Register Here to profit from stock investment: www.ein55.com

Dr Tee (Ein55) FREE Stock Investment Course in Singapore

Register Here to profit from stock investment: www.ein55.com

I stay till over 3am tonight (9 May 2018) so far, observing an important historical milestone in my home country, Malaysia: a dramatic change of federal government, from BN to PH. PH will also control 7 state governments (Perak is still uncertain).

Chinese believes in 60 years of cycle duration (5 x 12 = 60, 一甲子), it is about 60 years of BN ruling Malaysia since independence in 1957. 《三国演义》:“话说天下大势,分久必合,合久必分。From the wisdom of thousand years of Chinese history, we learn that when there is common interest, various groups could become friends, but one day, they will split due to internal conflicts again. It will take a long time before the next cycle to split begins, if the new PH government could use this historical opportunities to strengthen the foundation, it could continue to rule Malaysia for several decades.

How’s the impact on Malaysia future economy, stock investment, forex, etc? Short term market reaction so far is a weaker Ringgit vs USD because this is a major change in Malaysia. PH has announced 2 days of public holidays on May 10 and 11, not sure if Bursa stock market will follow the soon-to-be government to rest for 2 days. If yes, there could be some turbulence.

We don’t have to speculate which Malaysia stocks will rise or fall down. Instead, let the trading or investing opportunities come to us. Let the share prices stabilize for a few days after absorbing the market news. It is never too late to grab on investing opportunities in Malaysia.

In a longer term, if Malaysia is under a more efficient government, the economy and stock market will have higher growth potential but it will take at least 1 decade to see the results. PH is still an alliance of different parties, sometimes compromised decision may not be the best but as long as it is fair and transparent, the country could move in a positive uptrend direction again.

Optimism is also crucial for a political system. BN lost in this political tsunami, partly due to past few years of oil & gas crisis and weak ringgit, local people has been at low optimism in life, especially with the rising cost of living (eg. GST). PH may not be lucky as well because currently is Level 4 (global) high optimism, even if Malaysia stock is at moderate optimism, based on a 5 years political cycle for 1 term of government, it is not easy to achieve uptrend in stock market to show the results 5 years later. It is the same situation for Trump in US, who may try to sustain the high optimism US stock market till at least year 2020 as a report card to seek for his second term as US president.

There is no regret to witness a political cycle of a country. Sincerely hope Malaysia will become a better country, being a closer partner with Singapore. Learn about future stock investment opportunities in Malaysia, Singapore and the rest of the world with from Dr Tee free investment courses.

Crisis stock investing is investing in cyclic giant stocks, ideal for Buy Low Sell High investing strategy. Usually crisis may happen at business (Level 1, company losing money), sector (Level 2, bearish sector), country (Level 3, recession) or global (Level 4, financial crisis), creating different degrees of fear in the stock market, resulting in fall of share prices. Subsequently, when the market fear turns into greed, these crisis stocks may become uptrend momentum stocks, ideal for selling high.

There are 4 different qualities of crisis stocks with long term low optimism. An investor has to carefully identify the nature of crisis stock investing, understanding how the falling in share prices are induced.

1) Low Quality Low Optimism (L1 Crisis Stock Investing)

Long term optimism of stock is low, driven by decline in L1 business but L2-L4 are fine. Noble Group could be an example. Without consideration of sustainable business, pure strategy of Buy Low may result in Get Lower in share prices, which is a common pitfall for Technical Analysis. Both Fundamental Analysis (FA) and Technical Analysis (TA) should be integrated with Optimism Strategies with consideration of Personal Analysis (PA)

2) Average Quality Low Optimism (L2 Crisis Stock Investing)

Long term optimism of stock is low, driven by decline in L1 business & L2 (sector), while L3-L4 are fine. Examples include oil & gas crisis stocks in the last 1 year, casino crisis stocks 2 years ago, etc. It happens during the sector rotation which the sector market cycle may not align with the country/global economy cycle. If the sector is not a sunset industry, usually it would recover again as there is unique demand vs supply within each sector for investment.

3) High Quality Low Optimism (L3/L4 Crisis Stock Investing)

Long term optimism of stock is low, driven by decline in L1-L4 (business/sector/country/global financial crisis). More than 50% global cyclic giant stocks during global financial crisis would be affected in both business (drop in earning or even losing money) and share prices (L1-L4 from individual stock to global stock indices). Since the market fear at L3/L4 may not last long (global political leaders would take actions by then to save the whole world), the downside of global stock market is limited but an investor needs to have sufficient holding power through the cold winter time of global financial crisis. For example, many cyclic giant bank stocks may behave this way.

4) Excellent Quality Low Optimism (L4 Crisis Stock Investing with strong L1 Business)

Long term optimism of stock is low, driven by decline in L2-L4 (sector/country/global financial crisis) but L1 business is fine. Less than 10% global growth giant stocks during global financial crisis could still be profitable or even growing in business while the share prices falling relatively less (defensive in nature) than the average in global stock market. In fact, defensive growth giant stocks are suitable for Buy Low & Hold for long term investing, sell is an optional strategy.

The safest time to buy a giant stock is when everyone is afraid the sky will fall down while the business is still operating normally with consistent performance. This could be a rare opportunity to buy during a crisis but many people are too normal, do not know how to take this advantage to truly buy low sell high.

A smart investor may not need to consider only crisis stock investing. There are other strategies such as growth stocks, dividend stocks, undervalue stocks and momentum stocks, etc, may be integrated to form a balance stock investment portfolio.

Learn from Dr Tee through high-quality free stock investment courses.

I would like to wish Ein55 community, a Happy Lunar New Year of Dog, profiting in 2018 stock market. If you ask doggie, what is the outlook for Year of Dog 2018 Stock Market? The answer mostly likely is “Wang! Wang!” (旺旺 = “prosperous” in Chinese).

I would like to wish Ein55 community, a Happy Lunar New Year of Dog, profiting in 2018 stock market. If you ask doggie, what is the outlook for Year of Dog 2018 Stock Market? The answer mostly likely is “Wang! Wang!” (旺旺 = “prosperous” in Chinese).

Doggie could feel it because the global economy has been bullish with increasing GDP, higher PMI and lower unemployment rate. Likely doggie could chew on bigger bone for its meals because the master is getting rich as well.

Economy and stock are related as if the Master walks the Dog. Sometimes the dog (stock market) runs ahead of master (economy), sometimes it is behind but they are closely connected.

The master has been chasing the dog uphill for quite a few years, recently the doggie decides to take a rest as it is either too tired or scared when seeing a sign of bear coming from far away. It has to wait for more encouragement and assurance from the master to move forward again. It is possible both the Master and the Dog may turn direction to go downhill as they have been away from the Home (Value) for quite some time.

In the world of stock investment, we need to analyze both fundamental (country economy to company business) and technical (prices from Level 1 individual stock to Level 4 global stock market), understanding the risk of greedy high optimism market and opportunity in fearful low market market.

Enjoy a peaceful Lunar New Year 2018 Stock Market with your dream team stock portfolio!

As much as I love investing, I believe that most of us invest with a similar goal in mind, i.e. to make money, to get our money to work for us, and to attain financial freedom. However, considering how different investors can be when it comes to styles and personalities, there is really no one rule that applies to all. Perhaps, that also explains why the stock market is so confusing and unpredictable in the first place.

There is no way to know what every single person thinks, but we can make our lives easier by knowing our own investing personalities and what floats our boats. Boiling down to the basics, you need to know whether you are a short-term trader or a long-term investor (though in real life, many of us are a mix of both).

Short-term Trading

You will like short-term trading if:

Misperceptions of Short-term Trading

Truth: Even for a short-term trader, not every day is a trading day. We need to wait patiently for the best opportunity to long or short.

Truth: Short-selling (profit from falling in share prices) is equally if not more important. Most people only know how to long the market, and therefore they lose money or end up doing nothing when the market is bearish.

Currently, there is still upside in the last phase of the bull market for short-term traders, possible to buy high sell higher but shorter term position should follow shorter term market signals.

In my free 4hr investment course, I will share with you high-probability trading techniques for short-term traders to profit from the rising and falling stock market.

Truth: Short-term trading, being more speculative and volatile in nature, requires one to react quickly to market news and sentiments. In order to profit in both bearish and bullish markets, one would still need to read up to understand the impact of market-changing factors such as the US Federal Reserve interest rate hike, Donald Trump’s national policies, oil & gas crises, and global quantitative easing (QE), etc. It is important to know the impact of global economy on stock market.

Long Term Investing

On the other hand, you may like long-term investing if

Misperceptions of Long-term Investing

Truth: Even if you have met the “golden opportunity” where blue chips have more than a 50 percent discount in stock prices, you as an investor have to accumulate bullets (cash) to be able to make substantial profits when you buy low and sell high.

Truth: While it may be true that you do not have to react to stock market changes immediately like short-term traders do, you still need to review and reevaluate your stock portfolio from time to time. Even in long-term investing, you would need to do spring cleaning regularly, classifying your stocks into different categories and treat them differently, for e.g. fundamentally-strong stocks for long-term holding, cyclical stocks to sell at a high, and junk stocks to sell at the right time, etc.

============================================================

Time flies, and before we realise it, half of 2017 has already passed. On a global level, stock markets have performed superbly for 1H2017, rewarding investors with attractive returns that have not been seen for quite a few years. How sustainable is the stock market rally then? Will there be a market correction? Take actions now to position yourself for investment.

There are many people confused, what they should do in the phase2 of bull market. Which action is right? Buy, Hold, Sell, Wait or Shorting?

The answer is dependent on unique personality and condition. In general, we could broadly categorize 4 types of critical actions for 4 groups of traders and investors. Each of them as a gift from heaven:

1) Long Term Investor (No Stock)

– best gift from heaven is to wait patiently for global financial crisis, applying low optimism to buy fundamentally strong stocks at lousy price

– intermediate plan is for a long term investor to apply mid-term trading (provided able to match with this personality) to profit from the phase2 of bull market, but the investor must follow trading exit strategy as Optimism is high.

2) Long Term Investor (with Stocks)

– examine the past entry price, was it low optimism? If yes, hold during intermediate optimism (with consideration of L2-L4 signals), prepare to take profit when optimism is high. Ein55 Graduates have learned many techniques to integrate trading into investing to maximize the gains.

– after selling the stocks one day, move to Group1 for next action.

3) Short Term Trader (No Stock)

– 2 possible strategies, 1) buy low sell high (swing trading) which requires a minor correction, 2) buy high sell higher (position trading) with momentum trading or breakout strategy, entering when a critical resistance is broken upward.

4) Short Term Trader (with Stocks)

– hold and take profit using quicker signal, different price target as Group 2.

– after exit, the buy/sell process could be repeated many times until the bull run has ended one day, then applying reversed strategy of shorting to profit from bearish market one day. Trend follower for short term trader.

=========================================

In summary, there is no one solution, one could make money with any action aligning to one’s personality: Buy, Hold, Sell, Wait or Shorting. If there is a mismatch in personality with strategy, then any action could result in losses eventually. So, we should know ourselves first before planning for stock trading or investing. Actual personality is much more complicated, each one of us is unique but the 4 types above are the most common ones: trader vs investor, with and without stocks.

We need to take action to convert knowledge into fortune. It has to be the right action at right time, aligning to our unique personality.

There are three schools of thought to achieve the best of both worlds in stock trading and investing. To bridge these three schools of thought, i.e. Fundamental Analysis (FA: business and economic performance), Technical Analysis (TA: price movement) and Personal Analysis (PA: emotional management), I have formulated the Optimism Strategies.

The essence of the optimism strategies is to identify fundamentally strong stocks, and buy/sell at a time aligned with technical analysis indicators, matching our personalities to take the right actions: Buy, Hold, Sell, Wait, Short.

It may seem hard to practise the above when pessimism is looming over the markets, but as investors, we all need a bit of optimism.

To make things simpler, I measure optimism on a 0 to 100% scale, where 0% stands for fearfulness or extreme pessimism, and 100% stands for greed or extreme optimism.

The general aim of investors is to find the best time for entry or exit by applying the Optimism Strategy at four different levels: Level 1 – individual stocks, Level 2 – sector/ industry, Level 3 – country/region, and Level 4 – world.

However, most undisciplined retail investors would simply follow the herd mentality—buying when everyone is buying and selling when everyone is selling. But again, these people usually end up buying high and selling low, and thus losing in investment.

Don’t be Thrown Off by the Word “Crisis”

I think a very important part of being optimistic is to not be afraid of crises, and not be distracted by “what everyone is saying”, because every crisis presents an opportunity.

If we were to observe how frequently crises occur, we will find that Level-1 crises happen almost all the time. Wind ups happen for weak companies when the earnings, assets, and/or cash flow are insufficient to pay for the debt. This could happen very unexpectedly; such was the case for Swiber.

Level-2 crises tend to follow the market cycle of the particular sector, for example oil & gas, casino, etc. But that also means that opportunities can be found every few months.

Level-3 crisis could happen every year, e.g. the US losing AAA credit rating (2011), China stock crisis (2015), Brexit crisis (2016), etc.

Level-4 crisis is even bigger in scale, but less frequent as well. Picture the Dotcom Bubble (2001) and Subprime Crisis (2008).

The above sound scary, don’t they? But I think that the greatest investment opportunities lie in the most fearful and most unexpected financial crises. This brings me to the next point.

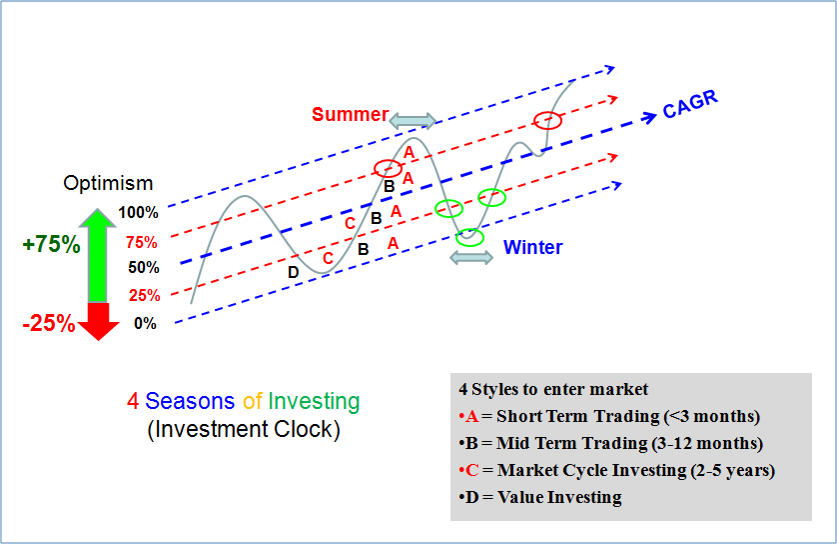

The 4 Seasons of Investing

Of course, I don’t mean seasons in the literal sense, neither am I referring to the quarters in a year.

I use seasons as an analogy to describe market optimism. Winter is cold and seemingly lifeless, so I use it to represent a time/period when investors’ interest is very low (Optimism < 25%).

Summer, on the other hand, is hot and vibrant. I use it to represent a time when investors’ interest is high (Optimism > 75%).

Spring and autumn are seasons with milder climates, thus these two seasons refer to times when investors’ interest is average.

Needless to say, seasons come in cycles. Knowing that the market neither prospers nor stagnates forever, our aim is to enter investment in “winter” (when others are fearful), and exit in “summer” (when others are greedy).

Based on the concept of the four seasons, I have formulated a strategy to pick the optimum times of entering or exiting the market, as depicted in the diagram below:

If you are unsure about what this diagram means, I will be giving a more detailed breakdown of the approach investors can take in my free investment course.

If you’re interested to learn more, you may stay tune to my upcoming articles in this space or even attend a free investment course where I would explain the concepts more in-depth. During the free 3hr high-quality short course to the public, I will also share about 5 out of my 55 investment styles. Click on the button below to find out more about the latest upcoming workshop.

Exchange Traded Fund (ETF) is getting popular among the investors, total global asset value has exceeded US$3 trillion. ETF has the best DNA of both stocks and investment funds. ETF is an investment fund which can be traded like stocks, having the stability of investment funds (risk diversification over a large portfolio) and flexibility of stocks (buy / sell in stock market) with minimal fund management fee.

There are thousands of ETFs globally over various investment markets, eg:

Famous ETFs providers are SPDRs, iShares, PowerShares, ProShares, Vanguard, etc. For stocks ETFs, it could be related to stock indices, sectors or a group of stocks selected by the fund managers, either actively or passively managed. Some ETFs could be operated inversely (shorting, eg, PSQ – ProShares Short QQQ ETF, higher ETF price with falling in Nasdaq 100 stocks) or with leverage (Ultra, eg. SSO – Ultra S&P500 Proshares, 2 times leveraging of S&P500 stock index movement).

An investor must learn how to choose the top 10 global ETFs (low risk high return), aligning with own personality and investment goals. Fund managers could help in what to buy, diversifying the investment over a large portfolio to lower the risks. For those with limited capital, ETF is a low-cost way of investment diversification, 1 ETF is equivalent to a portfolio of many stocks with good businesses. It is also easier to monitor 1 ETF, comparing to monitor the entire index with hundreds of component stocks.

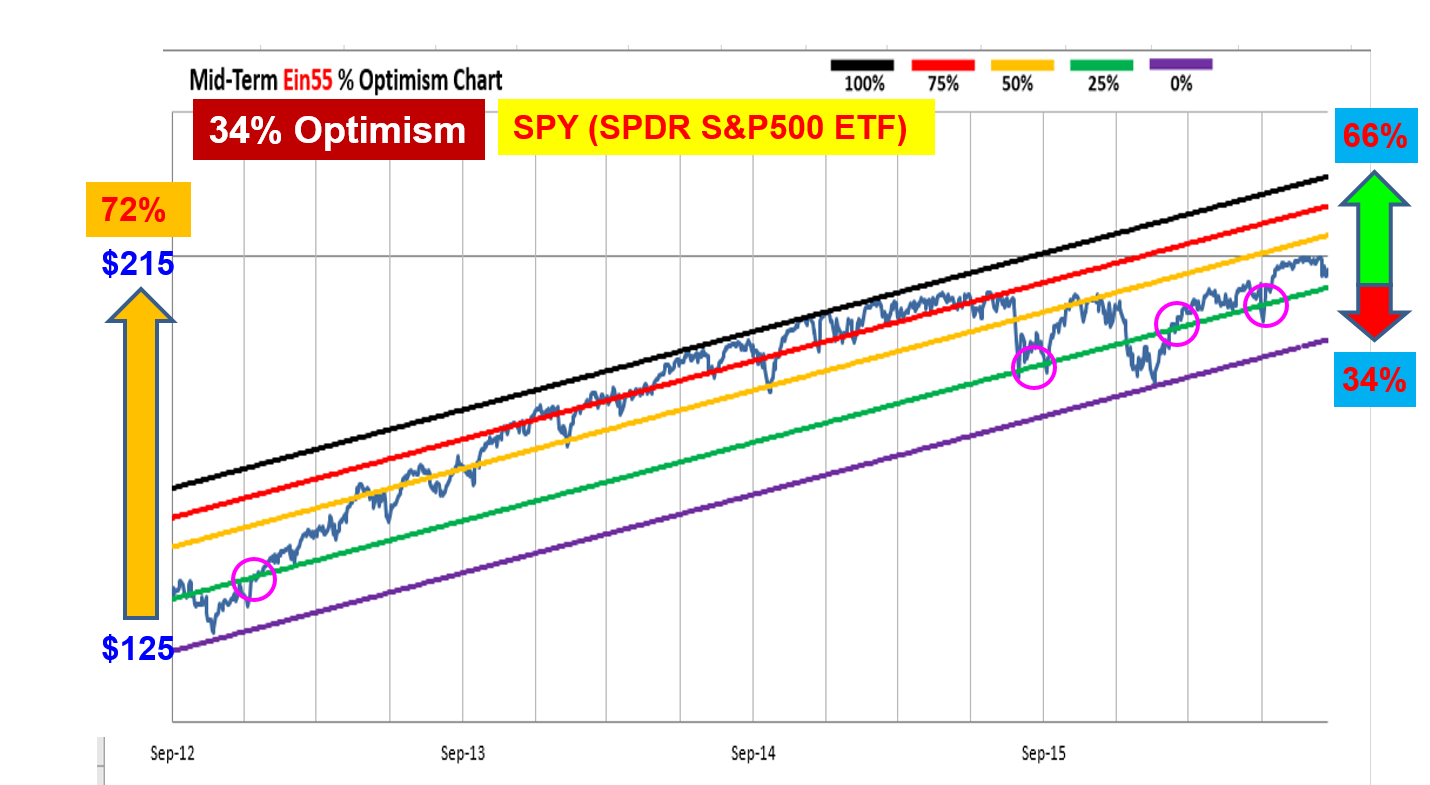

S&P500 stock index is a common fund of choice for ETF because this is an investment in US, No 1 economy in the world, through 500 top US stocks. SPY is a popular ETF by SPDR on S&P500. Let’s learn how to buy low sell high for medium term trading. Currently S&P500 is near to historical high price, long term optimism is moderate high, not suitable for investing. However, for medium term traders, each correction of mid-term optimism (see chart below) below 25%, creates a new trading opportunity to buy low. The reward to risk ratio for mid-term trading is around 2:1 (66% upside vs 34% downside, due to 34% Optimism). Over the past 4 years, SPY ETF has appreciated by 72% due to capital gains in S&P500 stocks. It is relatively safer to trade SPY ETF (through S&P500) compared to trade 1 US stock.

In the ancient time, Europeans thought that swans are all white in colour until one day, black swan was found in Australia, it became a surprised news. Black swan event is a financial term used to describe an unexpected event which later evolved into global financial crisis. There were people and company went bankrupt during the downfall of global stock market. There were also people who took advantage to buy good business at low price, making many times of fortune in a short time when the crisis is over.

Every crisis is an opportunity. However, there are different scales of financial crisis, from Level-1 (company level, eg. Swiber or Noble), Level-2 (sector level, eg. Shipping Industry), Level-3 (country level, eg. Russia) to Level-4 (global financial crisis). Level-1 crisis happened almost all the time, weak company could wind up the business when the earning, asset or cashflow is insufficient to pay for the debt. Level-2 crisis follows the unique sector market cycle, eg. Oil & Gas crisis, casino crisis, opportunity could be found every few months, suitable only for trading if it is not aligned with higher level of crisis. Level-3 crisis could happen every year, eg. Euro Debt Crisis (2010-2012), US losing AAA credit rating (2011), China stock crisis (2015), Brexit crisis (2016), creating a good opportunity for both traders and investors. However, none of them could be named as Black Swan event or Level-4 crisis (global financial crisis), similar to Dotcom Bubble (2001) and Subprime Crisis (2008).

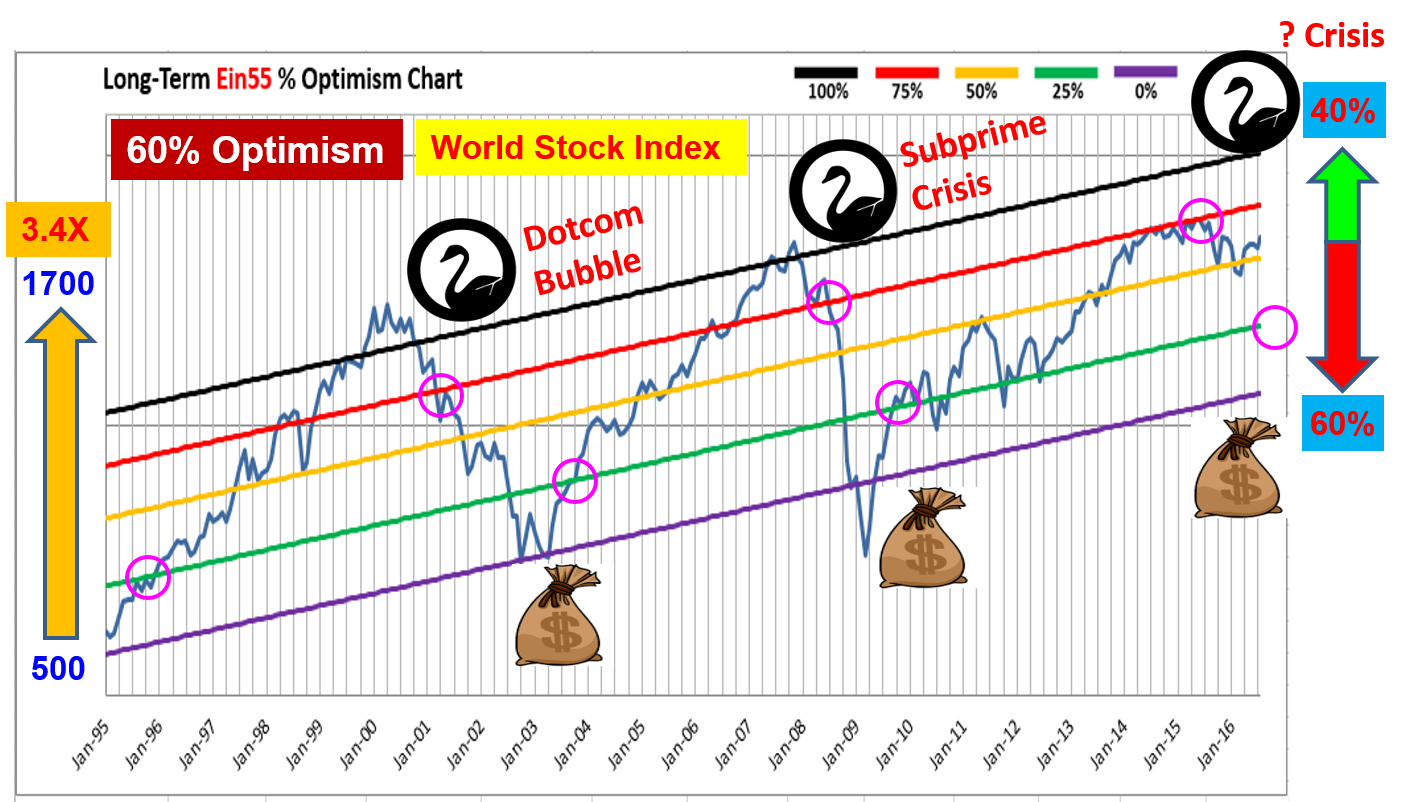

The greatest investment opportunity requires the most fearful financial crisis in an in unexpected way. Every year in a bull market, many “Dr Doom” will try to predict each event could become the next global financial crisis, but why it usually ended up just a smaller scale of regional crisis? In fact, each of the yearly financial crisis could become the next global financial crisis but it requires greater fear to trigger. Based on Ein55 Optimism Strategies (see chart below), global financial crisis will more likely to occur when world stock index is over 75% optimism, eg. in year 2000 (which triggered the dotcom bubble in 2001) and year 2007 (which triggered the subprime crisis in year 2008). For other smaller scale crisis (Euro Debt, Brexit, US credit crisis, etc), world stock market was at mid optimism level (<60%), it was not greedy enough, therefore the global investors were also not fearful enough to escape at the same time when crisis happened.

In the past 20 years, world stock market has gone up 3.4 times in share prices (see chart below), a highly profitable investment option. World stock market index was at the critical 75% Optimism in year 2015, the global stock market correction has helped to cool down to moderate high level of 60% Optimism. With US S&P500 index reaching historical high every few months, world stock market has been increasing in optimism level, risk is getting higher each day (40% upside, 60% downside) but not back to the critical level yet. If there is still a last rally, global stock market could be speculated to a high optimism level, the black swan of the next global financial crisis will be likely to wait there. We don’t have to guess what and when is the black swan event because it is unpredictable in nature, therefore it is called a black swan. However, Ein55 Optimism Strategies could help us to prepare for that golden opportunity in future. As long as we are not too greedy, taking profit at high optimism (>75%), we could save enough capital, overcome our fear to buy low at low optimism (<25%) and hold until recovery of world economy, making profit from global financial crisis.

===============================

eBook #1 (Global Stock Market Outlook)

===============================

1. Mass Market Sentiment Survey

2. Review of Global Stock Markets

3. US Market Outlook (Stock / Property...)

4. China / HK / Europe Market Outlook

5. Singapore Stock & Property Outlook

6. Conclusions and Recommendations

===============================

eBook #2 (Top 10 Stocks: Dream Team Portfolio)

===============================

1. Personalized Stock Investment Portfolio

2. Ein55 Global Top 10 Stocks

3. Summary of Actions

Copyright © 2025 · Focus Child Theme on Genesis Framework · WordPress · Log in