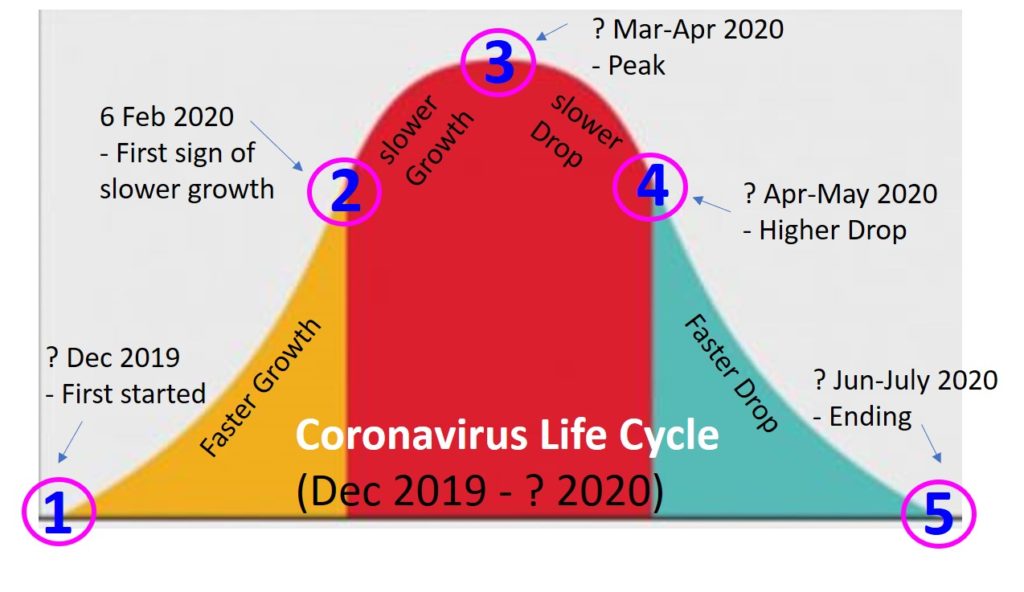

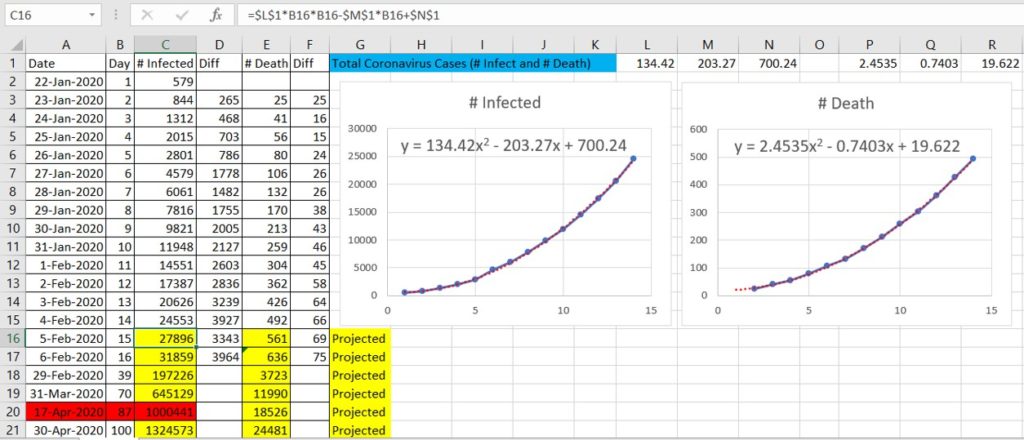

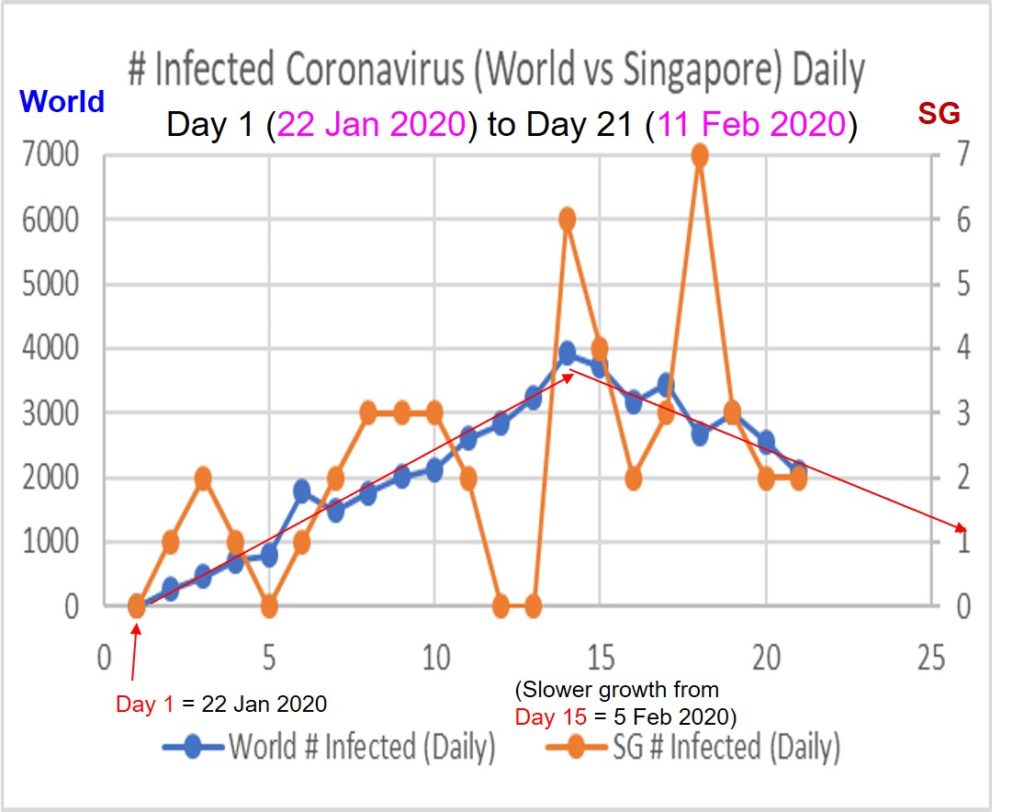

After the reversal of new daily cases of Coronavirus to downtrend from 5 Feb 2020, it still follows the bi-linear predictive model (see earlier video talk for details), continue to fall for both World and SG (not obvious in trend based on 1 day as sample size is smaller).

Similar to Technical Analysis, when a clearer reversal pattern is formed, if data reported is reliable, Coronavirus could reach its peak by end of Feb 2020, then fading away in 1-2 months. However, if there is a second or multiple peaks with significant surge in new daily cases, then the duration of Coronavirus may be prolonged by 1 month for each new peak of new daily cases. So, we need to monitor daily from now.

Coronavirus monitoring is as if short term stock trading, daily price day has to be analyzed to form a longer term trend analysis (weeks / months) for better consistency in results.

Bullish US (strong economy) + Bearish China (Coronavirus spreading + economy slow down) = Mild bullish global stock market.

Despite both countries have comparable world GDP contribution (US 24%, China 15%) but for stock market value, US contributes to more than 50% of world stock market cap, therefore impact of US is much stronger than China.

Singapore is affected by both US and China, therefore the trends for stocks is sideways with moderate economy, close to 50% optimism, fair value.

During Coronavirus crisis time, demand for some commodities is increasing. Commodity market has been at low optimism for about 5 years, it is time to explore this area: Oil & Gas, Palm Oil, Mining, Agricultural, Precious Metals, etc.

You may learn from Dr Tee on how to position in global giant stocks in this current market condition. Sign up for free 4hr course: www.ein55.com