Warren Buffett invests in Apple Inc (NASDAQ: AAPL) and thinks that it is “probably the best business in the world”.

Of course, this statement should be issued AFTER Warren Buffett has invested heavily in Apple Inc. Followers of Buffett would then follow to buy the same stock but at much higher price. Apple is still the same Apple with strong fundamental but FA (Fundamental Analysis) is not the only consideration. There are other key variables in investment, eg:

1) Prices of Apple is a few times higher. This will affect price to valuation. Warren Buffett bought Apple at much lower price, therefore the risk of longer term investing is lower and return is much higher.

2) S&P 500 is at high optimism. US stock market could affect Apple but Apple may not able to affect US stock market. This is Level Analysis, aligning individual stock with the stock market.

3) US economy is at the best of past decade, how to be better? When spending is high, how to be higher for Apple to grow? This is a relative consideration of business for individual stock (Level 1) vs economy of a country (Level 3).

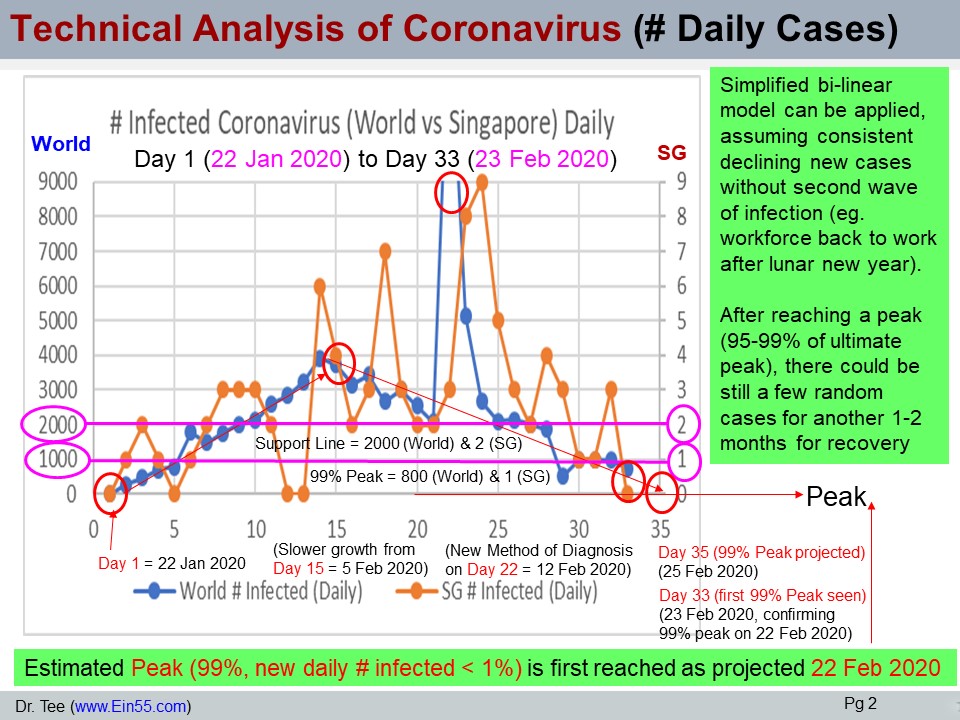

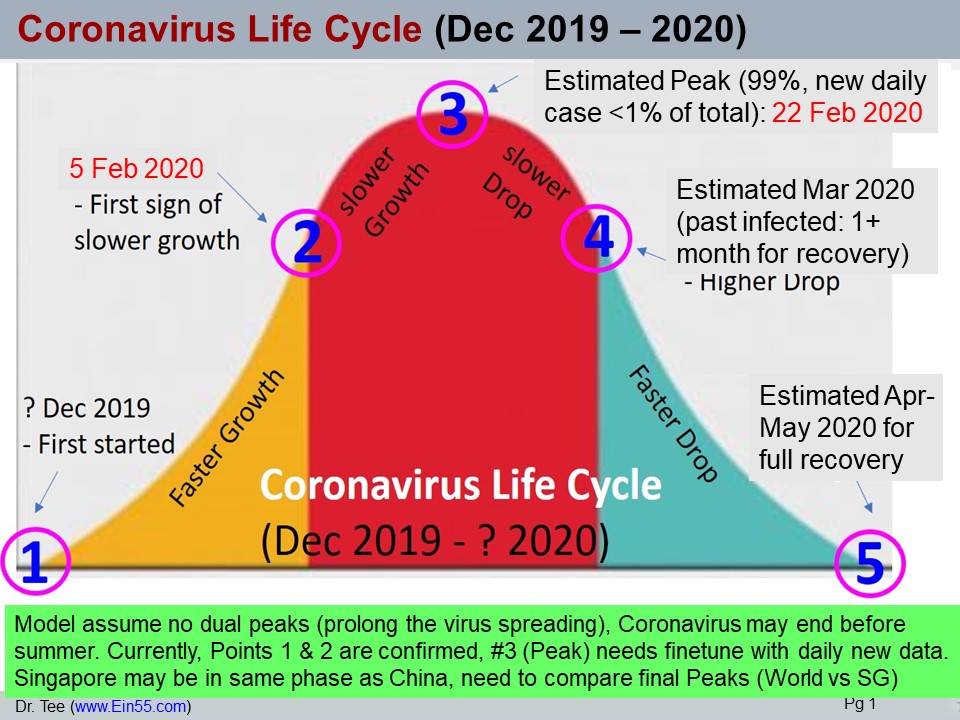

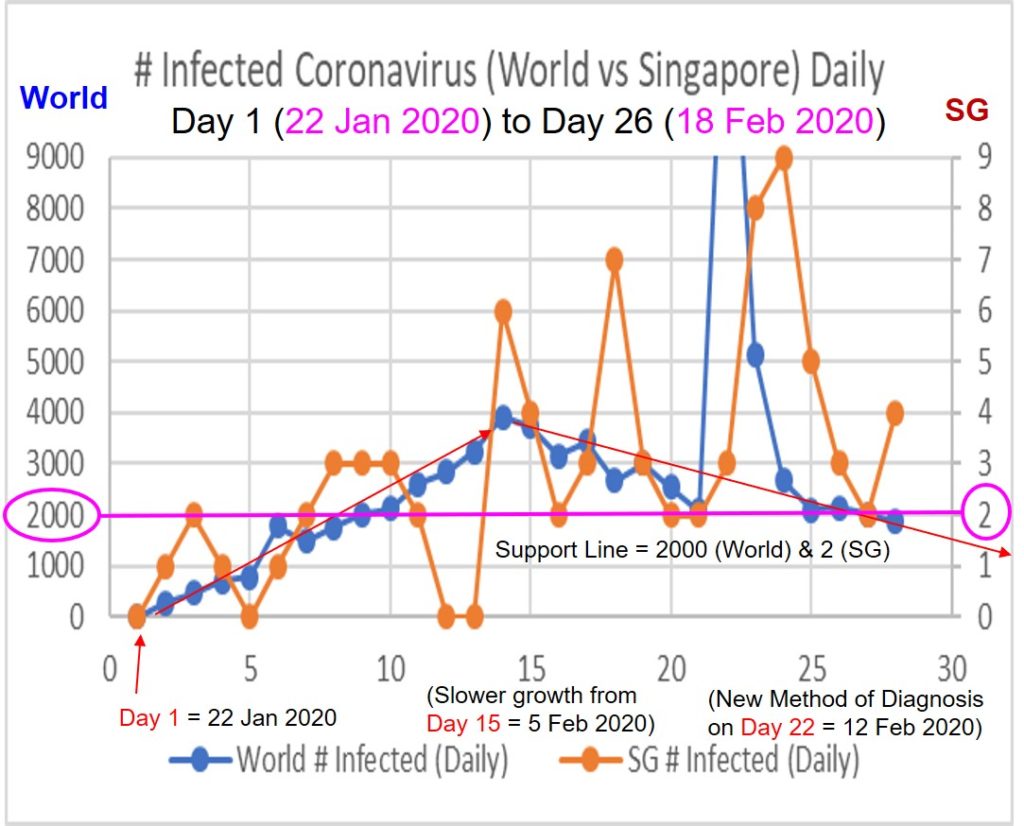

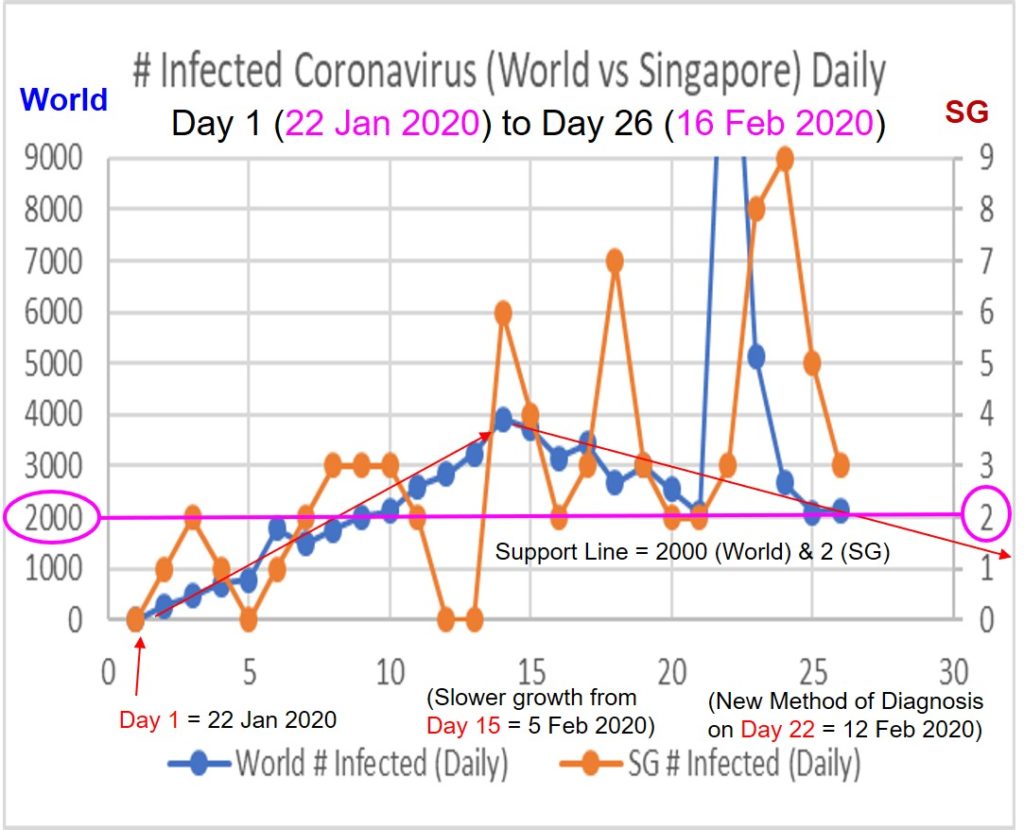

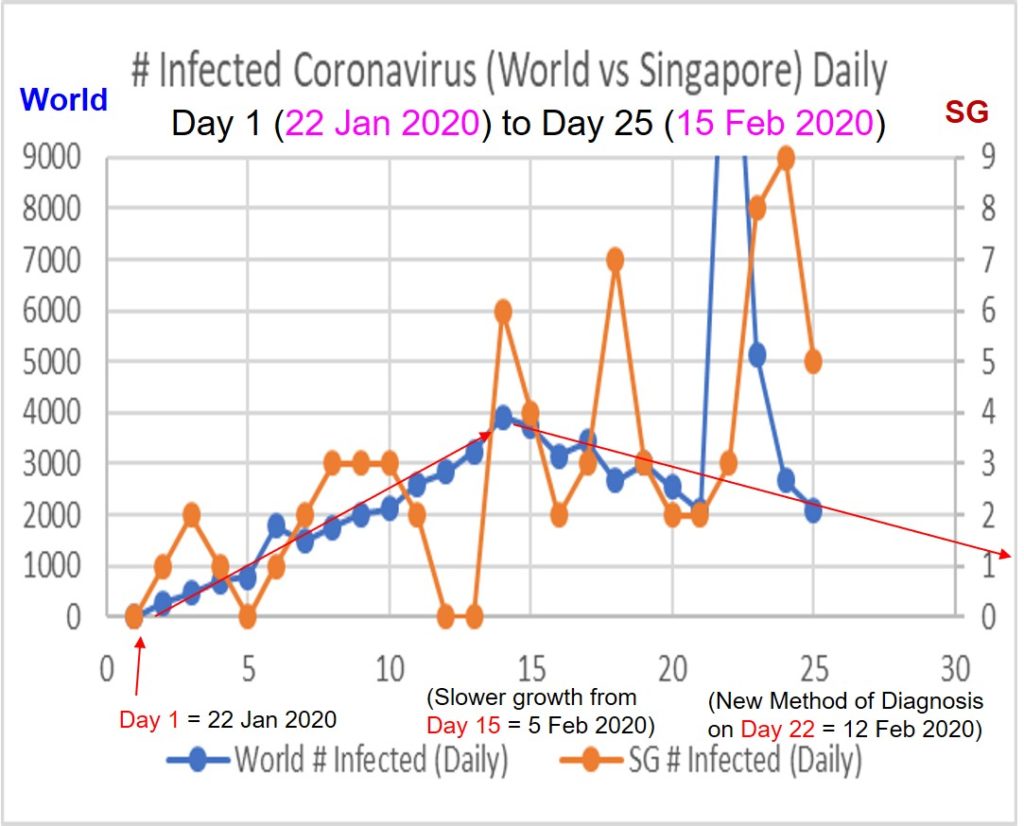

4) Other black swans such as Coronavirus threat (affect retail shopping), China economy slowdown (Apple having lots of business in China), US presidential election (results could affect US-China trades in future), etc.

==========================

In short, investing in Apple has to align with own personality, not simply following Warren Buffett blindly as his personality (depth of business analysis, self-confidence, holding power, diversification, capital, etc) could be different.

Even at current high price (nearly US$300, doubled from US$150 in about 1 year), the optimism level is around 41%, considered a fair price based on Ein55 valuation. However, Apple is more suitable for short term momentum trading as world stock market (Level 4) and US stock market (Level 3) are at higher optimism, it is safer to do short term investing, applying trend-following with closer monitoring. Of course, if Apple is fine each month, then short term investor may gradually become medium term or even long term investor. This is different from starting to aim for long term investing at high optimism stock market unless one could accept moderate return by holding a long term and able to withstand the possible correction due to global financial crisis.

===========================

Back to the title, is “Apple the Best Business in the World”? Fundamental of Apple is indeed very good, it may be Warren Buffett’s best business (since he invested in this business) but may not be the best business in the world. There are other better stocks in the world with stronger business than Apple but investor has to learn how to identify these giant stocks and wait patiently to invest in them at discounted prices.

A giant stock could be just a small cap company (too small for Warren Buffett’s capital which could only consider large cap) but suitable for retail investor with condition to diversify with 10 giant stocks.

Learn from Dr Tee free 4hr stock investment course to consider global giant stocks from various sectors with strong business comparable with Apple, then forming a dream team stock portfolio. Register Here: www.ein55.com