China Aoyuan (HKEX: 3883) is a giant property stock with strong business fundamental from Guangzhou, having properties in many China cities.

This reminds me of another China Guangzhou property giant stock, Yuexiu Property (HKEX: 0123), also strong in business fundamental. Main key difference is China Aoyuan is bullish in short term but Yuexiu Property is still catching up.

I plan to visit Guangzhou (广州) of China with family in coming Dec holiday period, leveraging on the low optimism Forex of RMB/SGD (1 SGD = 5.15 RMB, highest value of SGD over the past 8 years), tasting the nice Cantonese food (since Hong Kong is unstable), enjoying free & easy trip.

I will have chance to observe the changes in China (PA, Personal Analysis) since my last year Dec trip to Fujian of China. Guangzhou is also a good place to observe these 2 giant Guangzhou stocks, China Aoyuan and Yuexiu Property.

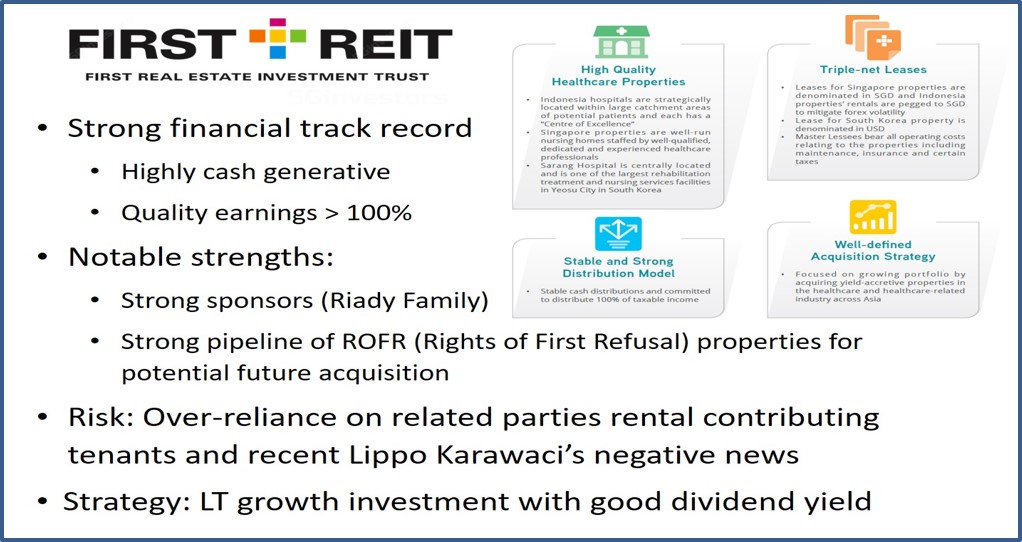

You could learn how to find global giant stocks (property, bank, F&B, healthcare, REIT, energy, etc) from Dr Tee. Register for FREE 4hr stock investment course: www.ein55.com