Stock Market Gravity: Heaven – Earth – Hell

Time for Actions in Stocks (Personality Based)

Position in the current high optimism stock market with 10% dip in S&P 500, following your unique personality: Trader or Investor, having stocks or no stock. Here are possible time for actions in stocks for 4 types of personalities:

1) Traders – With Stocks:

Time for Actions in Stocks: Short term traders should have sold the stocks (taking profit or even cut loss) a few days ago when short term trend turned bearish. For medium term traders with higher risk tolerance level, plan to exit if the correction has met the exit strategy.

2) Traders – No Stocks

Time for Actions in Stocks: Waiting for signal to come back again (either short term or medium term), don’t capture the falling knife buying low in downtrend. Current short term support is broken for Level 3 (stock indices), about 10% price correction for S&P 500 is significant, it may take time (weeks or even months, need strong economic data and even support from political economy, price will show if there is any recovery signal) for the market to recover. Even if individual stock (Level 1) is strong, it is against the market trend, chances of sustainable bull may not be high. Since the long term and medium terms are still bullish, possible shorting for trading may be only considered for short term.

3) Investors – With Stocks:

Time for Actions in Stocks: Long term investor have already gained if holding from low optimism to high optimism market. Current high optimism market is only a bonus, not to use fundamental or strong economy to justify the holding because any black swan (may not be a known crisis, could be a butterfly flapping wings, potentially could cause a thunderstorm eventually) or the last straw which may break the camel’s back due to sudden transition from greed to fear. Investors may have used trailing support so far, risk tolerance level is higher (possible to hold as long term optimism is still high) but when the condition is met, has to exit as well, just needs more signals for confirmation. There is no need to guess the direction of high optimism stock market which is full with randomness. For investors, the difference is only big win or smaller win.

4) Investors – No Stocks

Time for Actions in Stocks: Current market correction is still not yet the condition to buy low as optimism is still high. It requires patience to wait for tremendous fear in the market to truly buy low, eg. a blue chip with more than 50% discount. Investors are likely to continue to wait but studying harder to shortlist at least 10 global giant stocks, so that action taking can be faster if global financial crisis really comes one day. Cash is king when used at the right time.

—————————

Currently it is too early to conclude whether it is only a short term stock market correction or beginning of global financial crisis. A wise trader and smart investor would not take it lightly, starting to take the right actions (Buy / Hold / Sell / Wait / Shorting) following own personality. Doing nothing (pure ignorance) without a strategy can be very risky.

Learn further from Dr Tee on how to Time for Actions in Stocks.

Walking on Thin Ice of Stock Market

After the surprise dip of 666 points on 2 Feb 2018, Dow Jones Index dropped another 1175 points on 5 Feb 1018, there is total of about 7% correction over the last 2 trading days, strong enough to drive short term traders (who long) out of the game temporarily. The thin ice of stock market is getting fragile.

Those algorithmic trading tools which follows the TA rules, when critical short-term support is broken, would rush to find the nearest exit to sell down with high volume recorded, adding to the power of market correction in a short time. There are over 70% stock trading in US is done by robot or algorithmic trading, mostly are trend follower, therefore when there is a flash crash, the robots will follow one another to exit from the stock market or even start the shorting process.

The 7% stock market correction is overdue, especially for US and Hong Kong stock markets which have been over-heated in the past few months. Macroeconomy and stock market are connected loosely, when the fear emotion is over (intra-day VIX was 50 but subsiding quickly), fundamental will have influence over the technical again, before the greed emotion takes over again.

There is nothing wrong for short to medium term traders to take profits of last few months as this was the exit strategy. After all, US was at very high Optimism (over 90%), any potential risk could be the next black swan, resulting in the global financial crisis. In year 2000, the dot com bubble was simply too large, price over value, therefore a high optimism stock index, itself can be a potential crisis because when most people are profiting from the bullish market, any shake would change the greed into fear, breaking the thin ice of stock market.

Trading in a high optimism stock market is as if walking on a layer of thin ice of stock market. Sometimes it could be a false alarm (wolf is coming), sometimes it could be a real crash of ice and stock market. Therefore a systematic and disciplined trading plan is needed.

Investors would want to wait for the global financial crisis to come ASAP to buy low for strong fundamental stocks. However, political economy could add more complexity and traders could buy low again in short term if it is only a regular correction. Therefore, patience is crucial for investors.

Allocation of funds (cash vs stock) is critical to manage the emotions for a trader and an investor. When one invests too much at high optimism, the self control is weak. It is fine to cut loss in a trading market when the future price trend is against the earlier assumption. The worst is a mismatch of personality with strategy, eg. entering as a short term trader for a quick return, ending up holding as a long term investor when stock market is confirmed a crash.

This Chinese saying is a good summary of strategy at high optimism stock market:

《詩》云:「战战兢兢,如临深渊,如履薄冰。」

Learn from Dr Tee to match the stock trading or investing strategy with own personality, mastering Walking on Thin Ice of Stock Market.

Market Signals from Bull to Bear

Global Bond Market has been at historical high prices over the past few years. It is possible that the crash of bond market could be the next black swan. Currently the funds from bond market is transferred gradually to stocks, properties or safe cash in banks. The changes are still not an alarm yet but if both stock and bond prices drop significantly over a period of time, an investor would have to be very careful on potential market signals from bull to bear.

This is the characteristic of last phase of bull run with high prices, any drastic movement will shake the confidence of investors who have high profits in stocks. The solution? Sell some as well to take partial profits. The initiation of market signals from bull to bear is not confirmed yet.

VIX (Volatility Index) is shooting up to more than 17 but the uptrend fear may not be sustainable.

During 911 time, a drop of 600 points overnight is about 5% to Dow Jones, considered a disaster. After Dow Jones is doubled since then till now, the impact of the same drop of 600 points is only 2.5%.

We need to compare the stock market in both relative and absolute ways. A stock market cannot be bullish every week, needs to take a rest, allowing some people to take profit and some people to enter the market again.

Since the global stock market is over 80% Optimism, US more than 90% Optimism, it could be a smart move to adopt a shorter term position.

High Optimism = bonus price, we want to sell high to others. Low Optimism = discounted price, we want to buy low from others. Stock market has returned the last 2 months of bonuses (gains) after the correction so far. Each of our unique personality will determine the unique low and high optimism, forming a personalized trading plan or investing strategy.

A stock trader would not capture the falling knife, waiting patiently for the uptrend to come back again after breaking the resistance to form higher lows. Global stock market is “tired” after the bull is running for so many months, need time to rest. A trader would not guess the direction of market or future prices but self-discipline is important (entry, take profit, cut loss, position sizing, etc). An investor would use the market greed and fear as additional weapon to fundamental analysis. Ability to take actions aligning to own personality is key to success.

Eventually the train will reach the terminal of “Bull Line”, changing the direction to “Bear Line”, these are market signals from bull to bear. Knowing the risk tolerance of oneself is critical, knowing when to alight. Before changing the lines from Bull to Bear, we will see some road signs, now a few are shown, more will be seen in future.

Learn from Dr Tee through Market Signals from Bull to Bear to take actions in the current stock market.

Save Lives with Charity Investment Course (中华医院)

The Ein55 students have learned the Practical of PA (Personal Analysis) from Ein55 Charity Investment Course by James Hon, understanding the importance of systematic approach of trading plans and investing strategies. Here are the 10 key elements learned in charity investment course:

- Skill Assessment – Tested system? Confidence?

- Mental Preparation – Are you emotionally and psychologically ready?

- Set Risk Level – This depends on your trading style and risk tolerance.

- Set Goals – What is your realistic profit targets and risk/reward ratios? How to stop loss?

- Do Your Homework – Before the market opens, what is going on around the world? Calm? Volatile?

- Trade Preparation – Set alerts for entry and exit signals!

- Set Exit Rules – Most traders concentrating 90% or more for buy signals, very little attention to when and where to exit.

- Set Entry Rules – Exits are far more important than entries!!!

- Keep Excellent Records – use your Journal!

- Perform a Post-Mortem – To know the why and how of your profit and losses. (Continuous Process Improvement)

Life is not just making money. To encourage successful Ein55 Graduates to help other needy groups, Dr Tee and Ein55 Mentor James Hon take the lead to donate to a charity organization, Singapore Chung Hwa Medical Institution (SCHMI, 中华医院), which has been helping the poor and needy Singaporeans over the past 50 years with free / subsidized medical services.

There are similarities in investment, charity donation and medical services:

1) Medical services help to save lives or improve the quality of lives with better health. A good health is the fundamental of happy life for an individual.

2) Charity donation provides the practical help to the needy group with money. However, the help is limited, support could be stopped when there is no further donation from the society.

3) Investment is a sustainable way of generating the profits when applied in the right way. The additional incomes could help to support charity, including but not limited to donation to medical institution for needy people.

The needy group probably could only wait for fishes from others due to their limitation in ability or knowledge to make money. However, majority of the people has the potential to learn to fish, generating consistent capital gains and passive incomes from investment. More importantly, these fishes caught could be shared with other needy people.

Dr Tee provides free high-quality investment education regularly to the general public, which may be considered a form of donation in financial knowledge, which could help a person for a lifetime, after mastering the right skills of stock investment.

Start learning these life skills NOW, helping oneself, own family and other needy people in the society. Save Lives with skills learned from Charity Investment Course.

Download Latest 2 eBooks by Dr Tee: Global Market Outlook & Top 10 Stocks in Dream Team Portfolio

Fresh from Oven: Download the latest 2 eBooks by Dr Tee on (1) “Global Market Outlook“, covering comprehensive investment topics: Stock, Property, Commodity, Forex, Bond and Political Economy & (2) “Dream Team Portfolio” with Top 10 global stocks for capital gains and passive incomes. Past readers have benefited, learning Simple and Powerful strategies which deliver incredible results in stocks.

Are you worried or excited about the current global stock market, especially with the controversial US President, Donald Trump? Every crisis is an opportunity for investing. You will learn useful methods step by step from 2 valuable eBooks by Dr Tee which work in stock market. Take action now to surprise yourself with formation of dream team portfolio!

Dr Tee 刚完成2本投资秘籍。《环球市场展望》书内覆盖很多在环球主要市场 (美国、新加坡、香港、中国、欧洲) 的投资议题及提供解决方法。《10大梦幻股票》书则分享了各种实用投资策略于10大高潜能股票。很多读者已经从Dr Tee过去发表的股票投资书中受惠,大家可在Dr Tee 的最新报告中洞悉环球市场目前面对的风险及机遇。

eBook #1: Global Stock Market Outlook 2018 《环球市场展望》

- Mass Market Sentiment Survey (大众市场情绪调查)

- Review of Global Stock Markets (环球股市回顾)

- US Market Outlook (美国市场展望)

- Regional Market Outlook (Europe, China, Hong Kong) (区域市场展望)

- Singapore Market Outlook (Stock & Property) (新加坡市场展望)

- Conclusions and Recommendations (总结及建议)

eBook #2: Top 10 Global Stocks – Dream Team Portfolio 《10大梦幻股票》

- Personalized Stock Investment Portfolio (个人化股票投资组合)

- Ein55 Global Top 10 Stocks (10大全球高潜能股票)

- Summary of Actions (投资方向总结)

The safest time to buy a stock is when everyone is afraid the sky will fall while the business in dream team portfolio is still operating normally with consistent performance. This could be a rare opportunity to buy during a crisis; we should learn how to take this advantage to truly buy low sell high.

When Optimism Strategies are combined with Fundamental Analysis (value investing & growth investing), Technical Analysis (support / resistance / trends), and Personal Analysis (mind control of greed and fear), it is very powerful as one can take the right action (Buy, Hold, Sell, Wait or Short) at the right time aligning with his own personality.

The unique Optimism Strategy developed by Dr Tee provides a special advantage to know which investment (stock, forex, property, commodity, bond, etc.) to buy safely, when to buy, when to sell, including the option of long term holding. So far over 20,000 attendees have benefited from Dr Tee high-quality free courses to the public. Take action now to invest in your financial knowledge, starting your journey towards financial freedom.

Learn 10 Strategies of Stock Trading & Value Investing (股市投资十大策略)

1) Master Buy Low Sell High for all investment markets (stock, property, commodity, forex, bond) (买低卖高:股票、房地产、商品、外汇、债券)

2) Profit in bearish and bullish markets, understanding the true impact of US Interest Rate Hike, Bullish Global Economy, Oil & Gas Crisis (环球经济)

3) Long-term investing strategies to outperform portfolio return of Temasek, Li Ka-Shing, Warren Buffett, major stock indices/ETF and other funds with dream team portfolio (长期投资策略)

4) High-probability Shorting techniques for short term traders to profit from falling stock market while others are losing money or doing nothing (短期卖空技巧)

5) Generate consistent Passive Income with REITS and real property with knowhow of high dividend stock and property market cycles (房地产信托股的被动收入)

6) Methods of Spring Cleaning for own stock portfolio to eliminate junk stocks without any hope (股票大扫除)

7) Time for Global Financial Crisis to buy blue chip stocks on sale (危机也是良机)

8) What to buy (stock screening), When to buy/sell (buy low sell how), How much to buy/sell (risk management): (股票三部曲:买何股?何时买卖?买卖多少?)

9) Fundamental Analysis (FA) + Technical Analysis (TA) + Personal Analysis (PA), integrated with unique Optimism Strategy by Dr Tee (乐观指数:三法一体)

10) Global Stock Market Outlook: emerging opportunities with high potential in Singapore, US, China & Hong Kong stock markets (环球股票市场展望: 新美中港,股票良机)

3 BONUSES for Dr Tee Workshop Attendees:

Bonus for Readers: Dr Tee Investment Forum with over 6000 members (Private Group)

(Please click “JOIN” with link above and wait for Admin approval of membership)

- Market Outlook (stocks, properties, bonds, forex, commodities, macroeconomy, etc)

市场展望 (股票、房地产、债券、外汇、商品、宏观经济等) - Optimism/ Fundamental / Technical / Personal Analyses

(乐观指数 / 基本分析 / 技术分析 / 个人分析) - Investment risks & opportunities (投资风险及机遇)

- Dr Tee graduates events and activities updates (Dr Tee学员活动最新消息)

Click here to join future Dr Tee (Ein55) investment courses: www.ein55.com

Top 10 Global Blue Chip Stocks – Dream Team Portfolio

There are over 40,000 stocks in the world, a smart investor has to carefully choose Top 10 global blue chip stocks aligned with own unique personality as investment portfolio to grow the wealth.

A smart investor should form a dream team portfolio with global Top 10 stocks for both passive incomes and capital gains. Let’s learn step-by-step with a portfolio of 10 global blue chip stocks with strong fundamentals in 8 growing sectors (Bank, Property, REIT, F&B, Casino, Consumer, Oil & Gas, ETF), applying Ein55 Optimism as investment clock, waiting patiently to buy low in global financial crisis and sell high in bullish stock market for tremendous potential return. These Top 10 blue chip stocks are diversified over 4 countries: 4 from Singapore, 3 from USA, 2 from Hong Kong, 1 from Malaysia. Strength and opportunities for each stock and suggested strategies will be explained.

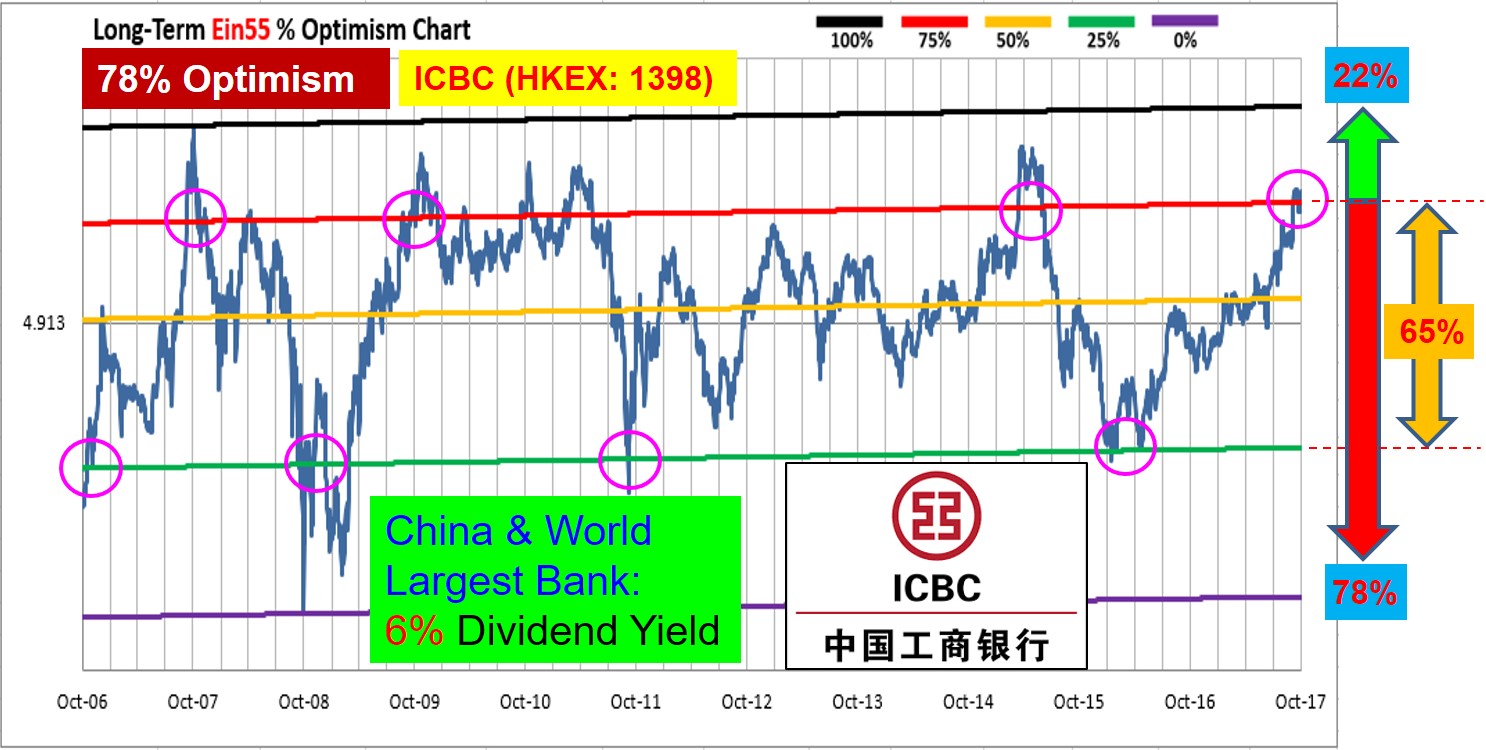

Stock investment is not just what to buy, the mastery of investment clock is crucial, knowing when to buy and sell to maximize the profit. In general, Buy when Optimism <25%, Hold or Wait when Optimism 25-75%, Sell when Optimism >75% (see sample Ein55 Optimism in Figure below).

(#1) ICBC (Hong Kong, HKEx: 1398), Industrial and Commercial Bank of China

Defender / Midfielder Strategies: For long term investing, collect stable dividend payment as passive income with China and Temasek protection. Maximize dividend yield when buying stock at low optimism. For medium term trading, apply Ein55 Optimism to buy low sell high every few years for quicker capital gains.

ICBC is the largest bank in China and also the whole world (based on current share price and valuation). The business with stable growing fundamental is supported by strong economy in China with large population. Temasek is a major shareholder, providing stability to the share prices, an additional shield of defense for investors. With increasing US and global central bank interest rates, the outlook for banking and finance stocks are positive as the net interest margin (NIM) will help the global banks to grow in earnings until the next global financial crisis.

Current Ein55 Optimism of ICBC is high at 78% (see Figure above), in addition to hold for stable 6% dividend yield, an investor also has an option to sell the stock first, buying back when share price drops to below 25% Optimism in future, aiming to maximize the dividend yield. Since global stock market is at high optimism, an investor has to take note of the signals of global financial crisis which would affect the global banking and finance stocks significantly. Crisis is an opportunity if an investor knows when to buy a strong fundamental stock at price with low Ein55 Optimism.

ICBC is a bank blue chip stock, cyclic in nature due to volatile China / Hong Kong stock market and economic cycles. Therefore, besides being a “Defender” stock (dividends only), it may also be considered as a “Striker” (capital gains only) or “Midfielder” (capital gains and dividends) for trading in medium term, following trends to long or short, gaining from average 65% profit from medium-term volatility of share prices with cyclic investing every 2-3 years.

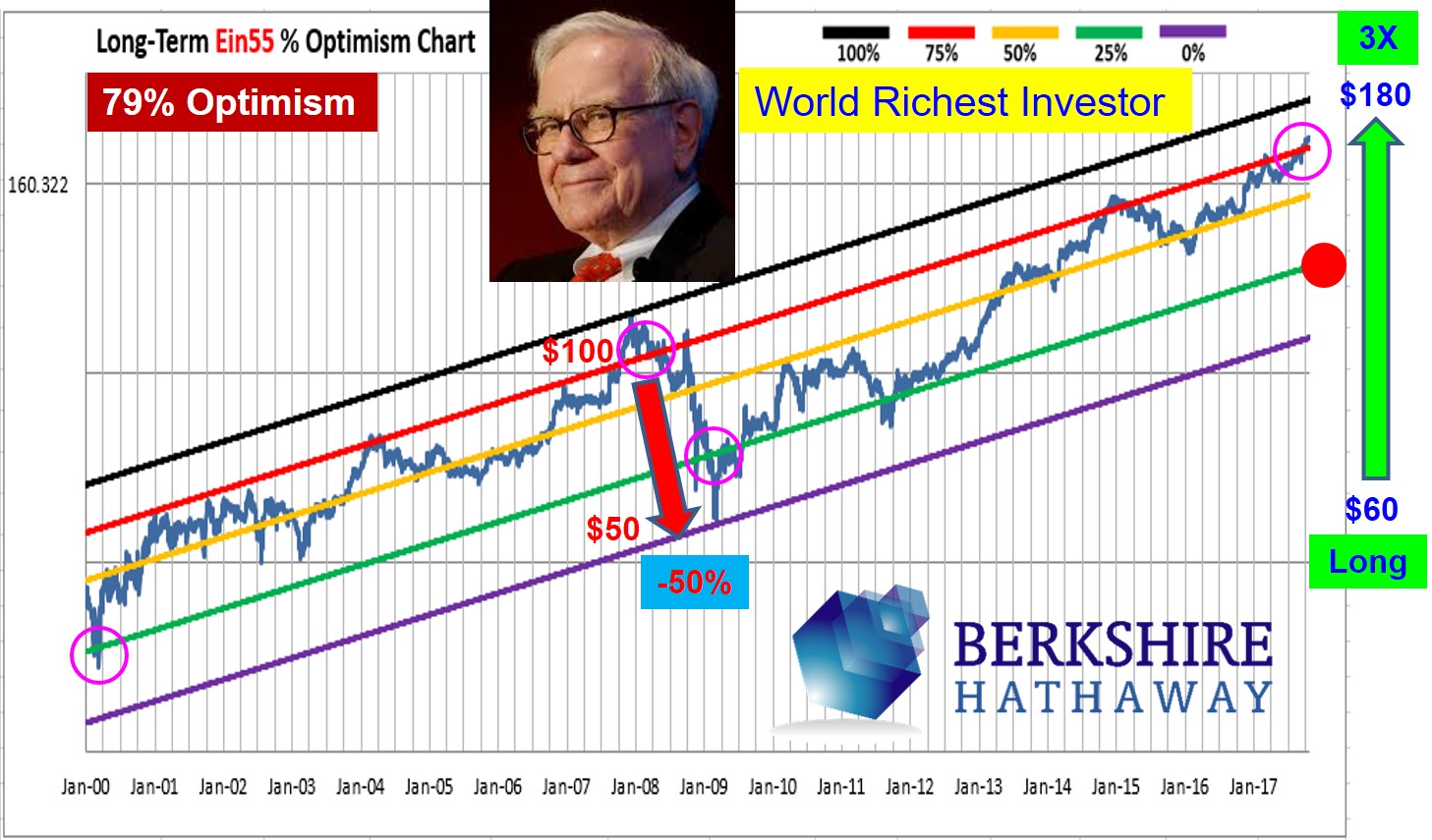

(#2) Berkshire Hathaway Class-B (US, NYSE: BRK.B)

Midfielder Strategy: High-growth fund for capital gains with Warren Buffett wisdom when buying at low optimism

Warren Buffett is the richest investor in the world. Berkshire Hathaway represents an average performance of Buffett’s investment portfolio. Berkshire Class-A stock is very expensive, approaching $300,000 for 1 share, mainly suitable for high net worth individuals or big funds with long term investment strategies as the stock did not pay dividend, there was no change in number of shares, all the retained earnings for decades are accumulated and reflected in its growing share prices. Berkshire Class-B stock is a more affordable option for retail investors, pro-rated at 1/1500 price of the Class-A stock, below $200 / share currently.

Berkshire Class-B allows an easy way for retail investor to diversify over a portfolio of strong fundamental stocks owned by Warren Buffett. Despite Berkshire is a growth giant stock, it is still susceptible to systematic risk of economy cycle. During global financial crisis in 2008-2009, Berkshire share price was halved due to excessive market fear. An investor who follows Ein55 Optimism to buy below 25% Optimism, the current share price has gone up by 3 times, currently at high optimism of 79% (see Figure above).

As an investor, one has 3 possible options for investing in Berkshire stock. Firstly, assuming a buy & hold long term strategy, one may continue to hold the stock despite at high optimism but using the strong fundamental to overcome the next global financial crisis. This option is only suitable for those who have strong investor mindset, bought the share at low optimism price last time. Secondly, an investor may adopt cyclic investing approach, selling Berkshire stock first, buying back at <25% Optimism in future. This option is suitable for those investors who know how to integrate trading and economy cycle investing into overall strategy. Finally, a smart investor has the choice of buying better stocks than Warren Buffett, i.e. focusing on a few best component stocks of Berkshire to achieve higher growth than Berkshire but still enjoying the protection by Warren Buffett as a major shareholder of these few stocks.

The remaining 8 of the Top 10 blue chip stocks in dream team portfolio with key summary of strategies and Ein55 Optimism Investment Clock can be found here (30 pages eBook). Click to Download FREE eBook #1 by Dr Tee: “Global Top 10 Stocks – Dream Team Portfolio” (latest version of eBook with complete guide of What to Buy, When to Buy, When to Sell).

In the same eBook Download link, reader will get another FREE eBook #2 by Dr Tee: “Global Market Outlook” covers comprehensive investment topics: Stock, Property, Commodity, Forex, Bond and Political Economy. Past readers have benefited from the analysis. Learn to position for each market crisis and opportunity with Ein55 Optimism Strategies.

Table of Contents (eBook: Global Stock Market Outlook)

- Mass Market Sentiment Survey

- Review of Global Stock Markets

- US Market Outlook (Economy, Stock, Property, Commodity, Bond, USD)

- Regional Market Outlook (Europe, China, Hong Kong)

- Singapore Market Outlook (Stock & Property)

- Conclusions and Recommendations

The safest time to buy a stock is when everyone is afraid the sky will fall while the business of blue chip stock is still operating normally with consistent performance. This could be a rare opportunity to buy during a crisis; we should learn how to take this advantage to truly buy low sell high.

When Optimism Strategies are combined with Fundamental Analysis (value investing & growth investing), Technical Analysis (support / resistance / trends), and Personal Analysis (mind control of greed and fear), it is very powerful as one can take the right action (Buy, Hold, Sell, Wait or Short) at the right time aligning with his own personality.

The unique Optimism Strategy developed by Dr Tee provides a special advantage to know which investment (stock, forex, property, commodity, bond, etc.) to buy safely, when to buy, when to sell, including the option of long term holding. So far over 20,000 attendees have benefited from Dr Tee high-quality free courses to the public. Take action now to invest in your financial knowledge, starting your journey towards financial freedom.

Learn 10 Strategies of Stock Trading & Value Investing (股市投资策略)

1) Master Buy Low Sell High for all investment markets (stock, property, commodity, forex, bond) (买低卖高:股票、房地产、商品、外汇、债券)

2) Profit in bearish and bullish markets, understanding the true impact of US Interest Rate Hike, Bullish Global Economy, Oil & Gas Crisis (环球经济)

3) Long-term investing strategies to outperform portfolio return of Temasek, Li Ka-Shing, Warren Buffett, major stock indices/ETF and other funds (长期投资策略)

4) High-probability Shorting techniques for short term traders to profit from falling stock market while others are losing money or doing nothing (短期卖空技巧)

5) Generate consistent Passive Income with REITS and real property with knowhow of high dividend blue chip stocks and property market cycles (房地产信托股的被动收入)

6) Methods of Spring Cleaning for own stock portfolio to eliminate junk stocks without any hope (股票大扫除)

7) Time for Global Financial Crisis to buy blue chip stocks on sale (危机也是良机)

8) What to buy (blue chip stocks screening), When to buy/sell (buy low sell how), How much to buy/sell (risk management): (股票三部曲:买何股?何时买卖?买卖多少?)

9) Fundamental Analysis (FA) + Technical Analysis (TA) + Personal Analysis (PA), integrated with unique Optimism Strategy by Dr Tee (乐观指数:三法一体)

10) Global Stock Market Outlook: emerging opportunities with high potential in Singapore, US, China & Hong Kong stock markets (环球股票市场展望: 新美中港,股票良机)

3 BONUSES for Dr Tee Workshop Attendees:

Bonus for Readers: Dr Tee Investment Forum with over 6000 members (Private Group)

(Please click “JOIN” with link above and wait for Admin approval of membership)

- Market Outlook (stocks, properties, bonds, forex, commodities, macroeconomy, etc)

市场展望 (股票、房地产、债券、外汇、商品、宏观经济等) - Optimism/ Fundamental / Technical / Personal Analyses

(乐观指数 / 基本分析 / 技术分析 / 个人分析) - Investment risks & opportunities (投资风险及机遇)

- Dr Tee graduates events and activities updates (Dr Tee学员活动最新消息)

Click here to join future Dr Tee (Ein55) investment courses: www.ein55.com

Summary of $90,000 Charity Courses for Tzu Chi (慈济) with High Dividend Stocks

Dr Tee, Ein55 Mentor & Graduates have together organised 5 charity investment courses (REITs/Business Trusts in Nov 2015 and May 2017, High Dividend stocks in Mar 2016 and Oct 2017, and Discounted NAV stocks in Sep 2016) in the past 2 years, donating net income of around $90,500 to Tzu Chi 慈济 (Singapore). We hope to inspire more Ein55 Graduates to reach out the society, helping others who are in need. More importantly, they have also learned the secrets of making money through investment. When more Ein55 Graduates are successful financially, they could also contribute back to the society to help more people in future.

Here are key learning points from the recent Charity Course on High Dividend Stocks:

1) Five Characteristics of High Dividend Yield Stocks

1.1) Mature Company that have already growth to sizable scale, meaning Equity > US$1B, Market Cap >US$1B, with stable Revenue >US$1B

1.2) Dividend pay-out ratio of at least 50% or more

1.3) Fundamentally remain strong and robust for many years to come because company have certain economy moat.

1.4) Low CAPEX business

1.5) Able to generate stable Free Cash Flow

2) Seven Myths about Dividend Investing

Myth: Stock prices are adjusted downward when dividends are paid.

Truth: Stock prices are adjusted on XD date, not on dividend payment date.

Myth: Dividend stocks are always safe

Truth: A company can stop payout of dividend when business is declining, may not be always safe.

Myth: Companies that pay dividends limit growth

Truth: The growth depends on business concept / innovation, leading to consistent profit and cash flow to pay for dividend. A company could have both dividend payment and high business growth at the same time.

Myth: The highest yielding stocks are the best

Truth: It can be risky because high yield stocks could have weak business with falling share prices.

Myth: Dividends are guaranteed upon company announcement

Truth: Company can cancel the dividend payout even after announcement

Myth: Investors should buy the cheapest dividend stocks

Truth: Dividend investor intention is to have low risk investment, better pick up healthy dividend stock

Myth: Dividend stocks are boring

Truth: Dividend stocks are still investment that could rise and drop at any time, requiring investors to pay close attention to monitor and follow up the stocks. An investor should not feel boring when receiving consistent dividend payment to their bank accounts as passive incomes.

———————————————————————————

We should drive the money (helping others when you are successful), not driven by the money (making money only for own gain). Investors should learn the unique Optimism Strategies with FA (Fundamental Analysis) + TA (Technical Analysis) + PA (Personal Analysis) developed by Dr Tee to choose strong global stocks, buying them at low price, then holding for consistent dividend payout or selling for high capital gains. High-quality free stock investment courses are provided by Dr Tee to the public.

Investing Strategies for US Stock Markets (S&P, Dow Jones, Nasdaq, Russell) at Historical Peaks

US major stock market indices (S&P 500, Dow Jones Index, Nasdaq, Russel 2000) set new record of historical high again with 8th quarterly gains in a row. The earlier nuclear “crisis” has set a nice market correction for short term traders to buy low and sell high now.

US and most global stock markets (including Singapore) are still under a bull market but mainly suitable for shorter term trading due to moderate high market optimism. Despite at historical high stock prices, long term Optimism for US stock market is about 81%, still have room for further growth, although it is limited by probability.

One has to know own’s personality (trader or investor), designing the right trading plan or investing strategy for the current stock market. The US market is ideal for short term trading, buy high sell higher, especially after breaking 2500 points for S&P 500.

Singapore STI is still supported above 3200 points with Optimism about 48%, getting stagnant over the past few months. With global stock markets are still at relatively high optimism, market risks are getting higher but there are still opportunities for everyone but need to align with own personalities:

1) Short Term Traders: Buy High Sell Higher (Duration: weeks)

– entering after each break out of high resistance but not hesitating to exit when the signal is reversed

2) Medium Term Traders: Buy Low Sell High (Duration: months)

– buying after intermediate correction, focusing on bullish mid-term stock markets

3) Long Term Investors: Sell High Buy Low (Duration: years)

– selling stocks on hold at high optimism with declining bullishness, waiting to buy low during the next global financial crisis.

Learn further on Investing Strategies for US Stock Markets.

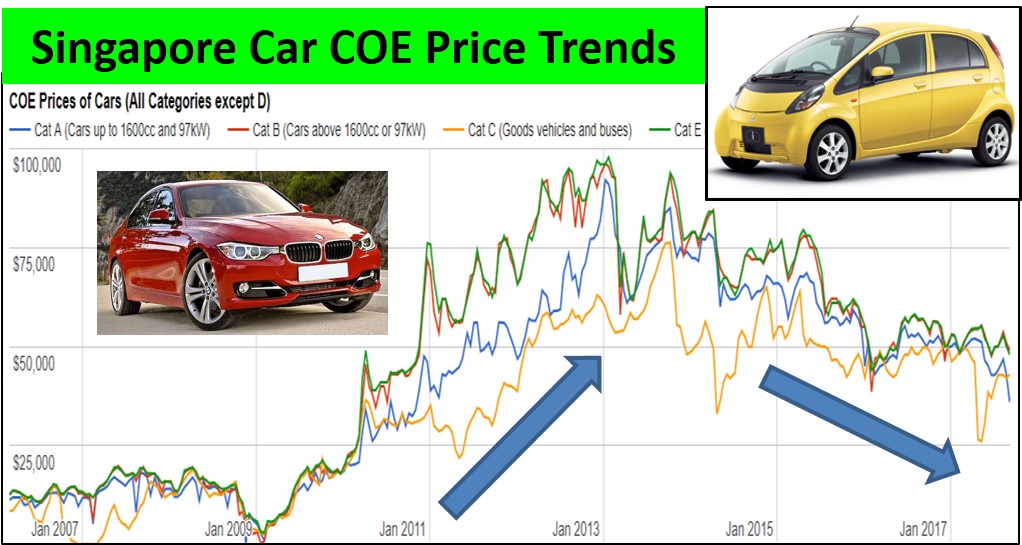

How to Buy Singapore Car COE at Abnormal Low Price for with Market Cycle Method?

Singapore car COE system is a unique way to regulate the number of cars on the road based on demand and supply of cars. Many Singaporeans hope to buy low for car COE as its price could contribute to about 50% of a new car price. Although car COE is not really an investment, its prices vary with stock market and economic cycle, together with human emotions of greed and fear, we could apply investment methods to buy low for car COE.

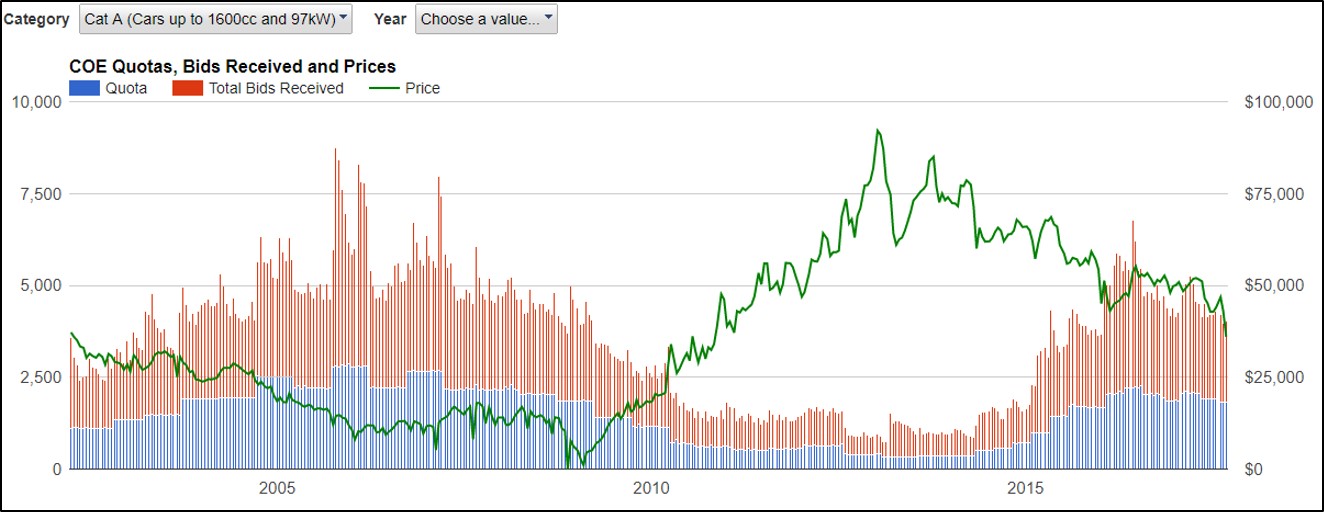

After dropping to historical low price during the global financial crisis in 2009, car COE was bullish till it reached the peak in Jan 2013. As a result of Singapore economy slowdown with low inflation rate, bearish property market and stagnant stock market, car COE has been bearish in price trends from year 2013 till now. The small car COE (Category A) has dropped from $92k to $36k (as of 6 Sep 2017), nearly 1/3 of the price (see 2 COE charts, source from coe.sgcharts.com).

COE prices usually follow Singapore economic cycle which affects the demand and supply of cars. The private hire cars (Grab & Uber) have disturbed the natural COE price cycle in the last few years, supporting the falling COE prices but prolonging the bearish period of COE prices. With oversupply of taxis and private hire cars currently, there is a significant drop in COE prices, especially for Category A, breaking the critical support of $40k, trending downwards, setting a 7-year low price.

In fact, it is possible to make money from changes in COE prices. Yearly car depreciation is about $12k (about $1k/month) for a new car of $120k. If buying car with COE at low optimism with uptrend (eg. year 2009-2010), it is possible to have $25k yearly capital gains in car COE alone, more than enough to offset the car with COE depreciation.

For those with older car and COE expiring soon, one strategy is to renew 5 or 10 years of COE (using last 3 months moving average of car COE price) first, waiting for the global financial crisis to come during this period, then deregister the old car with higher COE (get back the pro-rated high COE value for years remaining), buying a new car with COE at much lower price (eg. $10k or $20k lower). This is similar to a shorting strategy in stock investment but applying in car COE.

PARF value is the remaining car value (from car value + remaining years of COE) when one deregisters car. After 10 years, PARF value for small / medium sizes car could be around $10k (depending on type of car). If one renews only COE but keeping old car, this $10k PARF value will be lost. If 10 years COE is around $40k, adding the “lost” in PARF of $10k, total is around $50k, yearly depreciation is around $5k, still cheaper than $12k/year depreciation of a new car. One does not need to hold the old car for too long, when COE has chance to drop another $10k-$20k, lost in PARF for old car could be recovered easily when getting a new car at lower COE (deregister the old car with extended COE, get back the high COE price for years remaining). If COE price goes up, it is also a good deal to only pay for renewed COE, not price of a new car. This assumes the old car condition is still ok, able to operate for a few years without major issue (high maintenance cost), then worth the effort to renew COE and waiting for global financial crisis to change a new car in future.

Similar to stock market. we don’t predict the future of COE price. From probability point of view, COE is at downtrend for medium term, breaking the support of $40k for category A. At the same time, Singapore economy is recovering, therefore this downtrend may not drop to very low unless coupled with global financial crisis.

Is it time to enter to buy low for new car or bid for COE? Similar to investment, the decision has to match with personality and physical constraints. If a car driver has to renew COE soon, then the current intermediate price correction is a good opportunity to have some discount, especially for cars in Category A. However, the current 7-year low car COE price is still far from the low optimism target of car COE. If a driver is patient enough, willing to stop driving for a period of time, similar to waiting for investment opportunity, the next global financial crisis could help to create an abnormal low COE prices for entry.

A wise investor would know when to buy truly low for stocks, properties and even car with COE at abnormal low price by applying investment methods of Optimism + FA (Fundamental Analysis) + TA (Technical Analysis) + PA (Personal analysis).