Stock prices will rise over time when business is growing. Consumer stocks depends on businesses in consumer market. A consumer business sells us products and services which could be in 2 broad categories:

1) Good to Have (we WANT)

Optional for us, eg high end restaurants, premium property, branded handbag, children enrichment programs, etc.

In stock market, “Good to Have” are Consumer Discretionary stocks, they are usually dependent on consumer purchasing power which subject to economy condition. In a bull market, many people could make money in stocks or properties or having a higher increment in salary, therefore having more budget to buy non-essential products, eg. a car with high COE price, even public transportation is easily available. In a bear market, this type of stocks are likely to fall down badly in share prices.

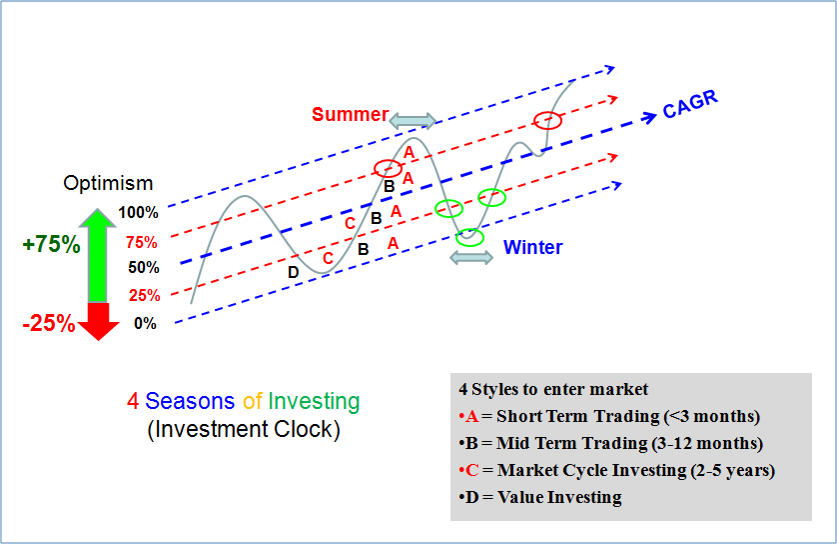

One could position with “Cyclic Investing” strategy for Stocks or Business with Good to Have products or services.

2) Must Have (we NEED)

Essential for us, eg. basic 3 meals in foodcourt or simple bread & coffee at home, a house (HDB) to stay (rent or own), a bag which we could carry when going for work, children public transport to school, etc.

In stock market , “Must Have” are Consumer Staples stocks, they are usually more defensive, needed in daily life regardless of economy condition. Whether good time or bad time, people still need to eat & drink, taking bus or train, wearing clothes. Most people are unlikely to cancel their mobile phone plans or cut their utilities (water/electricity/gas) supplies.

One could position with “Long-term Defensive or Dividend Investing” strategy for Stocks or Business with Must Have products or services.

————————————————————-

In actual stock market, most stocks are hybrid of Good to have and Must have, because the definition of needs are dependent on individual. Therefore, we could have a variety of investing strategies over a spectrum of needs for products and services.