Position in the current high optimism stock market with 10% dip in S&P 500, following your unique personality: Trader or Investor, having stocks or no stock. Here are possible time for actions in stocks for 4 types of personalities:

1) Traders – With Stocks:

Time for Actions in Stocks: Short term traders should have sold the stocks (taking profit or even cut loss) a few days ago when short term trend turned bearish. For medium term traders with higher risk tolerance level, plan to exit if the correction has met the exit strategy.

2) Traders – No Stocks

Time for Actions in Stocks: Waiting for signal to come back again (either short term or medium term), don’t capture the falling knife buying low in downtrend. Current short term support is broken for Level 3 (stock indices), about 10% price correction for S&P 500 is significant, it may take time (weeks or even months, need strong economic data and even support from political economy, price will show if there is any recovery signal) for the market to recover. Even if individual stock (Level 1) is strong, it is against the market trend, chances of sustainable bull may not be high. Since the long term and medium terms are still bullish, possible shorting for trading may be only considered for short term.

3) Investors – With Stocks:

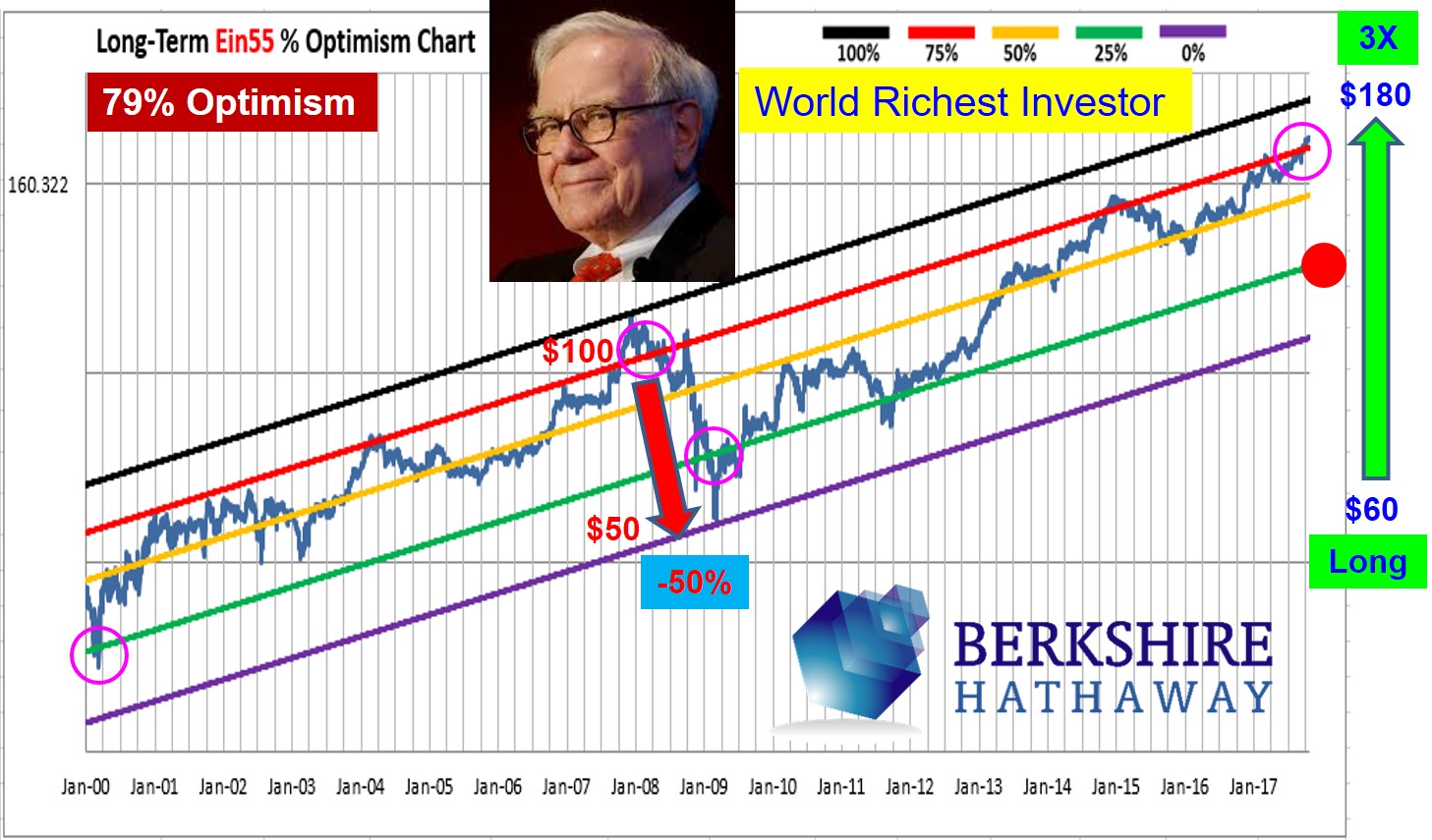

Time for Actions in Stocks: Long term investor have already gained if holding from low optimism to high optimism market. Current high optimism market is only a bonus, not to use fundamental or strong economy to justify the holding because any black swan (may not be a known crisis, could be a butterfly flapping wings, potentially could cause a thunderstorm eventually) or the last straw which may break the camel’s back due to sudden transition from greed to fear. Investors may have used trailing support so far, risk tolerance level is higher (possible to hold as long term optimism is still high) but when the condition is met, has to exit as well, just needs more signals for confirmation. There is no need to guess the direction of high optimism stock market which is full with randomness. For investors, the difference is only big win or smaller win.

4) Investors – No Stocks

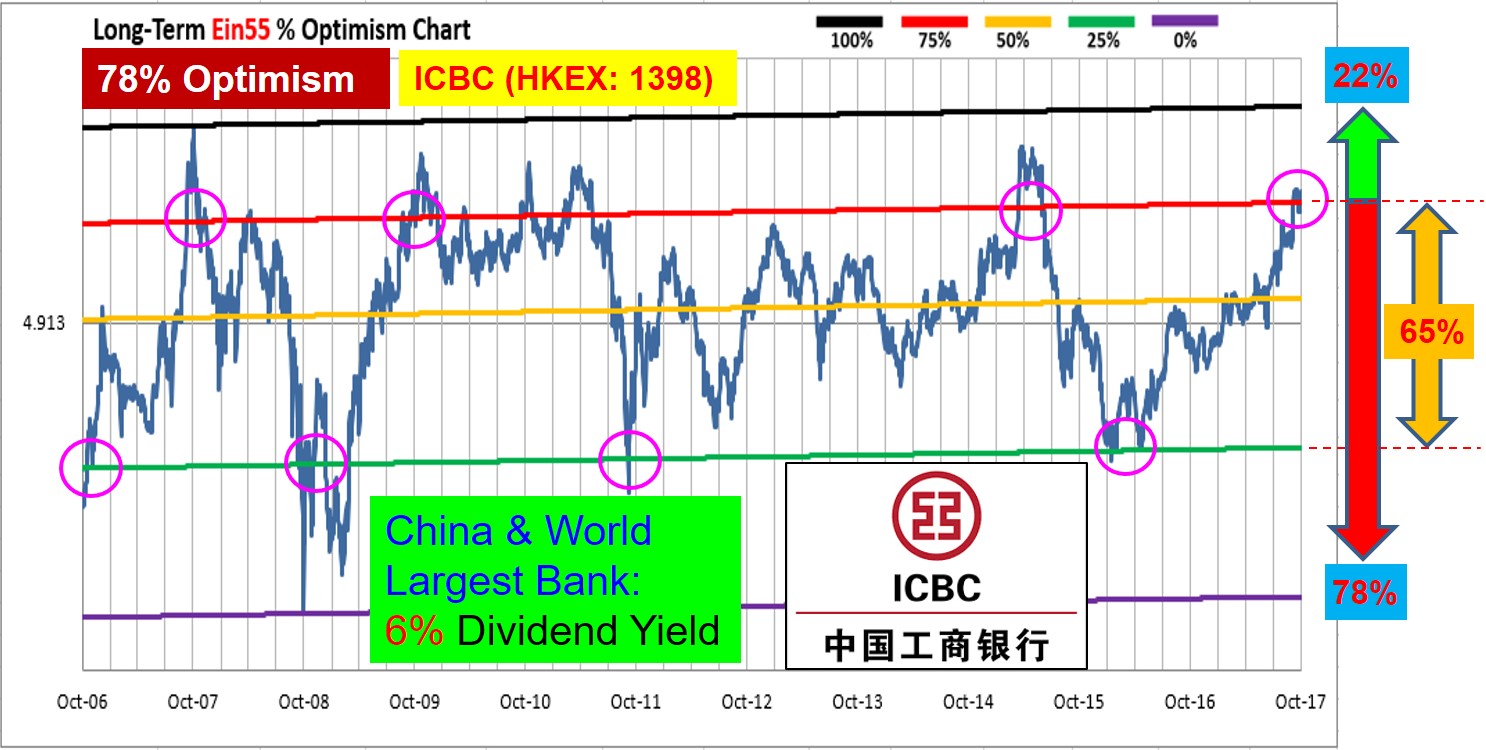

Time for Actions in Stocks: Current market correction is still not yet the condition to buy low as optimism is still high. It requires patience to wait for tremendous fear in the market to truly buy low, eg. a blue chip with more than 50% discount. Investors are likely to continue to wait but studying harder to shortlist at least 10 global giant stocks, so that action taking can be faster if global financial crisis really comes one day. Cash is king when used at the right time.

—————————

Currently it is too early to conclude whether it is only a short term stock market correction or beginning of global financial crisis. A wise trader and smart investor would not take it lightly, starting to take the right actions (Buy / Hold / Sell / Wait / Shorting) following own personality. Doing nothing (pure ignorance) without a strategy can be very risky.

Learn further from Dr Tee on how to Time for Actions in Stocks.