0% US interest Rate + $700B QE = Stock Crisis Fear

US Fed just cut interest rate to historical low of 0-0.25% + strength of $700B QE (Quantitative Easing) but introducing on bearish stock market. This is wasting bullet. In fact, global stock market falls more due to fear of such action, US stock market is halted due to circuit breaker with 7% fall.

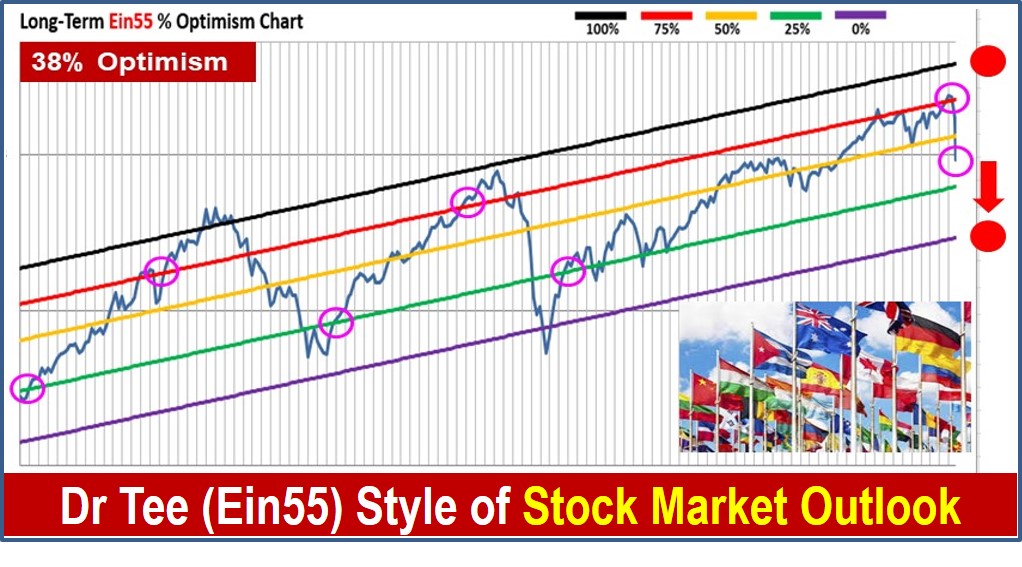

A natural way is to let the market reset itself with a global financial crisis and falling of global stock market to low optimism < 25%. However, this would affect the chances of Trump second term presidential election as S&P 500 has been his report card, hard to show negative results to his supporters who may also be investors.

If US stock market (Level 3) falls to low optimism <25%, world stock market (Level 4) would also follow, officially falling into Global Financial Crisis which may last longer than 6-12 months, depending on the severity. It would be timely to consider cyclic giant stocks from sectors such as bank, property, airline, technology, etc, focusing on strong fundamental stocks only, don’t buy stock purely based on prices (eg. historical low price).

======================================

A stock market could only reborn after falling to worse case of <25% optimism, then measures such as QE1 in 2009 could be effective (limited downside then).

US stock market is still at 50% optimism, Trump tries an uphill task to save the stock market by introducing interest rate cut to 0% and massive QE of $700, it is wasting money and effort. Stock market bubbles may be burst, money would escape from stock market, even from bond market (since bond yield is <1%), holding as cash which is king but low interest rate would push some investors to invest again in future, after global financial crisis with low prices of stocks everywhere.

It would take time to recover or if Trump is lucky, Coronavirus may end by summer, then it could still be a mini bear, but fear in stock market may spread faster than Coronavirus over the next few critical months, depending on global countries, need to fight 2 crisis (health + stock) together.

Learn further from Dr Tee, strategies to integrate economy with stock market: www.ein55.com

You are invited to join Dr Tee private investment forum (educational platform, no commercial is allowed) to learn more investment knowledge, interacting with over 8000 members:

https://www.facebook.com/groups/ein55forum/