The earlier two Ein55 Charity courses on REITs/BT (Nov 2015) and High Dividend Stocks (Mar 2016) were great successes (click links above to read the reports), enriching the investment knowledge of Ein55 graduates in dividend income approach, helping other needy people at the same time. Chye Tin, an Ein55 Graduate Mentor and successful investor, together with Dr Tee, have organized the third Charity Course, Discounted NAV (Net Asset Value) Stocks for capital growth on 17 Sep 2016, part of a series of 4 investment courses based on practical strategies.

The responses from Ein55 Graduates were overwhelming, about 220 students have attended this Charity Course, learning how to choose stocks with significant discounts in good assets, when to buy and sell them in future with investing-for-capital growth strategies, integrating advanced Fundamental Analysis and Ein55 Optimism Strategies.

The net income from this Charity Course is donated to Tzu Chi to help more needy people. It is an honour that the management of Tzu Chi 慈济 (Singapore), Mr Sim, also attended this charity event, sharing how Tzu Chi has helped numerous needy people regardless of races, religions and nationalities. Through the combined effort of all Ein55 Graduates, we have donated directly and indirectly, an amount of $15,400 to Tzu Chi in this third Charity Course.

We hope to inspire more Ein55 Graduates to reach out the society, helping others who are in need. More importantly, they have also learned the secrets of making money through investment. When more Ein55 Graduates are as successful as Chye Tin, they could also contribute back to the society to help more people in future.

Here are key learning points in this Discounted NAV Stocks course:

1) Before invest our money in any stock, we should learn to apply 2 investing strategies:

– Invest for Income – focus on REIT or/and High yield stock (non REIT),

– Invest for Capital Growth – based on its asset or earning / cash flow growth

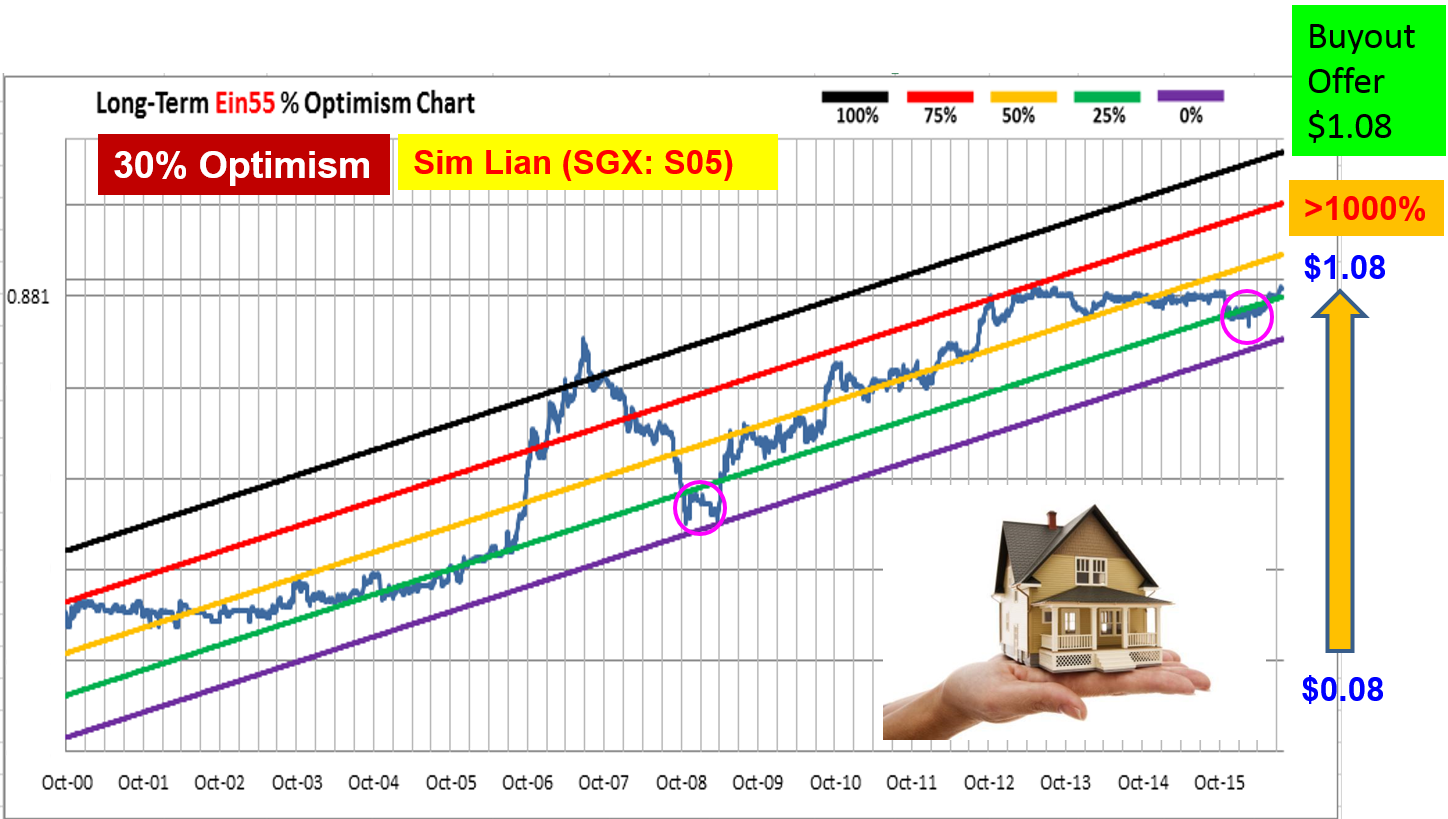

2) Discounted Asset Strategy – valuation of company business base on the Net Asset Value (NAV) listed in current Balance Sheet. Then, we determine the net CASH that would be received if all assets were sold and liabilities paid off. Various discounts will be applied based on different quality of asset classes. It is safe to buy stock with share price below the Discounted NAV.

3) Ensure the Discounted NAV stocks are fundamentally strong (checking several additional FA criteria, eg. Earning per Share > 0), not to fall into the value traps.

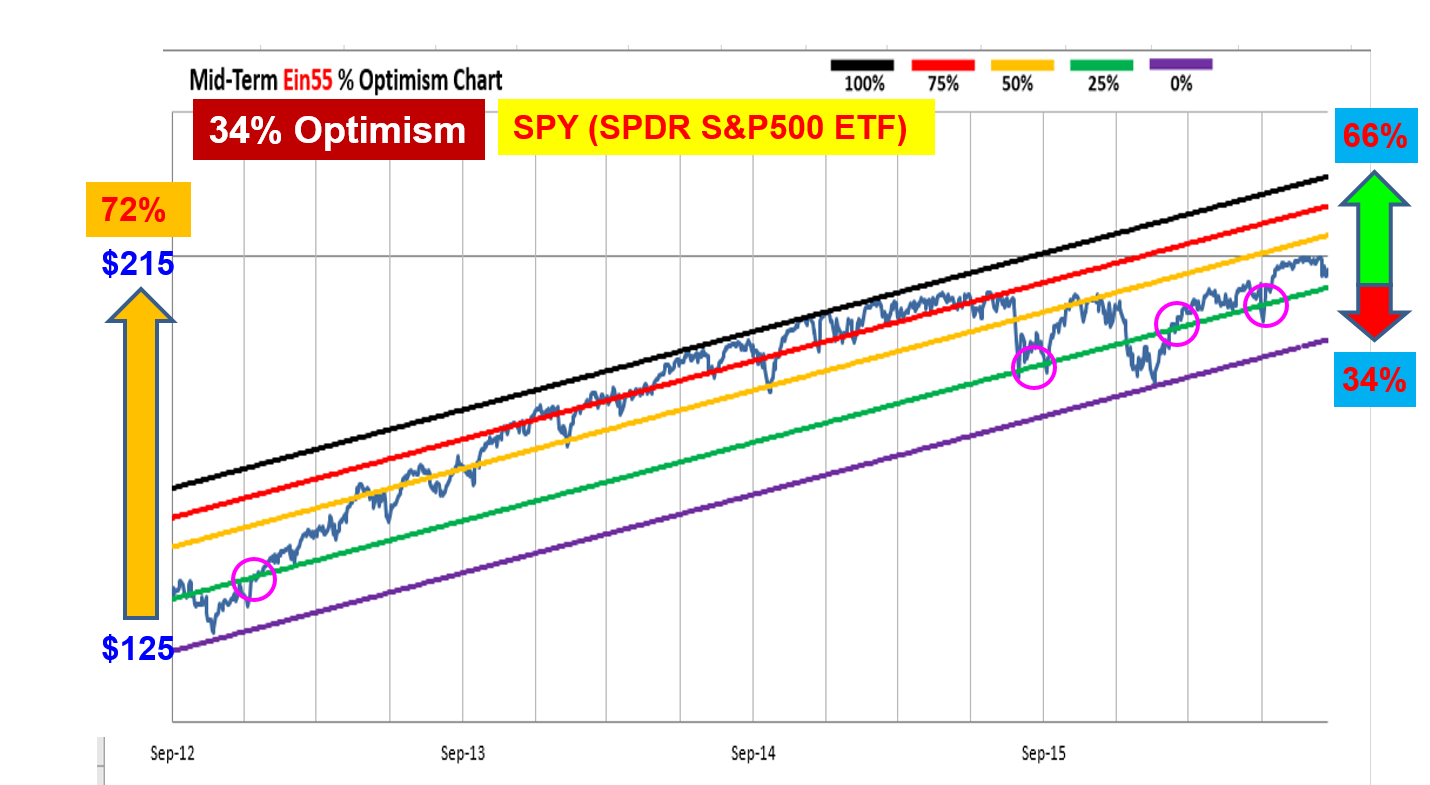

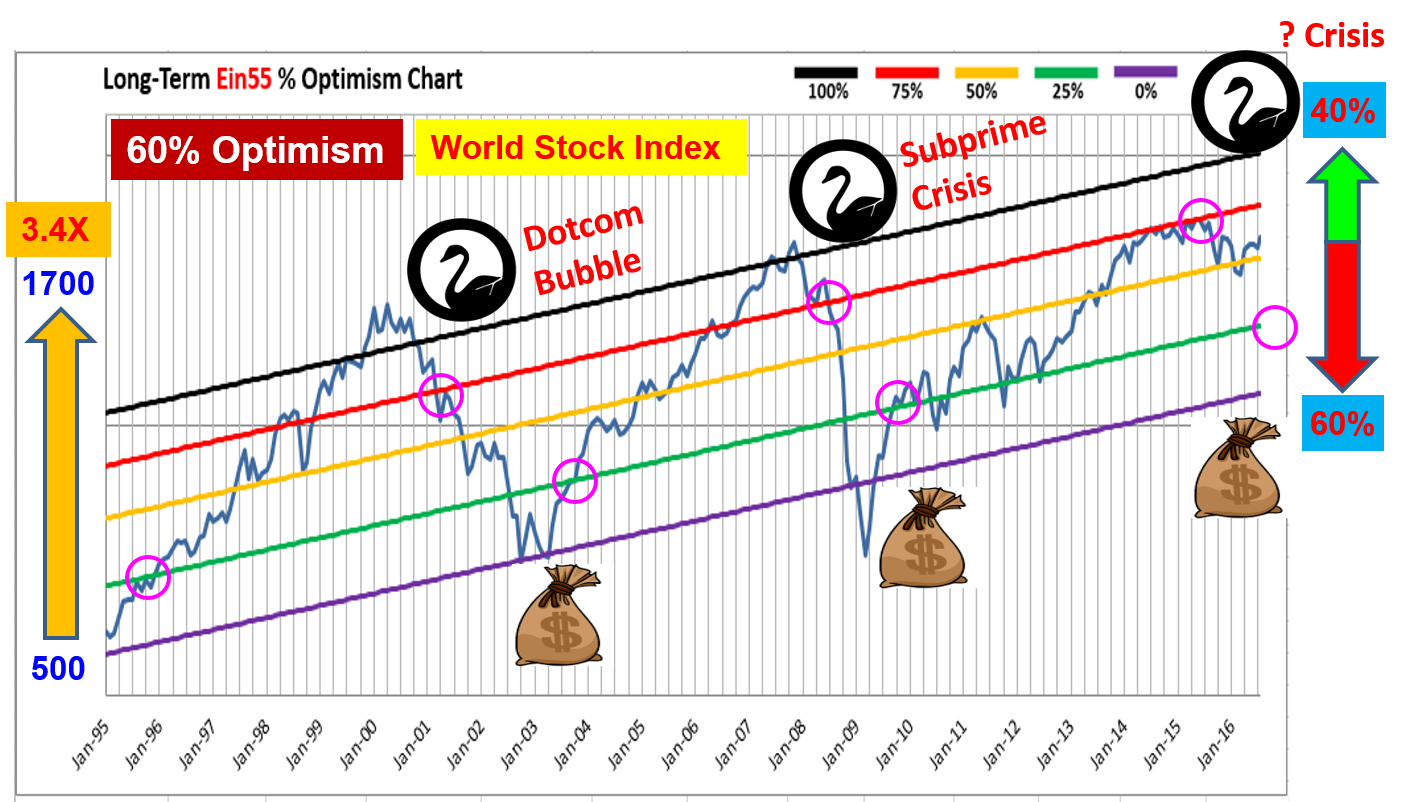

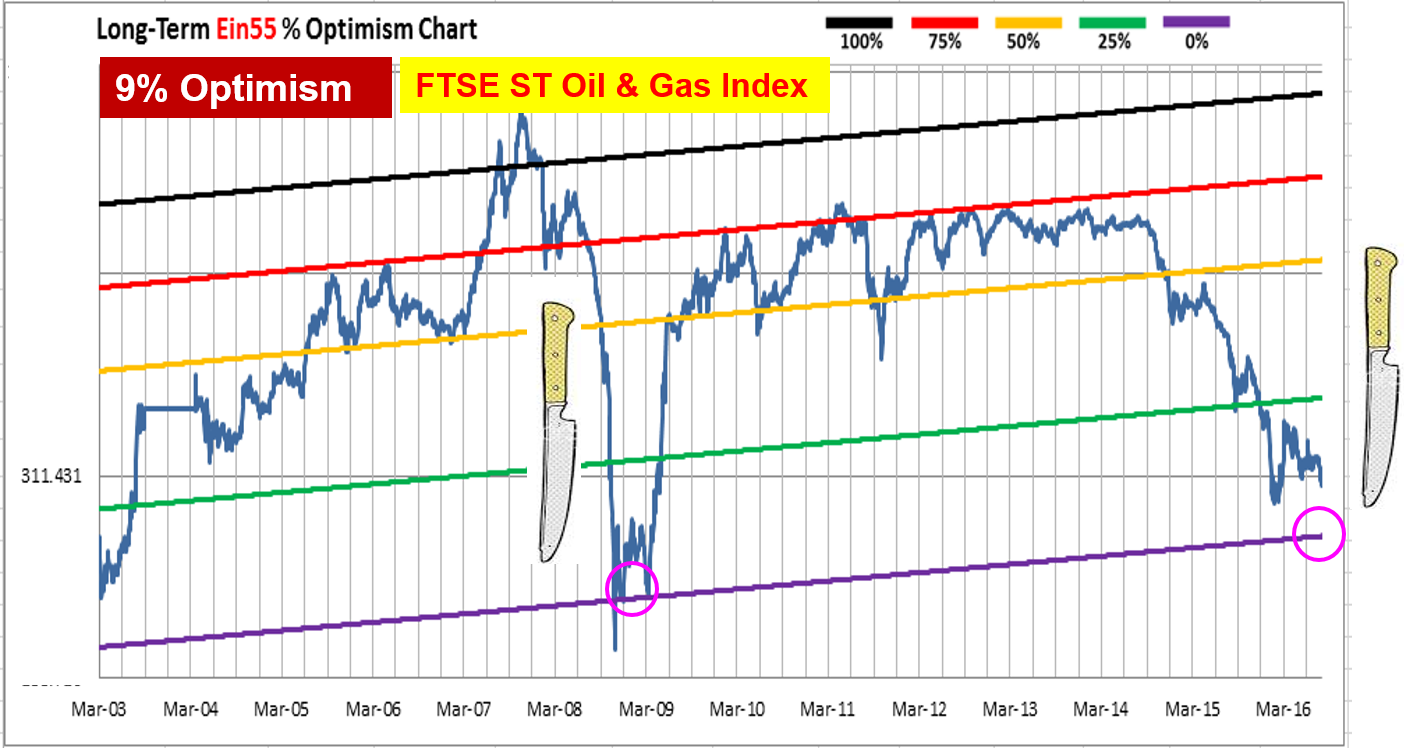

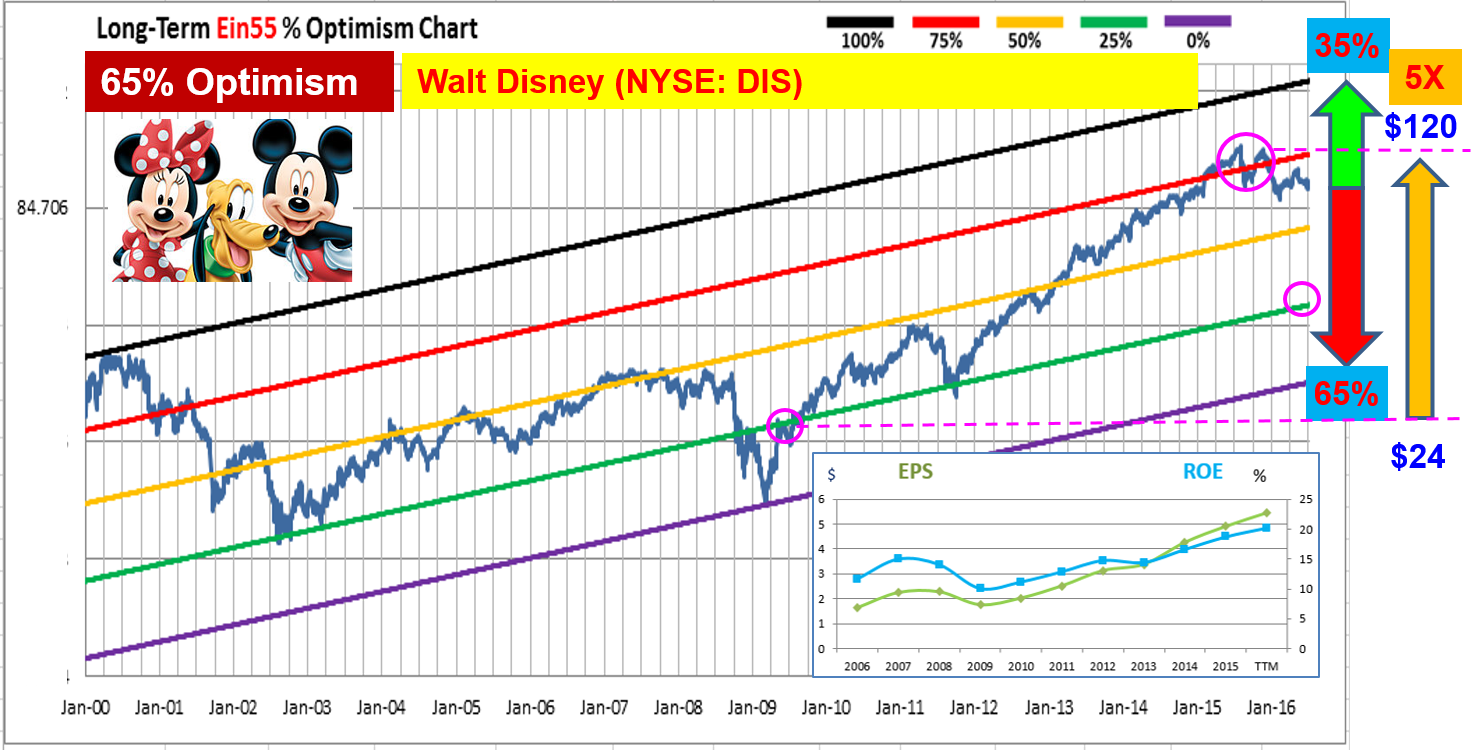

4) Combine with Ein55 Optimism Strategies to decide BUY/SELL points

BUY – when low optimism (<25%)

SELL – when high optimism (>75%)

5) One Discounted NAV stock fulfilled all the criteria mentioned above is HongKong Land (SGX: H78), click here to read analysis on this stock. There are many undervalue Singapore and global stocks, we should learn to form a portfolio to own these Discounted NAV stocks.

We should drive the money (helping others when you are successful), not driven by the money (making money for own gain). Investors should learn the unique Optimism Strategies developed by Dr Tee to choose strong global stocks, buying them at low price, then holding for consistent dividend payout or selling for capital gains. Free high-quality investment courses are provided by Dr Tee to the public.