With recent Global Tariff Crisis, global investors so far have digested the worst case scenario of no trade between US and China (main target for Trump) with global stocks falling by about average of 20-25% (still less than 30% correction during 2020 COVID crisis and 2022 US tech stock crisis). At the same time, even US bond market which traditionally is the safe haven, becomes unstable with massive sell, Trump is under pressure to pause the tariff (except for China with 145% tariff) by 90 days to cool down the investment markets (stocks, bonds, forex, property), motivating global stock markets to recover strongly.

However, duration of uncertainty in global tariff (may affect global economy negatively) would determine the degree of stock crisis, from mid term bear (down >20-30%) to long term bear (down >50% for global financial crisis) to the worst bear (down >80%, eg. 1929 Great Depression, 1989 Japan lost 3 decades, 2000 dotcom bubble). It is not wrong to be long term or lifetime investors with condition one is prepared mentally (aligned with own personality) for different degrees of bear while holding a portfolio >10-20 giant stocks (ideally generating steady dividend with yield better than bank >2.5% yearly).

2 main potential opportunities for global stock markets with global tariff crisis are:

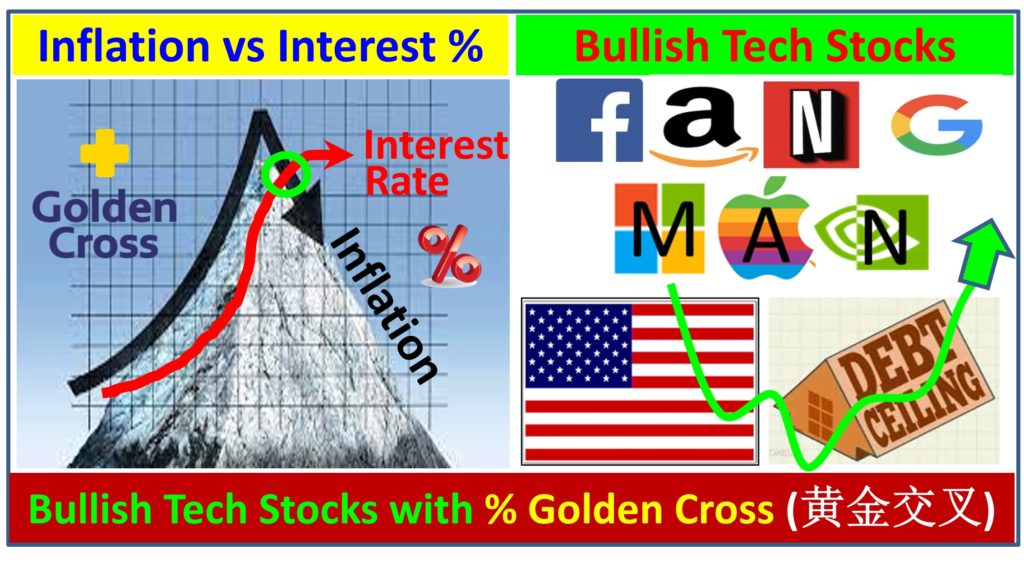

1) Short Term / Mid Term Cyclic trading of US stocks (Buy Low Sell High)

Trump starts Ver 2.0 of political mind games, starting with global tariffs. Global investors dislike uncertainties, both Fed and Trump + global leaders would need to strike a balance of power to support economic growth. Negative impact on higher US inflation (due to higher tariff) will be clearer over the next few months, if US economy is weaker at the same time, the Fed may be in dilemma to adjust, especially if it may become stagflation (stagnant economy + high inflation).

S&P 500 has been falling down from high Optimism >75%, a critical signal for both traders and even investors. There is no need to catch the falling knife of bearish stock prices but smart investors would know the re-entry point to leverage on the stock crisis for discounted share price.

Investors may apply trend-following trading, focusing on giant US stocks with reversal of recent corrections while monitoring the economic signals.

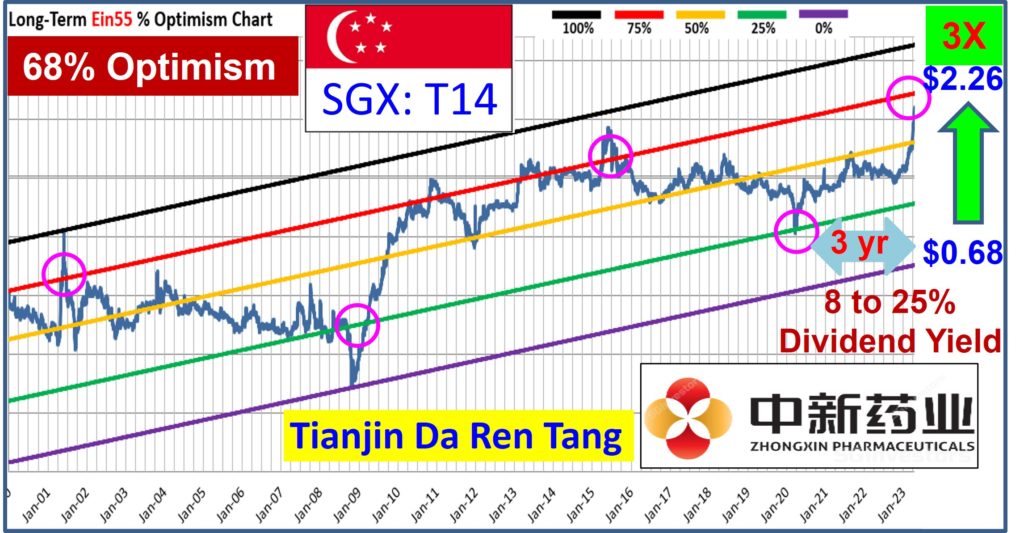

2) Mid Term / Long Term Cyclic investing of Asian stocks (Buy Low Sell High)

Hong Kong & China have been recovering gradually after massive China stimulus package but economic growth needs more effort and time, stock markets falling together with global stocks. China/Hong Kong may have sovereign funds to support stock index (eg. A50 and HSI). HSI Index is corrected back to low Optimism <25%, average down strategy may be considered for contrarian. China SSEC is mild bearish but could be speculative due to possible political intervention (China may need to plan for more QE to resist 145% tariff of US).

Not all the countries or stocks are affected in negative way by high US tariff. China and many countries (who are more dependent on US) may need to find new markets to partially replace US, therefore need to sell at reduced rates (this would trigger price war, good for consumers but bad for business).

Singapore becomes bearish (STI near 3500 points, dropping 15% from peak of 4000 points, worrying 3 major banks would have lower interest income due to interest rate cut). Malaysia Bursa is also bearish (KLCI is shaky, just above 1400 points support, affected by outflow of foreign funds).

Investors may consider cyclic investing strategy, monitoring undervalue asian giant stocks with steady dividends as defenders, converting stock crisis into a rare opportunity with Buy Low Sell High.

It is timely now to review own stock portfolio, making decisions (Buy / Hold / Sell / Wait / Shorting) ahead of majority. Ride the next global stock rally after global tariff crisis.

===================================

There are over 2000 giant stocks in the world based on Dr Tee criteria, choice of 10 Dream Team giant stocks have to align with one’s unique personality, eg. for shorter term trading (eg. momentum or swing trading) or longer term investing (cyclic investing, undervalue investing or growth investing). Readers should not just “copy and paste” any stock (What to Buy, When to Buy/Sell) as successful action taking requires deeper consideration (LOFTP strategies – Level / Optimism / Fundamental / Technical / Personal Analysis) which you could learn further from Dr Tee Free 4-hr Webinar.

Drop by Dr Tee free 4hr webinar (learning at comfort of home with Zoom) to learn how to position in global giant stocks during global tariff crisis with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Zoom will be started 30 min before event, bonus talk (Q&A on any investment topics from readers) for early birds. There are many topics we will cover in this 4hr webinar, Dr Tee can have more time for Q&A if you could stay later after the webinar, you could ask on any global and local stocks including but not limited to 30 STI component stocks:

Ascendas Reit (SGX: A17U), CapitaLand (SGX: C31), CapitaLand Integrated Commercial Trust (SGX: C38U), City Development (SGX: C09), ComfortDelGro (SGX: C52), Dairy Farm International (SGX: D01), DBS Bank (SGX: D05), Frasers Logistics & Commercial Trust (SGX: BUOU), Genting Singapore (SGX: G13), Hongkong Land (SGX: H78), Jardine Cycle & Carriage (SGX: C07), Jardine Matheson Holdings JMH (SGX: J36), Keppel Corp (SGX: BN4), Keppel DC Reit (SGX: AJBU), Mapletree Commercial Trust (SGX: N2IU), Mapletree Industrial Trust (SGX: ME8U), Mapletree Logistics Trust (SGX: M44U), OCBC Bank (SGX: O39), SATS (SGX: S58), Sembcorp Industries (SGX: U96), Singapore Airlines (SGX: C6L), Singapore Exchange (SGX: S68), Singtel (SGX: Z74), ST Engineering (SGX: S63), Thai Beverage (SGX: Y92), UOB Bank (SGX: U11), UOL (SGX: U14), Venture Corporation (SGX: V03), Wilmar International (SGX: F34), YZJ Shipbldg SGD (SGX: BS6).

Dr Tee will cover over 20 case studies, Singapore giant stocks, eg. CapitaLand Integrated Commercial Trust (SGX: C38U), Singapore Exchange (SGX: S68), Keppel Corp (SGX: BN4), Top Glove (SGX: BVA), Jardine Matheson Holdings JMH (SGX: J36), Vicom (SGX: WJP) and many others, Malaysia giant stocks, Hong Kong giant stocks and US giant stocks, both long term investing and short term trading.

There are limited tickets left for this 4hr free webinar, please ensure 100% you could join when register: www.ein55.com

View quick preview video below, Dr Tee will introduce 10 key stock investment strategies (股票投资十招) to be learned in 4hr free stock webinar:

Register Here (Dr Tee Free 4hr Stock Webinar): www.ein55.com