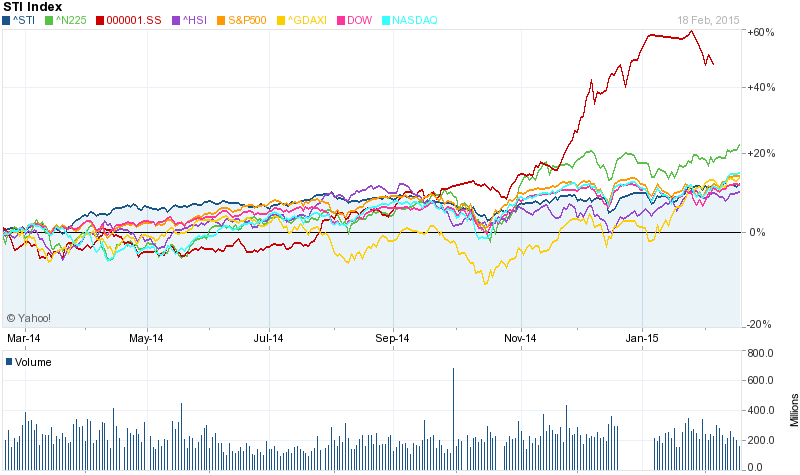

After breaking the triple top resistance of 2100, short term S&P500 becomes very bullish, setting new record high each day. Current US stock market is only suitable for short term trader to apply breakout strategy, buy high sell higher with trailing stop.

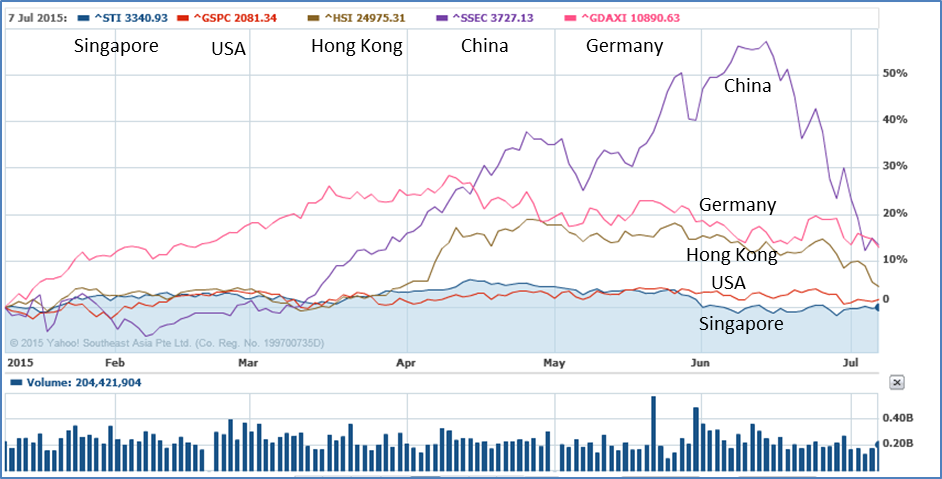

When S&P500 enters danger zone of >75% Optimism again, any future crisis could potentially become the next global financial crisis. Since global stock traders have not reached the euphoric stage yet, US stock market could remain bullish, sustainable if there are intermediate cooling measures, eg. news of US interest rate hike or another regional crisis, while the US economy is still growing.

Short term bullishness of S&P500 (another historical high at 2163), winning of Japan Prime Minister Abe (more QE is expected), lower fear factor (VIX is at low), have helped the global stock market to recover and achieve short term high. The trend is ideal for short to mid-term trading. Even Malaysia has lowered down the interest rate, this could be a gradual growing bull market.

For long term investors, it is important to learn to take profit at the right time, so that there is enough cash, which is king, to buy blue chip stocks at low price during the next global financial crisis. For value investors, it is possible to hold the stocks without selling with condition that these are truly giant stocks, which the business can still be profitable even during economy recession.