Stock Investing Strategy with Top 10 Richest Investors and Businessmen

Summary of $90,000 Charity Courses for Tzu Chi (慈济) with High Dividend Stocks

Dr Tee, Ein55 Mentor & Graduates have together organised 5 charity investment courses (REITs/Business Trusts in Nov 2015 and May 2017, High Dividend stocks in Mar 2016 and Oct 2017, and Discounted NAV stocks in Sep 2016) in the past 2 years, donating net income of around $90,500 to Tzu Chi 慈济 (Singapore). We hope to inspire more Ein55 Graduates to reach out the society, helping others who are in need. More importantly, they have also learned the secrets of making money through investment. When more Ein55 Graduates are successful financially, they could also contribute back to the society to help more people in future.

Here are key learning points from the recent Charity Course on High Dividend Stocks:

1) Five Characteristics of High Dividend Yield Stocks

1.1) Mature Company that have already growth to sizable scale, meaning Equity > US$1B, Market Cap >US$1B, with stable Revenue >US$1B

1.2) Dividend pay-out ratio of at least 50% or more

1.3) Fundamentally remain strong and robust for many years to come because company have certain economy moat.

1.4) Low CAPEX business

1.5) Able to generate stable Free Cash Flow

2) Seven Myths about Dividend Investing

Myth: Stock prices are adjusted downward when dividends are paid.

Truth: Stock prices are adjusted on XD date, not on dividend payment date.

Myth: Dividend stocks are always safe

Truth: A company can stop payout of dividend when business is declining, may not be always safe.

Myth: Companies that pay dividends limit growth

Truth: The growth depends on business concept / innovation, leading to consistent profit and cash flow to pay for dividend. A company could have both dividend payment and high business growth at the same time.

Myth: The highest yielding stocks are the best

Truth: It can be risky because high yield stocks could have weak business with falling share prices.

Myth: Dividends are guaranteed upon company announcement

Truth: Company can cancel the dividend payout even after announcement

Myth: Investors should buy the cheapest dividend stocks

Truth: Dividend investor intention is to have low risk investment, better pick up healthy dividend stock

Myth: Dividend stocks are boring

Truth: Dividend stocks are still investment that could rise and drop at any time, requiring investors to pay close attention to monitor and follow up the stocks. An investor should not feel boring when receiving consistent dividend payment to their bank accounts as passive incomes.

———————————————————————————

We should drive the money (helping others when you are successful), not driven by the money (making money only for own gain). Investors should learn the unique Optimism Strategies with FA (Fundamental Analysis) + TA (Technical Analysis) + PA (Personal Analysis) developed by Dr Tee to choose strong global stocks, buying them at low price, then holding for consistent dividend payout or selling for high capital gains. High-quality free stock investment courses are provided by Dr Tee to the public.

2 Simple Steps of Investment

Many people thought investment is very complicated, only for smart people. Actually, there are only 2 simple steps of investment to bridge between knowledge and fortune. Let’s learn together here.

1) Set the Right Direction

Knowing the right direction to go is very important for any investment. One could be very hardworking but running in opposite direction, will be further away from the goal.

In investment, we need to know what are the good businesses which are profitable, sustainable for a long term. We could simply buy their stocks to have a share of this wonderful business. If one knows how to buy a portfolio of giant stocks, the undervalued or growing business with help to support the uptrend share price over the time. However, if one partners with a losing business, buying their stock, the direction will be wrong, share prices will be declining as well.

Share prices could be emotional but they follow the mega trend of businesses. If we could understand the fundamental of business, we could control the wild horse of share prices.

2) Take Action

Knowing the direction but if one does not take action to move, the goal cannot be reached. Some may take smaller steps, some may walk faster, so the pace will vary for each person to achieve the goal, just sooner or later.

In investment, we need to learn to take one of the actions: Buy, Hold, Sell, Wait or Shorting, eg. for stocks. Ideally, the choice of actions could be aligned with investment clock and personalities for best results.

However, even the simple action of “Buy” stock now and hold permanently could make money, if one knows how to set the direction correctly, buying a portfolio of giant stocks which could overcome all the cyclic stock market. If one still hesitates without any action, despite hundreds of excellent plans with so much investment knowledge learned, there will be no fortune.

Still considering? Don’t be just a knowledge collector. Practice these 2 simple steps of investment: set the right direction and start your investment journey now!

Invest in Golden Goose or Golden Egg?

In the investment world, a golden goose can be a giant stock with growing or highly profitable company. The golden eggs could be the quarterly or yearly dividend distributed by the business to shareholders. The golden goose or business could grow in size and therefore could produce bigger golden eggs in future.

If one could have a golden goose which could lay a golden egg once a year, should the investor sell the golden goose to exchange for a big sum of money in short time or collecting the golden eggs patiently over a long time?

This is exactly the dilemma of some investors who hold on to a stock which has both passive income (eg. yearly dividend which is a golden egg) and capital gains over the time (golden goose becomes larger in size). They may get disappointed at later time if they keep the golden goose (stock) but the size (market cap and capital gains) could vary over the time, sometimes could have a weight loss or price loss of 50% during global financial crisis.

On the other hand, if they decide to sell the golden goose, it is a one-time profit, they may regret later when the golden goose becomes larger with more eggs laid consistently each year.

In fact, there is no right or wrong choice. They key is to ensure it must be a golden goose or a strong business. Whether buy low sell high (selling the golden goose) or buy & hold (growing the golden goose and collecting the golden eggs) is just a choice, matching own’s personality. In general, we should have 10 golden goose in our investing farm. Sometimes we may sell a goose for immediate gains when the goose grows faster than expected. When the crisis comes, we may use the cash from the gains to buy other golden goose at cheaper price. At the same time, the farm has some other golden goose which could lay eggs consistently even during the global financial crisis, providing stability to our overall investment.

One has to learn how to choose a golden goose, knowing when to buy / sell the goose and whether to keep the goose for golden eggs.

Power of Compound Interest

Albert Einstein is my idol, his scientific mindsets could be applied in investing world (inspiring me to establish Ein55 Styles of investing). He said “Compound Interest is the 8th Wonder of the World”. It is important for an investor to know which role to play, receiving or paying the compound interest. The results can be very different.

1) Receiving Compound Interest

Growth stocks receive compound interest with growing business and share price. An investor could become richer at faster rate because the growth stock may not pay dividend. Instead, the earning is invested back to the business to enlarge the market share, revenue and income. Even after a business has reached its maturity, the excess income could be redistributed as dividend to shareholders who could invest in other growth companies.

2) Paying Compound Interest

Junk stocks pay compounding interest with declining business and share price. An investor could become poorer at faster rate because the company business could be in crisis, not making money but still need to pay high interest of debt yearly. The worst is the company may still pay dividend to the shareholders with past saving while the company is still losing money, need to borrow more money externally at highest interest rate. This is a process of burning money. Eventually, the company could go bankrupt and the investors could lose all the money invested in a short time.

————————–

Compounding interest is a double-edged sword, if we use it correctly, the business could grow faster, an investor could benefit from larger capital gains and passive incomes from dividends. If this weapon is generalized, it is not limited to “interest” literally, it could be any method which could give the special edge to an investor or trader, eg:

1) Optimism Strategy – Reward/Risk ratio

2) Fundamental Analysis (FA) – Business Strength

3) Technical Analysis (TA) – Momentum / Trend Following

4) Personal Analysis (PA) – Contrarian to Herd Mentality

Ideally, we could integrate all the 4 weapons of (Optimism = FA + TA + PA), into a mega compound “interest” to accelerate the growth in investment.

3 Right Ways of Long Term Investing (Buy & Hold)

Long term investing does not guarantee success. Why investors such as Warren Buffett could make a lot of fortune with simple buy & hold strategy but some investors become poorer with investing over the long term?

“Buy stocks and hold for long term” is not sufficient.

Here are 3 right ways of Long Term Investing, depending on the expertise level:

1) Beginner Investors

“Buy good stocks and hold for long term.”

By adding a condition of “good” stocks, the long term investing strategy becomes 10X stronger because it has additional edge from FA (Fundamental Analysis) with strong business.

Even one does not know how to select good stocks, a no-brainer way of investing is to buy stock indices of growing economies, eg. S&P 500, Dow Jones Index, China A50, Hang Seng Index, or even Singapore STI. This provides sufficient diversification with strong country (Level 3 giant) as protection of investment.

Property in certain countries (big cities, limited land, growing populations), by default is a giant. Therefore even if one does not know how to choose property, majority of property investors could make money if having the holding power more than 1 decade.

Stock is different, careful selection of strong business is critical. Weak stocks could make us poorer with time, while giant stocks will grow stronger with holding for long term.

This group of investors need to master strategy to select giant stocks.

2) Intermediate Investors

“Buy good stocks at lousy price and hold for long term”

On top of the Strategy #1, if one could integrate the TA (Technical Analysis) weapon to buy low, only then hold for long term, this will help to maximize the capital gains.

One could integrate trading (eg. trend following) into investing, after buy low, there is no need to sell high. After the stocks have recovered from correction during market crisis, the capital gains will help to strengthen the confidence to hold for long term.

This group of investors need to master strategy to buy low for giant stocks.

3) Advanced Investors

“Buy good stocks at lousy price and hold for long term, aligning to own personality”

The risk of “Beginner and Intermediate Investors” is to overcome own’s fear during global financial crisis because they may have capital loss if enter the investment market at a wrong time. Warren Buffett’s Berkshire share price drops more than 50% in subprime crisis 2008-2009 but he could overcome the crisis because he has a portfolio of strong giant stocks. More importantly, this buy & hold strategy is aligned to his personality. For others who blindly copy and paste this strategy, it may not work because there is a mismatch with personality (risk tolerance level, emotional control, investment knowledge level, etc)

============================

In short, investing could be very simple (buy & then do nothing, holding for life), it could also very complicated if one does not have the right weapons of (Optimism = FA + TA + PA). Before we envy of those simple investment methods, we should check if it is suitable for us.

Jardine Group and UOB Group with Cross-Holding Stock Network

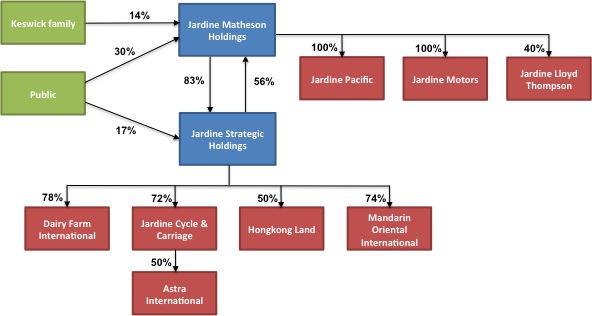

Company A owns Company B. In return, Company B also owns Company A. This is a complex cross-holding of stock network. Let’s learn how smart investors in Jardine Group and UOB Group, using the complex structure to hide their undervalue gem of stock.

Jardine is a giant group of stocks with nearly 200 years of history for Jardine Matheson Holdings, originally from China/Hong Kong, then having dual stock listing in London and Singapore stock exchanges. Ein55 Graduates have already considered Jardine Group of stocks: Jardine Strategic Holdings (SGX: JSH), Jardine Matheson Holdings (SGX: JMH), Jardine Cycle & Carriage (SGXL C07), Hong Kong Land (SGX: H78) last year when their Optimism levels were still low, share prices have gone up more than 20% since then when the market fear has subsided.

There is an interesting history for the cross-holding structure for Jardine group (image source: seekingalpha). Hong Kong richest person, Mr Li Ka-Shing planned to increase ownership in Hong Kong Land in 1980s, the Jardine group with Keswick family defended their control, forming JSH which owns JMH, in return JMH also owns JSH, very hard for any hostile takeover with this complex share structure.

UOB chairman, Mr Wee Cho Yaw also has a similar cross-holding network of stocks under UOB Group. There is a hidden gem in Wee family stock portfolio. Ein55 Graduates have learned in the last Charity Course (Discounted Asset Stock) on this special stock. The stock structure is so complex that undervalued stock could not be seen easily.

Normal investors could only buy at fair price because they don’t know how low is considered low for a share price. Traders would buy at high price, following trend to sell at higher price. Speculators would consider when there is good news with surge of more than 20%, buying at higher price, hoping to sell at highest price. Due to difference in entry prices, their reward / risk ratio will be different.

Ein55 Graduates have learned to buy giant stocks at unfair price with low optimism. For long term investors, some even consider low optimism from level 1 (business), level 2 (sector), level 3 (country) to level 4 (world).

Make Friend with Billionaires in Investment

A multi-billionaire could become super rich mostly because they they have a profitable business or they invest in other people’s profitable business. Their wealth is growing over the years, some could be as rich as the wealth of a small country.

We may not be able to establish the same business as them but we could make friends with these multi-billionaires by becoming a shareholder of their business. Alternatively, we could also study their stock portfolio because they also invest in other businesses.

So, what are the billionaire stocks to buy? The Billionaire Index is a compilation of stocks owned by global billionaire investors

https://www.ibillionaire.me/ibillionaireindex/

Based on a homework done by Ein55 Graduate, many (but not all) of these stocks by billionaires are strong business. So, it it is critical for us to know what are the truly giant stocks which make these billionaires richer over the time. Even we may not become a billionaire, we could share a profit by becoming a millionaire one day, if we know their investing mindset. More importantly, many of these stocks are at high price due to high optimism of US market.

We only make friends with these billionaires when their net worth is reduced by more than 20% one day during global financial crisis due to falling down in share prices but the strong business still make money consistently yearly for them and for us.

Roller Coaster Investment Strategy with Walt Disney in Global Financial Crisis

You are tortured with turning upside down, but still willing to pay to exchange for this experience. This is the glamour of Disneyland, a defensive recession-proof entertainment industry, which you could profit through investment partnership with Walt Disney stock, a nearly 100 years old business.

There are many mega theme parks in the world, why there are so many people fascinated about Disneyland? Personally I have been to Disneyland in Florida, California, Japan and Hong Kong. The new Disneyland is opening in Shanghai, overwhelming response, a new gold mine for the company. Disney’s power is with its intangible asset of brand, for so many years, from watching Disney cartoons to movies and all kinds of Disney related products. Everyone of us still has a childhood dream which becomes real only in the world of Disney.

Enjoy the rides, including the roller coaster. My first experience with roller coaster was in Six Flags Texas when I was still an undergraduate many years ago, trying the world Tallest wooden roller coaster at that time. The outcome is predictable, I was so nervous and scared, not enjoyable at all. After so many years of roller coaster experience, I learn to be flexible, following the trend of movement (eg. move the body when turning together), imagining it is only a swing or a bird flying in the sky, then I could enjoy it.

We can learn a lot about investment from the rides:

1) Following the mega market trend. It is painful when we try to move against it. Each of us should define our comfortable levels of rides, from short term trading, mid term trading to long term investing.

2) Cyclic movement, what goes up will come down. That’s why we should buy low sell high, not following our emotions of greed and fear. For experienced riders, they actually becomes fearful when roller coaster is hanging at the peak because they know the predictable next move: falling down!

3) At the end of ride, you will be fine. If we learn how to find giant stocks, regardless up and down in share prices, eventually the business is still making money each month and each year, we will become the final winner.

Walt Disney stock (NYSE: DIS), is falling from its peak of $120, currently at 65% long-term Optimism (see chart). In the last stock market cycle, an investor could apply Optimism Strategy developed by Dr Tee to buy Walt Disney at $24 (25% Optimism) in year 2009, selling at $120 (75% Optimism) in year 2015 with potential gain of 5 times. For investors, they should have sold the stock in 2015 as the risk of falling is 65% with limited upside (35%). At the same time, regional crisis including Brexit and economy slowdown, has created a mid-term low optimism, suitable for trading Walt Disney. The right action or strategy depends on our personality.

Walt Disney is a global giant stock worth consideration during crisis at Level 3 (country/regional crisis) or Level 4 (global financial crisis) for investing. The earning per share over the past 10 years is consistently growing (see chart). I am not surprised if this brand could exist for another 100 years because our children will pass this unique memory to future generations who may continue to pay for this childhood dream. We should learn when and what price to buy Walt Disney for trading or investing.

Opportunity after Brexit to Invest in Li Ka-Shing Portfolio and other Blue Chips

The Brexit crisis is a blessing in disguise, many people sell away their best stocks out of fear, creating a rare opportunity to buy blue chips at intermediate low prices. People worry about the status of London as global financial center, many bank stocks are affected. Share price of top UK Bank, Barclays, was falling by 30%, while global major banks such as JP Morgan and Citigroup, were corrected more than 10% in share prices.

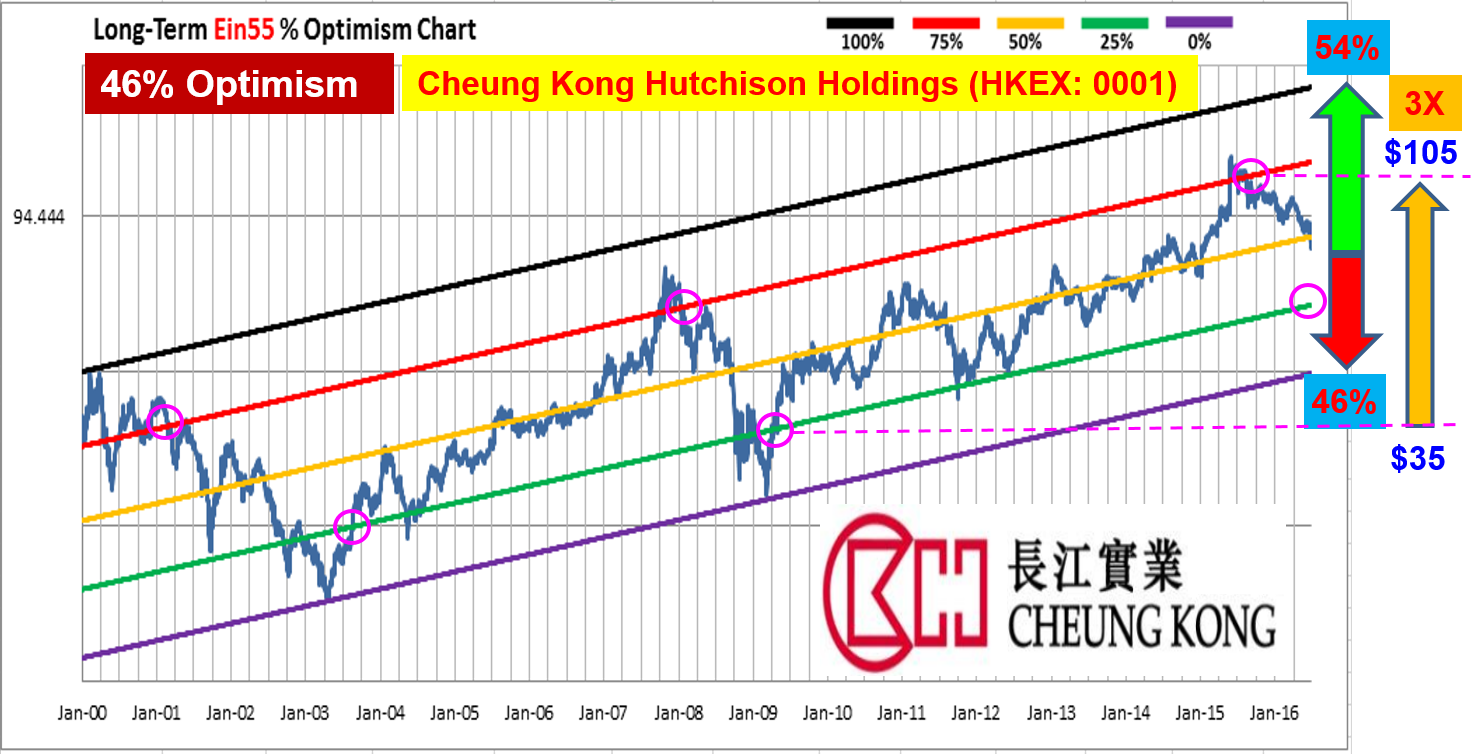

Many global blue chip stocks with business in UK, become target for speculation. The richest man in Asia, Li Ka-Shing, suffers the most. The #1 stock in Hong Kong (Cheung Kong Hutchison Holdings, HKEX: 0001), is severely corrected is stock price, currently at $82, down by about 1/3 from its peak price of $122 (see chart below). In the last stock market cycle, an investor could apply Optimism Strategy developed by Dr Tee to buy Cheung Kong at $35 (25% Optimism) in year 2009, selling at $105 (75% Optimism) with potential gain of 3 times. Usually it is hard to wait for the giant stocks to fall down, Brexit has helped to correct the long-term Optimism to 46%, getting closer for an investor to consider again. At the same time, mid-term Optimism of Cheung Kong is down to 0%, an attractive price for trading.

This is a rare opportunity for investor, share price correction is partly due to Brexit, economy slowdown in Hong Kong / China and major correction in Hang Seng Index (HSI). Optimism is a probability calculator, we could estimate the reward to risk ratio, we could safely consider a good stock if we could wait for the giant to fall down. However, the short term trend is negative due to bearish global stock market sentiments, an investor could apply trading strategy to buy this stock when sentiment is positive again.

When Optimism Strategies are combined with Fundamental Analysis (value investing & growth investing), Technical Analysis (support / resistance / trends), and Personal Analysis (mind control of greed and fear), it is very powerful when one is able to take the right action (Buy, Hold, Sell, Wait or Short) at the right time aligning with own personality.

The unique Optimism Strategy developed by Dr Tee provides a special advantage to know which investment (stock, forex, property, commodity, bond, etc) to buy safely, when to buy, when to sell, including option of long term holding. So far over 10,000 audience have benefited from Dr Tee high quality free courses to the public. Take action now to invest in your financial knowledge, starting your journey towards financial freedom.

Brexit has created new stock trading and investing opportunities globally. At the same time, British Pound is severely corrected, one could apply Forex Optimism to maximize the gains in stock market. The fear factor has supported the bullish gold price and gold related stocks (eg. gold miners), analysis with Commodity Optimism is needed. Every crisis is an opportunity, provided one knows how to position.