I just talk to my sister in LA, confirming California people (richest state of USA, about 1/3 national wealth if remember correctly) also feel fearful now of Coronavirus.

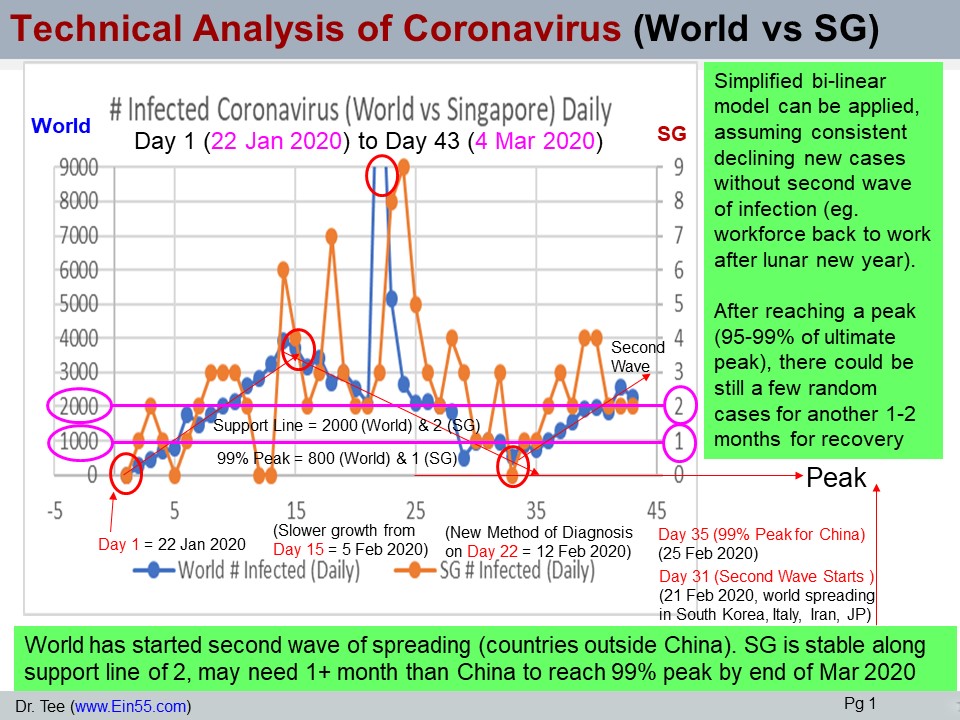

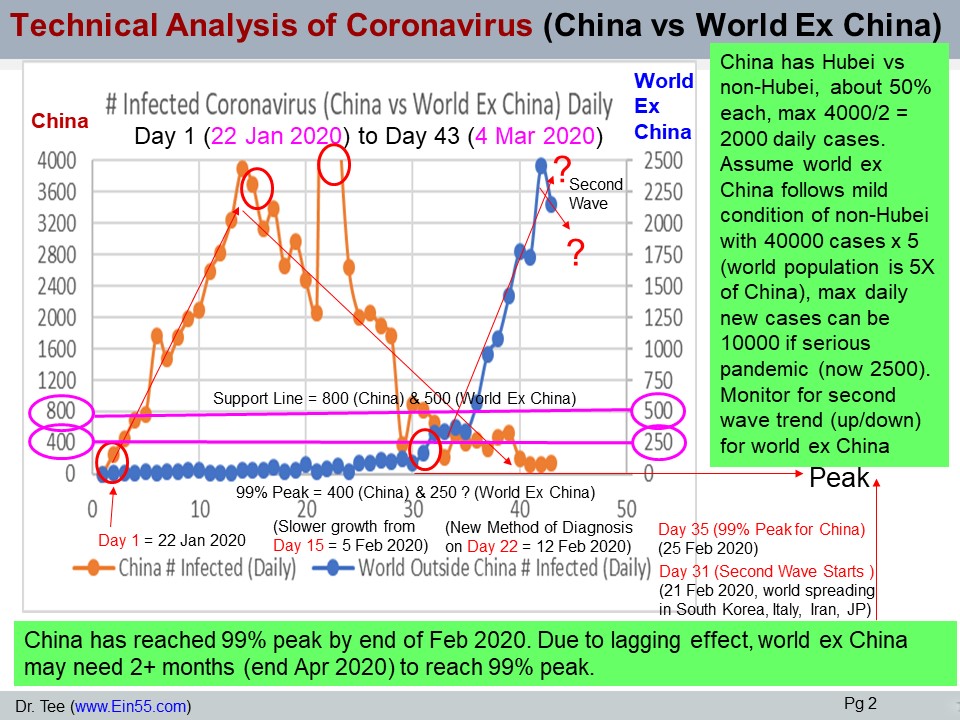

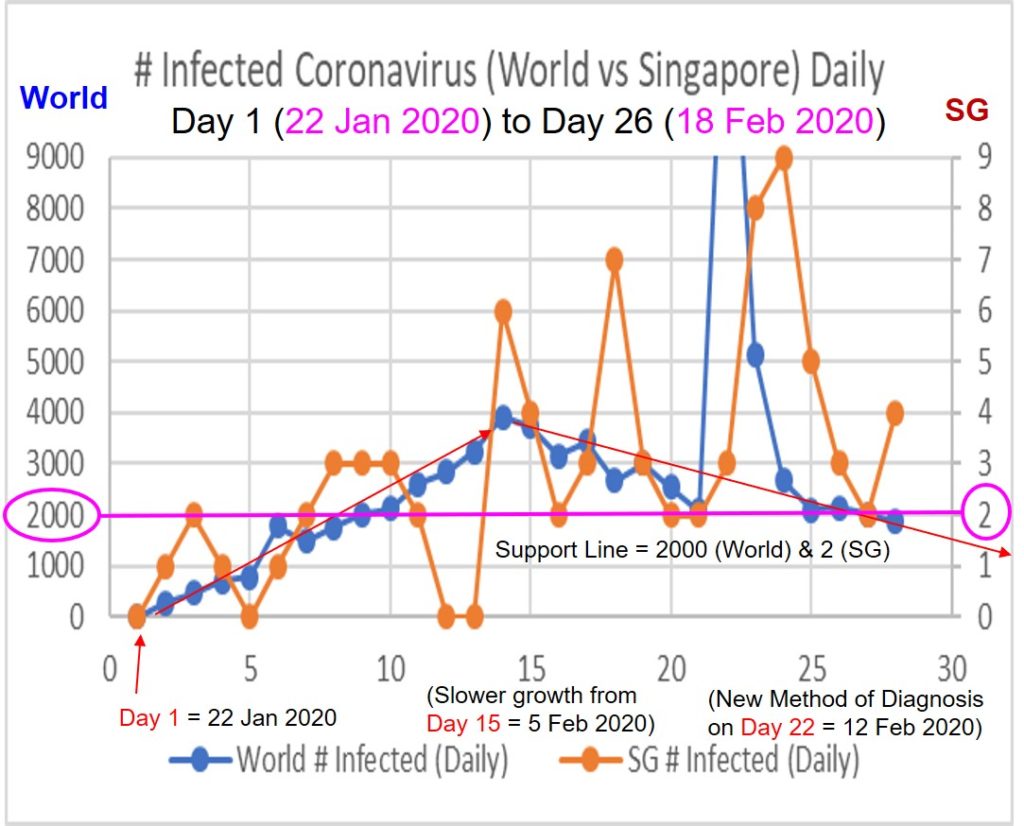

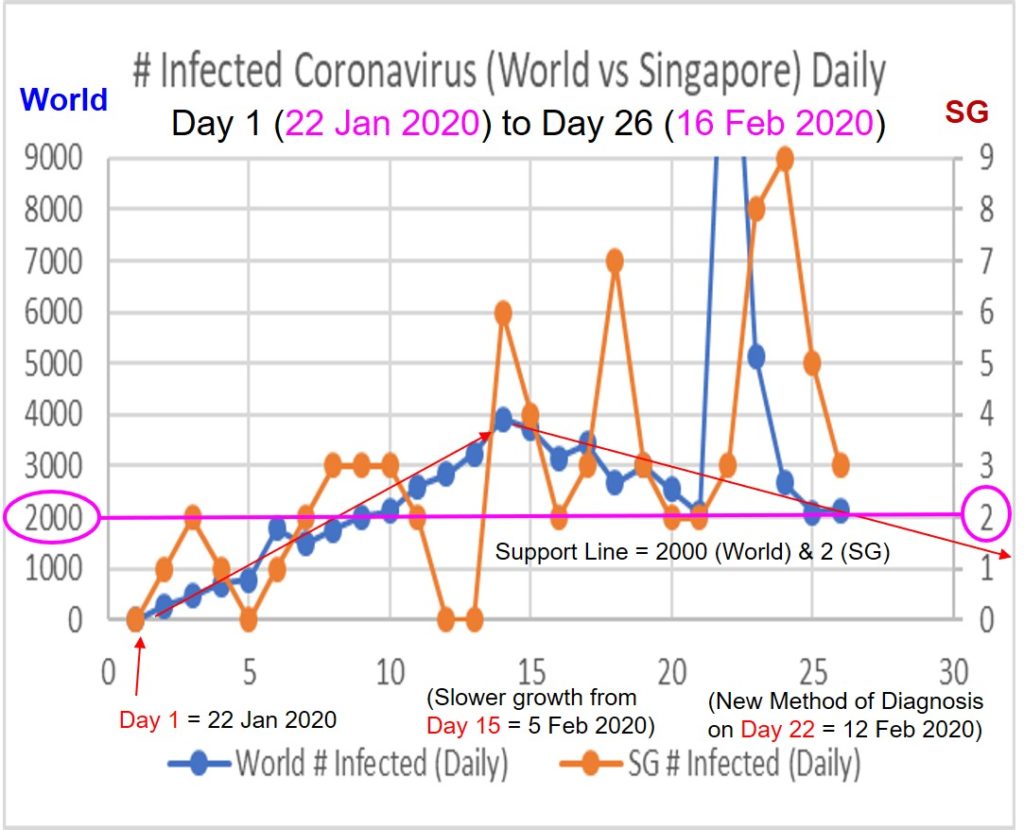

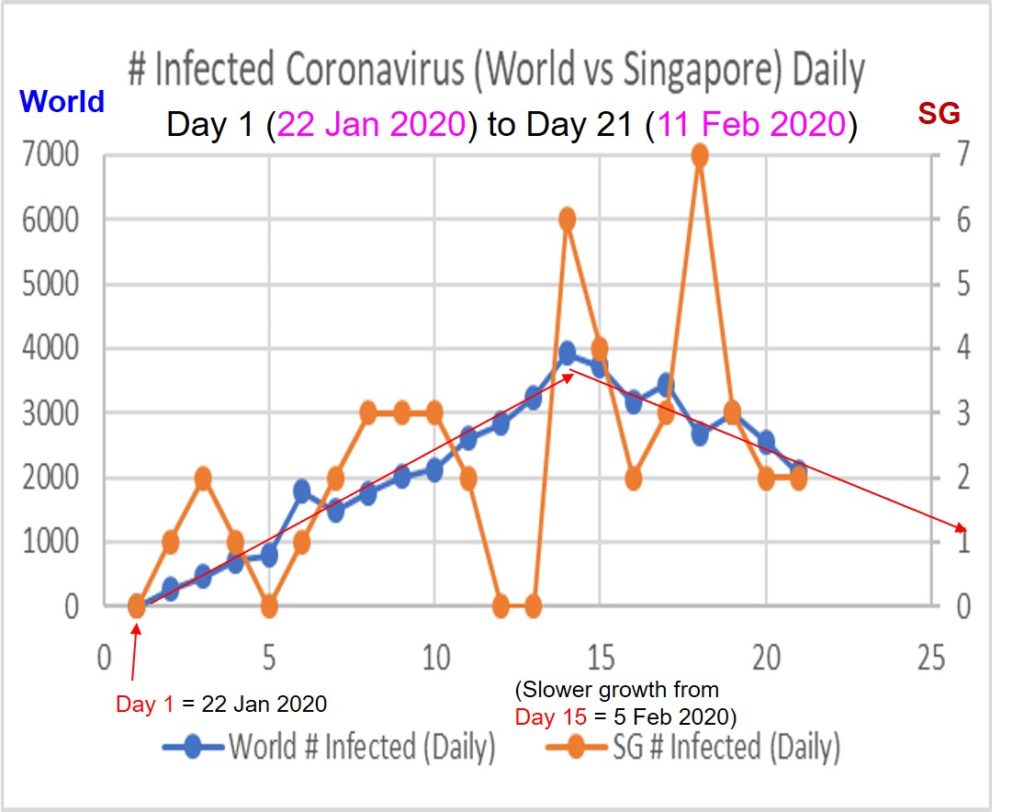

Last 1 week of global stock market correction was a reflection of such initial global fear. China, “leader” of Coronavirus crisis is on the way of recovery (estimated duration of 6 months from Dec 2019 to May 2020). For other countries in the world, there is lagging effect, eg Singapore started first Coronavirus case in late Jan, may end about 1 month after China. For US and Europe, there could be another 1 month lagging, so hot summer would be just nice if following similar exit pattern of SARS, cousin of Coronavirus.

Question is Australia and NZ would be winter then in Jun-Aug, if the global spreading could not end by Jun, it may become seasonal flu every 6 months, worst during cold winter when temperature is colder, most people would stay indoor, higher chances of close contacts for infection.

Singapore by right is a hot tropical country but due to artificial mini winter or autumn (aircon room), the condition is much worse than neighbouring countries of Malaysia and Indonesia along the equator.

Health crisis is usually more fear than actual harm. If the deadly virus may kill all human, then stock market is not important anymore. If not, it means the stock market will always recover when crisis or more precisely, the fear is over.

I read news that some people are worry of “Corona” beer as name is close to “Corona” virus. So, what is real crisis (fact-based harm) or just a fear due to ignorance? Remember, stock market is made of mass with all types of investors: smart, ordinary, ignorant, etc.

However, fear can be deadly. Corona beer belongs to AB InBev (NYSE, BUD), same company which owns Budweiser, share price fell about 40% over the past 1 month when global Coronavirus condition gets worse. AB InBev is the world largest brewery, also a giant beer stock. The fear of stock market and “Corona” has created an artificial crisis on this stock. Crisis is Opportunity if business fundamental is not much affected while the share prices falling.

Learn fact-based scientific stock investing strategies from Dr Tee free 4hr course, leveraging on market fear, converting into opportunity. Register Here: www.ein55.com