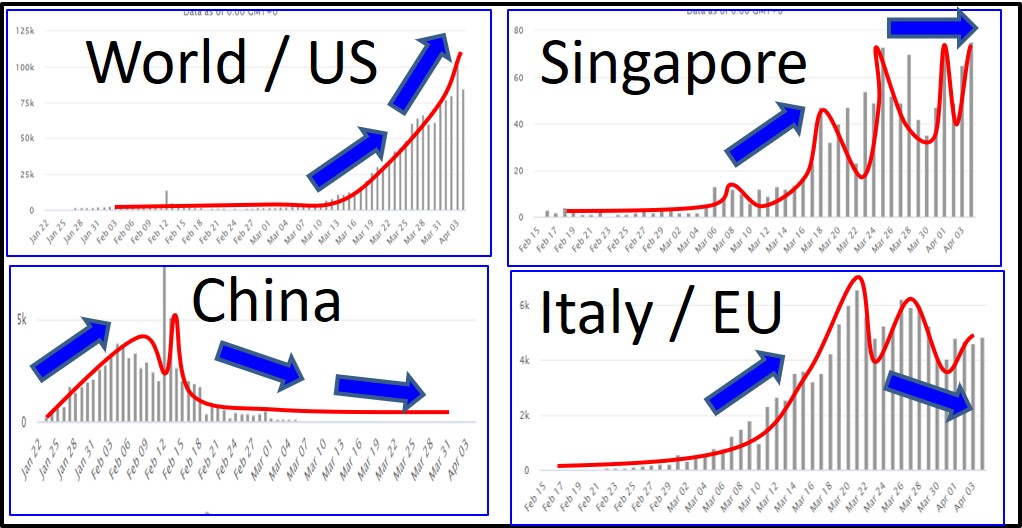

The scale of global stock crisis is conditional: whether Coronavirus is short term, mid term or long term. So, we need to monitor the daily new cases of Coronavirus in the world (Singapore would follow the main trend):

World New Daily Cases:

https://www.worldometers.info/coronavirus/coronavirus-cases/

Singapore New Daily Cases:

https://www.worldometers.info/coronavirus/country/singapore/

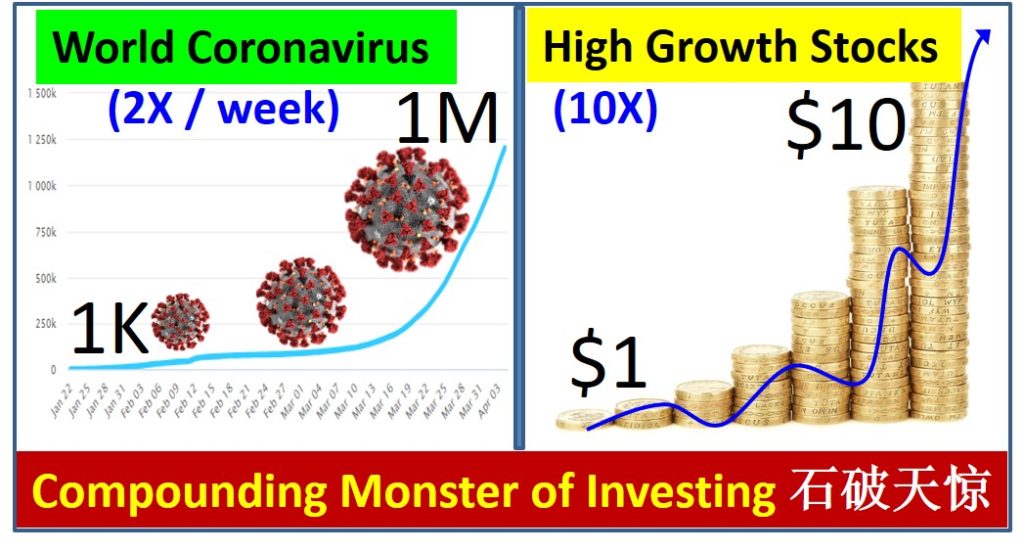

The virus has a compounding formula of 2X every 7 days (some countries could be slightly faster or slower, 6-8 days), therefore in 1 month with about 30 days, it would have about 4 times of 2X, total 2^4 = 16 times monthly.

The tracking is from Day1 (23 Jan 2020) with about 1000 case in the world (mainly in China) and 1 case in Singapore. We can apply the formula from 23 Jan 2020 to 5 Apr 2020 with about 2.5 months or 10 times of 2X: 2^10 = 1024, approximately 1000 times. Therefore, world just crosses 1 Million cases (1000 cases on Day1 x 1000 times = 1M) and Singapore has just exceeded 1000 cases (1 case on Day1 x 1000 times = 1000 cases).

If this compounding continues, it would double itself every 1 week, eg 2 Millions cases in the world within 1 week, 8 Million cases within 1 month. The average fatality rate is 5% (country dependent, from 0.5% to 10+%, also depends on how comprehensive is the detection of infected cases, especially mid cases or no symptom cases). So, if the growth with 2X compounding is not ending soon, more people in the world would become victims in this health crisis.

The deadly compounding trend may be ended with 2 critical stages. Details of analysis of P1-P5 Coronavirus life cycle, may refer to Dr Tee past youtube video on global stock crisis:

P2) High to Slow Growth

The daily new cases fall from the peak of max daily cases. This would show the transition from high growth to slower growth (lower rate of compounding). Currently only China and Korea have observed this downtrend consistently. Good news is even “Top 5” of Italy, Spain, Germany and Iran are seeing downtrend over the past 1 week, a stronger light at the end of tunnel after 1-2 months of lockdown.

On 3 Apr 2020, there is a surge with over 20k new cases added in 1 day, this is due to 1 time correction added by France for not accounting to cases in nursing homes (previously only for those hospitalized are counted). So, we could not take 3 Apr as peak. Currently no clear ultimate peak is seen for the world, every day is a new peak for the world.

For Singapore, due to cross infections among different international travellers and community infections, the general trend is unfortunately aligned with the world (uptrend with new peak each day). At the point of writing this article, 120 new cases are reported (new daily high) which is not a surprise because the compounding “law” is governing with 2X every 7 days, implying 1000 cases recorded a few days ago could become 2000+ cases by coming weekend, therefore new potential weekly cases of 1000 over 7 days is reasonable to be over 100 daily cases. The worry is next 1 week as it would follow the next tier of “compounding monster” from 2000+ to 4000+ cases until the social distancing could slowdown the spreading of Coronavirus. So, it is right for Singapore government to advise (perhaps should be a “law” as in China and Italy, then it would be labelled as lockdown) to stay at home in Apr as this will be the highest growth rate of Coronavirus, similar to some stock crisis, don’t catch the falling knife by taking unnecessary risks.

US takes the lead as world no 1 in total cases, current uptrend is aligned with the world, each day is a new peak. We need to observe for the first dip, following by 7 days of more consistent downtrend to have a stronger confidence that growth rate is moved from high to slower growth. When cases in US are down, likely the world cases would fall unless new leader in country with high population (eg. India, Pakistan, Indonesia) may continue this world uptrend.

Hopefully, the world may reach a peak new daily case by mid of Apr (could be over 2 Million cases by then), could only confirmed with 7 days of downtrend (observed in most countries in Europe but not yet in US and Singapore and other Southeast Asian countries).

P3) Slow Growth to Zero Growth

After declining from the peak new daily cases (eg. completed in China and nearly for Korea), it would have minimal new daily cases (less than 1% of total cases), considered under control.

In terms of Coronavirus life cycle (P1 – P2 – P3 – P4 – P5 as given in earlier youtube video), here are the countries who take the lead to complete in advance:

1) China (2 months downtrend)

2) Korea (1 month downtrend)

3) Italy (2 weeks downtrend)

4) Spain, Germany, Iran, etc (1 week downtrend)

5) Most countries (less than a few days of downtrend or still uptrend each day)

===========================

So, what is the significance of Coronavirus even one may not worry about health? Well, it would affect stock market and global economy. If Coronavirus may end by summer, then world may follow China economy with V-shape recover, then stock market may experience a rally with support by economic stimulus plans or even unlimited QE (Quantitative Easing or simply “Printing of Money”) by many global countries government.

It means, there is a chance for global stock “crisis” to recover from the flash crash over the past 1 month as the economic crisis is short term. High unemployment rate would gain back the jobs if crisis just comes and go. Consumers after months of lockdown may “revenge” with more shopping (retail sector recovers), more playing (entertainment sector recovers) or more travelling (airlines sector recovers). There is real experience after SARS 2003, world travelling increases due to suppression of demand and supply for 8 months after the outbreak.

However, if the Coronavirus continues beyond summer, the global recession with stock crisis may continue for mid term till 1-2 years later when vaccine is developed.

Of course, if the Coronavirus comes back every winter with a more deadly strain (new mutant), then it may become great depression similar to 1929 for at least 5 years until 2/3 world population are infected, only then the community immunity may stop this virus naturally (similar to Spanish Flu about 100 years ago) but this would be a disaster to mankind.

======================

We could experience the compounding effect of Coronavirus, similarly we may imagine if this is applied in a positive way on growth stock with 2X compounding in share price every few years, it would become 10x or 100x in a longer term.

There are over 1500 global giant stocks based on Dr Tee unique selection criteria. Some of them belong to this multibagger (3X to over 10X growth of share prices) or high growth stock which one could buy (ideally during a stock crisis) and hold long term or even for lifetime until the growth rate has slower down due to change in business (similar to change in rate on Coronavirus analysis), only then an investor would say farewell to this lifetime partner of growth stocks.

==================================

Drop by Dr Tee free 4hr investment course to learn how to position in global giant stocks with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Learn further from Dr Tee valuable 7hr Online Course, both English (How to Discover Giant Stocks) and Chinese (价值投资法: 探测强巨股) options, specially for learners who prefer to master stock investment strategies of over 100 global giant stocks at the comfort of home.

You are invited to join Dr Tee private investment forum (educational platform, no commercial is allowed) to learn more investment knowledge, interacting with over 9000 member.