Some may be puzzled why there are so many death cases for Coronavirus in China, especially in Hubei (258) but 0 (zero) case outside mainland China. From statistics point of view, this drastic difference may be due to certain reasons.

Does it mean the virus is more deadly in China than outside China (quite unlikely as many who are infected outside China traveled from Wuhan). Does it mean China medical resources are less, resulting in lower survival rate (may be but unlikely to be so different)?

From statistical analysis (as of 1 Feb 2020), we may identify possible sampling or reporting error:

Area / # Infected / # Death / Fatality Rate (%)

==============================

Mainland China / 11757 / 258 / 2.19%

Hubei only / 7153 / 249 / 3.48%

Mainland China ex Hubei / 4604 / 9 / 0.19%

World ex mainland China / 108 / 0 / 0.00%

World inc China / 11865 / 258 / 2.17%

================================

There are a few key observations:

1) Using total sample size (world inc China) to compute 2% fatality rate of 2% may not be accurate. This results in great fear overseas but so far 0 death overseas, while common flu has more death in these countries.

2) Within mainland China, when comparing Hubei vs the rest of the region in mainland China, we can observe drastic difference of fatality rate of 3.48% (Hubei) vs 0.19% (other China cities, although not 0 but closer to observation outside China, a low fatality rate).

Assuming reporting are all true (one may argue), here are possible reasons:

Hubei could have much more infected cases but only those diagnosed officially in hospitals are reported, this lower down the base of # infected. At the same time, those minor cases or not diagnosed cases may recover gradually at home, therefore not reported. Those severe cases need to seek medical help, therefore were sent to hospital which eventually some are reported as death.

So, assuming Hubei vs other China cities should have the same fatality rate of 0.19%, this implies actual # infected in Hubei could be 3.48/0.19 = 16.7 times more than 7153 reported based on official / hospital cases.

This is same as common flu in the world, no one could be precise to tell the actual fatality rate because the # death could be accurate (sent to hospital) but # infected is just an estimation.

For world ex China, currently has 0 death case but let’s take the worst case of having 1 death based on current # 108 infected, then max fatality rate is 0.93%, which is less than 1%.

Based on different grouping of data above, the 0.19% fatality rate of China ex Hubei may be a more likely number for Coronavirus, which is about 3-4 times stronger than normal flu (estimated as 0.05%). The key is to control the base (# infected) for Coronavirus, therefore current moves to restrict travelling among the countries are correct. If not, if the base is similar to common flu (which have 12000 death in US yearly), the 3-4 times higher fatality could be disaster to the world. Despite Ebola virus is very deadly (over 50%) but # infected is less.

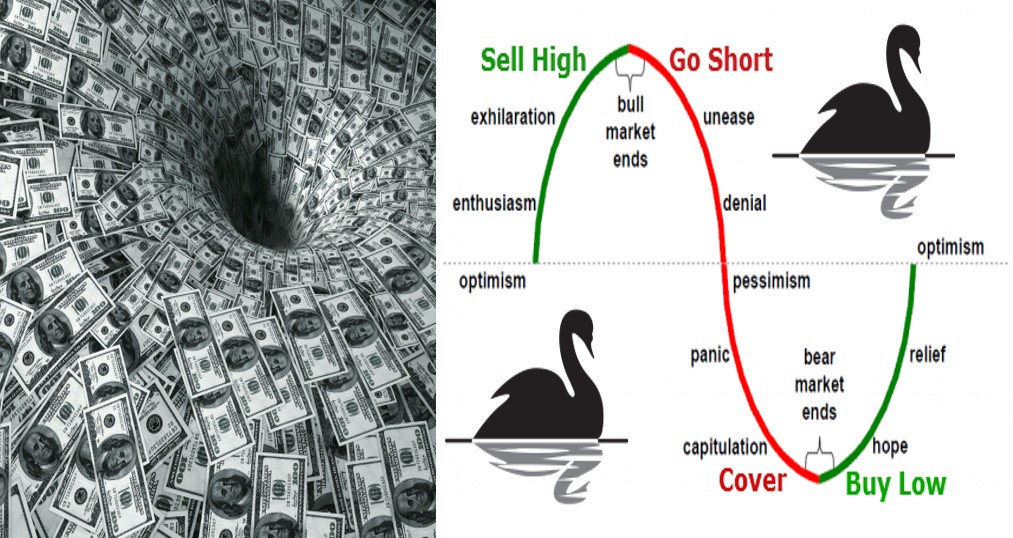

Crisis is Opportunity if one is prepared, eg waiting patiently for price of giant stocks to drop much lower value, having holding power for recovery.

Crisis is Crisis if one simply follows other people’s views (especially mass market), fearful and greedy at the same time, not considering own personality (eg. risk tolerance, reward expectation, holding power, etc).

Conclusions:

Coronavirus may not be as deadly as reported (2%), could be 10 times weaker, 0.2%, may be due to many cases # infected unreported (not sent to hospital). However, even if fatality is as low as common flu, it can still cause many deaths due large # infected, which should be the priority now to limit the spreading of virus while finding a medical solution.

The most deadly part of any new virus (Coronavirus or any future virus) is not death case but the FEAR emotion which drives humanity into selfishness, loneliness / isolation, depression, etc. So, science including statistical analysis would help us to stay calm but continue to keep the right habits to minimize the spreading, infection and fatality of viruses.

Application of statistics and sampling is everywhere. Eg. in Taiwan recent presidential election, we can observe poll from small sample is relatively accurate to predict the winning rates of different candidates (within 5% difference) but not on actual final number which depends on how many people present to cast the vote on actual day.

Similarly for stock investment, careful statistical analysis is required, not to just take a gross number, eg business is up or down within certain year (eg. Breadtalk). It is important to further divide into different divisions, each could have different performance (eg. Food court and Restaurant divisions are profitable, Bakery and 4orth divisions with external partnership are in loss).

Fundamental Analysis using some key numbers (eg. ROE > 5%) is fine as a quick filter but deeper analysis is required to understand the business (eg economic moat). Similarly for LOB-FTP (Level/Optimism/Business/Fundamental/Technical/Personal) Analysis, this requires much more time to evaluate a stock before making decision (Buy / Hold / Sell / Wait / Shorting) aligning with own personality (eg. short/medium/long term investing).

Interested readers may register for Free 4hr stock investment course by Dr Tee to learn the details. Register Here: www.ein55.com

Wish all readers Healthy and Wealthy at the same time!