Are you worrying about the current stock market fears which may become the next Black Swan: Russia / Ukraine war, high inflation and interest rate hike, resulting in significant market correction? Is it time to Buy, Hold, Sell, Wait or Shorting?

In this Dr Tee 1.5hr video education (6 Giant Singapore Banking & Finance Stocks under Potential Black Swan), you will learn:

1) Impact of Political Economy and Business on Stocks

– Russia / Ukraine War

– High Inflation & Interest Rates Hike

– Recent Final Financial Reports of Case Studies

2) Singapore Stock Market Outlook

– Short term, medium term & long term

3) 6 Giant Singapore Banking & Finance Stocks

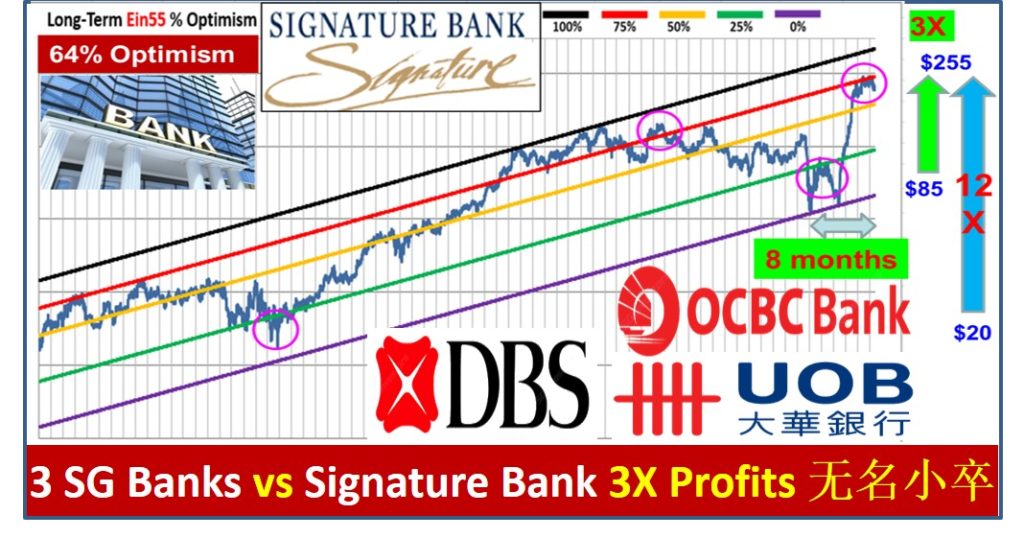

– SG Giant Bank Stock: DBS Bank (SGX: D05)

– SG Giant Bank Stock: OCBC Bank (SGX: O39)

– SG Giant Bank Stock: UOB Bank (SGX: U11)

– SG Giant Insurance Stock: UOI – United Overseas Insurance (SGX: U13)

– SG Giant Insurance Stock: Great Eastern (SGX: G07)

– SG Giant Financial Stock: Singapore Exchange – SGX (SGX: S68)

4) Long Term / Mid Term Investing vs Short Term Trading with 3 Strategies

– Optimism Analysis (Cyclic Investing)

– Fundamental Analysis (Value Investing)

– Technical Analysis (Trend-following Trading)

Here is English Version of Dr Tee Video Course (Chinese version is also available as Dr Tee is bilingual). Enjoy and give your comments for improvement. You may subscribe to Dr Tee Youtube channel (Ein Tee) for future Dr Tee video talks.

English Video:

你害怕目前潜在的股票市场黑天鹅 (俄罗斯与乌克兰战争、高通膨、加息) 吗? 应该买、卖、持有、等待、还是卖空?

在这Dr Tee 1小时教育视频(6只新加坡金融牛股在黑天鹅阴影),您可学习:

1) 政治经济影响股市

– 俄罗斯与乌克兰战争

– 高通膨、加息

– 最新财表

2) 新加坡股市展望

3) 6只新加坡金融强股

– 新加坡银行巨股: 星展银行 DBS Bank (SGX: D05)

– 新加坡银行巨股: 华侨银行 OCBC Bank (SGX: O39)

– 新加坡银行巨股: 大华银行 UOB Bank (SGX: U11)

– 新加坡保险巨股: 大华保险 UOI – United Overseas Insurance (SGX: U13)

– 新加坡保险巨股: 大东方控股 Great Eastern (SGX: G07)

– 新加坡金融巨股: 新加坡交易所 Singapore Exchange – SGX (SGX: S68)

4) 长中期投资与短期交易三招

– 乐观指数分析 (周期投资)

– 基础分析 (价值投资)

– 技术分析 (趋势交易)

这儿是 Dr Tee 华语视频 (英语视频也已完成,Dr Tee 双语皆行)。请欣赏鄙作,留言求进步。您可订阅 Dr Tee Youtube 频道(Ein Tee),链接未来投资视频。

Chinese Video (华语视频):

===================================

There are over 2000 giant stocks in the world based on Dr Tee criteria, choice of 10 Dream Team giant stocks have to align with one’s unique personality, eg. for shorter term trading (eg. momentum or swing trading) or longer term investing (cyclic investing, undervalue investing or growth investing). Readers should not just “copy and paste” any stock (What to Buy, When to Buy/Sell) as successful action taking requires deeper consideration (LOFTP strategies – Level / Optimism / Fundamental / Technical / Personal Analysis) which you could learn further from Dr Tee Free 4-hr Webinar.

Drop by Dr Tee free 4hr webinar (learning at comfort of home with Zoom) to learn how to position in global giant stocks during COVID-19 stock crisis with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Zoom will be started 30 min before event, bonus talk (Q&A on any investment topics from readers) for early birds. There are many topics we will cover in this 4hr webinar, Dr Tee can have more time for Q&A if you could stay later after the webinar, you could ask on any global and local stocks including but not limited to 30 STI component stocks:

Ascendas Reit (SGX: A17U), CapitaLand (SGX: C31), CapitaLand Integrated Commercial Trust (SGX: C38U), City Development (SGX: C09), ComfortDelGro (SGX: C52), Dairy Farm International (SGX: D01), DBS Bank (SGX: D05), Frasers Logistics & Commercial Trust (SGX: BUOU), Genting Singapore (SGX: G13), Hongkong Land (SGX: H78), Jardine Cycle & Carriage (SGX: C07), Jardine Matheson Holdings JMH (SGX: J36), Keppel Corp (SGX: BN4), Keppel DC Reit (SGX: AJBU), Mapletree Commercial Trust (SGX: N2IU), Mapletree Industrial Trust (SGX: ME8U), Mapletree Logistics Trust (SGX: M44U), OCBC Bank (SGX: O39), SATS (SGX: S58), Sembcorp Industries (SGX: U96), Singapore Airlines (SGX: C6L), Singapore Exchange (SGX: S68), Singtel (SGX: Z74), ST Engineering (SGX: S63), Thai Beverage (SGX: Y92), UOB Bank (SGX: U11), UOL (SGX: U14), Venture Corporation (SGX: V03), Wilmar International (SGX: F34), YZJ Shipbldg SGD (SGX: BS6).

Dr Tee will cover over 20 case studies, Singapore giant stocks, eg. CapitaLand Integrated Commercial Trust (SGX: C38U), Singapore Exchange (SGX: S68), Keppel Corp (SGX: BN4), Top Glove (SGX: BVA), Jardine Matheson Holdings JMH (SGX: J36), Vicom (SGX: WJP) and many others, Malaysia giant stocks, Hong Kong giant stocks and US giant stocks, both long term investing and short term trading.

There are limited tickets left for this 4hr free webinar, please ensure 100% you could join when register: www.ein55.com

View quick preview video below, Dr Tee will introduce 10 key stock investment strategies (股票投资十招) to be learned in 4hr free stock webinar:

Register Here (Dr Tee Free 4hr Stock Webinar): www.ein55.com