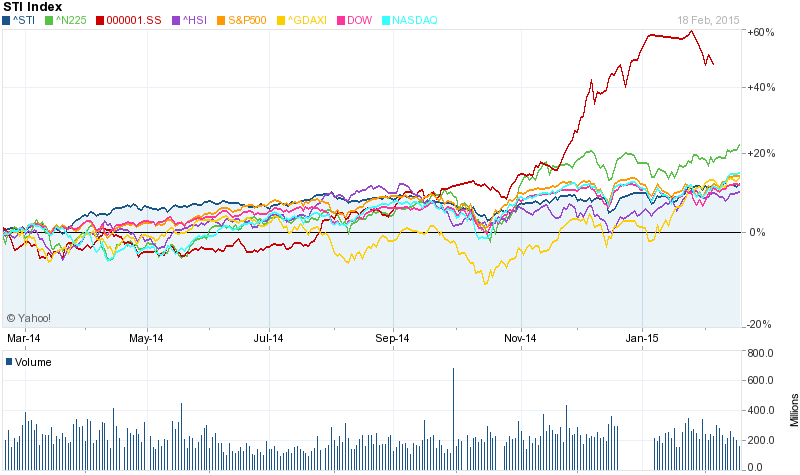

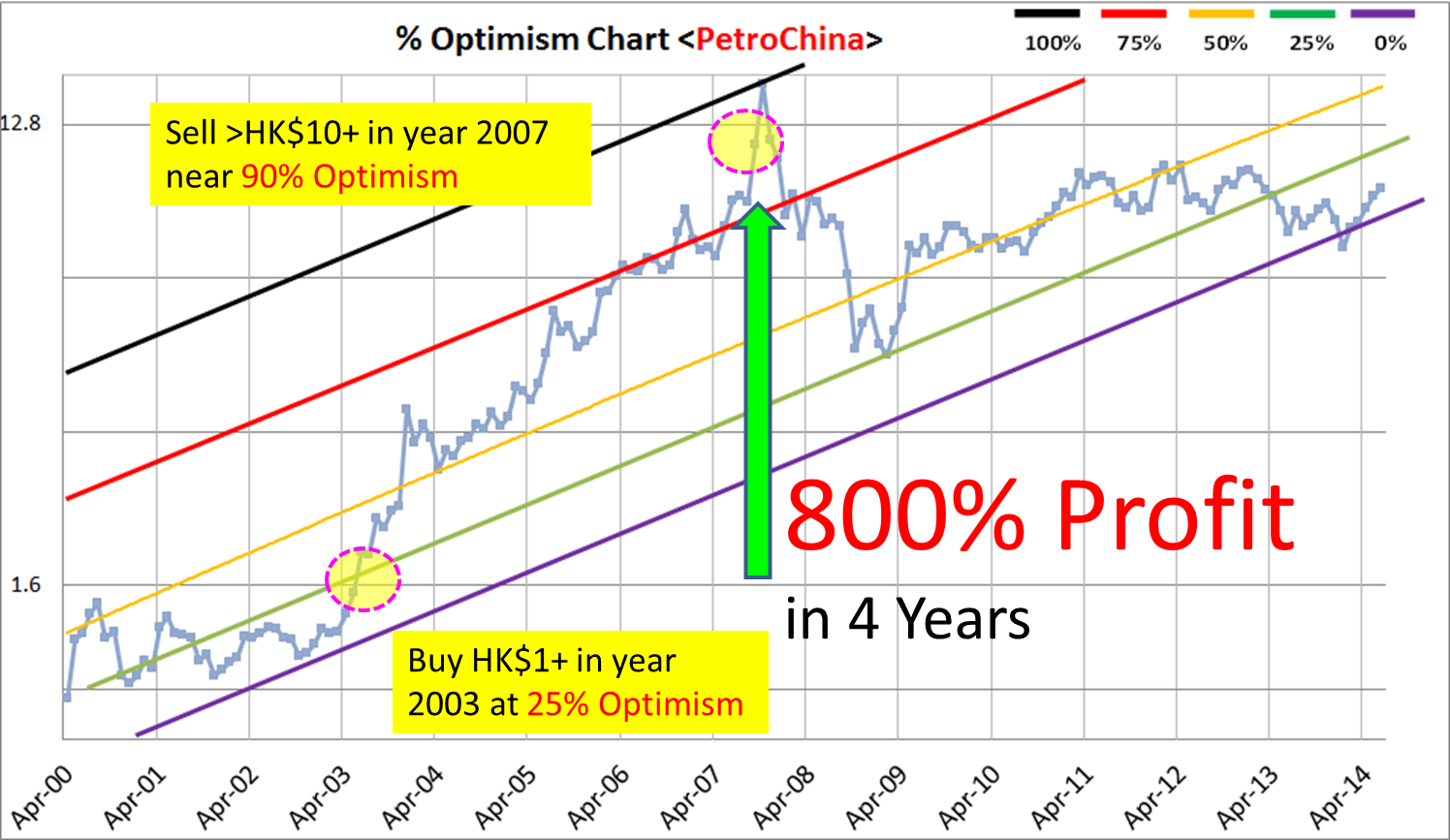

Even if one does not know which good stock to buy, top 10 brands are definitely Giant stocks. Ein55 graduates could perform Optimism + FA (Fundamental Analysis) + TA (Technical Analysis) + PA (Personal Analysis) of these 10 brands to time the investing clock for entry/exit.

Even if it is long-term high optimism (quite likely based on current global stock market), not suitable for investing, you may still consider these giants in the next global financial crisis (when it will be at low optimism again at long-term), usually the share price will be cut by half. Alternatively, you could consider mid-term or short-term trading opportunities after correction to buy low and then sell high at the high of trading cycle.

This is how to profit from 4 steps of Ein55 Investing Styles (details will be given in Dr Tee workshop):

Step 1 = Find the Giant

Step 2 = Wait for the Giant to Fall Down

Step 3 = Help the Giant to Get Up

Step 4 = Say Goodbye to the Giant

If we are patient, we could find the most valuable investment (stock, property, commodity, forex, bond, etc…) at the lousiest price, owing to the greeds and fears of the majority. Ein55 Optimism strategy is a unique investing method, learning how to be the minority who are usually the big winners.