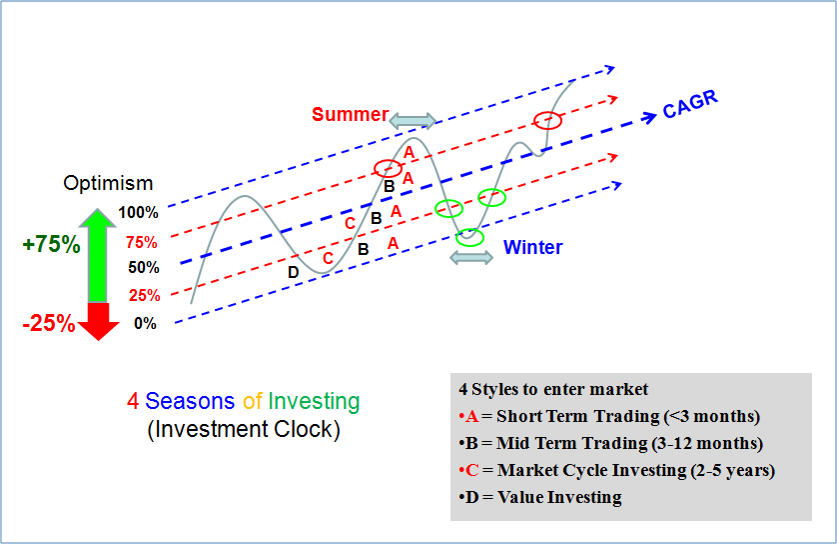

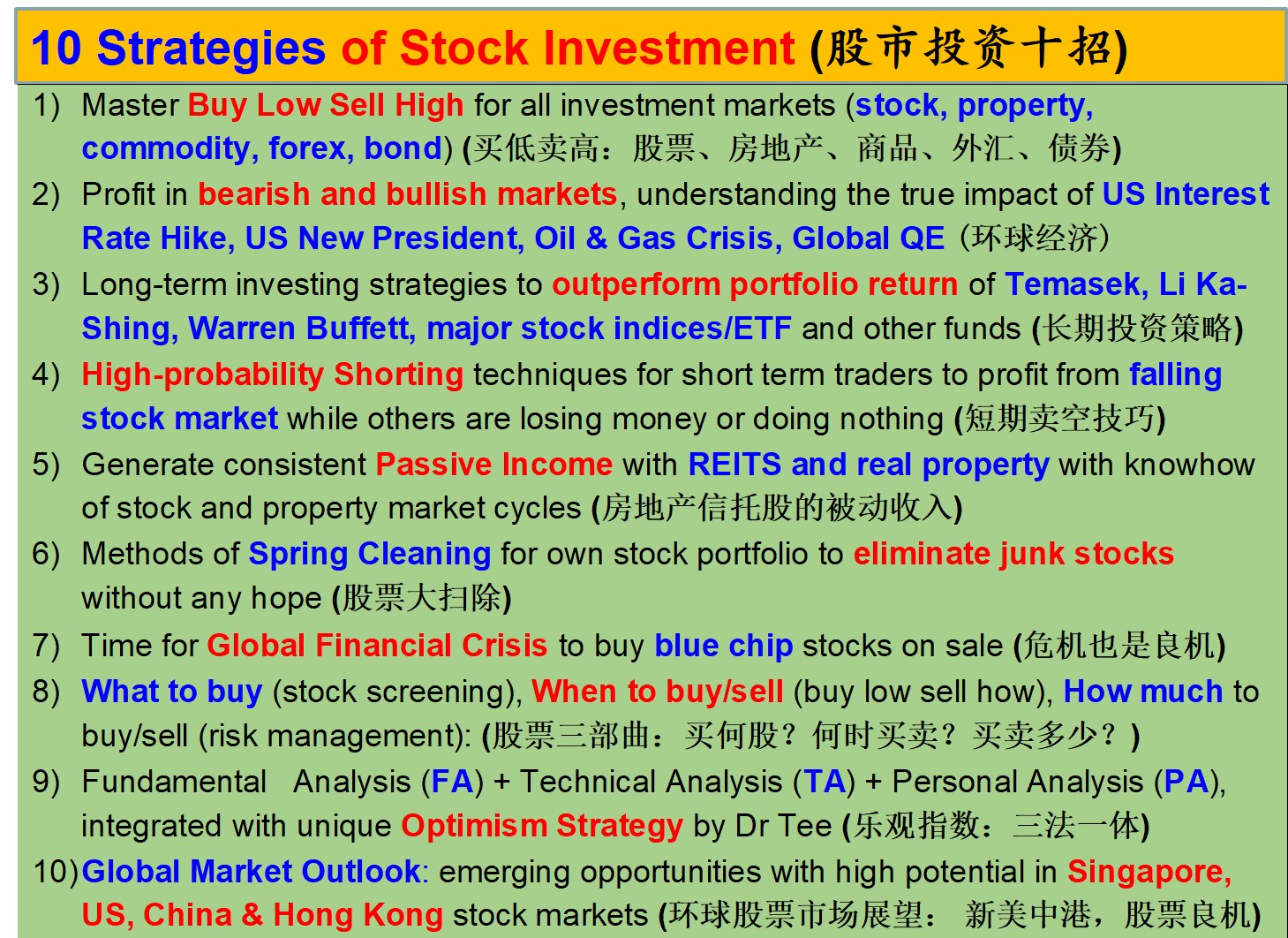

There are many people confused, what they should do in the phase2 of bull market. Which action is right? Buy, Hold, Sell, Wait or Shorting?

The answer is dependent on unique personality and condition. In general, we could broadly categorize 4 types of critical actions for 4 groups of traders and investors. Each of them as a gift from heaven:

1) Long Term Investor (No Stock)

– best gift from heaven is to wait patiently for global financial crisis, applying low optimism to buy fundamentally strong stocks at lousy price

– intermediate plan is for a long term investor to apply mid-term trading (provided able to match with this personality) to profit from the phase2 of bull market, but the investor must follow trading exit strategy as Optimism is high.

2) Long Term Investor (with Stocks)

– examine the past entry price, was it low optimism? If yes, hold during intermediate optimism (with consideration of L2-L4 signals), prepare to take profit when optimism is high. Ein55 Graduates have learned many techniques to integrate trading into investing to maximize the gains.

– after selling the stocks one day, move to Group1 for next action.

3) Short Term Trader (No Stock)

– 2 possible strategies, 1) buy low sell high (swing trading) which requires a minor correction, 2) buy high sell higher (position trading) with momentum trading or breakout strategy, entering when a critical resistance is broken upward.

4) Short Term Trader (with Stocks)

– hold and take profit using quicker signal, different price target as Group 2.

– after exit, the buy/sell process could be repeated many times until the bull run has ended one day, then applying reversed strategy of shorting to profit from bearish market one day. Trend follower for short term trader.

=========================================

In summary, there is no one solution, one could make money with any action aligning to one’s personality: Buy, Hold, Sell, Wait or Shorting. If there is a mismatch in personality with strategy, then any action could result in losses eventually. So, we should know ourselves first before planning for stock trading or investing. Actual personality is much more complicated, each one of us is unique but the 4 types above are the most common ones: trader vs investor, with and without stocks.

We need to take action to convert knowledge into fortune. It has to be the right action at right time, aligning to our unique personality.