Why certain people could have a more successful investment life than others? Why some stock traders / investors are more likely to make consistent profits? They have 3 key elements in a successful investment life:

Why certain people could have a more successful investment life than others? Why some stock traders / investors are more likely to make consistent profits? They have 3 key elements in a successful investment life:

Element #1 of Successful Investment Life: Following Proven Rules

Successful Life

=============

One could learn from past successful persons who did well in various areas: scholar, politician, teacher, parents, etc. Perseverance is required to follow the path towards the success because there could be obstacles along the way.

Successful Investment

===================

One could learn from successful traders / investors to apply high probability rules to make decisions: eg. what to buy, when to buy, when to sell. Consistency and compliance to the trading plans or investing strategies are key to success. There is no 100% sure-win method in investment, a positive-edge method would give positive return over the time but not everyone could accept a few minor falls to exchange for a bigger reward.

Element #2 of Successful Investment Life: Hardwork

Successful Life

=============

Any expert in any profession requires more than 5000 hours of intensive time spent to be skillful. A successful life requires lifelong hardwork. Hardwork is not the same as “Hardship”. Hardwork implies interest, energy and full dedication of one person’s time and resources into activities which could lead to one’s life missions.

Successful Investment

===================

A successful investor or trader requires step by step learning as well. There is no short cut in investment. However, it does not need to be complicated. When one starts the first step in journey of investment towards financial freedom, the rest of steps would be relatively easier, just following through with hardwork to improve the life through investment.

Element #3 of Successful Investment Life: Right Mindset

Successful Life

=============

A person may not be successful when choosing a set of life principles against one’s personality. Each of us has unique beliefs in lives, the formation of personality can be a lifelong process. A successful person would feel happier when have the right mindset, working hard and follow the principles of life set.

Successful Investment

===================

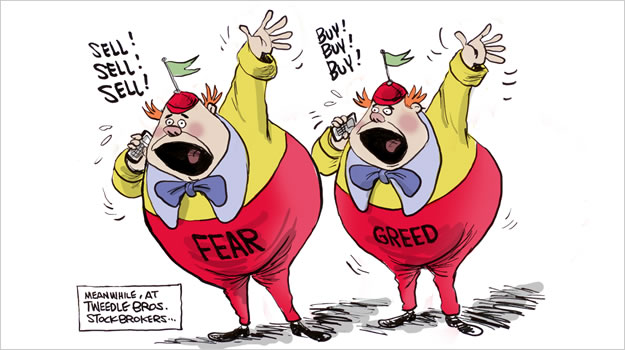

Some traders could not following investing rules because the risk tolerance level may be too much. Similarly, an investor may not follow trading rules to buy / sell every few weeks. Matching the personality with investment strategies, having the right mindset is crucial towards success in investment.

———————

There are many more similarities between life and investment. We learn from those successful cases, motivating us to have faith in following the principles in life or investment, despite the uncertainty in future for life & investment market, we could have a high probability of having a success investment life if having these positive habits.

Learn the keys to successful investment life from Dr Tee.

An investor has to be careful of stock market time bomb. S&P500 has to prove its recovery this week, breaking 2700 points will be a test of strength for US stock market. If this 2700 intermediate resistance could be broken, Asia stock market can only catch up next week after the Lunar New Year holidays.

An investor has to be careful of stock market time bomb. S&P500 has to prove its recovery this week, breaking 2700 points will be a test of strength for US stock market. If this 2700 intermediate resistance could be broken, Asia stock market can only catch up next week after the Lunar New Year holidays. I would like to wish Ein55 community, a Happy Lunar New Year of Dog, profiting in 2018 stock market. If you ask doggie, what is the outlook for Year of Dog 2018 Stock Market? The answer mostly likely is “Wang! Wang!” (旺旺 = “prosperous” in Chinese).

I would like to wish Ein55 community, a Happy Lunar New Year of Dog, profiting in 2018 stock market. If you ask doggie, what is the outlook for Year of Dog 2018 Stock Market? The answer mostly likely is “Wang! Wang!” (旺旺 = “prosperous” in Chinese).