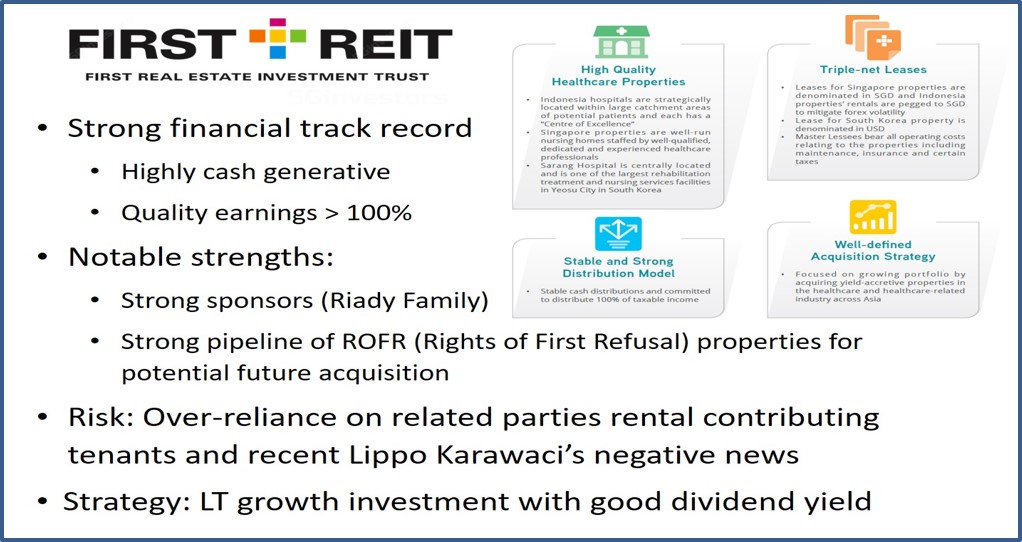

Ein55 coaching students just review First Reit (SGX: AW9U), a giant dividend stock in Singapore, which mainly collecting rental income through Reits to Siloam Hospitals (owned by same sponsor of First Reit, Lippo Karawaci Group) in Indonesia with triple-net lease without forex risk (pegged at fixed rate to SGD).

However, investing analysis in stock is never on just 1 business, one has to also consider related parties, eg. sponsor of First Reit, Lippo Karawaci (contributed to over 80% of rental income for First Reit), which has a poor credit rating of CCC+, mainly due to long term negative operating cashflow for many years, which expanding in a mega property project aggressively.

Despite strong fundamentals of First Reit, the fear on Lippo Group has corrected First Reit share price from about $1.50/share to $1/share over the past 1 year, dividend yield has climbed up to an impressive 8.7%, comparable to year 2008 during the last global financial crisis.

Ideally, one should buy dividend giant stocks during a crisis to get lower price with stable growing dividend to maximize the dividend yield for long term investing. However, there are different qualities of crisis stocks. Price correction during Level 4 crisis (global financial crisis) is the highest quality if the business remains intact. For the current situation, First Reit is only under Level 2 crisis (despite strong fundamental of First Reit at Level 1, price falls due to fear of deteriorating fundamental of sponsor, Lippo Group), therefore an average quality of low optimism stock.

OUE of Lippo Group is now the second sponsor of First Reit, creating new variable to future of First Reit on dividend growth as the new Reit component may come from Singapore property of OUE (worst if priced at higher level) which may not have the unfair advantages Siloams Hospitals with triple-net lease, fixed forex rate (highly subsidized by sponsor) with high growth of health care industry in Indonesia. However, the change will not be overnight as average lease expiry is about 8-9 years.

For investor who could take calculated risks (in the same boat as Lippo Group and Riady family, waiting for the revival of mega city project), First Reit may be considered for dividend investing but technical analysis should be considered (eg. investing above $1/share which is a critical support, avoiding possible risk of buy low get lower in prices with more future uncertainties) with risk management through diversification over 10 giant stocks. Alternatively, one has the choice of not to invest in average quality low-optimism dividend stock, there are still other better opportunities which are relatively safer.

Learn from Dr Tee free 4hr course on how to investing in global giant stocks (dividend investing, crisis investing, momentum trading, etc), understanding the risks and opportunities of current stock markets in Singapore, US, Hong Kong and China.

Share price is a 3-dimensional movement, governed by Ein55 Law of Stock Market Motion:

Share price is a 3-dimensional movement, governed by Ein55 Law of Stock Market Motion: