We may still remember the Malaysia 1MDB news a few years ago on millions of ringgit worth of luxury products (handbags –Bijan / Hermes / Gucci, jewelry, watches – Rolex / Patek Philippe) discovered as “gifts” to a lucky family. In fact, smart investors could profit from these luxury products in a legal way with stock investing, leveraging on global rich people with extravagant spending.

In this article, you will learn from Dr Tee on Top 10 Global Luxury Giant Stocks of 4 Countries for longer term investing and / or short term trading with COVID-19 recovery stock rally. Bonus for readers who could read every word of the entire article, learning unique strategy to position in each giant luxury stocks, including Ein55 Optimism level and Ein55 Intrinsic Value.

1) France Giant Luxury Stock: LVMH (EPA: MC), Hermes (EPA: RMS), Kering (EPA: KER)

2) US Giant Luxury Stock: Estee Lauder (NYSE: EL), PVH (NYSE: PVH)

3) Singapore Giant Luxury Stock: The Hour Glass (SGX: AGS), Cortina Holdings (SGX: C41)

4) HK Giant Luxury Stock: Chow Tai Fook (HKEx: 1929), Chow Sang Sang (HKEx: 116), Luk Fook (HKEx: 590)

Stocks with luxury products (eg. branded handbags, expensive gold jewelry, luxury watches, etc) are consumer discretionary stocks (纸醉金迷), usually following the economic cycle, very bullish during bull run (eg. last 1 year of pandemic recovery), very bearish during global financial crisis (eg. Q1 of 2020 pandemic, 2008-2009 subprime crisis, etc). Therefore, mastery of investment clock would help on cyclical luxury stocks to Buy Low Sell High.

However, there are some growth luxury giant stocks which are suitable with Buy Low and Hold long term strategy due to the fact that rich would become richer (sadly to say, may imply poor become poorer, especially those who don’t know investment, depending only on active income from 1 job) when global financial crisis is over. Therefore, the luxury product businesses of growth giant stocks could continue to grow for many decades, especially having a strong intangible asset of famous brands (status of rich people who are willing to pay more).

During COVID-19 pandemic, most luxury stocks suffer in businesses mainly due to temporary lower spending power of rich people and limited tourists who could be main customers in the past. With pandemic recovery (over last 1 year and likely for next 1 year) and availability of online purchases, both businesses and share prices of giant luxury stocks have been growing steadily. When international borders are fully opened one day after global vaccination of COVID-19, the business growth would be accelerated.

A giant stock may not need to be big in size, even a small company could be a giant stock. There are hundreds of luxury stocks globally but some could be junk stocks, Buy Low may become lower in share prices with declining businesses. Let’s study Top 10 Global Giant Luxury Stocks (following Dr Tee criteria), some are recovering from lower optimism in 4 global stock exchanges interested by readers:

1) France Giant Luxury Stock:

LVMH (EPA: MC), Hermes (EPA: RMS), Kering (EPA: KER)

Asian investors may not familiar with European stock market. In fact, France has the most famous luxury products brands in the world, many giant stocks are listed under Euronext Paris Stock Exchange (EPA) which is accessible to global investors. A smart investor would diversify investment over a portfolio of 10-20 global giant stocks in several countries, which may include No 6 largest economy in the world, France, which is famous for its people creativity (despite may not be as hardworking as Asian people).

LVMH (Moet Hennessy Louis Vuitton) is the world largest luxury product, including many famous brands such as Hennessy (wine), LV, Christian Dior, etc. The major shareholder, Bernard Arnault, recently becomes the World No 1 Richest person as LVMH share prices have outperformed No 2 (Jeff Bezos of Amazon) and No 3 (Elon Musk of Tesla). Ein55 Optimism level is over 80%, current price is far exceeding Ein55 Intrinsic value, more suitable with short term momentum trading strategy (Buy High Sell Higher), requiring S.E.T. (Stop Loss / Entry / Target Prices) trading plan.

Similar to LVMH, Hermes is also a family owned business but much smaller in business size, famous with luxury handbags (some rich people wives may have no resistance over them, becoming a collector with millions of dollars spent). However, Hermes is a much stronger growth stock than LVMH, business is so good that even LVMH was hoping to acquire it but mission failed many years ago. Ein55 Optimism level is near to 90%, suitable for both growth investing and momentum trading, but ideal entry point may be to wait for a global financial crisis, especially for longer term investors.

Dr Tee discussed both LVMH and Hermes as stock homework with Ein55 graduates about 2 years ago, even with over 30% share price correction during pandemic crisis, both stocks have achieved 70% potential gains so far. Both are excellent examples of growth stock investing, even if an investor did not sell during global stock crisis, growth giant stocks could recover faster to achieve a new high in future. The main enemy of an investor is usually oneself, especially when a giant stock with growing business is significantly corrected in share prices due to market fear.

Kering is No 4 largest luxury stock in the world, famous of brands such as Gucci, Yves Saint Laurent, etc. Kering is also strong in business but slower growth compared to Hermes and LVMH, more suitable with Buy Low Sell High strategy. Ein55 Optimism level is near to 80% with pandemic recovery, more suitable for short term trading.

In fact, short term performance of LVMH, Hermes and Kering are comparable (currently bullish trends) and aligned due to similar consumer discretionary sector (Level 2) and same country (Level 3). For both short term trading and long term investor, Level Analysis would help to improve probability of success, knowing the unique market cycles (bull / bear) of each sector and country.

Readers may read earlier article by Dr Tee for more details with Top 10 World Richest Persons stocks including LVMH:

https://www.ein55.com/2021/02/top-10-world-richest-giant-stocks/

2) US Giant Luxury Stock:

Estee Lauder (NYSE: EL), PVH (NYSE: PVH)

Estee Lauder is world No 2 largest luxury stock, famous of beauty products (cosmetics, fragrance, haircare, etc). It may be relatively easier to make money from ladies than men, therefore in a typical department store, men section is usually much smaller than lady section, mainly to maximize the business revenue.

Therefore, Ester Lauder is comparable with LVMH, also strong growth in business and share prices, recovering well after the correction during pandemic. Ein55 Optimism level is over 70%, more suitable for short term momentum trading, similar strategy as LVMH and Hermes.

PVH is world No 10 largest luxury stock, famous of brands such as Calvin Klein, Van Heusen, Tommy Hilfiger, etc. However, PVH business is affected much more than other giant stocks, was making a loss during 2020 pandemic year, recovery is also slower. PVH is more cyclical in nature, may be considered with Buy Low Sell High strategy. Ein55 Optimism level is still moderate low near to 30%, aiming for Ein55 Intrinsic Value of $170.

Despite global luxury giant stocks are from different countries, there is an alignment globally (Level 4) in businesses and share prices, especially with more online purchases without travelling, people from country A may purchase a luxury product from country B easily. Consumer discretionary sector with luxury products would follow economic cycles, higher growth during bullish economy, slower growth (or declining) during bearish economy.

Readers may read earlier articles by Dr Tee for more details of other US Giant Stocks:

https://www.ein55.com/tag/us-stocks/

3) Singapore Giant Luxury Stock:

The Hour Glass (SGX: AGS), Cortina Holdings (SGX: C41)

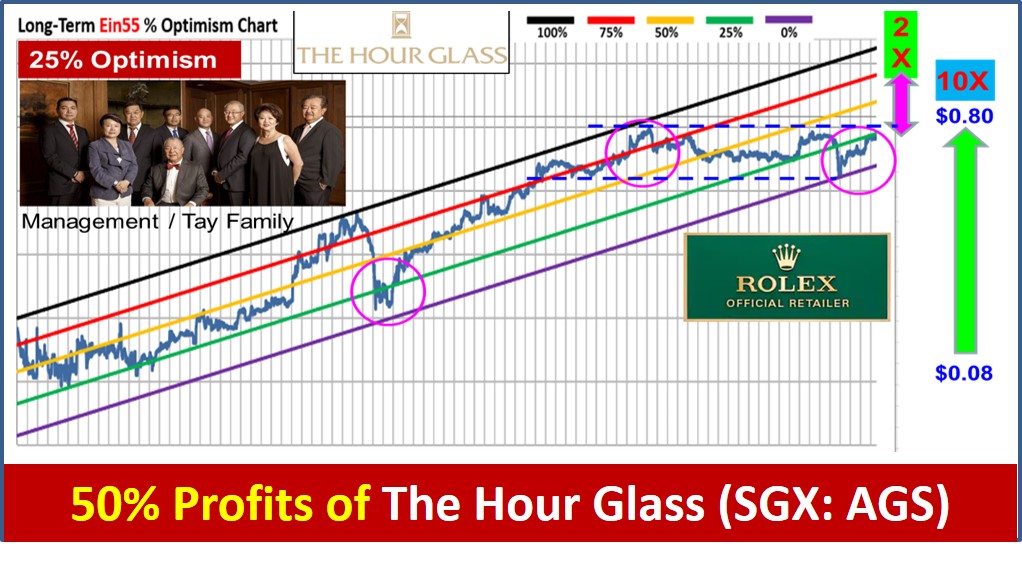

Hour Glass and Cortina are competitors, having very similar businesses, mainly in sales of luxury watches (eg. Rolex, Patek Philippe, Hublot, etc). For regular followers of Dr Tee education articles and videos (www.ein55.com/blog), you would not miss these 2 Singapore luxury giant stocks, Hour Glass and Cortina, at lower Ein55 Optimism levels when sharing during last 1 year of pandemic.

Both giant stocks are strong growth in businesses (cash rich companies), not significantly affected during pandemic (despite fewer tourists to Singapore). However, the strategy to position is very different for each stock. Hour Glass was having more discount a few months ago, when share price was near to 80 cents, Dr Tee discussed as stock homework with Ein55 graduates, also shared in earlier articles with readers, indicating Ein55 Intrinsic Value of $1.20 which is achieved recently, having 50% potential profits in a few months for readers who do own homework and take actions decisively. Despite the current price is near to its fair value, there is potential of higher price of over $1.60 if Hour Glass could attract institutional investors or supported by market greed to higher optimism level as its competitor, Cortina.

Cortina has much higher Ein55 Optimism level (over 90% currently), therefore the positioning over the past few months has been short term momentum trading, following trends to Buy High Sell Higher. Cortina is relatively an illiquid stock with less stock trading volume, therefore it could be very volatile (+/-10% price movement) on certain days. For stock analysis, instead of daily chart (certain days having 0 trading volume), it is clearer when viewing with weekly or monthly chart. Price trends of Cortina and Hour Glass are generally aligned but Cortina has appreciated much more than Hour Glass over the past 1 year.

For medium to long term investor, Hour Glass may be relatively more suitable than Cortina as Hour Glass has higher dividend yield (3-5%, depending on entry prices) and lower Ein55 Optimism level than Cortina. Recently, Hour Glass doubles the interim dividend from 2 cents (last year) to 4 cents (this year), higher dividend has helped to push up the share prices to a new historical high, also motivating Cortina to follow the same price trends. There is also good succession plan, Hour Glass business is passed from Henry Tay to his son (Michael Tay) who has been well trained in this luxury watch industry. So, a luxury watch may be a collection for decades but a smart investor may own “thousands” of watches by investing in Hour Glass or Cortina.

Hour Glass is 2 times larger than Cortina based on market cap but both are considered medium cap stocks, therefore may not be in the radar of institutional investors yet. Cortina has acquired Sincere Watch recently, business size is considered No 2 after Hour Glass for luxury watch market in Singapore. To benefit from the entire luxury watches market, major shareholder of Hour Glass, Henry Tay, is also the second largest shareholder of Cortina, which is a competitor of Hour Glass. A smart investor may learn from Henry Tay, sometimes may invest in a few competing giant stocks of any sector of interest If they are equally good.

For small or medium cap giant stock, it is easier for share prices to move up (or down) as shares are exchanging hands within a smaller group of investors, especially when majority of shares are controlled by a few major shareholders. For example, major shareholder of Hour Glass, Henry Tay, recently adding a small percentage of own shares (known insider trading) but this is sufficient to support Hour Glass above $1/share. A smart investor would diversify over a portfolio of giant stocks with small cap <$100M (higher potential), medium cap $100M – $1B (good balance of potential and stability) and large cap >$1B (more stability).

Readers may read earlier articles (during pandemic with lower Ein55 Optimism level) by Dr Tee for more details with Singapore Growth Stocks including Hour Glass and Cortina:

https://www.ein55.com/tag/growth-stock/

4) HK Giant Luxury Stock:

Chow Tai Fook (HKEx: 1929), Chow Sang Sang (HKEx: 116), Luk Fook (HKEx: 590)

Before pandemic, some readers who travel often to Hong Kong may remember these famous jewelry shops along shopping streets: Chow Tai Fook (周大福), Chow Sang Sang (周生生) and Luk Fook (六福), which are all giant luxury stocks, making money from both local residents and overseas tourists. However, there are many luxury stocks (jewelry, watches, etc) listed in Hong Kong Stock Exchange, not all are giant stocks.

Businesses of all these 3 Hong Kong luxury giant stocks were affected, not only during the last 1 year of pandemic. In fact, even before pandemic, despite growing gold price since Year 2015, jewelry market in Hong Kong has been declining over the years, partly because the number of mainland China tourists to Hong Kong is declining with local political differences. The activists in Hong Kong over the past few years (before pandemic) have further slowdown the demand of this luxury product market.

After the enhancement of local Hong Kong law against potential activists, these 3 luxury giant stocks have started to grow gradually in businesses, supported by pandemic recovery. These 3 giant stocks have very similar trends in businesses (same sector) and share prices (same stock market) in short to medium terms. Relatively, Chow Tai Fook (world No 9 largest luxury stock) is the strongest among 3 stocks on business recovery during pandemic, short term share price is also more bullish than Chow Sang Sang and Luk Fook.

In general, Chow Sang Sang and Luk Fook are still at low Ein55 Optimism levels (less than 25%), aiming for Ein55 Intrinsic Values of about $30 (Chow Sang Sang) and $60 (Luk Fook) respectively, may be considered for cyclic investing or short term trading. They are average quality of crisis stocks due to relatively weaker businesses. Major leader of sector, Chow Tai Fook, is more suitable for trend-following short term trading.

Readers may read earlier articles by Dr Tee for more details of other Hong Kong Giant Stocks:

https://www.ein55.com/tag/hong-kong-market/

===================================

It is easy to know “Buy Low Sell High” is universal secret to profit in most investment. However, most people dare not buy when share price of giant stocks fall to very low optimism (due to lack of visibility of how low is low). Similarly, some people may not buy when share prices of giant stocks go to very high optimism (despite possible to do short term trading). Eventually, some may buy junk stocks during speculative trading, making money for first few times, losing more in later trading when adding more position due to “confidence” of winning in the past.

It shows the importance for retail investors to master stock trading and investment skills, not only knowing but able to take actions (Buy / Hold / Sell / Wait / Shorting). Readers who could spend time to read until here is an achievement, continue the momentum to learn and apply further in stock investment after mastery of skills.

===================================

There are over 1500 giant stocks in the world based on Dr Tee criteria, choice of 10 Dream Team giant stocks have to align with one’s unique personality, eg. for shorter term trading (eg. momentum or swing trading) or longer term investing (cyclic investing, undervalue investing or growth investing). Readers should not just “copy and paste” any stock (What to Buy, When to Buy/Sell) as successful action taking requires deeper consideration (LOFTP strategies – Level / Optimism / Fundamental / Technical / Personal Analysis) which you could learn further from Dr Tee Free 4-hr Webinar.

Drop by Dr Tee free 4hr webinar (learning at comfort of home with Zoom) to learn how to position in global giant stocks during COVID-19 stock crisis with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Zoom will be started 30 min before event, bonus talk (Q&A on any investment topics from readers) for early birds. There are many topics we will cover in this 4hr webinar, Dr Tee can have more time for Q&A if you could stay later after the webinar, you could ask on any global and local stocks including but not limited to 30 STI component stocks:

Ascendas Reit (SGX: A17U), CapitaLand (SGX: C31), CapitaLand Integrated Commercial Trust (SGX: C38U), City Development (SGX: C09), ComfortDelGro (SGX: C52), Dairy Farm International (SGX: D01), DBS Bank (SGX: D05), Genting Singapore (SGX: G13), Hongkong Land (SGX: H78), Jardine Cycle & Carriage (SGX: C07), Jardine Matheson Holdings JMH (SGX: J36), Jardine Strategic Holdings JSH (SGX: J37), Keppel Corp (SGX: BN4), Keppel DC Reit (SGX: AJBU), Mapletree Commercial Trust (SGX: N2IU), Mapletree Industrial Trust (SGX: ME8U), Mapletree Logistics Trust (SGX: M44U), OCBC Bank (SGX: O39), SATS (SGX: S58), Sembcorp Industries (SGX: U96), Singapore Airlines (SGX: C6L), Singapore Exchange (SGX: S68), Singtel (SGX: Z74), ST Engineering (SGX: S63), Thai Beverage (SGX: Y92), UOB Bank (SGX: U11), UOL (SGX: U14), Venture Corporation (SGX: V03), Wilmar International (SGX: F34), YZJ Shipbldg SGD (SGX: BS6).

Dr Tee will cover over 20 case studies, Singapore giant stocks, eg. CapitaLand Mall Trust (SGX: C38U), Singapore Exchange (SGX: S68), Keppel Corp (SGX: BN4), Top Glove (SGX: BVA), Jardine Matheson Holdings JMH (SGX: J36), Vicom (SGX: WJP) and many others, Malaysia giant stocks, Hong Kong giant stocks and US giant stocks, both long term investing and short term trading.

There are limited tickets left for this 4hr free webinar, please ensure 100% you could join when register: www.ein55.com