Most people know that Warren Buffett is a value investor who usually buys stocks (eg. Coca Cola, >40% of the investment portfolio) and hold for a long term. Few people know that sometimes Warren Buffett also “trades”, the annualized return (CAGR) can be even more impressive than his long-term-investing stocks.

Most people know that Warren Buffett is a value investor who usually buys stocks (eg. Coca Cola, >40% of the investment portfolio) and hold for a long term. Few people know that sometimes Warren Buffett also “trades”, the annualized return (CAGR) can be even more impressive than his long-term-investing stocks.

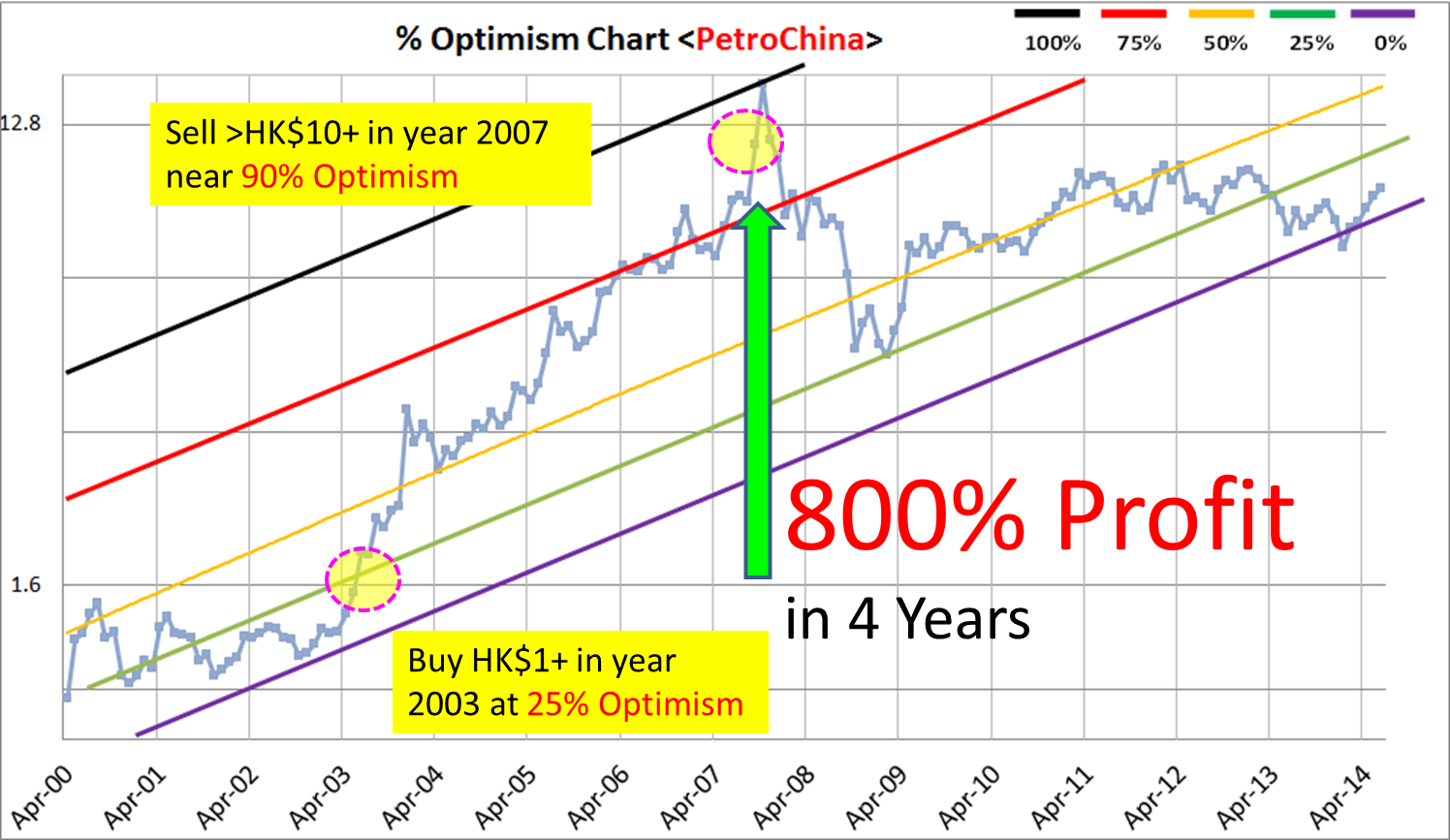

In the last market cycle, he decided to buy his first China stock (H-Share): Petro China in the year 2003 with an average price HK$1+ using about $500 Million capital. In the year 2007, the market soared and he made a surprised move (against his style) to sell all the stocks of Petro China, above HK$12, taking 800% profit in 4 years, average of 200%/year return, perhaps his best “short” term record.

How he did it: knowing when to buy at very low and sell at very high?

Applying the Ein55 Optimism Chart (see figure below), we could notice that Warren Buffett actually entered around 25% Optimism while the price and optimism trend was up, existing around 90% Optimism (countered trend, his favorite investing style). His famous saying is to be greedy when others are fearful, vice-versa. However, he did not teach his followers exactly when is considered fearful and greedy. Some people may have to guess, when market are having a mid-term correction, they may think it is time to invest and hold for a long term. However, when the true global financial crisis comes, the past earning will be completely wiped out, value investing or long term investing could make a loss if timing of entry is not a low enough position.

Ein55 Optimism Chart is a solution, one could know when is truly low (eg <25% Optimism), when is truly high (eg >75% Optimism), not limited to stocks, but also applicable for any investment involving human (eg. Property Market, Bond Market, Commodity Market, Forex, Bank deposit, etc) because human’s weakness in emotional control resulting in most people tend to buy high sell low: following others to buy together during the last rally, then again to sell together near to the end of the crisis. A trader and an investor’s biggest enemy are themselves, not the market. One has to overcome one’s mind to be a successful trader or investor.

At the highest level, the difference between trading and investing is only a fine line. The “secret” of making money in any investment is always BUY LOW SELL HIGH. It is easy but how many people could fully follow this belief? Warren Buffett was considered a trader because he only used 1% of his capital or wealth ($0.5B out of $60B) to buy Petro China. He bought when the trend was up (trend rider), taking profit when the profit target is reached. Warren Buffett actually integrates trading techniques into investing, translating into Market Cycle Investing which usually gives higher return than value investing (following economy cycles to buy low sell high) but a more predictable outcome than trading.

Many people argued whether trading (eg from day trader to a few months of trading) or investing (eg period of a few years or even permanently) is a preferred choice to make money from stock market. In my opinion, results of both methods are comparable if one could be the best trader or the best investor. The key of success is to align the trading plan or investing strategy with own’s personality (eg. risk tolerance level, target for profit, amount of free time, emotion control, etc). Many people simply pursue the best methods of other trading experts or investing masters, trying to duplicate the key of success. They could be disappointed if the missing link is not awared.

Whenever I conduct trading/investing courses, I would conduct an investing profile analysis of my students, knowing their past trading / investing behaviors. This is like a doctor must understand a patient’s medical history before recommending the best medication, which usually must match the patient’s health condition.

Ein55 Optimism method could successfully integrate short/mid-term trading and long term investing under one roof with consideration of Fundamental Analysis (both individual stock and macroconomy), Technical Analysis and Personal Analysis. A trader or an investor will know which hat (trading or investing) to wear, depending on the Optimism level of the market, so that one could fully utilize their strength.

Back to Petro China, the regret was that we can only watch Warren Buffett making big money from the market in 2003-2007. The good news here is that the low optimism level is finally back for Petro China. It is now at 7% Optimism with uptrend. The “parent” of this stock, China SSEC is now at 26% Optimism, a very attractive low level to buy A50 (through A50 ETF in Singapore or Hong Kong) or related H-Shares and S-Chips, many stocks are at low optimism, some with very good fundamentals and a few with strong uptrend. I prefer to apply multi-perspective methods through Ein55 Styles to maximize the profit with low risk.

A stock with strong FA, low optimism, uptrend TA and positive PA is hard to find, but when the opportunity comes, one has to be prepared to grab it: knowing what to buy, when to buy/sell, how much to buy/sell, how to react for different market conditions. One may not have to chase after a bullish market to make money. We may earn much more from a bearish or sideway market, if the right strategy is applied.