Key Learning Points from Ein55 Graduate Gathering 2018 July

YangZiJiang Stock Review – Sample Ein55 Analysis

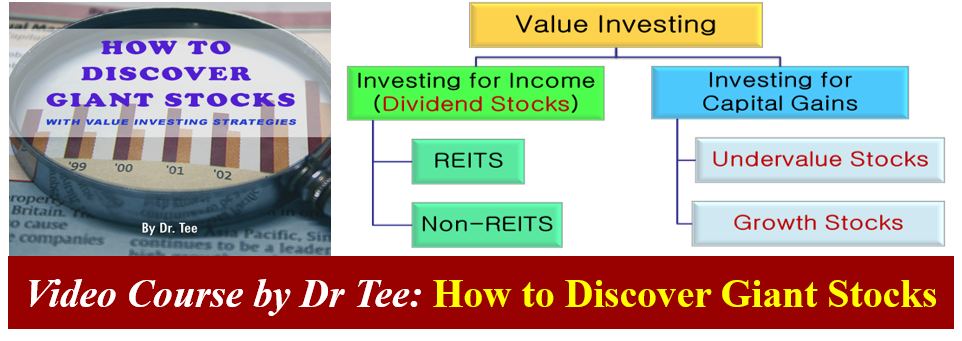

Online Investing Course by Dr Tee: How to Discover Giant Stocks with Value Investing Strategies

For the first time, Dr Tee has established a high quality online investing course (9 modules of videos over 2 hours) on How to Discover Giant Stocks with Value Investing Strategies. This is useful for both investors and traders to master the giant stocks to buy. The online investing course is hosted by investingnote, a permanent platform, meaning after signing up, the video course will be available for repeated viewing in future. You may also share this low cost educational program with family members (one payment for all to learn at own pace) who may have busy schedule or currently living overseas, learning useful stock investment knowledge remotely.

Currently there is a new launch special rate for Ein55 members (you may share this email with friends who can qualify the same rate), original online investing course fee is $100, currently selling at only $25 (75% Discount). This minimal course fee is helping the host to maintain the platform for online investing course, not driven by the profit. After the promotion period is over, course fee may be adjusted to original price.

Register Online Investing Course Here:

https://www.investingnote.com/store/products/discover-giant-stocks-value-investing-strategies

Step 1: Click Registration Link (Sign up for free investingnote account)

Step 2: Sign up Online Investing Course

$100 -> $25 (75% discount for Ein55 Members and friends)

Step 3: Learn 9 Modules Video Course

– Share with family. Permanent Video.

Step 4: Write Course Review

– Positive comments to encourage others

Online Investing Course Description

There are 2 main stock investing objectives: investing for income (dividends) and investing for capital gains, which we could achieve through a portfolio of global giant stocks with strong business fundamental. In this value investing course, Dr Tee will teach the powerful methods step by step, how to form a dream team stock portfolio with understanding of 3 financial statements and 11 critical fundamental criteria with practical applications in global stock screening.

Learning Points:

1) Master 3 Value Investing Strategies on What Giant Stocks to Buy:

– Growth Investing Strategy (Growth Stocks / Momentum Stocks)

– Undervalue Investing Strategy (Undervalue Property Stocks / Bank Stocks)

– Dividend Investing Strategy (REITs / non-REITs Dividend Stocks)

2) Apply Fundamental Analysis (FA) with 3 Key Financial Statements and 11 Critical FA Criteria to Identify Global Giant Stocks

– Income Statement

– Balance Sheet

– Cashflow Statement

3) Practical Demo on Global Giant Stock Screening

– Selection Criteria for Growth Stocks, Undervalue Stocks & Dividend Stocks

– Sample 100 Global Giant Stocks for Singapore, US, Hong Kong & Malaysia

– 5 Free Global Stock Screeners

After mastering What Stocks to Buy from this online investing course, learners may proceed to sign up for free stock investment courses by Dr Tee to master When to Buy / Sell with 10 Optimism Strategies, you could meet up with Dr Tee, coming earlier for bonus stock diagnosis. Content of online investing course ($25) and monthly 4hr meet-up course (free) are different, knowledge can be integrated into 10 different stock trading and investing strategies.

Amazing Wealth with Life-time Compounding Return in Stocks

Just read this touching news, a real life example of long term stock investing with compounding return, helping an accountant (Mr Loh) to accumulate S$20 millions in wealth when died at 89 years old. He may be a miser, spending little on himself but he is very generous to donate more than S$3 millions to charity organization.

This is the power of compounding return in stocks, assuming 50 years of investing (assuming this investor started investing only at 39 years old), here are return for different compounding rate, return for every $1 invested:

5% compounding: (1+0.05)^50 = $11

10% compounding: (1+0.1)^50 = $117

Even with only 5% growth rate (slow growth stocks), an investor could expand the wealth by 11 times by holding blue chip for long term. For moderate giant stocks with 10% return, the return is 117 times. There is no surprise then why Mr Loh could accumulate so much wealth unknowingly by others.

What impressed me is not his wealth but his “misery” on himself but generosity on others. Money is only useful when it is used when one is still alive. Money is not almighty but if we could become master of money, knowing the skills of both making money and spending money in the right ways, this will lead to a very meaningful life.

Start learning value investing for long term compounding return of wealth with giant stocks. The first step is 4 hours of time in learning in a free course by Dr Tee, what stocks for long term investing, when to buy / sell or holding for life. This is not a sales talk, you will learn solid investing knowledge with investment of your time.

Crisis Stock Investing with 4 Qualities of Low Optimism Stocks

Crisis stock investing is investing in cyclic giant stocks, ideal for Buy Low Sell High investing strategy. Usually crisis may happen at business (Level 1, company losing money), sector (Level 2, bearish sector), country (Level 3, recession) or global (Level 4, financial crisis), creating different degrees of fear in the stock market, resulting in fall of share prices. Subsequently, when the market fear turns into greed, these crisis stocks may become uptrend momentum stocks, ideal for selling high.

There are 4 different qualities of crisis stocks with long term low optimism. An investor has to carefully identify the nature of crisis stock investing, understanding how the falling in share prices are induced.

1) Low Quality Low Optimism (L1 Crisis Stock Investing)

Long term optimism of stock is low, driven by decline in L1 business but L2-L4 are fine. Noble Group could be an example. Without consideration of sustainable business, pure strategy of Buy Low may result in Get Lower in share prices, which is a common pitfall for Technical Analysis. Both Fundamental Analysis (FA) and Technical Analysis (TA) should be integrated with Optimism Strategies with consideration of Personal Analysis (PA)

2) Average Quality Low Optimism (L2 Crisis Stock Investing)

Long term optimism of stock is low, driven by decline in L1 business & L2 (sector), while L3-L4 are fine. Examples include oil & gas crisis stocks in the last 1 year, casino crisis stocks 2 years ago, etc. It happens during the sector rotation which the sector market cycle may not align with the country/global economy cycle. If the sector is not a sunset industry, usually it would recover again as there is unique demand vs supply within each sector for investment.

3) High Quality Low Optimism (L3/L4 Crisis Stock Investing)

Long term optimism of stock is low, driven by decline in L1-L4 (business/sector/country/global financial crisis). More than 50% global cyclic giant stocks during global financial crisis would be affected in both business (drop in earning or even losing money) and share prices (L1-L4 from individual stock to global stock indices). Since the market fear at L3/L4 may not last long (global political leaders would take actions by then to save the whole world), the downside of global stock market is limited but an investor needs to have sufficient holding power through the cold winter time of global financial crisis. For example, many cyclic giant bank stocks may behave this way.

4) Excellent Quality Low Optimism (L4 Crisis Stock Investing with strong L1 Business)

Long term optimism of stock is low, driven by decline in L2-L4 (sector/country/global financial crisis) but L1 business is fine. Less than 10% global growth giant stocks during global financial crisis could still be profitable or even growing in business while the share prices falling relatively less (defensive in nature) than the average in global stock market. In fact, defensive growth giant stocks are suitable for Buy Low & Hold for long term investing, sell is an optional strategy.

The safest time to buy a giant stock is when everyone is afraid the sky will fall down while the business is still operating normally with consistent performance. This could be a rare opportunity to buy during a crisis but many people are too normal, do not know how to take this advantage to truly buy low sell high.

A smart investor may not need to consider only crisis stock investing. There are other strategies such as growth stocks, dividend stocks, undervalue stocks and momentum stocks, etc, may be integrated to form a balance stock investment portfolio.

Learn from Dr Tee through high-quality free stock investment courses.

Song of Stock Market

Don’t Put All Eggs in 1 Basket – Golden Egg Stocks

Political Economy Drama on Stock Investment

US/China Trade War Impact on Stock Market

Global stock market has lost the short term growth momentum with new variable of potential US/China trade war impact on stock market, triggered by Trump latest political economy move.

US Interest Rate Hike