Share price is a 3-dimensional movement, governed by Ein55 Law of Stock Market Motion:

Share price is a 3-dimensional movement, governed by Ein55 Law of Stock Market Motion:

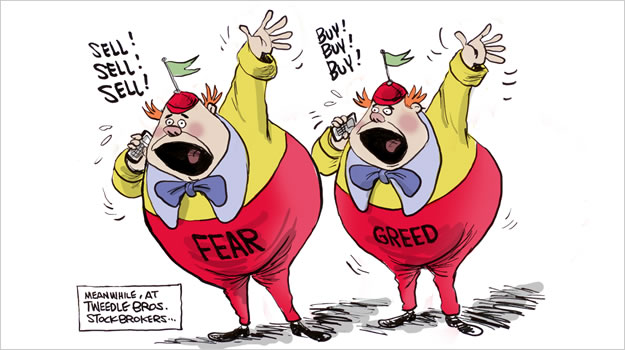

Optimism = PA = TA – FA, [gap between price and value]

TA = FA + PA

z = f (FA, PA), function of FA and PA

where PA = Personal Analysis, TA = Technical Analysis, FA = Fundamental Analysis

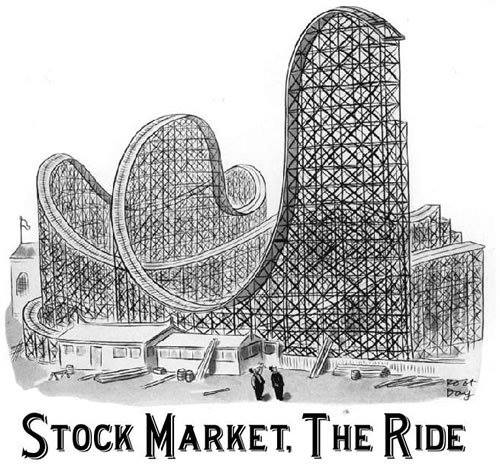

It means share price (TA) which is the vertical Z-axis, is a function of X-axis which is business Fundamental Analysis (FA: strong or weak) and Y-axis (depth direction of roller coaster) which is market emotions with Personal Analysis (PA: greed or fear). Both the FA and PA could contribute to up and down in share prices (TA), main contributors to the Law of Stock Market Motion.

Ein55 Law of Stock Market Motion simply means that both market emotions and macroeconomy / business strength contribute to movement in stock market. Based on probability, a company which has consistent good performance in business will likely to perform well in stock prices over a longer term. Similarly, when there is an unexpected bad news or unpredictable outcome which results in stock market fear, the share price is likely to fall down. In the real world of stock market, both fundamental (FA) and emotions (PA) will be combined to form an unique condition of stock market on different day, therefore creating different share prices each day, hour or even minute.

When we buy a stock at low optimism, it means we buy when the gap between share price and value is the large, an undervalue stock with price below value. When we sell a stock at high optimism, it means the share price is much more than value, an overpriced stock.

Learn the Law of Stock Market Motion from Dr Tee FREE stock investment course to understand how the share prices could move up and down in the stock market.

An investor has to be careful of stock market time bomb. S&P500 has to prove its recovery this week, breaking 2700 points will be a test of strength for US stock market. If this 2700 intermediate resistance could be broken, Asia stock market can only catch up next week after the Lunar New Year holidays.

An investor has to be careful of stock market time bomb. S&P500 has to prove its recovery this week, breaking 2700 points will be a test of strength for US stock market. If this 2700 intermediate resistance could be broken, Asia stock market can only catch up next week after the Lunar New Year holidays.