Temasek has offered partial acquisition to Keppel Corp (SGX: BN4) shareholders at the price of $7.35/share up to 51% ownership over 1 year period (with some conditions applied). Since this is not a full acquisition, some investors may be confused of what is fair price for Keppel Corp. Let’s study this acquisition offer in details.

Temasek owns 20.45% of Keppel Corp, intending to purchase shares owned by remaining shareholders (100 – 20.45% = 79.55%) to top up to 51% (still need 51% – 20.45% = 30.55%). So, it is partial acquisition of 30.55/79.55 = 38.4%. It means for every 1000 shares, 384 unit will be acquired.

The offer price of Temasek at $7.35 is about 20% premium over the average price before acquisition, aligned with several other acquisitions in Singapore. However, it only has 38.4% power, not the same as 100% power as other full acquisition (eg. Breadtalk current acquisition offer of $0.77, price would surge near to this price overnight after the announcement). Assuming the Keppel Corp share price is $5/share (on certain day), the theoretical share price after 38.4% partial acquisition = $5 + (7.35 – $5) x 0.384 = $5.90/share. Reader may replace this equation of $5 share price with any latest share price of Keppel Corp before acquisition.

Over the past 1 month of global stock crisis, Singapore stocks fall by about 30% in average but Keppel Corp only falls about 20%, aligning with 38.4% potential acquisition by Temasek which is about 1/3, therefore the stock corrections is also reduced by about 1/3 from 30% to 20%.

It means the global stock crisis still has about 60% impact on Keppel Corp prices. Therefore, an investor has to make decision mainly based on global stock crisis and current stock market condition with Keppel Corp value, not to assume price would recover to $7.35/share price eventually.

==========================

Keppel Corp is a diversified corporation with 4 businesses: offshore &marine, property, infrastructure and investment. The 2 main pillars are Property (Keppel Land, contributing to about 50% company profits) and Oil & Gas (Keppel O&M, main source of losses over the past few years). Over the past 5 years after the oil price fell from $100 to $27/barrel, Keppel Corp suffers directly as main clients reduce the capital expenditure (eg. oil rigs), therefore Oil & Gas becomes a losing segment.

Since 2015 crude oil crisis, Keppel Corp has temporary lost the giant stock title, currently a marginal giant (likely will become giant stock again after oil & gas sector recovery). Luckily Keppel Corp still has 50% earnings from Property (eg. Keppel Land and Keppel Reit), even Oil & Gas is a loss for several years (recovering to small profits in last 1 year), the entire company as a whole could still make a profit. Compared with competitor or sibling, Sembcorp Marine (SGX: S51, also owned by Temasek through Sembcorp Industries) which has full risk exposure to oil & gas crisis, losing money for several years, resulting in share prices falling from $5 to $0.70 (last 17 years low).

Some may think it is “cheaper” to invest in Sembcorp Marine stock (85% correction) compared to Keppel Corp stock ($13 falling to $5/share during oil & gas crisis, about 60% correction). This comparison is only valid if both companies are giant stocks (which are not) because “crisis is not opportunity” if business fundamental is weak, eg for the case of Sembcorp Marine. For Keppel Corp, it is still a 50% giant stock due to strong property business. Therefore, investor of Keppel Corp is actually investing in value of Keppel Corp property (main value) while taking advantage of falling share price (due to Oil & Gas crisis). It was a good move in year 2015 (beginning of oil & gas crisis) for Keppel Corp to offer full acquisition of Keppel Land which 100% profits of property business goes to Keppel Corp, offset the losses in Oil & Gas segment in Keppel O&M.

Assuming Temasek could successfully own 51% of Keppel Corp by end of 2020, it is a full control of company. This may allow possibilities of strategic merging of Temasek subsidiaries companies (eg. Keppel O&M and Sembcorp Marine) or restructuring of Temasek companies, eg. Keppel Corp and Sembcorp Industries (Temasek nearly has 50% control), etc, to maximize the asset values.

===================

During crude oil crisis with Keppel Corp at low optimism prices, Temasek leverages on crisis to have majority control of Keppel Corp at reasonable low price of $7.35/share. This also provides an option for Keppel Corp investors to sell for 20% profit. However, the global stock crisis has disturbed the plans as prices of Keppel Corp are falling even lower than before acquisition news.

Analysis on Keppel Corp is beyond stock and Temasek, also requires understanding of property market and crude oil commodity market. So, it is a stock with complicated interactions of market signals, reflecting in final share prices.

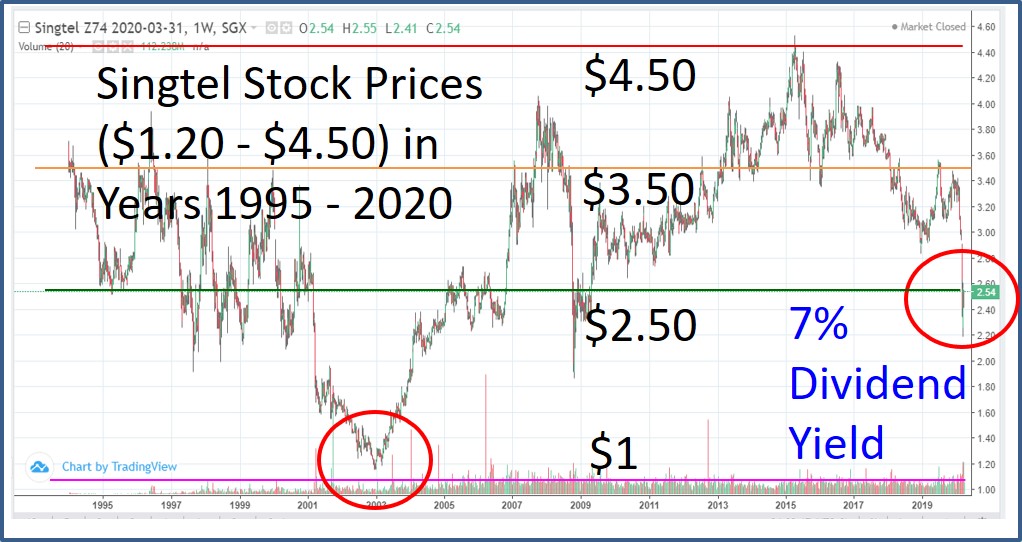

Here is a special Ein55 style, 50% Discount Method for investing in Keppel Corp during crisis (with or without Temasek acquisition) with multiple entries to fight against unknown market crisis ahead. Assuming $10 is a common high level prices (occurred during when economy and crude oil market are bullish), an investor may apply 50% discount in prices each time before each multiple low due several unforeseen market crisis.

$10 = High Level Price (potential future selling price level)

$5 = Crude Oil & Stock Crisis (3 times in 2009, 2016, 2020) after 50% discount x $10

$2.50 = Global Financial Crisis (17 years low) after another 50% discount x $5

$1.25 = Great Depression (20 years low) after another 50% discount x $2.50

This is a non-linear version of multiple entries for very conservative investor who hopes to buy low but afraid of prices could get lower. Assuming all the crisis come (hopefully not), this is average price after 3 entries (like Keppel Corp with property pillar could still survive):

($5 + $2.50 + $1.25) / 3 = $2.92

This is lower than using linear average down method at low optimism (assuming 3 entries with $1 lower each time):

($5 + $4 + $3) / 3 = $4

Each method (linear or non-linear 50% discount) has its benefits. Linear method is more likely to achieve in practical market, for those who wish to reduce downside risk through averaging (eg. 3 times x 33% capital). Non-linear method is for very conservative investor, demanding 50% discount each time before willing to take out precious cash from the pocket for investment. During the long holding period (could be 1-3 years, depending on severity of crisis), Keppel Corp investor may be given an average of 4-5% dividend yield (past 10+ years record), assuming the dividend is also cut by 50% due to crisis, one could still get about 2% dividend yield which is higher than fixed deposit in banks with 1% interest rate. After the crisis is over, assuming the average entry price is only $5 (only 1 crisis experienced), an investor may not need to sell at $10 average high prices for 100%, could even sell near to Temasek fair acquisition price of $7.35 which is over 40% higher than $5 price.

=======================================

Charlie Munger (partner of Warren Buffett) said the big money is not in the buying and selling, but in the waiting. Global stock crisis may happen only every 5 to 10 years. Similar to a lion ambushed, waiting patiently for target, when opportunity comes near, only then strike for higher chance of winning. It is the same for current global stock crisis, for investors “ambushed” for many years, it could be the right time to plan for a strategy to take action in stocks.

Frankly speaking, there are over 100 global giant property stocks and 44 global oil & gas giant stocks (based on Dr Tee criteria), which are much stronger than Keppel Corp. Some of these giant stocks are also falling in prices 20% – 50% recently, “Crisis is Opportunity” investing in these growing business (value) with significant discount in prices.

There are at least 26 Temasek / GLC stocks in Singapore including Keppel Corp, controlling shareholder with 15% or more ownership directly or indirectly (investor needs to focus only on giant Temasek stocks):

Singtel (SGX: Z74), DBS Bank (SGX: D05), ST Engineering (SGX: S63), Singapore Airlines (SGX: C6L), SIA Engineering (SGX: S59), Singapore Exchange (SGX: S68), SATS (SGX: S58), Sembcorp Industries (SGX: U96), Sembcorp Marine (SGX: S51), Olam (SGX: O32), CapitaLand (SGX: C31), CapitaLand Mall Trust (SGX: C38U), CapitaLand Commercial Trust (SGX: C61U), Ascendas Reit (SGX: A17U), Ascott Hospitality Trust (SGX: HMN), Ascendas Hospitality Trust (SGX: Q1P), CapitaLand Retail China Trust (SGX: AU8U), Ascendas-iTrust (SGX: CY6U), Keppel Corp (SGX: BN4), Keppel Reit (SGX: K71U), Keppel DC Reit (SGX: AJBU), Keppel Infrastructure Trust (SGX: A7RU), Mapletree Logistics Trust (SGX: M44U), Mapletree Commercial Trust (SGX: N2IU), Mapletree Industrial Trust (SGX: ME8U), Mapletree NAC Trust (SGX: RW0U).

Temasek stocks portfolio also affect about 15% of STI index stocks, which has strong impact on Singapore stock market. Here are 30 STI component stocks:

DBS Bank (SGX: D05), Singtel (SGX: Z74), OCBC Bank (SGX: O39), UOB Bank (SGX: U11), Wilmar International (SGX: F34), Jardine Matheson Holdings JMH (SGX: J36), Jardine Strategic Holdings JSH (SGX: J37), Thai Beverage (SGX: Y92), CapitaLand (SGX: C31), Ascendas Reit (SGX: A17U), Singapore Airlines (SGX: C6L), ST Engineering (SGX: S63), Keppel Corp (SGX: BN4), Singapore Exchange (SGX: S68), HongkongLand (SGX: H78), Genting Singapore (SGX: G13), Mapletree Logistics Trust (SGX: M44U), Jardine Cycle & Carriage (SGX: C07), Mapletree Industrial Trust (SGX: ME8U), City Development (SGX: C09), CapitaLand Mall Trust (SGX: C38U), CapitaLand Commercial Trust (SGX: C61U), Mapletree Commercial Trust (SGX: N2IU), Dairy Farm International (SGX: D01), UOL (SGX: U14), Venture Corporation (SGX: V03), YZJ Shipbldg SGD (SGX: BS6), Sembcorp Industries (SGX: U96), SATS (SGX: S58), ComfortDelGro (SGX: C52).

==================================

Drop by Dr Tee free 4hr investment course to learn how to position in global giant stocks with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Learn further from Dr Tee valuable 7hr Online Course, both English (How to Discover Giant Stocks) and Chinese (价值投资法: 探测强巨股) options, specially for learners who prefer to master stock investment strategies of over 100 global giant stocks at the comfort of home.

You are invited to join Dr Tee private investment forum (educational platform, no commercial is allowed) to learn more investment knowledge, interacting with over 9000 members.