Many readers have benefited from Dr Tee past 200 educational articles during pandemic, including making over 50% profits from 3 Singapore major bank stocks: DBS Bank, OCBC Bank and UOB Bank, which continue the strong momentum of prices with growing business.

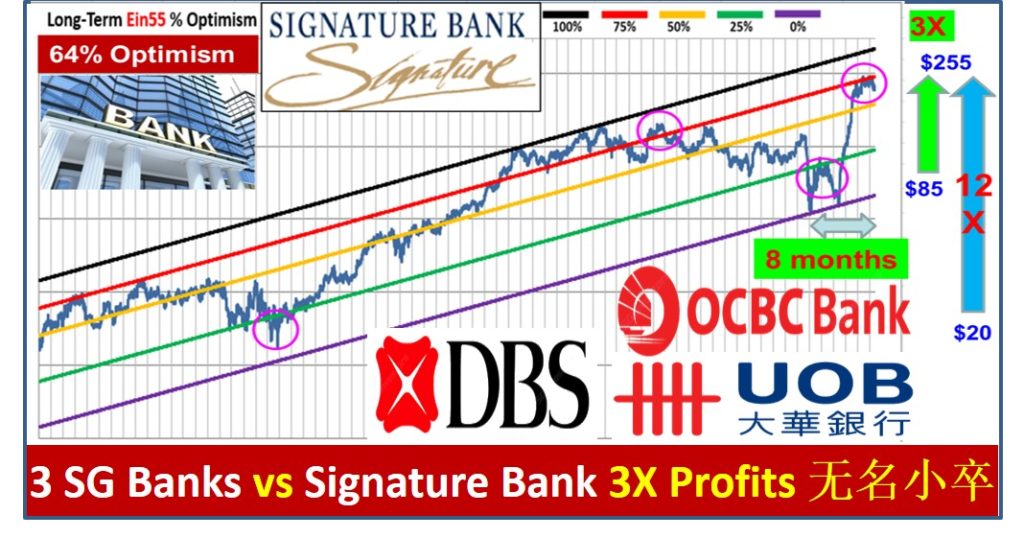

However, the big money is usually with hidden giant stock (无名小卒), Dr Tee Graduates could see the opportunity 1 year ago in Signature Bank (NASDAQ: SBNY) with 3X potential profits gained so far, outperforming 50% rally of 3 Singapore major bank stocks.

Let’s learn further from Dr Tee on the journey of successes for these 4 giant bank stocks, including how to position in other remaining Top 100 global giant bank stocks. A review of latest financial reports, stock prices, Ein55 intrinsic values and Optimism levels will be given.

With pandemic recovery over the last 1 year, 3 Singapore major bank stocks, DBS Bank (SGX: D05), OCBC Bank (SGX: O39) and UOB Bank (SGX: U11) have recovered both in share prices (50% rally from lower optimism levels to about fair values of mid optimism currently) and also businesses, since Q2/2020 circuit breaker period.

In the recent interim financial reports of H1/2021, all 3 Singapore giant bank stocks continue to report better earnings than the 6-12 months ago, partly due to growing businesses and lower allowance for NPL (Non-Performing Loans), supported by strong Singapore GDP growth (14.3% in Q2/2021), aligned with rapid global economy recovery (US GDP growth by 6.5% in Q2/2021).

Despite lower interest rate income due to lower NIM (Net Interest Margin), overall bank sector businesses (including investment, wealth management, credit card, insurance, etc) are profitable. Despite US treasury bond yield is getting lower over the past few months with less pressure on bank interest rate hike, global bank stocks still have positive outlook because of non-interest rate income is growing more rapidly. Higher global inflation rates may also accelerate the pace of central banks of major economies to increase interest rates which will be favorable to giant bank stocks.

From the table below, we may observe that 3 Singapore major bank stocks have comparable results, all are suitable as mid-fielders for both capital gains and passive incomes (dividend). In fact, they contribute to about 30% of Singapore STI Index, therefore the price trends are generally aligned with STI which is near to fair value of mid optimism level.

| 4 Giant Bank Stocks | ROE (%) | DY (%) | PB |

| DBS Bank (SGX: D05) | 8.6 | 2.8 | 1.5 |

| OCBC Bank (SGX: O39) | 7.2 | 2.5 | 1.2 |

| UOB Bank (SGX: U11) | 6.9 | 2.9 | 1.2 |

| Signature Bank (NASDAQ: SBNY) | 9.0 | 0.9 | 1.9 |

As expected, MAS recently announced to waive the 60% dividend payment cap of 3 Singapore major bank stocks, implying the potential of dividend yield in FY2021 could be increased by 100/60 = 67%, from current 2.5-3% to 4-5%. This is partially confirmed by recent announcement of interim dividends, back to FY2019 level before pandemic, likely will be higher for next 6 months if higher earnings by end of 2021 as usually 50% earnings (DBS and UOB) will be paid as dividend while OCBC is about 45% dividend payout ratio (more reserves for growth).

This confirmation by MAS is an important news for long term investors who aim for passive incomes, despite the best time to invest in these 3 banks stocks was in the worst time of pandemic during Q2-Q3/2020, eg. OCBC at about $8+/share while DBS and UOB below $20/share, shared by Dr Tee over the past 1 year of free public webinars (www.ein55.com) and articles, action takers could enjoy fruits of 6-7% dividend yield now, on top of over 50% capital gains over the past 1 year of pandemic recovery. This is much better than “safe” investment of keeping money as cash in banks for 0.3% interest rate or even Singapore Savings Bond of 0.5% return for the first year.

Currently, Singapore STI and 3 Singapore bank stocks are showing mid bullish trend but not strong enough for traders. A key trading signal is breakout of 3200 points resistance of STI, requiring support of other 27 STI component stocks. Traditionally, Aug is month for Ex-dividend date of many STI component stocks, therefore if Aug could achieve a monthly positive gain for STI, is a strong signal for DBS Bank, OCBC Bank and UOB Bank.

===================================

Many investors like to invest in bank stocks with BIG names but big size or most famous stock may not always be the best, eg. Hong Kong largest bank, HSBC Bank (HKEX: 0005) is a weak bank stock. Even an investor may run of idea of What to Buy, may refer to earlier Dr Tee article on Top 100 Bank Stocks in the world:

https://www.ein55.com/2021/03/top-100-singapore-and-global-bank-stocks-to-profit/

Both 3 Singapore major banks and Signature Bank (#76 in the long list) are listed as Top 100 Bank stocks. If bank stock interested by reader is not listed, may need to do more in-depth analysis before investing. Signature Bank is comparable in size with 3 Singapore banks but still considered small relative to big names in wall street, therefore gaining little attention from global investors who probably know more about JP Morgan Chase (NYSE: JPM) or even weaker bank stocks such as Citi Group (NYSE: C).

Signature Bank is a commercial bank with business mainly in state of New York (USA) and a few other states. So, it is relatively not known to global investors, few Asian investors may know how to invest in this hidden giant stock. Despite the businesses are strong with consistent growth over the past decade, after share prices reaching high Ein55 Optimism level of about $140 in Year 2017, starting to correct to lower optimism, reaching low optimism level of around $70/share during 2020 pandemic, which is 50% discount in share price but value becomes higher each year. The best “crisis” stock is when value is doubled but price is halved but few people could bridge between fundamental and technical worlds which needs more insights.

Dr Tee assigned Signature Bank as homework to Ein55 graduates during Aug 2020, possible to enter initially with contrarian investing (average down will falling in share prices) when share price less than $90 or with average up above $100 after the breakout from double bottom (see optimism chart of Signature Bank) or trend-following momentum trading from $100+ to $200+ in a few months. Even for long term investor (Buy & Hold), Signature Bank has grown over 12 times in share prices over the past 2 decades but it requires strong control of emotions, especially to hold through global financial crisis with significant price correction.

In Jan 2021 Ein55 Graduates Gathering Webinar, Dr Tee shared this giant stock again, despite at around $140, the stock continues to surge till high Ein55 Optimism of $255/share, potential 2 to 3 times profits for those who could Buy at Low Optimism (below $100) and Sell at High Optimism (about above $200). In July 2021 Ein55 Gathering Webinar, Dr Tee has shared another healthcare giant stock which has surged over 20% in 1 month since then (will be reported in future).

There is little “luck” in stock investment, each of the fruit of investment is action taking by readers who could take calculated risks, applying strategy aligning with own personality. A real trader and investor has to take further action: Buy, Hold, Sell, Wait or Shorting with independent thinking. Without action taking, a reader is only a ‘knowledge collector”, knowing why or how but could not generate any profit.

Many investors know the secret of making money is Buy Low Sell High but if purely based on price action (i.e. Technical Analysis), the probability of success may not be high, especially Buy Low may Get Lower. Success in Signature Bank requires integration of Ein55 styles of investing, especially with LOFTP Strategies: Level, Optimism, Fundamental, Technical and Personal Analysis, sharing regularly in hundreds of Dr Tee educational articles in the past decade.

Unlike 3 Singapore major banks, Signature Bank is more suitable for cyclic investing (then become momentum trading) with support by strong growing businesses. Since the current share prices have reached high optimism level with sideways share prices, potential traders may need to wait for stronger signal or consider other Top 100 global bank stocks in earlier list, some still have over 50% upside potential of share prices.

Bank stocks are cyclical in nature, therefore the best time to invest in a giant bank stock is usually during the recovery phase from global or regional financial crisis. Even an investor may miss the last 1 year of pandemic stock crisis to Buy Low Sell Fair Price, not to miss the next few years with opportunity for giant bank stocks moving from fair prices to greedy prices at high optimism levels. After that, the next Black Swan would wait to reset the global stock market again with a new Global Financial Crisis, usually over 50% discount in stock indices. Instead of waiting for sky to fall down one day (wasting the opportunity cost of time which could be several years), a more practical approach is to apply trend-following strategy to ride the uptrend of global giant stocks during bullish stock market.

There are many other global giant stocks prepared to surge with pandemic recovery, are you ready to become their business partners as a stock investor?

===================================

There are over 2000 giant stocks in the world based on Dr Tee criteria, choice of 10 Dream Team giant stocks have to align with one’s unique personality, eg. for shorter term trading (eg. momentum or swing trading) or longer term investing (cyclic investing, undervalue investing or growth investing). Readers should not just “copy and paste” any stock (What to Buy, When to Buy/Sell) as successful action taking requires deeper consideration (LOFTP strategies – Level / Optimism / Fundamental / Technical / Personal Analysis) which you could learn further from Dr Tee Free 4-hr Webinar.

Drop by Dr Tee free 4hr webinar (learning at comfort of home with Zoom) to learn how to position in global giant stocks during COVID-19 stock crisis with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Zoom will be started 30 min before event, bonus talk (Q&A on any investment topics from readers) for early birds. There are many topics we will cover in this 4hr webinar, Dr Tee can have more time for Q&A if you could stay later after the webinar, you could ask on any global and local stocks including but not limited to 30 STI component stocks:

Ascendas Reit (SGX: A17U), CapitaLand (SGX: C31), CapitaLand Integrated Commercial Trust (SGX: C38U), City Development (SGX: C09), ComfortDelGro (SGX: C52), Dairy Farm International (SGX: D01), DBS Bank (SGX: D05), Frasers Logistics & Commercial Trust (SGX: BUOU), Genting Singapore (SGX: G13), Hongkong Land (SGX: H78), Jardine Cycle & Carriage (SGX: C07), Jardine Matheson Holdings JMH (SGX: J36), Keppel Corp (SGX: BN4), Keppel DC Reit (SGX: AJBU), Mapletree Commercial Trust (SGX: N2IU), Mapletree Industrial Trust (SGX: ME8U), Mapletree Logistics Trust (SGX: M44U), OCBC Bank (SGX: O39), SATS (SGX: S58), Sembcorp Industries (SGX: U96), Singapore Airlines (SGX: C6L), Singapore Exchange (SGX: S68), Singtel (SGX: Z74), ST Engineering (SGX: S63), Thai Beverage (SGX: Y92), UOB Bank (SGX: U11), UOL (SGX: U14), Venture Corporation (SGX: V03), Wilmar International (SGX: F34), YZJ Shipbldg SGD (SGX: BS6).

Dr Tee will cover over 20 case studies, Singapore giant stocks, eg. CapitaLand Integrated Commercial Trust (SGX: C38U), Singapore Exchange (SGX: S68), Keppel Corp (SGX: BN4), Top Glove (SGX: BVA), Jardine Matheson Holdings JMH (SGX: J36), Vicom (SGX: WJP) and many others, Malaysia giant stocks, Hong Kong giant stocks and US giant stocks, both long term investing and short term trading.

There are limited tickets left for this 4hr free webinar, please ensure 100% you could join when register: www.ein55.com

View quick preview video below, Dr Tee will introduce 10 key stock investment strategies (股票投资十招) to be learned in 4hr free stock webinar:

Register Here (Dr Tee Free 4hr Stock Webinar): www.ein55.com