Trump started as US president on 20 Jan 2017, S&P 500 index was 2271 points (Trump “IPO” price), surging to historical high of 3386 points on 19 Feb 2020, rising about 50% in 3 years, reaching over 90% Optimism for US stock market, then following to 2227 points currently, below “IPO” price of Trump when he was elected.

S&P 500 index is report card of Trump. Some US voters may not like Trump but still support him due to economic consideration (job market with low unemployment rate, strong GDP, bonus fortune from US stock and property markets, etc). Now, Trump’s report card is back to square one, falling below the first date as president (“IPO” price), is an indication of market valuation of his performance.

Optimism is a measurement of market greed and fear. High optimism > 75% usually is not sustainable, therefore I have been reminding readers over the past 2 years when S&P 500 over 3000 points, to be extra cautious, focusing mainly on short term trading (trend-following, entry/exit with short term signal, including cutloss when there is unexpected reversal signal).

Unfortunately, some investors may think it is a free ride with bullish US economy supported by a strong president who knows stock market, therefore entering initially as a short term trader, after market correct down more than 30% in 1 month, being forced to be a long term investor.

US and G20 political leaders decide to adopt an easy old way, Quantitative Easing (QE, printing money) to revive the global stock market and economy with antibiotic. However, QE as antibiotic can be addictive, last global financial crisis of 2008-2009 required a few trillions of dollars in QE 1-4 over about 5 years. When the same market patient falls again in the next global financial crisis, it may require over 10 times more dosage, eg over tens of trillions dollars to revive again.

By right, global stock market and economic crisis are common over the hundred years. A patient who is falling sick due to flu, usually there is no need for antibiotic, just sufficient rest with down time would help to recover gradually. Similarly, usually stock market just needs to fall to low optimism for a period of time, then it would recover naturally, even the Great Depression in 1929 could recover again after 5 years of “depression”.

Year 2020 is special. It is election year for Trump’s second term US presidency. Therefore, Trump does not have time for typical bear market to fall and recover after 12 months later. Trump needs the report card of S&P 500 to become positive again by summer, aligning with similar timing of Coronavirus may fade away with warmer weather. Therefore, financial antibiotic is used by many countries, including US which shows the ultimate super cure of “unlimited QE”, implying unlimited purchase of asset with virtual money.

“Unlimited” QE may not be really unlimited but it could help to give confidence to market without spending 1 cent. Therefore, usually when the Fed say something, wording has to be careful as it could cause the market to move in certain direction.

Unlimited QE or massive global QE (over 10 trillions dollars) would be another time bomb for future generation. In late 1980s, Japan has experienced burst of a super bubble of stock and property market, resulting in a lost 2-3 decades later, elderly people could not retire while young people see gloomy future with flat salary. Unlimited QE is as if financial addiction if without control, similar to drinking poisonous wine to quench the thirst (饮鸩止渴).

When global stock market experienced high optimism over 75% in the past 2 years, implying the market patient was having fever. There is no need in a hurry to revive the patient in short term, after falling to low optimism, it would recover naturally. Global political leaders hope to sustain the high optimism market or economy is uphill tasks to fight against the market fear with snow ball effect.

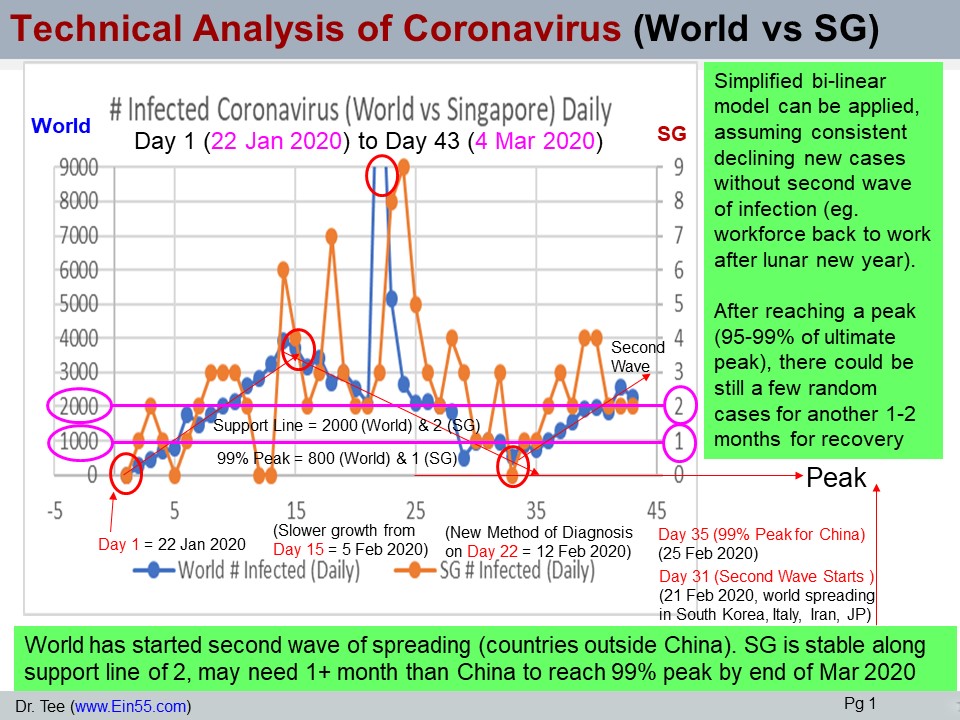

Trump is taking a chance but it depends on collaboration of Coronavirus to end by summer (Jun-July 2020). Even the global stock market may fall to low optimism < 25% before summer, if timing is aligned with W.H.O. declaration of ending of Coronavrius pandemic, then the global QE would help. Despite global stock market could be in crisis but real economy would take about 6 months to show the damage, therefore these financial stimulus plans have to be implemented ASAP, more or stronger dosage may be required before summer over the next few months.

For global investors, global stock crisis is a fact, only difference is whether it is a flash crash (V share recovery in 3 months) or typical global financial crisis (over 6-12 months for economy to fall to bottom before stock market could reborn). Either way, it would be a gift from heaven, either received in 3 months or 12 months later.

Investors may focus more in long term value investing during this period, entering in batches to preserve the bullets, some positions during downtrend of low market optimism to ensure a chance for lucky draw, then remaining positions in uptrend to align with market direction as a trader.

Learn from Dr Tee free 4hr investment course on 10 strategies aligned with unique personalities for a portfolio global giant stocks under tremendous discount now, leveraging on Unlimited QE with global stock crisis. Register Here: www.ein55.com

You are invited to join Dr Tee private investment forum (educational platform, no commercial is allowed) to learn more investment knowledge, interacting with over 8000 members:

https://www.facebook.com/groups/ein55forum/