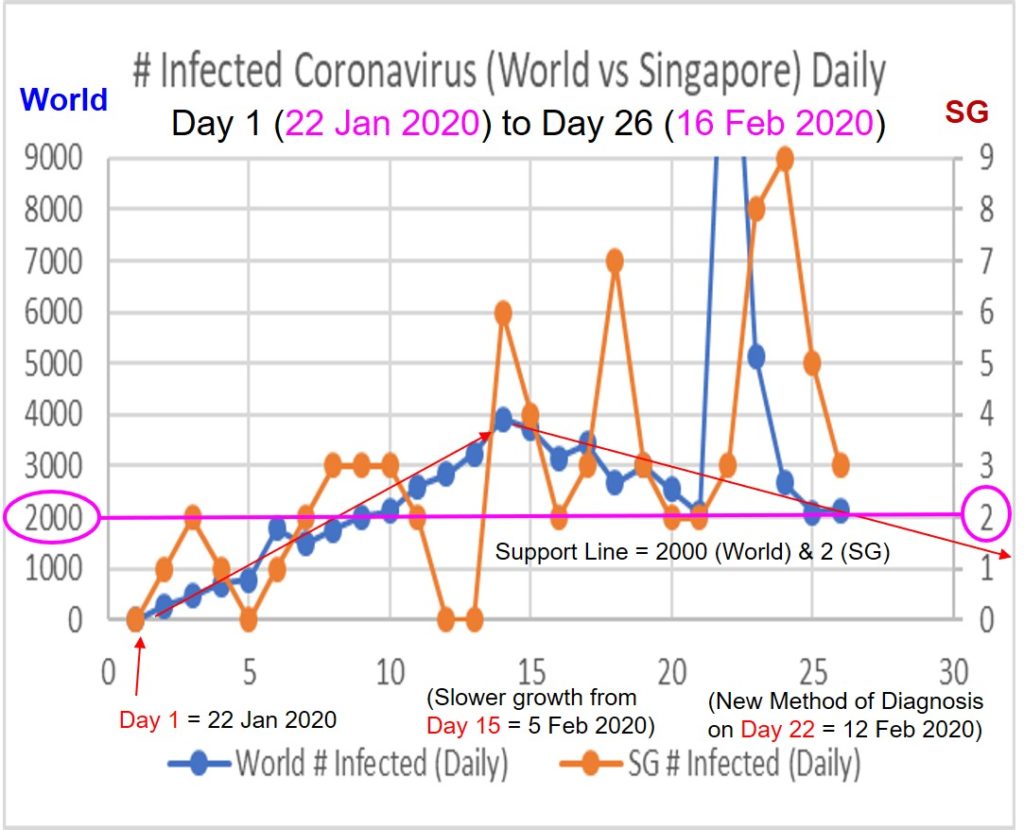

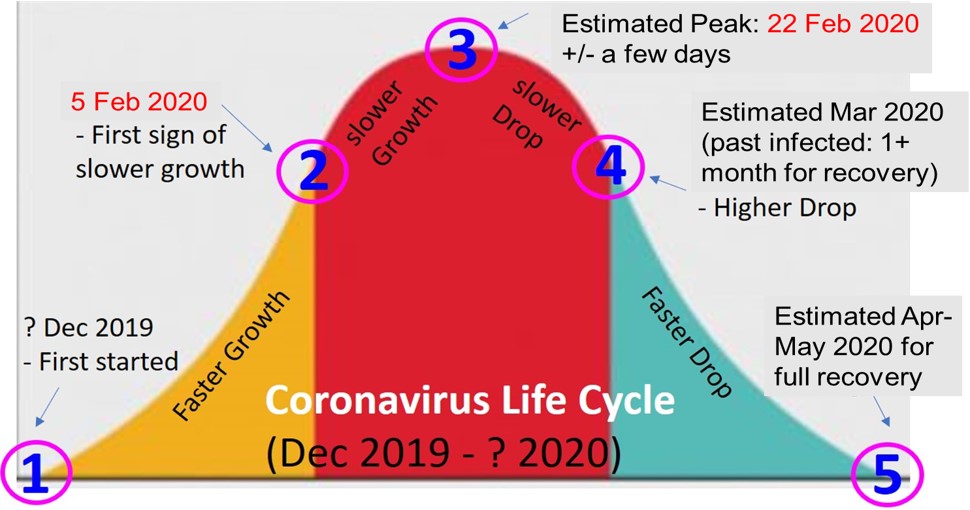

危机,有危就有机。Dr Tee 应用了难得休假,制作更多网上学习课程。几天的努力后,呈献给 Ein55 会员,全新的免费华语视频投资课程(一小时多的学习):环球股票市场展望与冠状病毒技术分析。

这儿是 Dr Tee 华语视频 (英语视频也已完成,Dr Tee 双语皆行): https://youtu.be/Wxq_6lj_mOE

请欣赏鄙作,留言求进步。您可订阅 Ein55 youtube 频道,链接未来投资视频。双红利:

1) Dr Tee 9堂网上价值投资策略课程 ($100, Ein55 会员获得75%折扣,只需$25, 可全家分享):

https://www.investingnote.com/store/products/discover-giant-stocks-value-investing-strategies

2) Dr Tee 免费投资课程与电子书下载:

www.ein55.com

Share price is a 3-dimensional movement, governed by Ein55 Law of Stock Market Motion:

Share price is a 3-dimensional movement, governed by Ein55 Law of Stock Market Motion: