First major airline in trouble after only 2 months of Coronavirus crisis. Flybe is the largest regional airline in Europe, cannot even sustain a few months of winter time, may not able to “fly” again due to lack of funding.

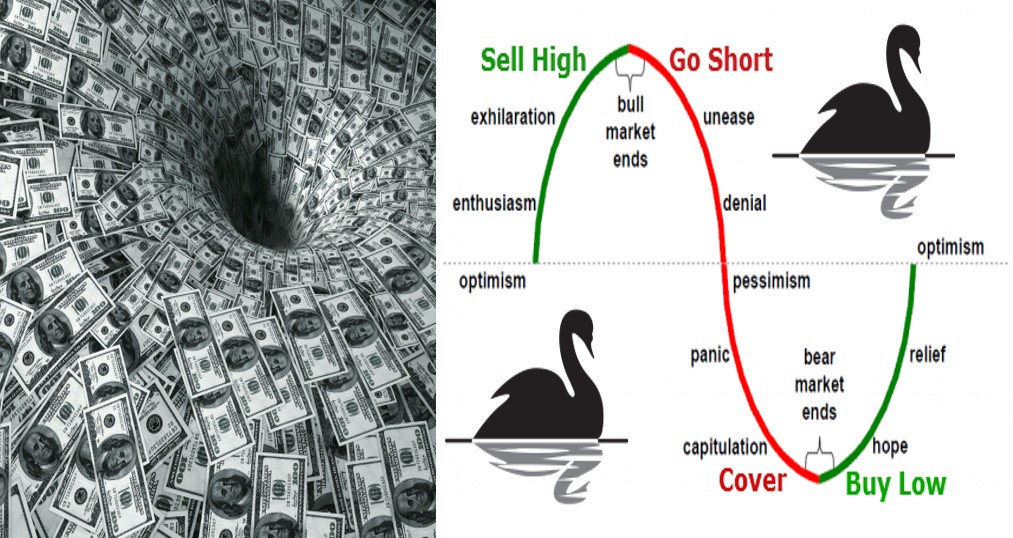

At the same time, Warren Buffett is indeed different from others, holding to 4 major airline shares: Delta Airlines (NYSE: DAL), American Airlines (NASDAQ: AAL), Southwest Airlines (NYSE: LUV) and United Airlines (Nasdaq: UAL). In general, airlines sector stocks (NYSEAcra: JETS ETF) have dropped about 1/3 share price over the past 1 month from its peak. There is more downside with bearish short term stock market, both at Level 3 (US stock market under correction, even recent 0.5% interest rate cut by the Fed won’t help to recover the confidence) and Level 2 (less travelling, “doom” for airline, burning money each month).

“Be greedy when others are fearful” is correct in principle but may not be suitable for everyone as it requires more investing skills than expected. Warren Buffett could be greedy now (eg. buying more Delta Airline stock) during crisis because he has a deep pocket with strong holding power with diversification over many industries. However, it may not be wise for others to follow Warren Buffett exactly as each person has unique personality, financial condition and investing strategy. Warren Buffett’s Berkshire (NYSE: BRK) loses 50% share price during 2008-2009 subprime crisis but he could still sleep soundly each night. Others may suffer depression with 50% loss in capital.

For retail investors and investors with small capital, weak holding power and low risk tolerance level, it is relatively safer to follow trend for entry or exit. Airline stocks are usually cyclic in nature, main strategy would be buy low sell high. Currently it is only a Level 2 crisis (airline sector earning drops significantly), but if Coronavirus drags longer than 6-12 months, it could become regional crisis (some countries economy will be affected) or even evolving into the next global financial crisis.

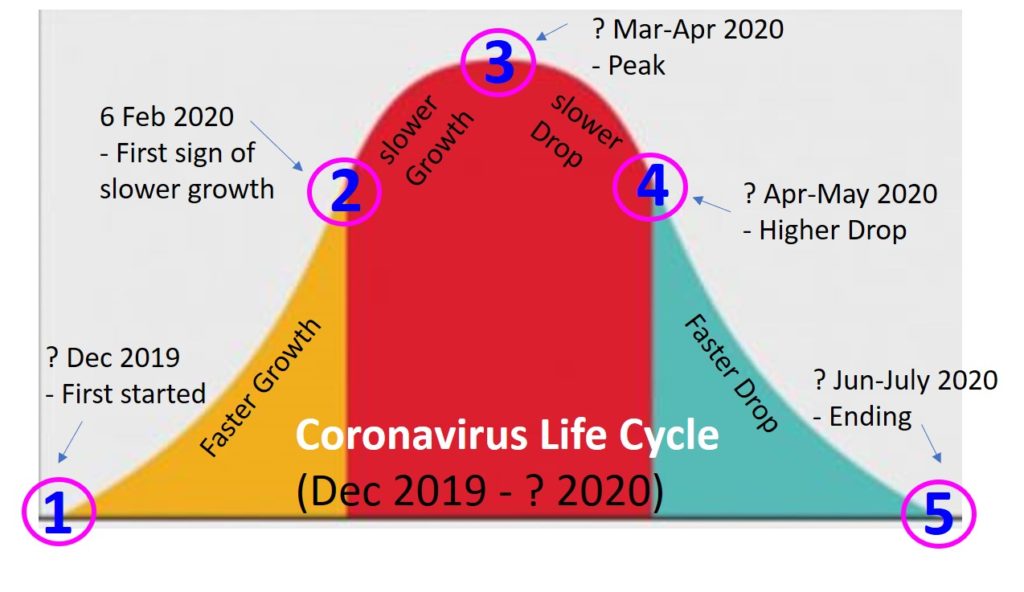

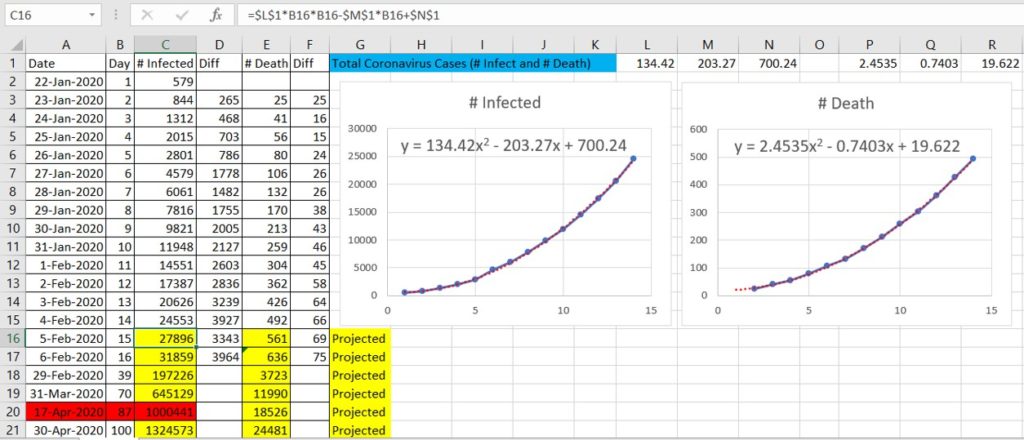

If we don’t know Coronavirus well (how it started and when it may end), shorter term investing or holding cash as opportunity fund would be relatively safer. In the meantime, smarts investors have to start to search for global giant stocks with strong business fundamental which can last through the potential financial crisis.

Learn from Dr Tee free 4hr course on Crisis Investing Strategies (What to Buy, When to Buy/Sell), either for Coronavirus Crisis (affecting consumers related sectors such as airlines, retailers, tourism, F&B, transportation, etc) or global financial crisis (affecting all sectors and all countries in the world). Register Here: www.ein55.com