Over the past few years, both Hong Kong and China stock markets have been bearish, under low Optimism level, many giant stocks (property, technology and nearly all sectors) are heavily discounted with over 50-70% price corrections.

However, it is not easy to “Buy Low” as the stock may get lower, an investor may end up selling lower with loss. Even Charlie Munger (business partner of Warren Buffett), has been trying to buy low several times for Alibaba when share prices falling down from $200+ to below $100, ending up stop loss when it exceeds risk tolerance level.

The key is timing of entry for low optimism giant stocks, including Hong Kong Hang Seng Index (HSI ETF) and China Shanghai Index (A50 ETF), aligning to own unique personality. Contrarian investing (buying during bearish trend) requires careful selection of stocks (eg. defensive dividend stocks), strong mind control and money management (eg. averaging down with position sizing and diversification over a portfolio of 10-20 giant stocks).

Trend-following investing could be more suitable for retail investors, aiming for giant stocks with prices far below value (need to compute fair price), then waiting patiently for reversal signals from bear to bull again. Both Hong Kong and China have created double bottom pattern opportunities, first recovery was late 2022 when zero COVID policy has ended but then corrected again with economy slowdown to another low (eg. 15000 points for Hong Kong HSI), second recovery only happens recently after economic stimulus plans (eg. loosening of property market, lower mortgage rate, etc). HSI recovers again from 15000 points valley to above 17000 short term resistance (late Apr 2024), currently near to 20000 points.

For investors who miss the Hong Kong HSI 30% rally from 15000 to nearly 20000 points, may feel “missing the boat”, thinking it is too “high” now to buy. In fact, this is the mentality of “penny wise but pound foolish”, i.e. only considering the near term (tree) but missing the mid to long term (forest). Even for a short term trader, it is fine to Buy intermediate “High” Sell Higher following trend, while the “High” for a trader is actually still “Low” (despite not the lowest) for longer term investor. These perception differences are personality dependent, alignment of strategy with unique personality (eg. short / mid / long terms, cyclic / growth / dividend, contrarian / follow-trend, etc) is key for success in stock trading or investing.

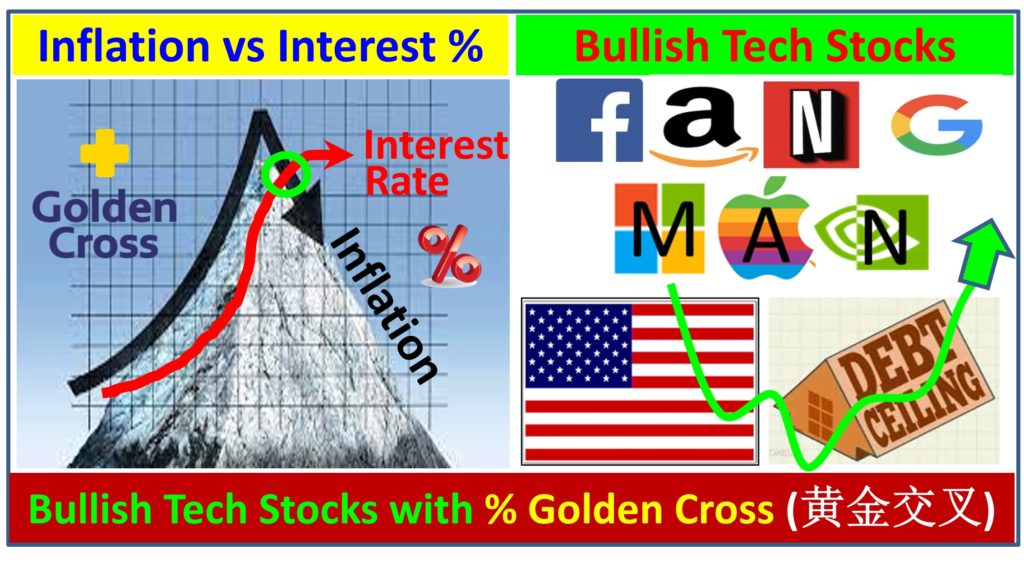

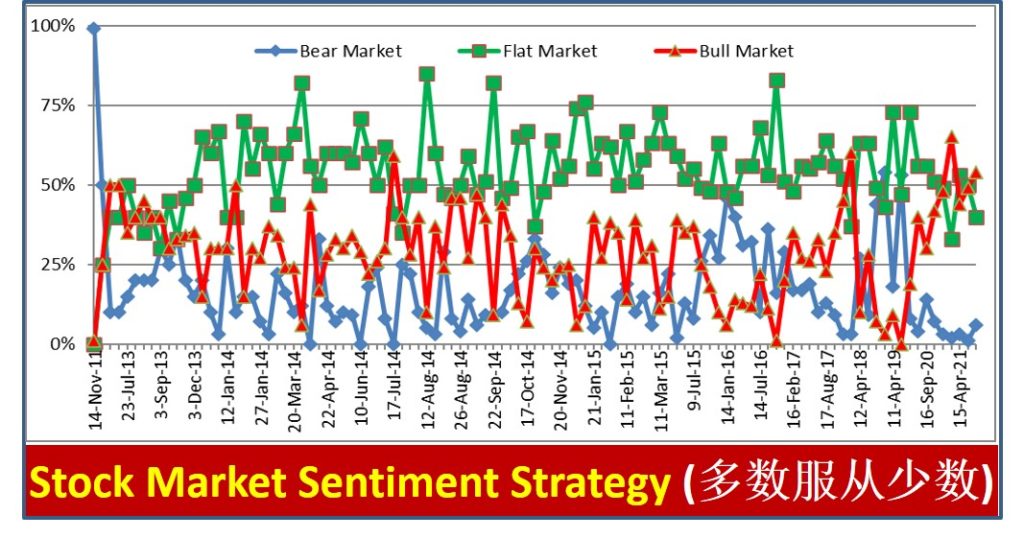

Current global stock markets provide special advantages to both short term traders (eg. bullish US market with new historical high for S&P500 and Dow Jones to Buy High Sell Higher with Momentum Trading, aiming for US interest rate cut in year 2024) and long term investors (eg. bearish or lagging Asian market (Hong Kong / China / Singapore / Malaysia) to Buy Low Sell High with Cyclic Investing, supported by recent economic stimulus plans in China.

It is timely now to review own global stock portfolio, making decisions (Buy / Hold / Sell / Wait / Shorting), leveraging on market greed and fear.

===================================

There are over 2000 giant stocks in the world based on Dr Tee criteria, choice of 10 Dream Team giant stocks have to align with one’s unique personality, eg. for shorter term trading (eg. momentum or swing trading) or longer term investing (cyclic investing, undervalue investing or growth investing). Readers should not just “copy and paste” any stock (What to Buy, When to Buy/Sell) as successful action taking requires deeper consideration (LOFTP strategies – Level / Optimism / Fundamental / Technical / Personal Analysis) which you could learn further from Dr Tee Free 4-hr Webinar.

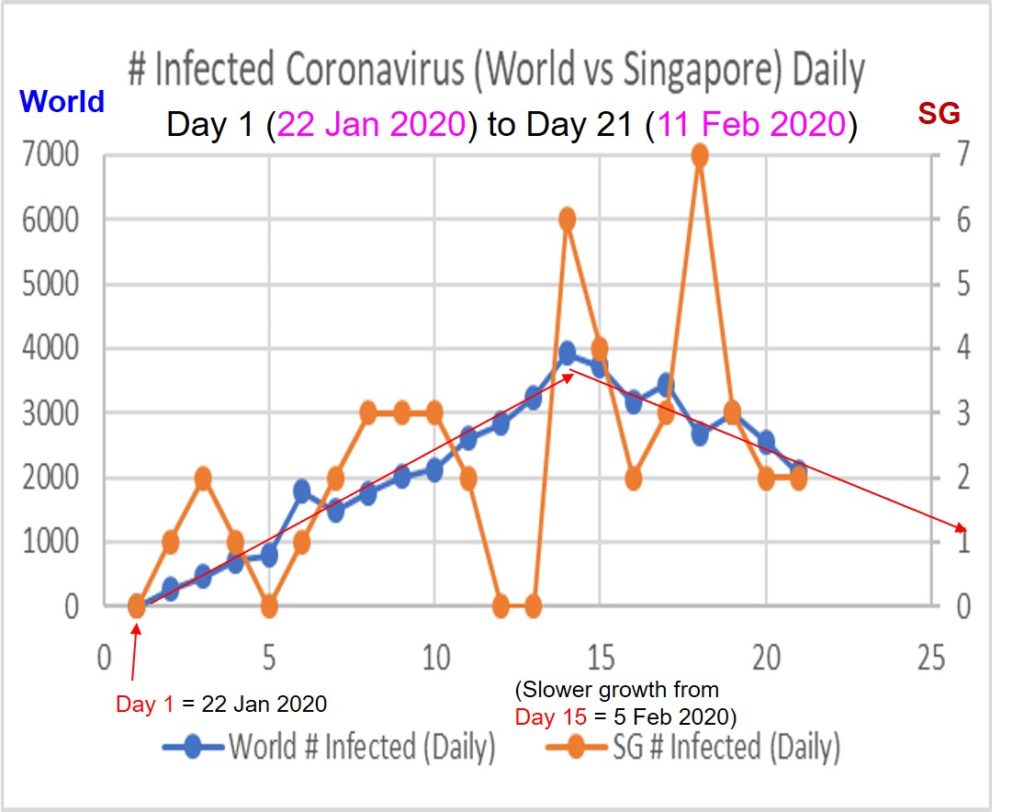

Drop by Dr Tee free 4hr webinar (learning at comfort of home with Zoom) to learn how to position in global giant stocks during COVID-19 stock crisis with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Zoom will be started 30 min before event, bonus talk (Q&A on any investment topics from readers) for early birds. There are many topics we will cover in this 4hr webinar, Dr Tee can have more time for Q&A if you could stay later after the webinar, you could ask on any global and local stocks including but not limited to 30 STI component stocks:

Ascendas Reit (SGX: A17U), CapitaLand (SGX: C31), CapitaLand Integrated Commercial Trust (SGX: C38U), City Development (SGX: C09), ComfortDelGro (SGX: C52), Dairy Farm International (SGX: D01), DBS Bank (SGX: D05), Frasers Logistics & Commercial Trust (SGX: BUOU), Genting Singapore (SGX: G13), Hongkong Land (SGX: H78), Jardine Cycle & Carriage (SGX: C07), Jardine Matheson Holdings JMH (SGX: J36), Keppel Corp (SGX: BN4), Keppel DC Reit (SGX: AJBU), Mapletree Commercial Trust (SGX: N2IU), Mapletree Industrial Trust (SGX: ME8U), Mapletree Logistics Trust (SGX: M44U), OCBC Bank (SGX: O39), SATS (SGX: S58), Sembcorp Industries (SGX: U96), Singapore Airlines (SGX: C6L), Singapore Exchange (SGX: S68), Singtel (SGX: Z74), ST Engineering (SGX: S63), Thai Beverage (SGX: Y92), UOB Bank (SGX: U11), UOL (SGX: U14), Venture Corporation (SGX: V03), Wilmar International (SGX: F34), YZJ Shipbldg SGD (SGX: BS6).

Dr Tee will cover over 20 case studies, Singapore giant stocks, eg. CapitaLand Integrated Commercial Trust (SGX: C38U), Singapore Exchange (SGX: S68), Keppel Corp (SGX: BN4), Top Glove (SGX: BVA), Jardine Matheson Holdings JMH (SGX: J36), Vicom (SGX: WJP) and many others, Malaysia giant stocks, Hong Kong giant stocks and US giant stocks, both long term investing and short term trading.

There are limited tickets left for this 4hr free webinar, please ensure 100% you could join when register: www.ein55.com

View quick preview video below, Dr Tee will introduce 10 key stock investment strategies (股票投资十招) to be learned in 4hr free stock webinar:

Register Here (Dr Tee Free 4hr Stock Webinar): www.ein55.com