Are you worried about the global stock market in year 2017, especially with the controversial new US President, Donald Trump? Political analysts thought Trump has slim chance of winning, will this surprise outcome become the next black swan event to correct the global stock market?

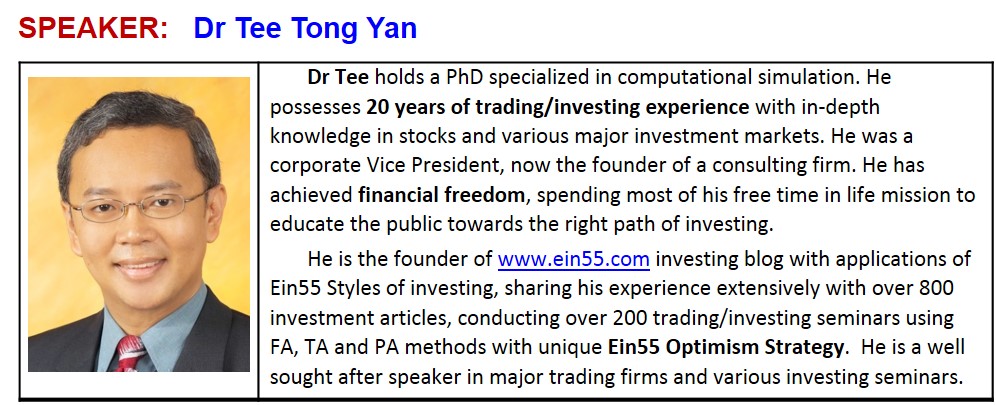

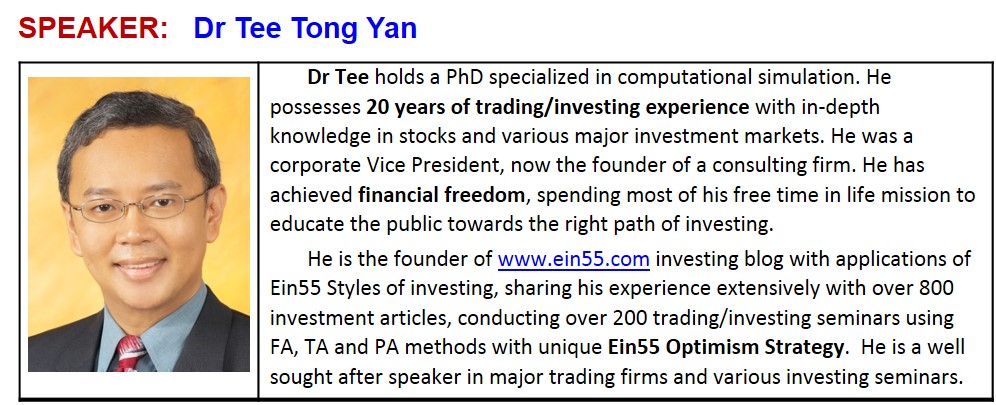

Dr Tee has written an eBook on “Global Market Outlook 2017” to provide solutions with comprehensive coverage of various investment topics in major global stock markets (US, Singapore, Hong Kong, China, Europe). Readers have benefited from the past Market Outlook reports by Dr Tee. Let’s learn the current global investment market risks and opportunities.

Table of Contents for Investment eBook

1. Mass Market Sentiment Survey

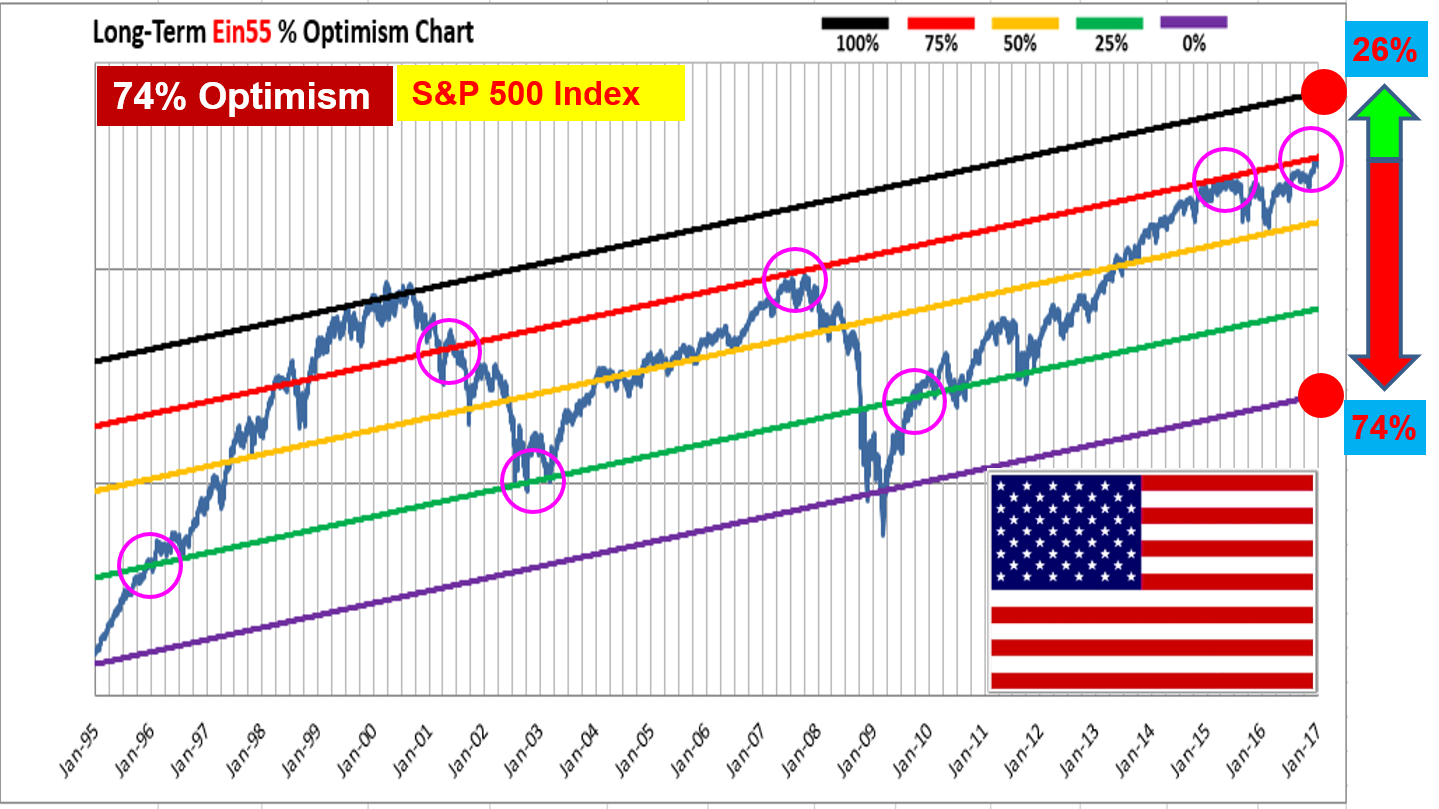

2. Review of Global Stock Markets

3. US Market Outlook

3.1 US President & Government

3.2 Effect of QE

3.3 US Interest Rate Hike

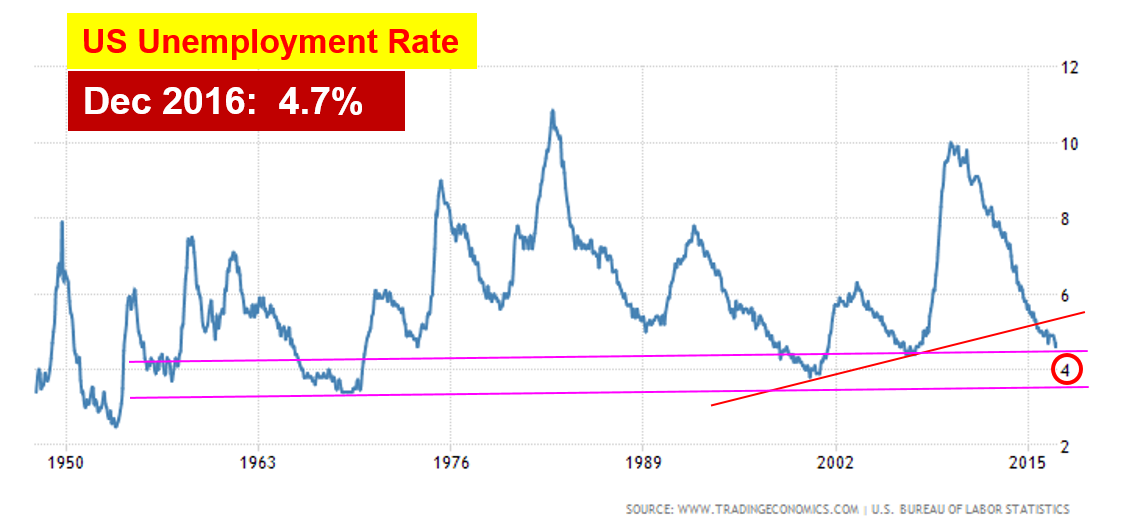

3.4 US Job Market

3.5 US Property Market

3.6 US Bond Market

3.7 US Dollar vs Commodity (Gold / Silver / Crude Oil)

4. Regional Market Outlook

4.1 Europe Market

4.2 China Market

4.3 Hong Kong Market

5. Singapore Market Outlook

5.1 Singapore Stock Market

5.2 Singapore Property Market

6. Conclusions and Recommendations

Appendix (附录)

The unique Optimism Strategy developed by Dr Tee provides a special advantage to know which investment (stock, forex, property, commodity, bond, etc) to buy safely, when to buy, when to sell, including option of long term holding. So far over 10,000 audience have benefited from Dr Tee high quality free courses to the public. Take action now to invest in your financial knowledge, starting your journey towards financial freedom.

Bonus #1 for Readers: FREE Investment Courses by Dr Tee

Bonus #2 for Readers: Dr Tee Investment Forum with over 3000 members (Private Group)

(Please click “JOIN” with link above and wait for Admin approval of membership)

- Market Outlook (stocks, properties, bonds, forex, commodities, macroeconomy, etc)

- Optimism/ Fundamental / Technical / Personal Analyses

- Investment risks & opportunities

- Dr Tee graduates events and activities updates