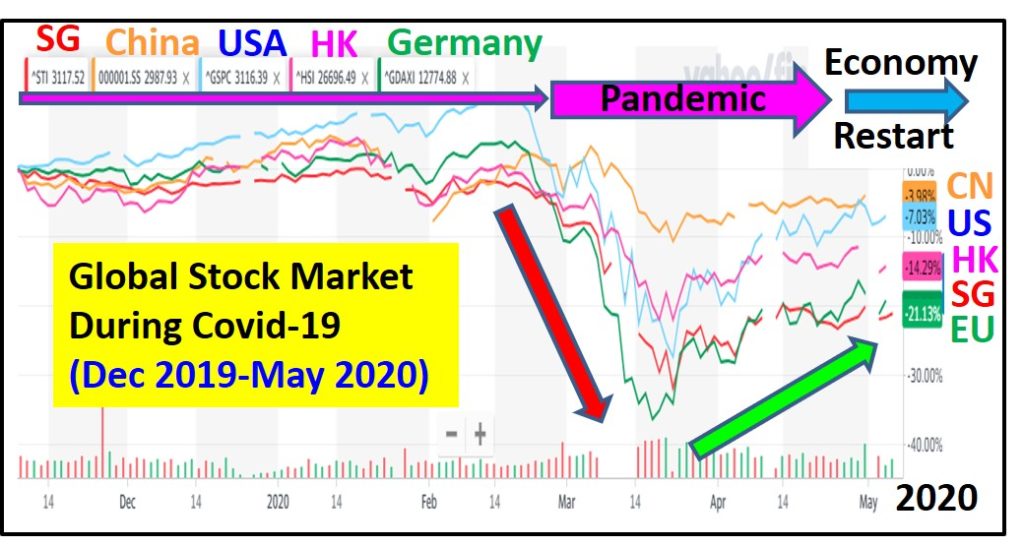

US stock markets (both S&P 500 and Nasdaq indices) start to form potential “Double Top” at high optimism levels, after last few days of correction, indices are approaching / below 20 days moving average. At the same time, Asian stock markets (Singapore, Hong Kong, China, Malaysia, etc) are still struggling to recover gradually at moderate low optimism level but may need to follow the footstep of US.

In this article, Dr Tee will share 3 main strategies with 3 unique personalities for the current global stock markets, either short term trading or long term investing, both follow-trend and counter-trend. Before that, let’s understand the main driver of stock and economic crisis: Covid-19 conditions locally and globally.

US has reported a few positive economic signals (eg. job market is not as bad as expected) but recovery phase would take longer time while stock market is back to high optimism level before Covid-19 crisis again. Covid-19 condition in US shows very gradual drop in number of infected cases as social distancing may not be strictly enforced while many people could not wait to restart the economy. Based on projection, Covid-19 in US may need to wait until end of summer (around Aug 2020) to fade away. The positive signal is the number of new daily death cases are dropped to only about 1/3 of the peak, although number of new daily infected cases are still about 2/3 of peak cases. This implies the strain of Covid-19 is getting weaker after 5 months of pandemic.

At the same time, world number of infected Covid-19 cases are still increasing (7.5M cases), mainly due to high increment in a few high population countries such as Brazil and India which may be hard to balance between lockdown (minimize health crisis) and continuation of economy (minimize financial crisis). Some more healthy people may not mind take the risk to work as no income may be higher “risk” to the family. Again, positive signal is number of death cases are in declining mode globally.

For Singapore, most of the Covid-19 cases are within worker dormitories which are under control (few cases in the community) and very few death cases. Therefore, Singapore government has restarted economy in phases. There are even plans to start travel within the regions with countries having mild condition (eg. China). Malaysia has also restarted the economy, similar to many other global countries.

In short, Covid-19 condition is improving in many countries (at least within major economies: US, China, Japan, Europe), may fade away by end of summer. With restart of economy, the worst of monthly economic performance could be over (during last few months of global lockdown). However, each of the global government has to work hard to avoid Covid-19 induced short term economic crisis is extended into a longer term and bigger scale global financial crisis.

The most direct method would be economic stimulus plan, different names in each country, eg: Quantitative Easing (QE) in US which is unlimited in scale. As a result, there is a divergence between stock market (V-shape recovery) and economy (sluggish). When US stock markets are recovering back to the level before Covid-19 crisis (Nasdaq has even achieved new historical high of 10000 points), market starts to show correction.

Stock correction is healthy for longer term growth, similar to a person climbs up a hill, need some rests or slowing down in bumpy path to preserve the energy (峰回路转). However, potential “Double Top” pattern for US stock market at high optimism is still a big threat as no one would know the possible scales of correction: minor correction (less than 10%), major correction (10-20%), stock crisis (eg. 20-30% during Covid-19) or even global financial crisis (over 50%).

Therefore, it is important for a stock trader or investor to take action (Buy / Hold / Sell / Wait / Shorting) aligning with own personality. Here are 3 potential strategies for 3 unique personalities when there are potential signals of stock market correction (different levels):

1) Short Term Momentum / Cyclic Trading (trend-following)

A short term trader would exit progressively or reduce position with S.E.T. (Stop Loss / Entry / Target Prices) trading plan. When stock market is back to bullish again for short term, can always re-enter the trading (acceptable even the price could be higher than the selling price). Selling a stock is taking an insurance for a trader to reduce the risk, especially when uptrend price is corrected below own risk tolerance level.

Friend of a trader is always the clear price trends and bonus is strong fundamental business (just in case a retail trader could not follow the trading, if forced to become a long term investor, at least the giant stock would give the protection). Of course, it is possible to apply reversed strategy to do shorting, same requirement of following trading plan but in a reversed way (eg. downtrend price with weak fundamental business, best with negative market news).

2) Long Term Growth Investing

A long term growth investor would either reduce position (if trend-following but price is corrected more than own risk level) to protect the capital gain or possible to hold (regardless of potential stock crisis) but need to ensure stock portfolio is well diversified, based on 10-20 growth giant stocks with strong business fundamental. When stock is back to bullish again, may consider to “Average Up” with multiple entries for longer term investor.

For investor who could also trade, there is also an option for hedging (shorting for short term while holding to position for long term if not selling).

3) Long Term Dividend Investing

A long term dividend investor, if applying contrarian strategy (counter-trend to buy low in bearish stock market), possible to apply multiple entries to enter while stocks are falling, 10-25% (or X% defined by individual) price gap between each entry to maximize the dividend yield (especially for Asian stock market at lower optimism) but need to ensure stock portfolio is well diversified, based on 10-20 giant dividend/growth stocks with strong business fundamental.

This is “Average Down” method, suitable for unknown scale of stock crisis (minor correction or global financial crisis), no need to guess the bottom as consistent averaging in prices would help but an investor needs to follow the discipline to continue to buy low (only for giant stocks) while others are fearful.

=====================================

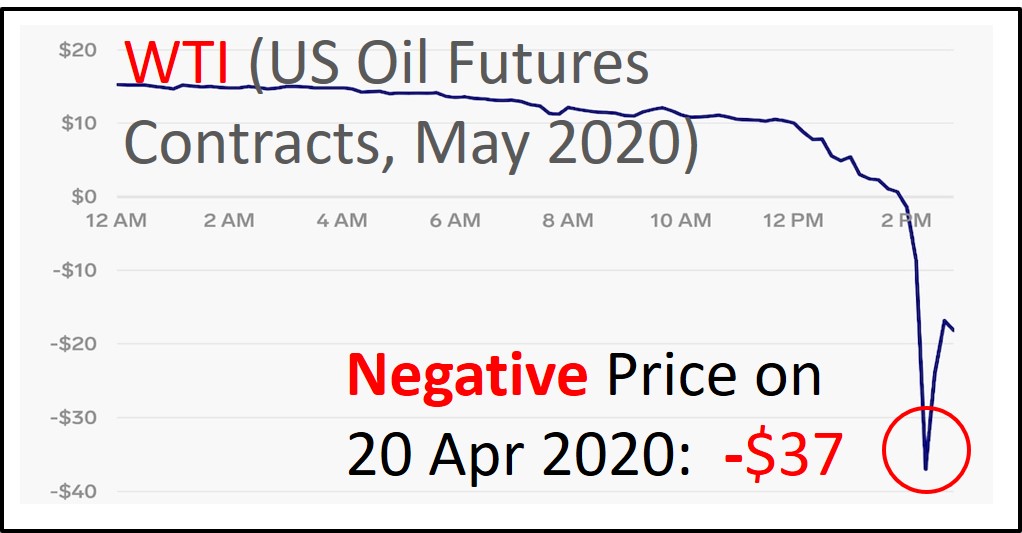

It is possible for 3 strategies above to be integrated, eg. trend-following dividend investing or growth + dividend investing, etc. There are over 10 different stock trading or investing strategies but one has to adjust to fit own personality. For example, for market cycle investor, needs to follow market optimism closely as US is back to high optimism level (>75%). Commodity stock investor (eg. oil & gas stock) needs to integrate different market cycles of stock market and commodity market.

Of course, the last possible option is do nothing all the time, regardless up or down in stock market: zero risk, zero reward. A stock trader or investor has to learn to take action (Buy / Hold / Sell / Wait / Shorting) unless “Do Nothing” (Wait or Hold) is part of strategy.

Drop by Dr Tee free 4hr investment course to learn how to position in global giant stocks with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Learn further from Dr Tee valuable 7hr Online Course, both English (How to Discover Giant Stocks) and Chinese (价值投资法: 探测强巨股) options, specially for learners who prefer to master stock investment strategies of over 100 global giant stocks at the comfort of home.

You are invited to join Dr Tee private investment forum (educational platform, no commercial is allowed) to learn more investment knowledge, interacting with over 9000 members.