In this article, you will learn 8 glove manufacturer stocks in Singapore and Malaysia and 6 other sectors which could profit from Covid-19 crisis, each requiring unique stock strategies for investing or trading.

1) Top Glove (SGX: BVA) / (Bursa: 7113) – Singapore / Malaysia Giant Glove Stock

2) Hartalega (Bursa: 5168) – Malaysia Giant Glove Stock

3) Kossan (Bursa: 7153) – Malaysia Giant Glove Stock

4) SuperMax (Bursa: 7106) – Malaysia Giant Glove Stock

5) Riverstone (SGX: AP4) – Singapore Giant Glove Stock

6) Comfort Gloves (Bursa: 2127) – Malaysia Glove Stock

7) Careplus (Bursa: 0163) – Malaysia Glove Stock

8) Rubberex (Bursa: 7803) – Malaysia Glove Stock

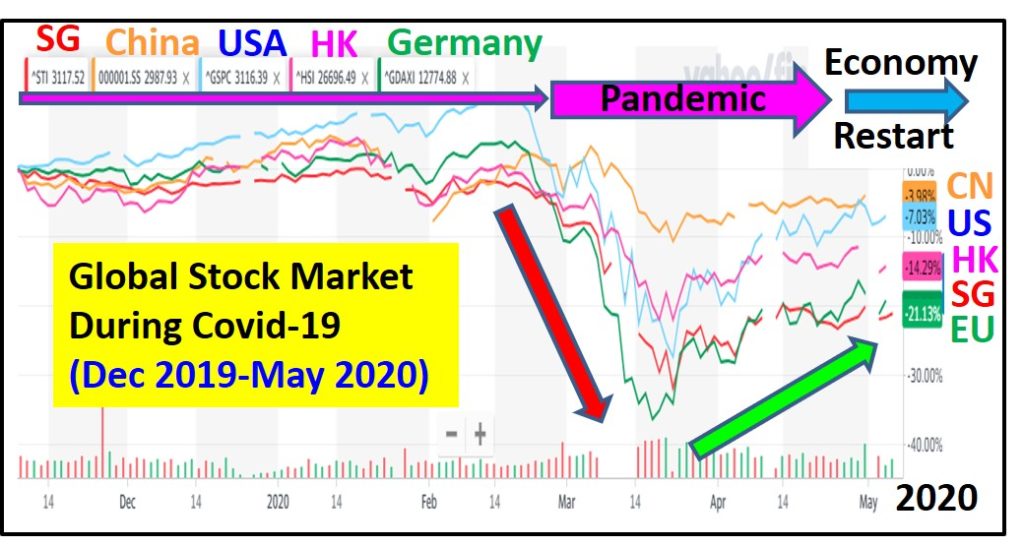

Crisis is opportunity for stock investing, especially true for glove manufacturers during Covid-19 crisis as demand for gloves are surging. In the past 1 decade, glove stocks are in the best time of era, strong growing business supported by 4 main factors:

1) Growing economy – higher manufacturing needs, especially glove is consumable (cheap but frequently used / replaced), recurring income.

2) Pandemic – higher healthcare needs, including Covid-19, H1N1 and other virus outbreaks.

3) Lower cost – especially for latex glove as rubber price has been low optimism due to bearish global commodity market. Thailand and Malaysia are rubber main producers, supplying to factories of these glove manufacturers within the same countries, saving more cost.

4) Stronger USD – forex becomes advantage for glove manufacturers as local expenses are mostly paid in ringgit but customers are based from overseas (world), therefore collecting payment (incomes) in USD which is stronger relative to ringgit. Of course, this advantage may become a weakness in future when USD becomes weaker.

Fundamentally, Covid-19 crisis helps to improve the business of these glove stocks, Q1/2020 financial results are even stronger than previous year. A strong fundamental business when encounter high demand due to market greed (which may be due to fear), the share price could be speculated higher.

Strong Fundamental + Market Greed = Positive Speculation

[Higher Sales + Stronger (USD/MYR) – Lower Cost] + Higher Greed (Pandemic Fear) = Higher Share Price

Indeed, all of these 8 glove stocks have surged more than 2 times in share prices over the past few months of Covid-19 pandemic. However, the current prices are at high optimism, mainly suitable for very short term momentum trading (Buy High Sell Higher).

Top Glove (listed in both Singapore and Malaysia), Hartalega, Kossan and SuperMax are considered the Big Four of glove manufacturers in Malaysia, all are giant stocks (based on Dr Tee criteria), will be discussed in further. Riverstone is a smaller player (listed in Singapore) but having strong business fundamental, will have more comments as well later. As for other 3 glove stocks (Comfort Gloves, Careplus, Rubberex) which are smaller in size, only have stronger business over the past 5 years (likely due to leftover demand, competing with lower prices or niche market), mainly suitable for short term trading, not a giant stock.

So, we will elaborate here mainly on 5 giant glove stocks (Top Glove, Hartalega, Kossan, SuperMax, Riverstone) which may be considered for both longer term investing (when correcting below a fair price with holding power) and short term trading (following S.E.T. trading rule – Stop Loss / Entry / Target Prices).

1) Top Glove (SGX: BVA) / (Bursa: 7113) – Singapore / Malaysia Giant Glove Stock

Top Glove is the world’s largest rubber glove manufacturer with many types of latex and nitrile gloves from manufacturing facilities in Malaysia, Thailand and China. Founder and major shareholder is Lim Wee Chai (27% ownership), also the No 14 richest person in Malaysia (Forbes’ List), supported mainly by rising share prices over the 2 past decades (share price goes up over 500 times since IPO till now). Top Glove has become 1 of 30 KLCI component stock, showing its business strength.

Top Glove has dual listing in Malaysia Bursa (longer history) and Singapore SGX. The relative stock performance are aligned but due to different group of investors, short term share price in SGX (BVA) is even more bullish than in Bursa (7113). Fundamentally, each share (SGX or Bursa) is the same but short term share price may not be due to difference of forex (SGD/MYR) alone.

Top Glove is a strong growth stock (supported by growing businesses with strong cash flow) but highly leveraged (high debt) to expand its capability further, strengthening its position as world’s largest glove manufacturer. Scale of economy is also a form of economic moat, position as bigger player could help to lower down the unit cost, therefore increase the profit margin.

Due to high optimism in share price, Top Glove may be considered as a mid-fielder stock (aiming for high capital gains with little dividend yield as bonus). It may also be considered for very short term momentum trading despite share price is speculated (Buy High Sell Higher strategy).

2) Hartalega (Bursa: 5168) – Malaysia Giant Glove Stock

Hartalega is the world’s largest nitrile glove manufacturer. Founder and major shareholder is Kuan Kam Hon (about 50% ownership with family), also the No 9 richest person in Malaysia (Forbes’ List), supported mainly by rising share prices over the past decade (share price goes up nearly 100 times since IPO till now). Hartalega has become 1 of 30 KLCI component stock, showing its business strength.

Hartalega main product of nitrile glove has higher profit margin compared to latex (rubber) glove. However, this profitable product segment also attracts many competitors, therefore the high growth of Hartalega is getting slower, now is more aligned (sustainable rate) with other major competitors, sharing the big pie of glove industries.

Hartalega is a strong growth stock (supported by growing businesses with strong cash flow) with lower debt level (having potential to expand further with more leveraging if needed). Scale of economy is also a form of economic moat, position as bigger player (nitrile glove) could help to lower down the unit cost, therefore increase the profit margin.

Due to high optimism in share price, Hartalega may be considered as a mid-fielder stock (aiming for high capital gains with little dividend yield as bonus). It may also be considered for very short term momentum trading despite share price is speculated (Buy High Sell Higher strategy).

3) Kossan (Bursa: 7153) – Malaysia Giant Glove Stock

Kossan is the world’s second largest glove manufacturer (technical rubber products, medical gloves, cleanroom products, etc). Founder and major shareholder is Lim Kuang Sia (about 50% ownership), was in 2017 Forbes’ List for Malaysia No 30 richest person, supported mainly by rising share prices over the past 2 decades (share price goes up about 60 times since IPO till now).

Kossan is a strong growth stock (supported by growing businesses with strong cash flow), performance is comparable with the main competitor, Top Glove. Kossan has moderate debt level, having potential to expand further with more leveraging if needed. The glove industry is big enough for major players to share the big global pie of growing demand for gloves in manufacturing and healthcare sectors.

Due to moderate high optimism in share price (compared to other 4 giant glove stocks at high optimism), Kossan has more upside potential, may be considered as a mid-fielder stock (aiming for high capital gains). It may also be considered for very short term momentum trading despite share price is speculated (Buy High Sell Higher strategy).

4) SuperMax (Bursa: 7106) – Malaysia Giant Glove Stock

SuperMax is a leading medical / latex gloves manufacturer. Founder and major shareholder is Thai Kim Sim (about 40% ownership together with wife) who was charged with insider trading in Year 2017. However, this negative news does not stop investors from supporting SuperMax, share price goes up about 60 times over the past 2 decades. During Covid-19 pandemic, SuperMax share price is the most bullish among 5 giant stocks, surging over 5 times in a few months time.

Among 5 giant glove stocks, SuperMax has relatively weaker business (but still a giant stock), earning has been declining despite growing revenue, indicating weaker profit margin which is not comparable with other competitors. Due to very high optimism in share price, SuperMax is more speculative in short term. For longer term investing, other 4 giant stocks are relatively safer for consideration.

5) Riverstone (SGX: AP4) – Singapore Giant Glove Stock

Among 5 giant glove stocks, Riverstone is the smallest player but it has its niche market. Riverstone manufactures cleanroom glove (eg. hard disk drive and semiconductor) and healthcare gloves. Founder and major shareholder is Wong Teek Son (about 50% ownership), also the No 44 richest person in Malaysia (Forbes’ List), supported mainly by rising share prices over the past decade (share price goes up nearly 20 times since IPO till now).

Riverstone is a Malaysia company but stock is listed in Singapore, therefore the share price potential is also partially affected by Singapore stock market. Choice of stock exchange for listing does not affect the company fundamental (same share ownership) but due to different characteristic of global investors in each stock exchange (eg. US, Hong Kong, Singapore, Malaysia), etc, would make a big difference in share prices which is the ultimate goal for a company to be listed. As a result, certain stock exchange is more popular of IPO stocks but may not be fundamentally strong. So, a stock investor has to consider a stock or even stock exchange, aligning with own personality and strategy, either on long term investing or short term trading.

Riverstone is a strong growth stock (supported by growing businesses with strong cash flow), a small player with potential to expand further with more leveraging if needed (current debt level is very low). A giant stock is not determined by its business size, if Riverstone could remain highly profitable within its niche market (also a form of economic moat), it can be a good stock investment.

Due to high optimism in share price, Riverstone may be considered as a mid-fielder stock (aiming for high capital gains with little dividend yield as bonus). It may also be considered for very short term momentum trading despite share price is speculated (Buy High Sell Higher strategy).

=====================================

Top Glove and Riverstone are not 30 STI index component stocks but they are much stronger than most of these blue chip stocks in Singapore (investor has to focus only on giant stocks for investing):

DBS Bank (SGX: D05), Singtel (SGX: Z74), OCBC Bank (SGX: O39), UOB Bank (SGX: U11), Wilmar International (SGX: F34), Jardine Matheson Holdings JMH (SGX: J36), Jardine Strategic Holdings JSH (SGX: J37), Thai Beverage (SGX: Y92), CapitaLand (SGX: C31), Ascendas Reit (SGX: A17U), Singapore Airlines (SGX: C6L), ST Engineering (SGX: S63), Keppel Corp (SGX: BN4), Singapore Exchange (SGX: S68), Hongkong Land (SGX: H78), Genting Singapore (SGX: G13), Mapletree Logistics Trust (SGX: M44U), Jardine Cycle & Carriage (SGX: C07), Mapletree Industrial Trust (SGX: ME8U), City Development (SGX: C09), CapitaLand Mall Trust (SGX: C38U), CapitaLand Commercial Trust (SGX: C61U), Mapletree Commercial Trust (SGX: N2IU), Dairy Farm International (SGX: D01), UOL (SGX: U14), Venture Corporation (SGX: V03), YZJ Shipbldg SGD (SGX: BS6), Sembcorp Industries (SGX: U96), SATS (SGX: S58), ComfortDelGro (SGX: C52).

Some investors may be envy of owners of these 5 giant stocks which most founders are Top 50 richest persons in Malaysia. In fact, the easiest way to get very rich may not be through a business. Rather, it is through stock market with a growing business to support the rising share prices which could be over 10-100 times in wealth after IPO (易如反掌). This is the reason why for successful businesses, most of the founders plan to list the stock at certain point of time.

Since all 5 glove giant stocks are mostly controlled (over 50% shares ownership) by founders and families, a key consideration for long term investing is on succession plan to either second generation or capable professionals. A smart retail stock investor has to review a giant stock yearly or even quarterly to ensure it is still a giant stock before continuing the long term support. A sector may not be bullish all the time, including glove industry as profitable business usually would attract many potential competitors which would reduce the profit margins with lower price, lower sales or higher cost.

Here is a list of 30 Malaysia Bursa KLCI Index component stocks which may be considered (investor has to focus only on giant stocks for investing):

CIMB (Bursa: 1023) CIMB GROUP HOLDINGS BERHAD, DIALOG (Bursa: 7277) DIALOG GROUP BERHAD, DIGI (Bursa: 6947) DIGI.COM BERHAD, GENM (Bursa: 4715) GENTING MALAYSIA BERHAD, GENTING (Bursa: 3182) GENTING BERHAD, HAPSENG (Bursa: 3034) HAP SENG CONSOLIDATED BERHAD, HARTA (Bursa: 5168) HARTALEGA HOLDINGS BERHAD, HLBANK (Bursa: 5819) HONG LEONG BANK BERHAD, HLFG (Bursa: 1082) HONG LEONG FINANCIAL GROUP BERHAD, IHH (Bursa: 5225) IHH HEALTHCARE BERHAD, IOICORP (1961) IOI CORPORATION BERHAD, KLCC (Bursa: 5235SS) KLCC PROPERTY HOLDINGS BERHAD, KLK (Bursa: 2445) KUALA LUMPUR KEPONG BERHAD, MAXIS (Bursa: 6012) MAXIS BERHAD, MAYBANK (Bursa: 1155) MALAYAN BANKING BERHAD, MISC (Bursa: 3816) MISC BERHAD, NESTLE (Bursa: 4707) NESTLE MALAYSIA BERHAD, PBBANK (Bursa: 1295) PUBLIC BANK BERHAD, PCHEM (Bursa: 5183) PETRONAS CHEMICALS GROUP BERHAD, PETDAG (Bursa: 5681) PETRONAS DAGANGAN BHD, PETGAS (Bursa: 6033) PETRONAS GAS BERHAD, PMETAL (Bursa: 8869) PRESS METAL ALUMINIUM HOLDINGS BERHAD, PPB (Bursa: 4065) PPB GROUP BERHAD, RHBBANK (Bursa: 1066) RHB BANK BERHAD, SIME (Bursa: 4197) SIME DARBY BERHAD, SIMEPLT (Bursa: 5285) SIME DARBY PLANTATION BERHAD, TENAGA (Bursa: 5347) TENAGA NASIONAL BHD, TM (Bursa: 4863) TELEKOM MALAYSIA BERHAD, TOPGLOV (Bursa: 7113) TOP GLOVE CORPORATION BHD.

Covid-19 could be a crisis for most sectors but there are still few sectors could remain profitable or having less impact than overall economy. Besides glove stocks, there are 6 other sectors which may be considered for stock investing during pandemic:

1) Supermarket stocks – eg. Sheng Siong (SGX: OV8), Dairy Farm International (SGX: D01), Wal-Mart (NYSE: WMT), Costco (NASDAQ: COST). etc. NTUC Fairprice is not publicly listed but it has limited private shares for members of NTUC Fairprice, paying about 6% yearly dividend yield. Those supermarket stocks with online business would have more advantages during pandemic.

2) Telco / 5G stocks – eg. Singtel (SGX: Z74), Apple (NASDAQ: AAPL), Xiaomi (HKEx: 1810), AT&T (NYSE: T), Verizon (NYSE: VZ), etc.

3) Semiconductor / Technology stocks – eg. Micro-mechanics (SGX: 5DD), UMS Holdings (SGX: 558), AEM (SGX: AWX), Frencken (SGX: E28), TSMC (NYSE: TSM), Intel (NASDAQ: INTC), AMD (NASDAQ: AMD), Nvidia (NASDAQ: NVDA), Qualcomm (NASDAQ: QCOM), Broadcom (NASDAQ: AVGO), etc.

4) Online / Software stocks – eg. BAT-FAANG stocks: Baidu (NASDAQ: BIDU), Alibaba (NYSE: BABA) / (HKEx: 9988), Tencent (HKEx: 0700), Facebook (NASDAQ: FB), Amazon (NASDAQ: AMZN), Apple (NASDAQ: AAPL), Netflix (NASDAQ: NFLX), Google / Alphabet (NASDAQ: GOOGL), etc.

5) Healthcare stocks – eg. 3M (NYSE: MMM), Gilead Sciences (NASDAQ: GILD), Raffles Medical Group (SGX: BSL), Q&M Dental Group (SGX: QC7), IHH Healthcare (SGX: Q0F), etc.

6) Stock Index ETF or stocks – eg. stronger defenders of major stock indices (STI, KLCI, DJI, S&P 500, MSCI, etc). STI ETF (SGX: ES3) / (SGX: G3B) or STI index component stocks with stronger businesses: DBS Bank (SGX: D05), OCBC Bank (SGX: O39), UOB Bank (SGX: U11), Singapore Exchange (SGX: S68), ST Engineering (SGX: S63), CapitaLand Mall Trust (SGX, C38U), Mapletree Commercial Trust (SGX: N2IU), Mapletree Logistics Trust (SGX: M44U), Jardine Matheson Holdings JMH (SGX: J36), Jardine Strategic Holdings JSH (SGX: J37), etc.

A stock investor may study Q1-Q2 / 2020 financial reports to compare the global giant stocks relatively to understand impact of Covid-19 for 3 group of stocks during pandemic with 3 unique stock strategies:

1) Profitable stocks – trading at higher prices with momentum trading (similar to glove stocks, Buy High Sell Higher strategy).

2) Defensive stocks – stable business with some price correction, collecting higher dividend yield or gradual growth in share prices (Buy Low and Hold strategy).

3) Crisis stocks – business disrupted by Covid-19 but no major risk (eg. bankruptcy), buying at low optimism price with cyclic investing or trading (Buy Low Sell High strategy).

Drop by Dr Tee free 4hr investment course to learn how to position in global giant stocks with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Learn further from Dr Tee valuable 7hr Online Course, both English (How to Discover Giant Stocks) and Chinese (价值投资法: 探测强巨股) options, specially for learners who prefer to master stock investment strategies of over 100 global giant stocks at the comfort of home.

You are invited to join Dr Tee private investment forum (educational platform, no commercial is allowed) to learn more investment knowledge, interacting with over 9000 members.