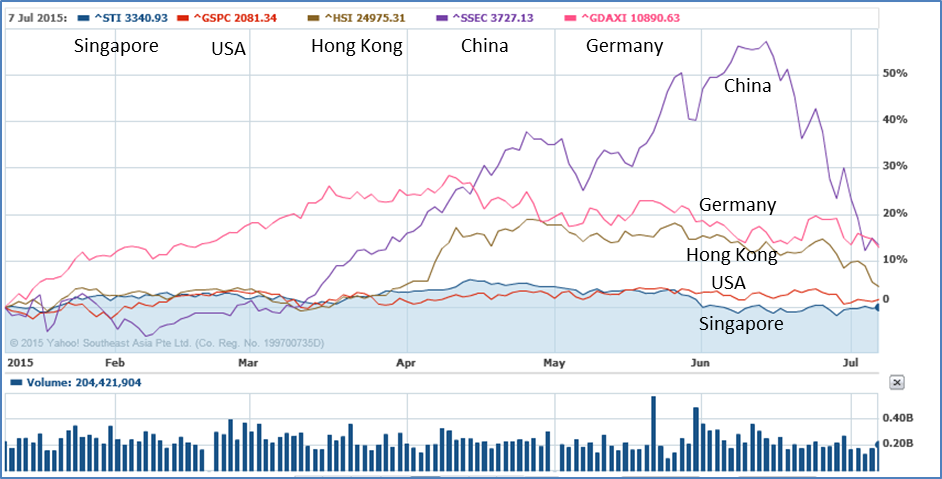

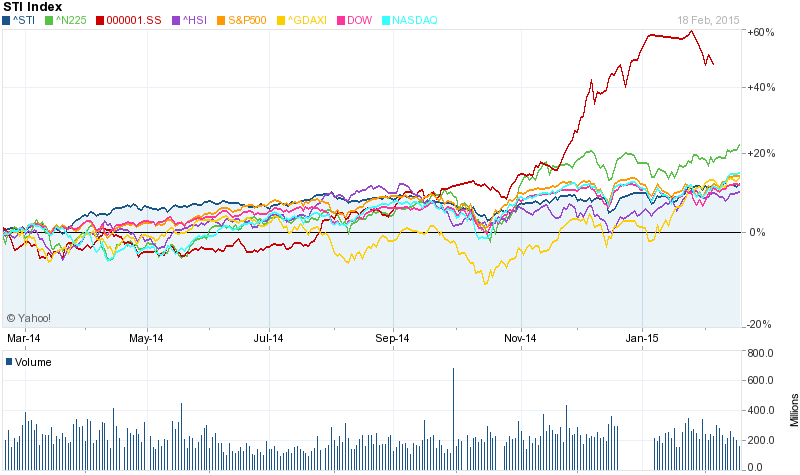

Global stock markets of 4 major economy: US, China, Japan and Germany have achieved 75% optimism. Therefore, it is not a surprise to see major correction in the past 1 month. We should follow Optimism from Level 1 (individual stock) to Level 2 (sector) to Level 3 (country/region) to Level 4 (world).

Although Singapore STI and Hong Kong HSI have been only 50+% optimism in the past few years, they are smaller market, we need to follow a bigger market to evaluate our probability of success with Optimism. High optimism = high risk, 75% World Optimism means the chances of falling down is 75% while there are only 25% chance to go up. Don’t over-trade or over-invest, keep at least 75% cash as world Optimism has reached 75% optimism. If we follow the rule of money management, taking profit with higher optimism, the risk could be minimized.

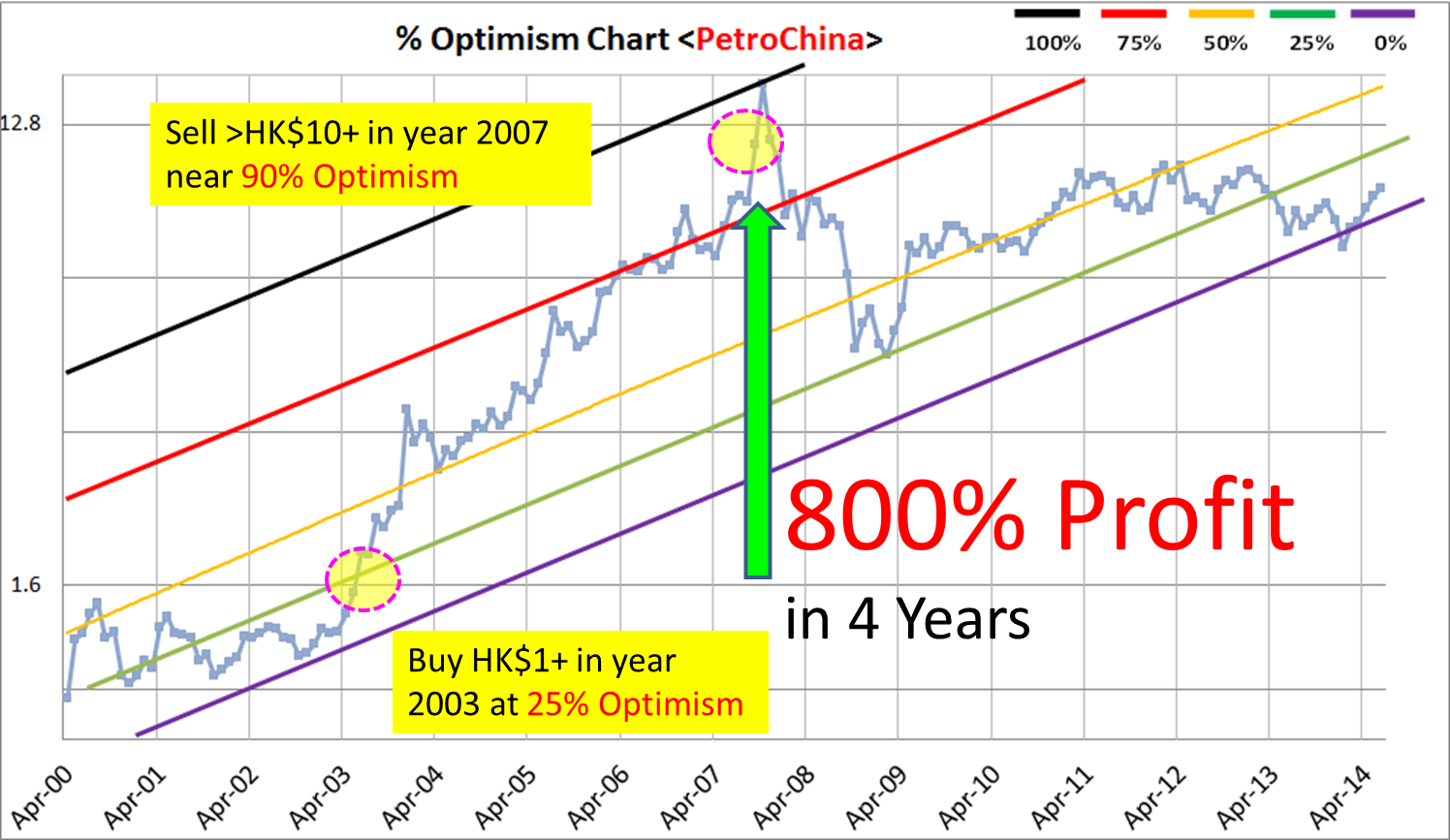

For those who want to grab on the opportunity of falling giants of global stock markets, adding Technical Analysis (TA) will be helpful because the falling knife could be severe, your personality may not be suitable to buy low with downtrend. Regardless it is a major correction (mid-term) or Level-4 (world) crisis at longer term, we should consistent to buy low (either long term, mid term or short term) and sell high later. If we could diversify over 10 different giants (through Fundamental Analysis, FA), even if the giants fall down, the chances of recovery is very high especially if the price correction is mainly due to the human greeds and fears (Personal Analysis, PA), not the FA (economy or company business performance).

TA = FA + PA

(Share price is a reflection of business performance and traders emotions)

We shall continue to apply this FTP (FA + TA + PA) analysis around the Optimism Strategy to profit from the global stock market in a safe way. There is no need to guess the direction of the market, low enough, we could enter; high enough, we will exit. The low and high shall follow our personality for short term trading, mid term trading or long term investing. New Level-3 giants are falling down (eg. Malaysia, both stock and currency markets), grab on the opportunity to time yourself with consideration of Level 1-4 Optimism.