We have learned from Dr Tee to buy giant stocks at low optimism for investing. However, nowadays fund managers have become competitors for retail investors for such investing opportunities. Recently a consortium including Temasek, has offered to acquire Eu Yan Sang. Let’s analyse further based on optimism strategies.

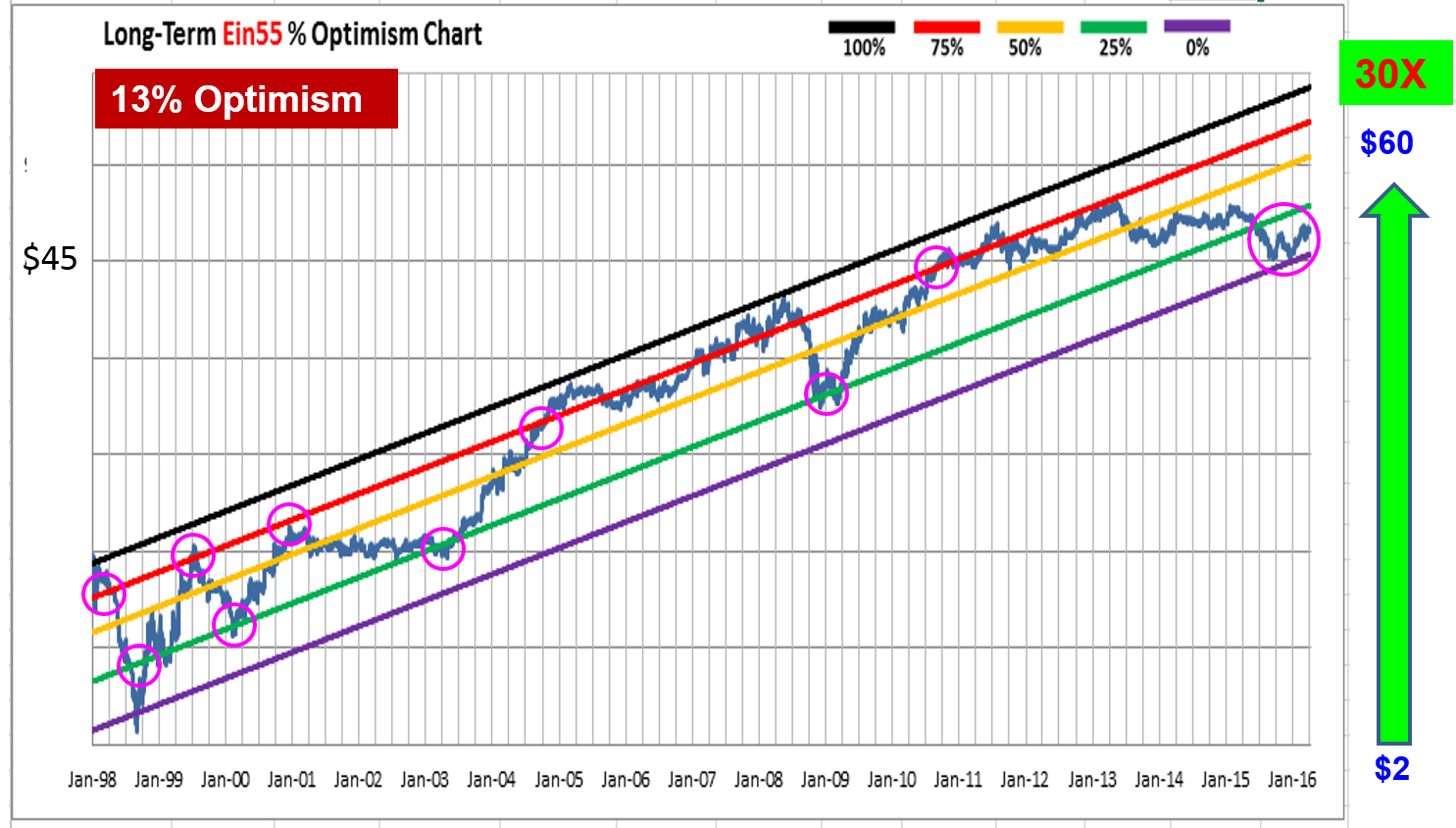

The earning ability of Eu Yan Sang has declined over the past few years due to slowdown in local and regional economy but still it is profitable. Net Asset Value (NAV) of Eu Yan Sang has increased consistently over the past 10 years since IPO (see chart below). Temasek and partners made the offer when Eu Yan Sang share price is still at low optimism (<25%). Even at current share price of $0.63 (slightly higher than offer price of $0.60), the Optimism is only 26%.

This implies that Temasek and partners have acquired a valuable business at a relatively low price with consideration of its value. Although the current stock price is 3 times compared to IPO price 16 years ago, it is still relatively cheap for a growing business. We could not compare with only the historical low price based on technical analysis, the fundamental of the business has to be considered as well.