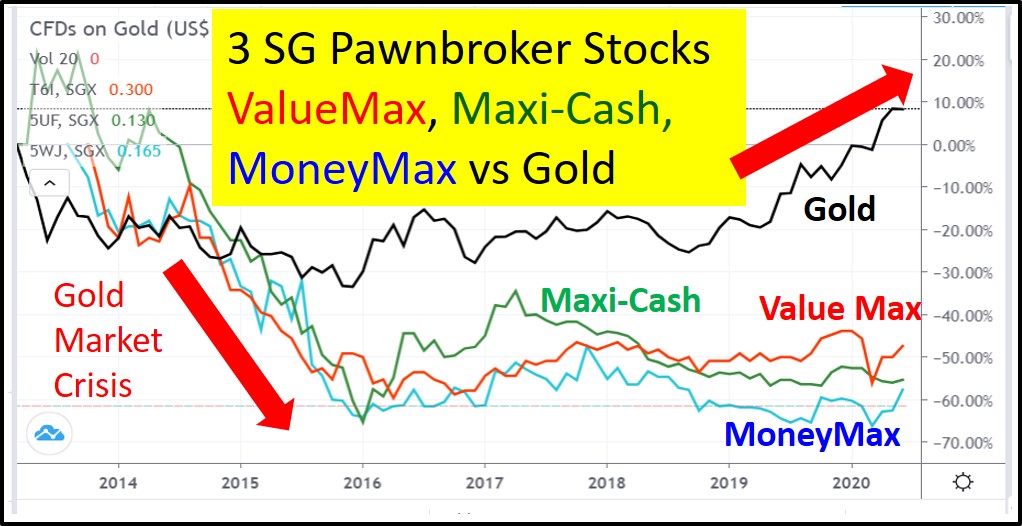

In fact, there are quite a few small or mid cap giant Singapore stocks, eg. Propnex (SGX: OYY), Union Gas Holdings (SGX: 1F2), iFAST Corporation (SGX: AIY), The Hour Glass (SGX: AGS), Cortina Holdings (SGX: C41), Q&M Dental Group (Singapore) (SGX: QC7), Raffles Medical Group (SGX: BSL), etc, which Dr Tee has mentioned in earlier educational posts or free webinars, continue to surge over 20-30% in bearish month of May, opposite in trend with STI.

So, selection of right stocks (Level 1) in right sectors (Level 2) in right country (Level 3) is crucial. In general, Singapore and US stock markets remain relatively more bullish than other global stock exchanges since early 2021. So, it is a good choice to focus in Singapore stock market, both for short term momentum trading and long term cyclic / dividend investing.

===================================

There are over 1500 giant stocks in the world based on Dr Tee criteria, choice of 10 Dream Team giant stocks have to align with one’s unique personality, eg. for shorter term trading (eg. momentum or swing trading) or longer term investing (cyclic investing, undervalue investing or growth investing). Readers should not just “copy and paste” any stock (What to Buy, When to Buy/Sell) as successful action taking requires deeper consideration (LOFTP strategies – Level / Optimism / Fundamental / Technical / Personal Analysis) which you could learn further from Dr Tee Free 4-hr Webinar.

Drop by Dr Tee free 4hr webinar (learning at comfort of home with Zoom) to learn how to position in global giant stocks during COVID-19 stock crisis with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Zoom will be started 30 min before event, bonus talk (Q&A on any investment topics from readers) for early birds. There are many topics we will cover in this 4hr webinar, Dr Tee can have more time for Q&A if you could stay later after the webinar, you could ask on any global and local stocks including but not limited to 30 STI component stocks:

Ascendas Reit (SGX: A17U), CapitaLand (SGX: C31), CapitaLand Integrated Commercial Trust (SGX: C38U), City Development (SGX: C09), ComfortDelGro (SGX: C52), Dairy Farm International (SGX: D01), DBS Bank (SGX: D05), Genting Singapore (SGX: G13), Hongkong Land (SGX: H78), Jardine Cycle & Carriage (SGX: C07), Jardine Matheson Holdings JMH (SGX: J36), Jardine Strategic Holdings JSH (SGX: J37), Keppel Corp (SGX: BN4), Keppel DC Reit (SGX: AJBU), Mapletree Commercial Trust (SGX: N2IU), Mapletree Industrial Trust (SGX: ME8U), Mapletree Logistics Trust (SGX: M44U), OCBC Bank (SGX: O39), SATS (SGX: S58), Sembcorp Industries (SGX: U96), Singapore Airlines (SGX: C6L), Singapore Exchange (SGX: S68), Singtel (SGX: Z74), ST Engineering (SGX: S63), Thai Beverage (SGX: Y92), UOB Bank (SGX: U11), UOL (SGX: U14), Venture Corporation (SGX: V03), Wilmar International (SGX: F34), YZJ Shipbldg SGD (SGX: BS6).

Dr Tee will cover over 20 case studies, Singapore giant stocks, eg. CapitaLand Mall Trust (SGX: C38U), Singapore Exchange (SGX: S68), Keppel Corp (SGX: BN4), Top Glove (SGX: BVA), Jardine Matheson Holdings JMH (SGX: J36), Vicom (SGX: WJP) and many others, Malaysia giant stocks, Hong Kong giant stocks and US giant stocks, both long term investing and short term trading.

There are limited tickets left for this 4hr free webinar, please ensure 100% you could join when register: www.ein55.com