Dr Tee (Ein55) FREE Stock Investment Course in Singapore

This is a short but powerful 11 min Chinese video (Becoming Warren Buffett) about Warren Buffett strength and weakness. The most touching part is final few minutes on why he decides to donate his fortune accumulated in life.

https://www.youtube.com/watch?v=0YJx2VkQPHc

For English version, you may search for “Becoming Warren Buffett” (see longer version below with 1hr 28min, thanks to suggestion by a member) but I could not find the same short and sweet version as this Chinese video.

https://www.youtube.com/watch?v=PB5krSvFAPY&feature=youtu.be

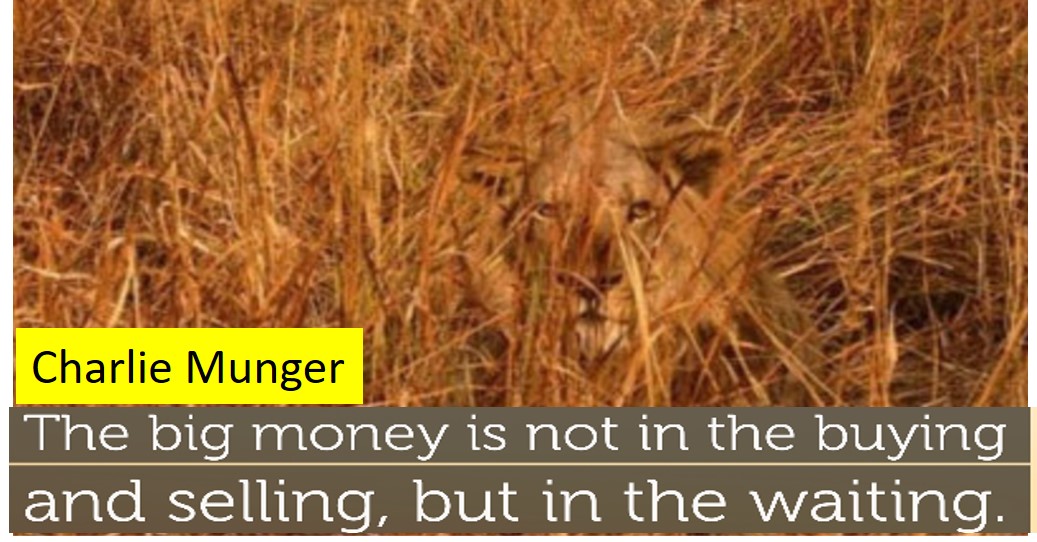

Warren Buffett initially only focused on buying undervalue stock (Buy Low) but this business partner, Charlie Munger, influenced him to buy good business at fair price (may not low price). The is the key difference of value investing vs growth investing, which Ein55 graduates have learned how to integrated with optimism strategies, including value growth investing to have the best of both worlds.

However, for investing, each of us should establish our own personalized investing styles, there is no need to follow Warren Buffett or Charlier Munger. Berkshire share price dropped by 50% during subprime crisis in 2008-2009, this max drawdown may force many investors out of the stock market, only those with strong faith, applying fundamental analysis, instead of technical analysis, still able to hold through the winter time to be the final winner.

The title of video is an important lesson for everyone: “Money is only numbers”. If we look at frugal lifestyle of Warren Buffett (eg. living in an old house, drive a small car, eating $3 McDonald burger for breakfast, etc), then we can understand money is only an indicator to show his performance in an hobby called investment. This is the same as computer gamers, scoring high from level 1 to 100 is important to their hobbies.

In fact, when we detach making money from investment, just focusing on how to push up the score of investing game with $ amount, our performance could be better.

General public can learn value investing and growth investing from Dr Tee free 4 hour course. Register here: www.ein55.com

===============================

eBook #1 (Global Stock Market Outlook)

===============================

1. Mass Market Sentiment Survey

2. Review of Global Stock Markets

3. US Market Outlook (Stock / Property...)

4. China / HK / Europe Market Outlook

5. Singapore Stock & Property Outlook

6. Conclusions and Recommendations

===============================

eBook #2 (Top 10 Stocks: Dream Team Portfolio)

===============================

1. Personalized Stock Investment Portfolio

2. Ein55 Global Top 10 Stocks

3. Summary of Actions

Copyright © 2025 · Focus Child Theme on Genesis Framework · WordPress · Log in