The Ein55 students have learned the details of Business Analysis Course #1 from Ein55 Mentor Kean Lim, understanding how to choose a giant stock with strong business fundamental with sound management. Here is the key summary:

Master 4 Steps of Business Analysis Course:

Step 1: Know the company core business:

- Business model

- Business history

- Business diversification

- Geographical presence

Step 2: Check whether the business has a durable competitive edge (economic moats)

- Intangible Assets – Brands, Patents or Licenses

- Consumers’ Switching Costs

- Cost Advantage – Process, Location or Unique Asset

- Efficient Scale

- Network Effect

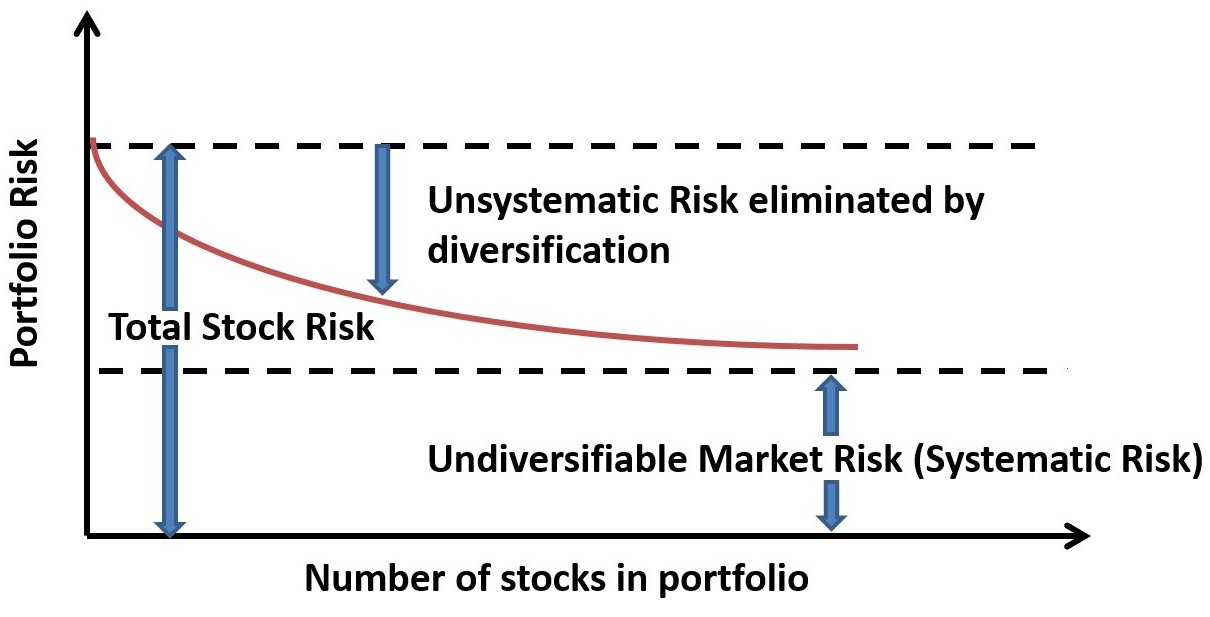

Step 3: Know the business risk and investment bear case

- Company Factors

- Industry Factors

- Valuation Factors

- Market Factors

Step 4: Know the company future growth drivers

(Price x Volume) – Costs = Operating Profit

- Higher Price

- Higher Volume

- Lower Cost

Investing in a company is akin to being in partnership with its business. It is therefore crucial for investors to possess the ability to analyse and make sense of the businesses of interest. The beauty of investment is that one can be selective to only invest in businesses that are profitable and therefore can bring about considerable capital gains in future.

Dr Tee provides free high-quality investment education regularly to the general public, including Business Analysis (BA), Fundamental Analysis (FA), Technical Analysis (TA), Optimism Analysis (OA) and Personal Analysis (PA). The knowledge could help a person for a lifetime, after mastering the right skills of stock investment. Register Here.