“For those properly prepared, the bear market is not only a calamity but an opportunity.” Sir John Templeton (Investing Master)

The safest time to enter stock market is usually after the correction, main difference for a trader and an investor is on how much discount is needed. A wise shopper would wait patiently for the Great Singapore Sales to buy desired products in bulk at significant discount. Similarly, an expert trader or seasoned investor would wait for the sales of desired stocks, when majority of the people are still fearful, only then the share price could fall to an attractive level.

The up and down in stock prices reflect both the business performance and the emotions of traders. The best time to buy stocks is when people worry the sky will fall down but the same business still makes money consistently each day. Such golden opportunities of investing only occur during global financial crisis, when majority of global investors are fearful, only then they would let go their most valuable stocks at tremendous discount.

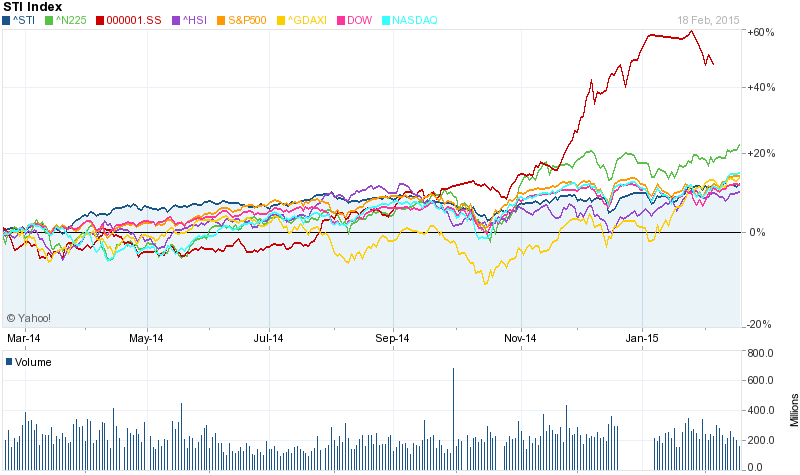

3 major banks in Singapore have fallen more than 20% in share prices over the past 6 months. Is it time to buy these giant stocks cheaply? The current global market corrections could be a good opportunity for traders but it is still insufficient for value investors who aim for more than 50% discount of such blue chips, proven historically in each economy cycles.

How long should the investors wait for the giants to fall down? We don’t have to time the market because the future is unpredictable, both the financial news and political economy could affect the stock markets daily. However, there is a predictability within the unpredictability, if we could wait patiently, preparing for each opportunities to enter the market, aligning the strategies with own personalities as a trader or an investor.

Optimism Analysis is a probability calculation, both for trading and investing. We would position ourselves to have higher chance of winning with limited downside, risk-to-reward ratio should be at least 1 to 2, every $1 of risk in investment should potentially bring $2 of return. Gambling could give special edge to the casino, while Optimism Analysis could give unfair advantage to the traders / investors if ones could wait patiently to be the minority who could gain from the majority. Golden opportunity is for those who are properly prepared, equipped with the investing knowledge!