Leveraging on Stock Market Greed and Fear

Inflation News: Good News is Bad News?

Inflation news is a relative indicator, having different impacts to different market conditions. Over the past decade, lagging economy (especially for Europe and Japan) hope to achieve higher inflation as it shows the expansion of economy with more spending.

In a bullish economy, it is natural to have higher inflation, then the inflation news could affect the stock market. The key is to know the limit: 2.5% will be a critical point for US inflation or CPI (Consumer Price Index), interest rate has to catch up more than 2%. US inflation for Jan 2018 is 2.1%, still within the limit. At the same time, US 10 years bond yield over 3% is another critical point. In fact, after breaking 3% critical resistance for US bond yield, bond market may suffer significant correction, resulting in lower bond price with higher bond yield. As long as economy is still healthy, funds may be channeled from bonds to stocks, until next time when the unexpected black swan comes, the funds will be moved back from stocks to bonds. The market is near to the transitional points of bull to bear, stocks to bonds but the signal has not reached the critical level yet.

Inflation News: is it Good News or Bad News? The interpretation has to align with investing strategies. Learn further from Dr Tee on how to leverage on macroeconomy indicators including inflation news.

Master the Year of Dog 2018 Stock Market

I would like to wish Ein55 community, a Happy Lunar New Year of Dog, profiting in 2018 stock market. If you ask doggie, what is the outlook for Year of Dog 2018 Stock Market? The answer mostly likely is “Wang! Wang!” (旺旺 = “prosperous” in Chinese).

I would like to wish Ein55 community, a Happy Lunar New Year of Dog, profiting in 2018 stock market. If you ask doggie, what is the outlook for Year of Dog 2018 Stock Market? The answer mostly likely is “Wang! Wang!” (旺旺 = “prosperous” in Chinese).

Doggie could feel it because the global economy has been bullish with increasing GDP, higher PMI and lower unemployment rate. Likely doggie could chew on bigger bone for its meals because the master is getting rich as well.

Economy and stock are related as if the Master walks the Dog. Sometimes the dog (stock market) runs ahead of master (economy), sometimes it is behind but they are closely connected.

The master has been chasing the dog uphill for quite a few years, recently the doggie decides to take a rest as it is either too tired or scared when seeing a sign of bear coming from far away. It has to wait for more encouragement and assurance from the master to move forward again. It is possible both the Master and the Dog may turn direction to go downhill as they have been away from the Home (Value) for quite some time.

In the world of stock investment, we need to analyze both fundamental (country economy to company business) and technical (prices from Level 1 individual stock to Level 4 global stock market), understanding the risk of greedy high optimism market and opportunity in fearful low market market.

Enjoy a peaceful Lunar New Year 2018 Stock Market with your dream team stock portfolio!

Stock Market Gravity: Heaven – Earth – Hell

Top 10 Global Blue Chip Stocks – Dream Team Portfolio

There are over 40,000 stocks in the world, a smart investor has to carefully choose Top 10 global blue chip stocks aligned with own unique personality as investment portfolio to grow the wealth.

A smart investor should form a dream team portfolio with global Top 10 stocks for both passive incomes and capital gains. Let’s learn step-by-step with a portfolio of 10 global blue chip stocks with strong fundamentals in 8 growing sectors (Bank, Property, REIT, F&B, Casino, Consumer, Oil & Gas, ETF), applying Ein55 Optimism as investment clock, waiting patiently to buy low in global financial crisis and sell high in bullish stock market for tremendous potential return. These Top 10 blue chip stocks are diversified over 4 countries: 4 from Singapore, 3 from USA, 2 from Hong Kong, 1 from Malaysia. Strength and opportunities for each stock and suggested strategies will be explained.

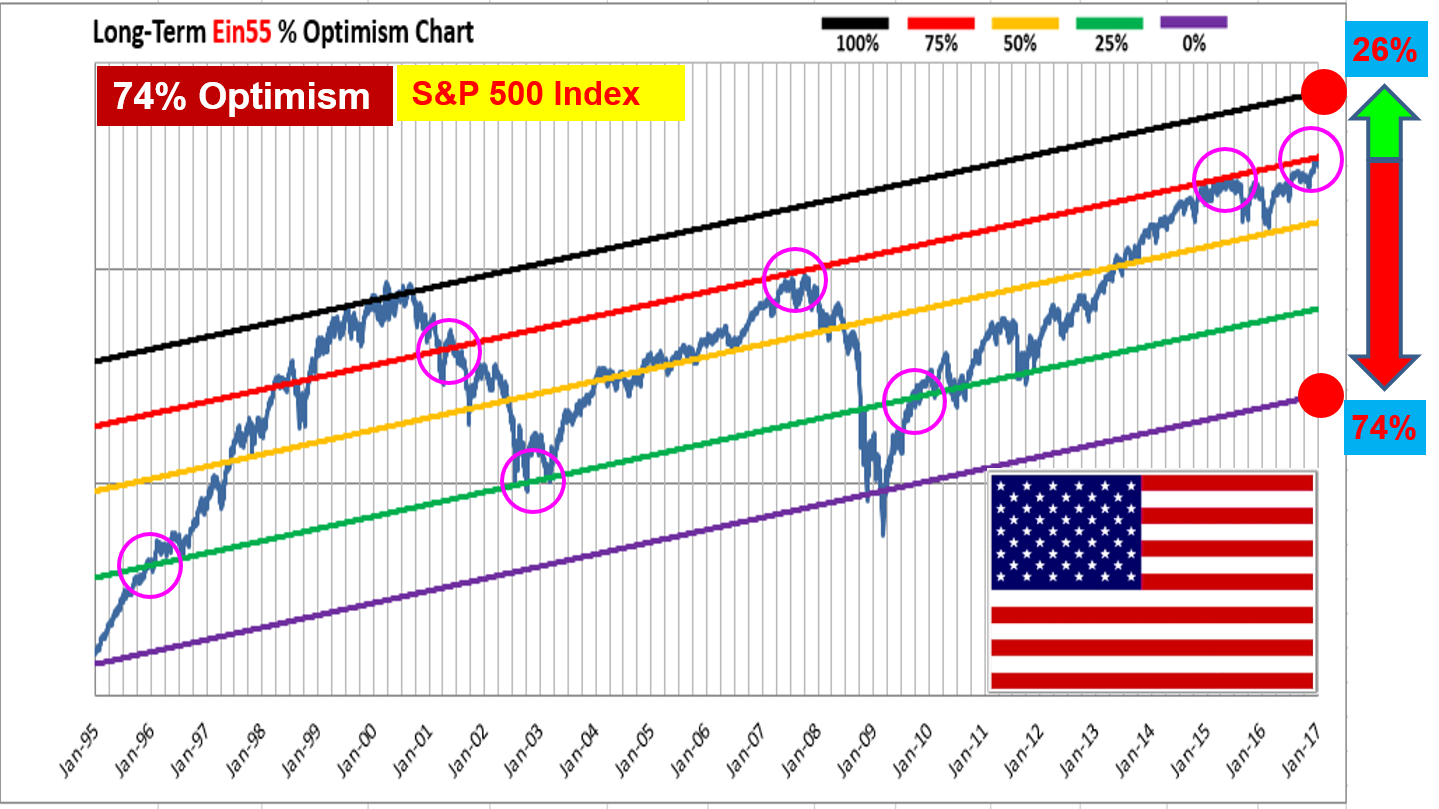

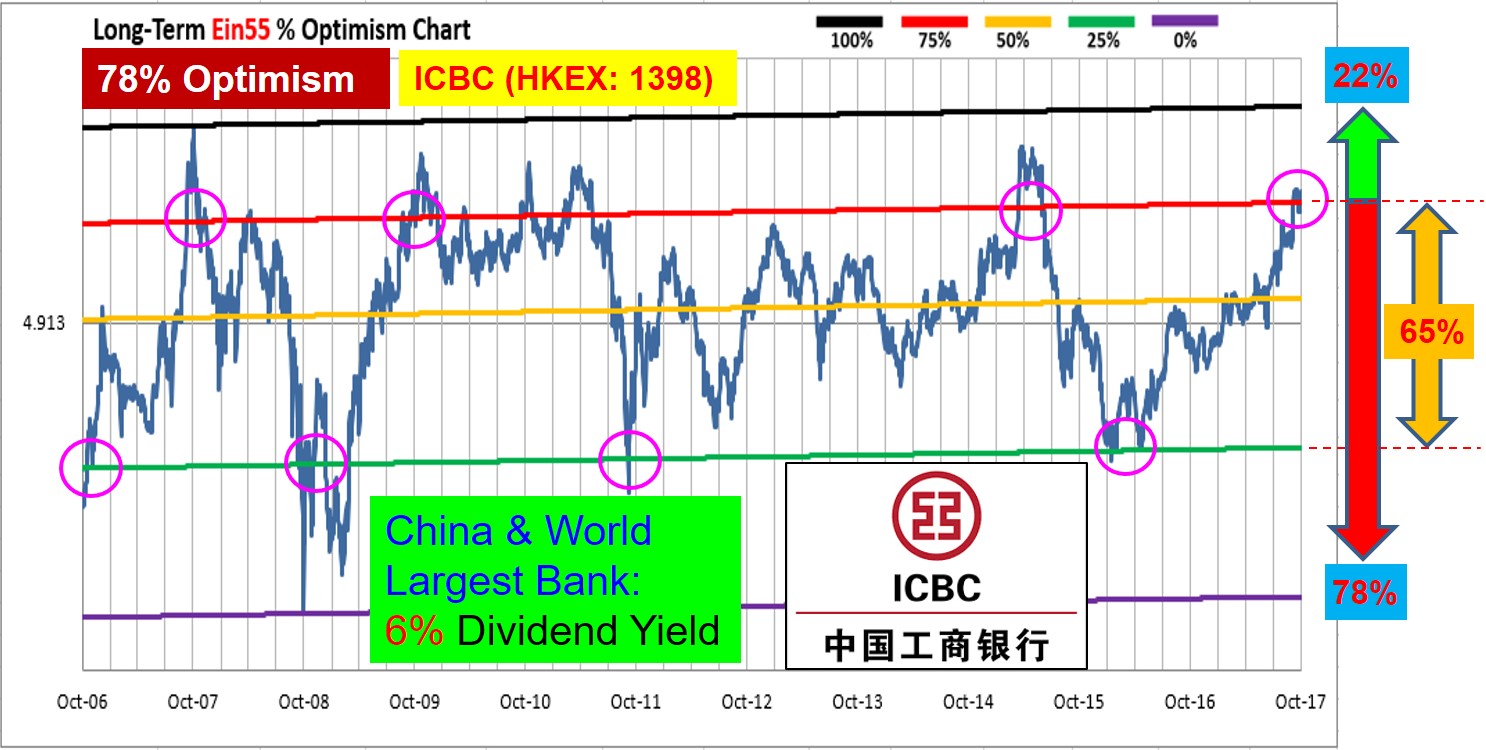

Stock investment is not just what to buy, the mastery of investment clock is crucial, knowing when to buy and sell to maximize the profit. In general, Buy when Optimism <25%, Hold or Wait when Optimism 25-75%, Sell when Optimism >75% (see sample Ein55 Optimism in Figure below).

(#1) ICBC (Hong Kong, HKEx: 1398), Industrial and Commercial Bank of China

Defender / Midfielder Strategies: For long term investing, collect stable dividend payment as passive income with China and Temasek protection. Maximize dividend yield when buying stock at low optimism. For medium term trading, apply Ein55 Optimism to buy low sell high every few years for quicker capital gains.

ICBC is the largest bank in China and also the whole world (based on current share price and valuation). The business with stable growing fundamental is supported by strong economy in China with large population. Temasek is a major shareholder, providing stability to the share prices, an additional shield of defense for investors. With increasing US and global central bank interest rates, the outlook for banking and finance stocks are positive as the net interest margin (NIM) will help the global banks to grow in earnings until the next global financial crisis.

Current Ein55 Optimism of ICBC is high at 78% (see Figure above), in addition to hold for stable 6% dividend yield, an investor also has an option to sell the stock first, buying back when share price drops to below 25% Optimism in future, aiming to maximize the dividend yield. Since global stock market is at high optimism, an investor has to take note of the signals of global financial crisis which would affect the global banking and finance stocks significantly. Crisis is an opportunity if an investor knows when to buy a strong fundamental stock at price with low Ein55 Optimism.

ICBC is a bank blue chip stock, cyclic in nature due to volatile China / Hong Kong stock market and economic cycles. Therefore, besides being a “Defender” stock (dividends only), it may also be considered as a “Striker” (capital gains only) or “Midfielder” (capital gains and dividends) for trading in medium term, following trends to long or short, gaining from average 65% profit from medium-term volatility of share prices with cyclic investing every 2-3 years.

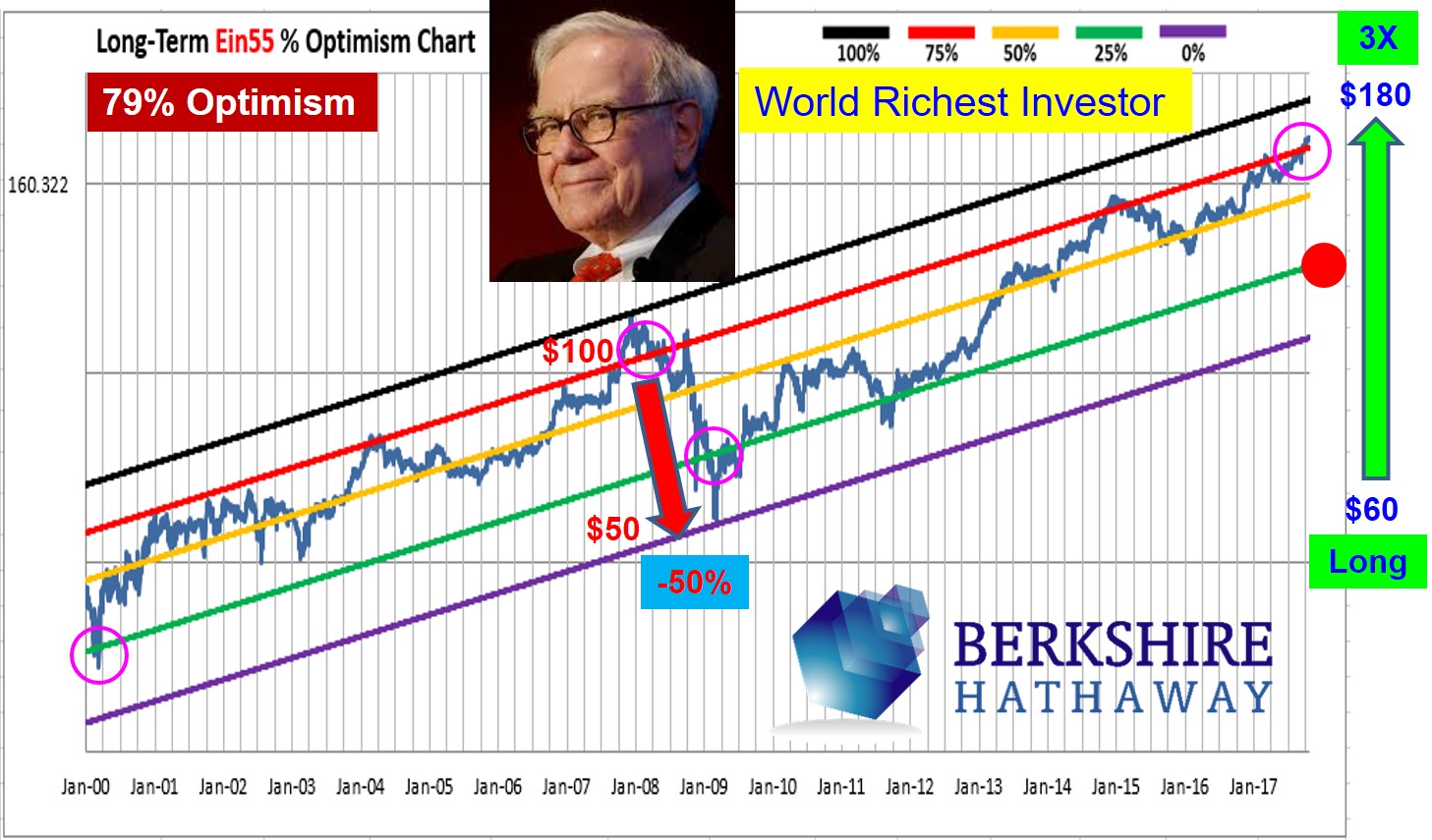

(#2) Berkshire Hathaway Class-B (US, NYSE: BRK.B)

Midfielder Strategy: High-growth fund for capital gains with Warren Buffett wisdom when buying at low optimism

Warren Buffett is the richest investor in the world. Berkshire Hathaway represents an average performance of Buffett’s investment portfolio. Berkshire Class-A stock is very expensive, approaching $300,000 for 1 share, mainly suitable for high net worth individuals or big funds with long term investment strategies as the stock did not pay dividend, there was no change in number of shares, all the retained earnings for decades are accumulated and reflected in its growing share prices. Berkshire Class-B stock is a more affordable option for retail investors, pro-rated at 1/1500 price of the Class-A stock, below $200 / share currently.

Berkshire Class-B allows an easy way for retail investor to diversify over a portfolio of strong fundamental stocks owned by Warren Buffett. Despite Berkshire is a growth giant stock, it is still susceptible to systematic risk of economy cycle. During global financial crisis in 2008-2009, Berkshire share price was halved due to excessive market fear. An investor who follows Ein55 Optimism to buy below 25% Optimism, the current share price has gone up by 3 times, currently at high optimism of 79% (see Figure above).

As an investor, one has 3 possible options for investing in Berkshire stock. Firstly, assuming a buy & hold long term strategy, one may continue to hold the stock despite at high optimism but using the strong fundamental to overcome the next global financial crisis. This option is only suitable for those who have strong investor mindset, bought the share at low optimism price last time. Secondly, an investor may adopt cyclic investing approach, selling Berkshire stock first, buying back at <25% Optimism in future. This option is suitable for those investors who know how to integrate trading and economy cycle investing into overall strategy. Finally, a smart investor has the choice of buying better stocks than Warren Buffett, i.e. focusing on a few best component stocks of Berkshire to achieve higher growth than Berkshire but still enjoying the protection by Warren Buffett as a major shareholder of these few stocks.

The remaining 8 of the Top 10 blue chip stocks in dream team portfolio with key summary of strategies and Ein55 Optimism Investment Clock can be found here (30 pages eBook). Click to Download FREE eBook #1 by Dr Tee: “Global Top 10 Stocks – Dream Team Portfolio” (latest version of eBook with complete guide of What to Buy, When to Buy, When to Sell).

In the same eBook Download link, reader will get another FREE eBook #2 by Dr Tee: “Global Market Outlook” covers comprehensive investment topics: Stock, Property, Commodity, Forex, Bond and Political Economy. Past readers have benefited from the analysis. Learn to position for each market crisis and opportunity with Ein55 Optimism Strategies.

Table of Contents (eBook: Global Stock Market Outlook)

- Mass Market Sentiment Survey

- Review of Global Stock Markets

- US Market Outlook (Economy, Stock, Property, Commodity, Bond, USD)

- Regional Market Outlook (Europe, China, Hong Kong)

- Singapore Market Outlook (Stock & Property)

- Conclusions and Recommendations

The safest time to buy a stock is when everyone is afraid the sky will fall while the business of blue chip stock is still operating normally with consistent performance. This could be a rare opportunity to buy during a crisis; we should learn how to take this advantage to truly buy low sell high.

When Optimism Strategies are combined with Fundamental Analysis (value investing & growth investing), Technical Analysis (support / resistance / trends), and Personal Analysis (mind control of greed and fear), it is very powerful as one can take the right action (Buy, Hold, Sell, Wait or Short) at the right time aligning with his own personality.

The unique Optimism Strategy developed by Dr Tee provides a special advantage to know which investment (stock, forex, property, commodity, bond, etc.) to buy safely, when to buy, when to sell, including the option of long term holding. So far over 20,000 attendees have benefited from Dr Tee high-quality free courses to the public. Take action now to invest in your financial knowledge, starting your journey towards financial freedom.

Learn 10 Strategies of Stock Trading & Value Investing (股市投资策略)

1) Master Buy Low Sell High for all investment markets (stock, property, commodity, forex, bond) (买低卖高:股票、房地产、商品、外汇、债券)

2) Profit in bearish and bullish markets, understanding the true impact of US Interest Rate Hike, Bullish Global Economy, Oil & Gas Crisis (环球经济)

3) Long-term investing strategies to outperform portfolio return of Temasek, Li Ka-Shing, Warren Buffett, major stock indices/ETF and other funds (长期投资策略)

4) High-probability Shorting techniques for short term traders to profit from falling stock market while others are losing money or doing nothing (短期卖空技巧)

5) Generate consistent Passive Income with REITS and real property with knowhow of high dividend blue chip stocks and property market cycles (房地产信托股的被动收入)

6) Methods of Spring Cleaning for own stock portfolio to eliminate junk stocks without any hope (股票大扫除)

7) Time for Global Financial Crisis to buy blue chip stocks on sale (危机也是良机)

8) What to buy (blue chip stocks screening), When to buy/sell (buy low sell how), How much to buy/sell (risk management): (股票三部曲:买何股?何时买卖?买卖多少?)

9) Fundamental Analysis (FA) + Technical Analysis (TA) + Personal Analysis (PA), integrated with unique Optimism Strategy by Dr Tee (乐观指数:三法一体)

10) Global Stock Market Outlook: emerging opportunities with high potential in Singapore, US, China & Hong Kong stock markets (环球股票市场展望: 新美中港,股票良机)

3 BONUSES for Dr Tee Workshop Attendees:

Bonus for Readers: Dr Tee Investment Forum with over 6000 members (Private Group)

(Please click “JOIN” with link above and wait for Admin approval of membership)

- Market Outlook (stocks, properties, bonds, forex, commodities, macroeconomy, etc)

市场展望 (股票、房地产、债券、外汇、商品、宏观经济等) - Optimism/ Fundamental / Technical / Personal Analyses

(乐观指数 / 基本分析 / 技术分析 / 个人分析) - Investment risks & opportunities (投资风险及机遇)

- Dr Tee graduates events and activities updates (Dr Tee学员活动最新消息)

Click here to join future Dr Tee (Ein55) investment courses: www.ein55.com

Investing Strategies for US Stock Markets (S&P, Dow Jones, Nasdaq, Russell) at Historical Peaks

US major stock market indices (S&P 500, Dow Jones Index, Nasdaq, Russel 2000) set new record of historical high again with 8th quarterly gains in a row. The earlier nuclear “crisis” has set a nice market correction for short term traders to buy low and sell high now.

US and most global stock markets (including Singapore) are still under a bull market but mainly suitable for shorter term trading due to moderate high market optimism. Despite at historical high stock prices, long term Optimism for US stock market is about 81%, still have room for further growth, although it is limited by probability.

One has to know own’s personality (trader or investor), designing the right trading plan or investing strategy for the current stock market. The US market is ideal for short term trading, buy high sell higher, especially after breaking 2500 points for S&P 500.

Singapore STI is still supported above 3200 points with Optimism about 48%, getting stagnant over the past few months. With global stock markets are still at relatively high optimism, market risks are getting higher but there are still opportunities for everyone but need to align with own personalities:

1) Short Term Traders: Buy High Sell Higher (Duration: weeks)

– entering after each break out of high resistance but not hesitating to exit when the signal is reversed

2) Medium Term Traders: Buy Low Sell High (Duration: months)

– buying after intermediate correction, focusing on bullish mid-term stock markets

3) Long Term Investors: Sell High Buy Low (Duration: years)

– selling stocks on hold at high optimism with declining bullishness, waiting to buy low during the next global financial crisis.

Learn further on Investing Strategies for US Stock Markets.

Short-term or Long-term Investing? Choose the One that Works for You!

As much as I love investing, I believe that most of us invest with a similar goal in mind, i.e. to make money, to get our money to work for us, and to attain financial freedom. However, considering how different investors can be when it comes to styles and personalities, there is really no one rule that applies to all. Perhaps, that also explains why the stock market is so confusing and unpredictable in the first place.

There is no way to know what every single person thinks, but we can make our lives easier by knowing our own investing personalities and what floats our boats. Boiling down to the basics, you need to know whether you are a short-term trader or a long-term investor (though in real life, many of us are a mix of both).

Short-term Trading

You will like short-term trading if:

- You are comfortable with keeping an investment for only a short period of a few weeks, or even days.

- Your goal is to make quick bucks to reach a shorter-term goal, e.g. purchasing a car, funding a vacation, etc.

- You are not a fan of doing extensive fundamental research on the businesses that you have invested in, but you are able/ willing to commit a significant amount of time to trading and checking stocks.

- You are ok with taking risks and dealing with profits and losses due to short-term price fluctuations.

- You can accept high transaction costs as a result of frequent trades, which reduces your income in a bigger proportion as compared to long-term investing.

Misperceptions of Short-term Trading

- Short-term trading does not require patience.

Truth: Even for a short-term trader, not every day is a trading day. We need to wait patiently for the best opportunity to long or short.

- Short-term trading is always about buying low then selling high.

Truth: Short-selling (profit from falling in share prices) is equally if not more important. Most people only know how to long the market, and therefore they lose money or end up doing nothing when the market is bearish.

Currently, there is still upside in the last phase of the bull market for short-term traders, possible to buy high sell higher but shorter term position should follow shorter term market signals.

In my free 4hr investment course, I will share with you high-probability trading techniques for short-term traders to profit from the rising and falling stock market.

- There is no need to read up on anything if I am trading short-term.

Truth: Short-term trading, being more speculative and volatile in nature, requires one to react quickly to market news and sentiments. In order to profit in both bearish and bullish markets, one would still need to read up to understand the impact of market-changing factors such as the US Federal Reserve interest rate hike, Donald Trump’s national policies, oil & gas crises, and global quantitative easing (QE), etc. It is important to know the impact of global economy on stock market.

Long Term Investing

On the other hand, you may like long-term investing if

- You are okay with holding an investment for a long period of time, and buy or sell only once every few years.

- You have a longer-term goal in mind, e.g. building resources for your retirement, and you are expecting your investment to increase in value over the long run, and/or also provide income in the form of dividends.

- You prefer fundamental analysis to technical analysis.

- You like value investing.

Misperceptions of Long-term Investing

- You do not have to hold a lot of cash if you are buying at a discount.

Truth: Even if you have met the “golden opportunity” where blue chips have more than a 50 percent discount in stock prices, you as an investor have to accumulate bullets (cash) to be able to make substantial profits when you buy low and sell high.

- If you are investing long-term, you can just sit on your stocks and not care about them for a long time.

Truth: While it may be true that you do not have to react to stock market changes immediately like short-term traders do, you still need to review and reevaluate your stock portfolio from time to time. Even in long-term investing, you would need to do spring cleaning regularly, classifying your stocks into different categories and treat them differently, for e.g. fundamentally-strong stocks for long-term holding, cyclical stocks to sell at a high, and junk stocks to sell at the right time, etc.

============================================================

Time flies, and before we realise it, half of 2017 has already passed. On a global level, stock markets have performed superbly for 1H2017, rewarding investors with attractive returns that have not been seen for quite a few years. How sustainable is the stock market rally then? Will there be a market correction? Take actions now to position yourself for investment.

Download Dr Tee Investment Toolbox

Are you worried about the global stock market in year 2017, especially with the controversial new US President, Donald Trump? Political analysts thought Trump has slim chance of winning, will this surprise outcome become the next black swan event to correct the global stock market?

Dr Tee has written an eBook on “Global Market Outlook 2017” to provide solutions with comprehensive coverage of various investment topics in major global stock markets (US, Singapore, Hong Kong, China, Europe). Readers have benefited from the past Market Outlook reports by Dr Tee. Let’s learn the current global investment market risks and opportunities.

Table of Contents for Investment eBook

1. Mass Market Sentiment Survey

2. Review of Global Stock Markets

3. US Market Outlook

3.1 US President & Government

3.2 Effect of QE

3.3 US Interest Rate Hike

3.4 US Job Market

3.5 US Property Market

3.6 US Bond Market

3.7 US Dollar vs Commodity (Gold / Silver / Crude Oil)

4. Regional Market Outlook

4.1 Europe Market

4.2 China Market

4.3 Hong Kong Market

5. Singapore Market Outlook

5.1 Singapore Stock Market

5.2 Singapore Property Market

6. Conclusions and Recommendations

Appendix (附录)

The unique Optimism Strategy developed by Dr Tee provides a special advantage to know which investment (stock, forex, property, commodity, bond, etc) to buy safely, when to buy, when to sell, including option of long term holding. So far over 10,000 audience have benefited from Dr Tee high quality free courses to the public. Take action now to invest in your financial knowledge, starting your journey towards financial freedom.

Bonus #1 for Readers: FREE Investment Courses by Dr Tee

Bonus #2 for Readers: Dr Tee Investment Forum with over 3000 members (Private Group)

(Please click “JOIN” with link above and wait for Admin approval of membership)

- Market Outlook (stocks, properties, bonds, forex, commodities, macroeconomy, etc)

- Optimism/ Fundamental / Technical / Personal Analyses

- Investment risks & opportunities

- Dr Tee graduates events and activities updates

Summary of Seminar with Hu Liyang 胡立阳 in Singapore (14 Jan 2017)

I was invited as a co-speaker in this seminar (14 Jan 2017, Singapore) with Hu Liyang (胡立阳), a famous stock investing guru in Asia. As requested by a reader, I am giving a summary here to show the similarities and differences of my views with Hu Liyang (胡立阳) on Market Outlook for the next few years.

The last time I met Hu Liyang (胡立阳) was probably 4-5 years ago. The first impression of him again is that both of us are getting much older. He has a few more “railway tracks” on forehead while I have many more white hairs.

Both of us have observed many economy cycles in the past few decades, although Hu Liyang (胡立阳) is probably 10+ years more senior than me, that’s why we are mostly aligned in many understanding on market outlook. Hu Liyang (胡立阳) hinted a retirement which I think he deserves it. For me, I don’t feel I am “working” on my interest of investment education, so I don’t feel tired yet. Perhaps one day I may also start a new phase in life, hoping investment is also part of lifelong learning for all the readers.

Similarities in Market Outlook

===========================

1) Final Phase of Bull Market

Both agree that the market is entering the final phase of bull run. I am supported by high optimism of stock market at Level 3 (especially US) and Level 4 (world), while Hu Liyang (胡立阳) is mainly based on interest rate cycle: “bull market starts when interest rate is cut, ends about 1-2 years after interest rate hike in US”

2) Danger Signals for Investment Market

Both agree that bond market is at high risk, bond yield has been at historical low, when bond yield hits 3% (now is 2+% for US 10 years bond yield), the fund is moving from bond to stock and property market, creating risky investment bubbles.

3) Market Cycle Investing

Both agree on market cycle theory. Hu Liyang (胡立阳) uses “pendulum theory”, market will swing from high to low, low to high, sometimes may be even over-corrected, applying his 50% discount theory and other correction factor. I mainly use Optimism to declare the market risk (>75% Optimism) or opportunity (<25 Optimism). Despite the exact methods may be different, both are suggesting buy low sell high based on economy cycles.

Differences in Market Outlook

==========================

1) Timing of Global Financial Crisis

Hu Liyang (胡立阳) has been trying to predict the timing of global financial crisis. I remember a few years ago, he predicted the great crisis may come around year 2013 or 2014. This time, the time bomb is extended to around year 2019. With political economy such as global QE and near zero interest rate for so many years, the current market cycle duration is much longer than last time. I could understand why Hu Liyang (胡立阳) still tries to predict the future as there are too many audience really hope to have a crystal ball to see the future, especially Hu Liyang (胡立阳) has an amazing record to predict the ending time of last global financial crisis in year 2008.

My view is that market cycle duration is unpredictable because it depends on the rate of optimism reaching danger zone of 75-100%. However, there is a predictability within the unpredictability. We just let Optimism shows us the risk level, no need to guess the future. If US takes 10+ years to reach high optimism, market cycle duration will be prolonged. If US behaves like China, stock index is doubled in 1 year, then market cycle will be shorter. This is one of my Ein 55 Investment Styles (of course, Hu Liyang (胡立阳) also has his 100 Investment Styles in his famous book), Optimism is a market thermometer. We will never know when we will have the next fever (eg >38 deg.C), but we will know when we have a fever because we could feel overheated, temperature measured is too high. It is never too late to find a Panadol to cool down the body when we really have fever. Similarly, we will not know when the next crisis may come, but we could guess the probability with market temperature using optimism. When market is having a mild fever (38 deg.C or 75% Optimism) or high fever (40 deg.C or 100% Optimism), we will know as well. The key challenge is whether a trader or investor is willing to take profit (as if taking Panadol), admitting the market is feverish. Based on my observations of past market cycles, more people work harder despite having high fevers, ending up losing what they have accumulated when the market bubble is burst.

2) Factors for Success in Stocks

Hu Liyang (胡立阳) believes the stock market is a probability game of 3 possibilities: up, flat or down in share prices (more of a TA believer); fundamental or business are not as important. He mainly uses “money analysis” to analyze the money flow in economy cycles, combining with many TA methods to predict the mega stock market low and high, both in prices and timing.

I believe in an integration of 3 pillars to be successful in stocks:

2.1) Optimism + Fundamental Analysis (FA, buy giant stock with strong business fundamentals).

2.2) Optimism + Technical Analysis (TA, investment clock to wait for giant to fall down and recover),

2.3) Optimism + Personal Analysis (PA, emotional control) to take actions.

I also believe there is a need to match the strategy with our unique personality:

– short term trader (buy/sell every few weeks),

– mid term trader (buy/sell every few months),

– long term investor (buy/sell every few years),

– life time investor (buy and not need to sell for life).

Warren Buffett, Jim Rogers, Hu Liyang (胡立阳), Jesse Livermore, etc, each investing master or trading guru, could have their own styles of making money, but it may not be suitable for everyone, unless you share the same frequency in mindset. This is the reason I teach the complete Ein55 Styles with consideration of both short term trading and long term investing, FA, TA & PA with economic analysis, showing Ein55 graduates how to customize an unique trading or investing style for individual.

The safest time to buy a stock is when everyone is afraid the sky will fall while the business is still operating normally with consistent performance. This could be a rare opportunity to buy during a crisis; we should learn how to take this advantage to truly buy low sell high.

When Optimism Strategies are combined with Fundamental Analysis (value investing & growth investing), Technical Analysis (support / resistance / trends), and Personal Analysis (mind control of greed and fear), it is very powerful as one can take the right action (Buy, Hold, Sell, Wait or Short) at the right time aligning with his own personality.

The unique Optimism Strategy developed by Dr Tee provides a special advantage to know which investment (stock, forex, property, commodity, bond, etc.) to buy safely, when to buy, when to sell, including the option of long term holding. So far over 20,000 attendees have benefited from Dr Tee high-quality free courses to the public. Take action now to invest in your financial knowledge, starting your journey towards financial freedom.

Learn 10 Strategies of Stock Trading & Value Investing (股市投资十大策略)

1) Master Buy Low Sell High for all investment markets (stock, property, commodity, forex, bond) (买低卖高:股票、房地产、商品、外汇、债券)

2) Profit in bearish and bullish markets, understanding the true impact of US Interest Rate Hike, Bullish Global Economy, Oil & Gas Crisis (环球经济)

3) Long-term investing strategies to outperform portfolio return of Temasek, Li Ka-Shing, Warren Buffett, major stock indices/ETF and other funds (长期投资策略)

4) High-probability Shorting techniques for short term traders to profit from falling stock market while others are losing money or doing nothing (短期卖空技巧)

5) Generate consistent Passive Income with REITS and real property with knowhow of high dividend stock and property market cycles (房地产信托股的被动收入)

6) Methods of Spring Cleaning for own stock portfolio to eliminate junk stocks without any hope (股票大扫除)

7) Time for Global Financial Crisis to buy blue chip stocks on sale (危机也是良机)

8) What to buy (stock screening), When to buy/sell (buy low sell how), How much to buy/sell (risk management): (股票三部曲:买何股?何时买卖?买卖多少?)

9) Fundamental Analysis (FA) + Technical Analysis (TA) + Personal Analysis (PA), integrated with unique Optimism Strategy by Dr Tee (乐观指数:三法一体)

10) Global Stock Market Outlook: emerging opportunities with high potential in Singapore, US, China & Hong Kong stock markets (环球股票市场展望: 新美中港,股票良机)

3 BONUSES for Dr Tee Workshop Attendees:

Bonus #1 for Readers: Dr Tee Investment Forum with over 6000 members (Private Group)

(Please click “JOIN” with link above and wait for Admin approval of membership)

- Market Outlook (stocks, properties, bonds, forex, commodities, macroeconomy, etc)

市场展望 (股票、房地产、债券、外汇、商品、宏观经济等) - Optimism/ Fundamental / Technical / Personal Analyses

(乐观指数 / 基本分析 / 技术分析 / 个人分析) - Investment risks & opportunities (投资风险及机遇)

- Dr Tee graduates events and activities updates (Dr Tee学员活动最新消息)

Bonus #2 for Readers: Dr Tee Investment eBooks x 2

Fresh from Oven: Download the latest 2 eBooks by Dr Tee on “Global Stock Market Outlook“, covering comprehensive investment topics: Stock, Property, Commodity, Forex, Bond and Political Economy & “Dream Team Portfolio” with Top 10 global stocks for capital gains and passive incomes. Past readers have benefited, learning Simple and Powerful strategies which deliver incredible results in stocks. Learn to position for each market crisis and opportunity with Optimism Strategies.

Click here to join future Dr Tee (Ein55) investment courses: www.ein55.com

New Year 2017 – Bull or Bear Market? Learn 2 Winning Strategies for Stocks

New Year 2017 will be an exciting year for global stock market with Donald Trump as the new US president, recovery of emerging markets and crude oil market, rising interest rate and a bullish US economy. Let’s learn how to position in stock market with 2 winning strategies: 1) Buy Low Sell High, 2) Buy High Sell Higher.

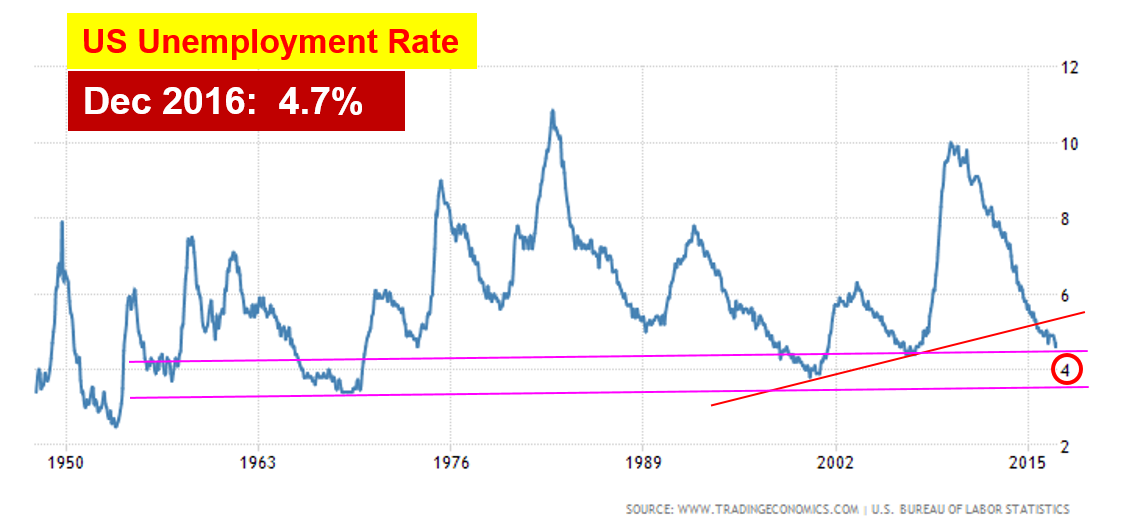

US contributes to 40% of global stock value, therefore it should be a key focus to understand the stock market outlook in year 2017. US economy has been consistently bullish, supporting the stock market. US unemployment rate has declined by half from 10% to 4.7% in Dec 2016. Based on the historical unemployment rates of US since year 1950 (see chart below), we could observe that US economy is entering the last phase of bull run as the unemployment rate is falling below 5%, moving towards the critical 4% value, reflecting the peak of US economy.

Lower unemployment rate implies more new jobs are created, therefore more spending power, which helps the business to grow with higher sales, eventually reflecting as higher stock prices due to stronger fundamental in financial statements. US stock market has been bullish in the past few years, following the trend of US economy, likely will continue in the New Year 2017.

US S&P500 stock index has achieved new historical high on 6 Jan 2017 with 2276 points. Based on Dr Tee (Ein55) Optimism Strategy, US stock market is close to danger zone with 74% Optimism in long term (see chart below), implying the probability of bear market risk is 74% while the upside potential is limited, only 26%.

There have been mixed feelings in the stock market. Some people have stopped investing, worrying about the peak of US stock market but unknowingly the stock prices become higher and higher with time, they may regret of missing the train, hoping to have the last ride.

There are actually many mechanisms to make money in stocks. Here are 2 winning strategies for the New Year 2017, to be aligned with one’s unique personality:

1) Buy Low Sell High

This strategy is suitable for long term investors who hope to invest safely, buying good fundamental stock at low price, selling high in future or holding for long term. Since US and global stock market are approaching higher optimism level, the chances of global financial crisis is high, any unexpected global event in near future could trigger the bear market.

An investor will need to be very patient, ignoring the temptation of the bullish market, taking profit while others are greedy (Optimism >75%), standby enough capital to prepare to buy low when Optimism of global stock market is below 25% again. Control of emotions is critical to buy low when others are fearful one day.

2) Buy High Sell Higher

Not everyone is an investor, having the patience to wait. Some people are more suitable for short term trading, which they could follow momentum trading to buy high and sell higher in near future. A stock price could be at high price but the trend is bullish, therefore the price is sustainable for short term, having the potential to go up even higher with time.

This strategy is more suitable for short term trading in the last phase of bull market, following the trends of stock prices, supported by news, speculations, business, economy, etc. When the trend has stopped, the traders have to stop as well or applying reversed trend in trading. Control of emotions are very critical as daily news could affect the traders’ psychology. The ability to take profit or cut loss is important as the elements of probability are stronger here.

There are other variations of the strategies, eg. an investor could buy low for strong fundamental stocks, sell high for short to medium terms. This way, an investor could also enjoy the last phase of the bull run in stock market with integration of trading strategies.