4 Positions of Economy vs Stock Market

High Probability Investing with Optimism Strategies

Key Learning Points from Ein55 Graduate Gathering 2018 July

YangZiJiang Stock Review – Sample Ein55 Analysis

Jungle Book – Rules of Stock Market

When there is no Jungle Book (rules of stock market), 2 elephants are fighting (trade war between US and China), both would get injured (lose-lose) while observers (other countries including Singapore) will also get the splash. The best protection for weaker animals (retail traders or investors) may be to exit and hide in a safer place with precious asset, watching remotely waiting until the crisis is over to rebuild the jungle of global stock market.

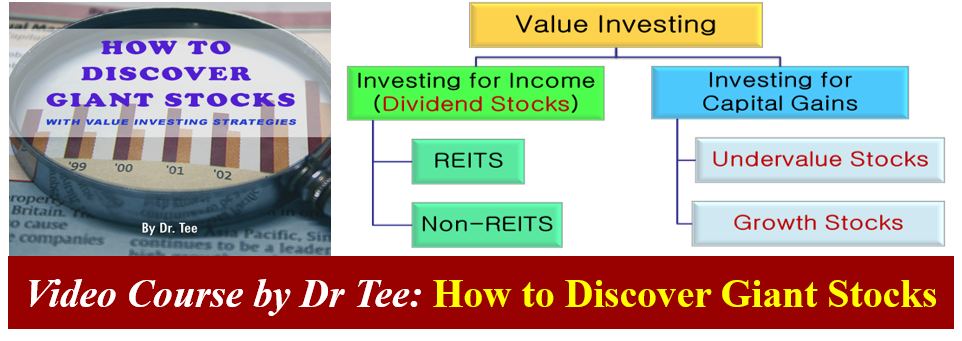

Online Investing Course by Dr Tee: How to Discover Giant Stocks with Value Investing Strategies

For the first time, Dr Tee has established a high quality online investing course (9 modules of videos over 2 hours) on How to Discover Giant Stocks with Value Investing Strategies. This is useful for both investors and traders to master the giant stocks to buy. The online investing course is hosted by investingnote, a permanent platform, meaning after signing up, the video course will be available for repeated viewing in future. You may also share this low cost educational program with family members (one payment for all to learn at own pace) who may have busy schedule or currently living overseas, learning useful stock investment knowledge remotely.

Currently there is a new launch special rate for Ein55 members (you may share this email with friends who can qualify the same rate), original online investing course fee is $100, currently selling at only $25 (75% Discount). This minimal course fee is helping the host to maintain the platform for online investing course, not driven by the profit. After the promotion period is over, course fee may be adjusted to original price.

Register Online Investing Course Here:

https://www.investingnote.com/store/products/discover-giant-stocks-value-investing-strategies

Step 1: Click Registration Link (Sign up for free investingnote account)

Step 2: Sign up Online Investing Course

$100 -> $25 (75% discount for Ein55 Members and friends)

Step 3: Learn 9 Modules Video Course

– Share with family. Permanent Video.

Step 4: Write Course Review

– Positive comments to encourage others

Online Investing Course Description

There are 2 main stock investing objectives: investing for income (dividends) and investing for capital gains, which we could achieve through a portfolio of global giant stocks with strong business fundamental. In this value investing course, Dr Tee will teach the powerful methods step by step, how to form a dream team stock portfolio with understanding of 3 financial statements and 11 critical fundamental criteria with practical applications in global stock screening.

Learning Points:

1) Master 3 Value Investing Strategies on What Giant Stocks to Buy:

– Growth Investing Strategy (Growth Stocks / Momentum Stocks)

– Undervalue Investing Strategy (Undervalue Property Stocks / Bank Stocks)

– Dividend Investing Strategy (REITs / non-REITs Dividend Stocks)

2) Apply Fundamental Analysis (FA) with 3 Key Financial Statements and 11 Critical FA Criteria to Identify Global Giant Stocks

– Income Statement

– Balance Sheet

– Cashflow Statement

3) Practical Demo on Global Giant Stock Screening

– Selection Criteria for Growth Stocks, Undervalue Stocks & Dividend Stocks

– Sample 100 Global Giant Stocks for Singapore, US, Hong Kong & Malaysia

– 5 Free Global Stock Screeners

After mastering What Stocks to Buy from this online investing course, learners may proceed to sign up for free stock investment courses by Dr Tee to master When to Buy / Sell with 10 Optimism Strategies, you could meet up with Dr Tee, coming earlier for bonus stock diagnosis. Content of online investing course ($25) and monthly 4hr meet-up course (free) are different, knowledge can be integrated into 10 different stock trading and investing strategies.

Amazing Wealth with Life-time Compounding Return in Stocks

Just read this touching news, a real life example of long term stock investing with compounding return, helping an accountant (Mr Loh) to accumulate S$20 millions in wealth when died at 89 years old. He may be a miser, spending little on himself but he is very generous to donate more than S$3 millions to charity organization.

This is the power of compounding return in stocks, assuming 50 years of investing (assuming this investor started investing only at 39 years old), here are return for different compounding rate, return for every $1 invested:

5% compounding: (1+0.05)^50 = $11

10% compounding: (1+0.1)^50 = $117

Even with only 5% growth rate (slow growth stocks), an investor could expand the wealth by 11 times by holding blue chip for long term. For moderate giant stocks with 10% return, the return is 117 times. There is no surprise then why Mr Loh could accumulate so much wealth unknowingly by others.

What impressed me is not his wealth but his “misery” on himself but generosity on others. Money is only useful when it is used when one is still alive. Money is not almighty but if we could become master of money, knowing the skills of both making money and spending money in the right ways, this will lead to a very meaningful life.

Start learning value investing for long term compounding return of wealth with giant stocks. The first step is 4 hours of time in learning in a free course by Dr Tee, what stocks for long term investing, when to buy / sell or holding for life. This is not a sales talk, you will learn solid investing knowledge with investment of your time.

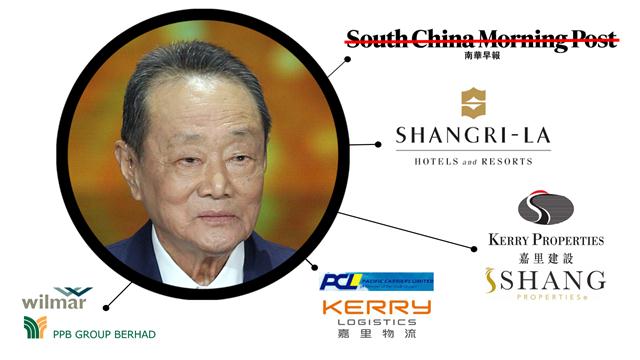

Robert Kuok Giant Stocks

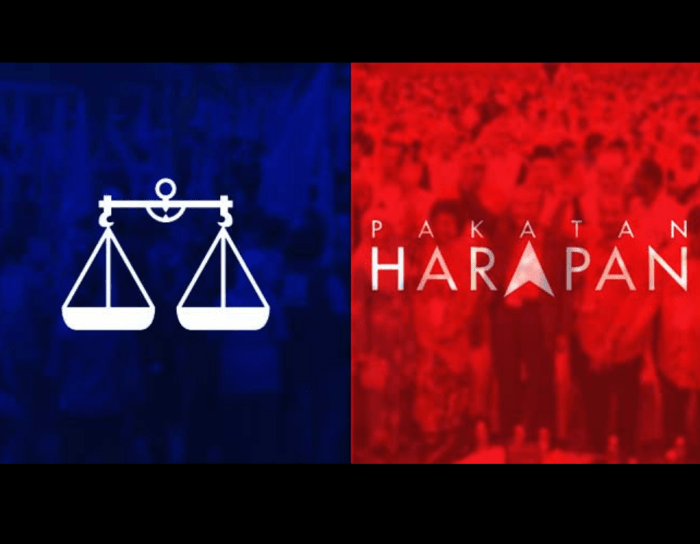

Stock Investment Lessons from Malaysia Election

Malaysia Political Cycle Investing

I stay till over 3am tonight (9 May 2018) so far, observing an important historical milestone in my home country, Malaysia: a dramatic change of federal government, from BN to PH. PH will also control 7 state governments (Perak is still uncertain).

Chinese believes in 60 years of cycle duration (5 x 12 = 60, 一甲子), it is about 60 years of BN ruling Malaysia since independence in 1957. 《三国演义》:“话说天下大势,分久必合,合久必分。From the wisdom of thousand years of Chinese history, we learn that when there is common interest, various groups could become friends, but one day, they will split due to internal conflicts again. It will take a long time before the next cycle to split begins, if the new PH government could use this historical opportunities to strengthen the foundation, it could continue to rule Malaysia for several decades.

How’s the impact on Malaysia future economy, stock investment, forex, etc? Short term market reaction so far is a weaker Ringgit vs USD because this is a major change in Malaysia. PH has announced 2 days of public holidays on May 10 and 11, not sure if Bursa stock market will follow the soon-to-be government to rest for 2 days. If yes, there could be some turbulence.

We don’t have to speculate which Malaysia stocks will rise or fall down. Instead, let the trading or investing opportunities come to us. Let the share prices stabilize for a few days after absorbing the market news. It is never too late to grab on investing opportunities in Malaysia.

In a longer term, if Malaysia is under a more efficient government, the economy and stock market will have higher growth potential but it will take at least 1 decade to see the results. PH is still an alliance of different parties, sometimes compromised decision may not be the best but as long as it is fair and transparent, the country could move in a positive uptrend direction again.

Optimism is also crucial for a political system. BN lost in this political tsunami, partly due to past few years of oil & gas crisis and weak ringgit, local people has been at low optimism in life, especially with the rising cost of living (eg. GST). PH may not be lucky as well because currently is Level 4 (global) high optimism, even if Malaysia stock is at moderate optimism, based on a 5 years political cycle for 1 term of government, it is not easy to achieve uptrend in stock market to show the results 5 years later. It is the same situation for Trump in US, who may try to sustain the high optimism US stock market till at least year 2020 as a report card to seek for his second term as US president.

There is no regret to witness a political cycle of a country. Sincerely hope Malaysia will become a better country, being a closer partner with Singapore. Learn about future stock investment opportunities in Malaysia, Singapore and the rest of the world with from Dr Tee free investment courses.