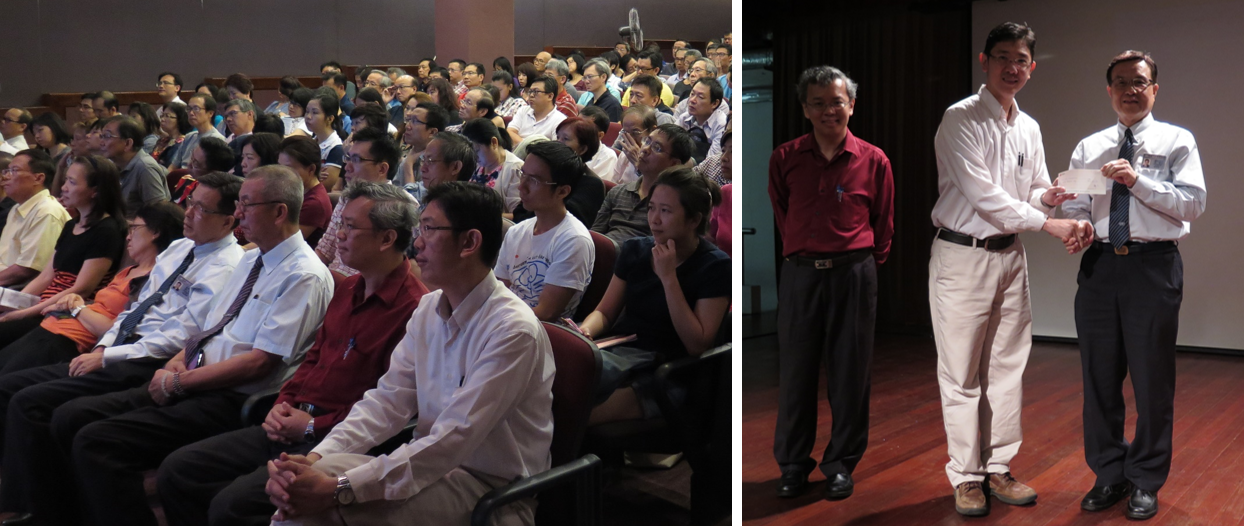

The first charity course on REITs / Business Trust in Nov 2015 was a success (read report here), helping Ein55 Graduates in enriching the investment knowledge, helping other needy people at the same time. Chye Tin, an Ein55 Graduate Mentor and successful investor, together with Dr Tee, have organized the second Charity Course (High Dividend Stocks) on 12 Mar 2016.

The responses from Ein55 Graduates were overwhelming, about 230 students have attended this Charity Course, learning how to choose high dividend stocks, when to buy and sell them in future with investing-for-income strategies, using Fundamental Analysis, Optimism Methods and Technical Analysis.

The net income from this charity course is donated to Tzu Chi to help more needy people. It is an honour that the CEO of Tzu Chi慈济(Singapore), Mr Low Swee Seh, also attended this charity event, sharing how Tzu Chi has helped numerous needy people regardless of races, religions and nationalities. Through the combined effort of all Ein55 Graduates, we have donated an amount of $15,100 to Tzu Chi in this second Charity Course.

We hope to inspire more Ein55 Graduates to reach out the society, helping others who are in need. More importantly, they have also learned the secrets of making money through passive income investing. When more Ein55 Graduates are as successful as Chye Tin, they could also contribute back to the society to help more people in future.

Here are a few useful learning points from Chye Tin in this High Dividend Stocks course:

1) We shall always ask will the dividend SUSTAINABLE and will the dividend continue to Grow? We should understand what are the factors affecting their business income? A companies without Free Cash-flow will not able to sustain the dividend pay out for long term.

2) Telecom, Utilities and Consumer Staples are considered defensive sectors that can make money in any economic environment. People are not going to shut off their power, give up their mobile line or Internet or stop buying toothpaste, food & drink when times get tough. The more predictable the revenues and earnings, the easier it is to give back some profits to shareholders.

3) For dividend investing, even in the right sector, we shall seek for the right stock that exhibited high dividend characteristic, then we shall study in detail the financial reporting of each sectors and do the peer comparison of the selected stocks in the same sector.