Hongkong Land (SGX: H78) is at 0% Optimism after falling in share prices over the past few years (especially over the past few months), very bearish (similar situation for other Jardine Group siblings of giant stocks – JMH, JSH, Jardine C&C, Dairy Farm, etc). Jardine Group of stocks are mainly suitable for contrarian investors (i.e. Warren Buffett styles) who only buy based on price below value, ignoring the falling knife of share prices.

There are 30 STI index component stocks including Hongkong Land (investor has to focus only on giant stocks for investing):

DBS Bank (SGX: D05), Singtel (SGX: Z74), OCBC Bank (SGX: O39), UOB Bank (SGX: U11), Wilmar International (SGX: F34), Jardine Matheson Holdings JMH (SGX: J36), Jardine Strategic Holdings JSH (SGX: J37), Thai Beverage (SGX: Y92), CapitaLand (SGX: C31), Ascendas Reit (SGX: A17U), Singapore Airlines (SGX: C6L), ST Engineering (SGX: S63), Keppel Corp (SGX: BN4), Singapore Exchange (SGX: S68), Hongkong Land (SGX: H78), Genting Singapore (SGX: G13), Mapletree Logistics Trust (SGX: M44U), Jardine Cycle & Carriage (SGX: C07), Mapletree Industrial Trust (SGX: ME8U), City Development (SGX: C09), CapitaLand Mall Trust (SGX: C38U), CapitaLand Commercial Trust (SGX: C61U), Mapletree Commercial Trust (SGX: N2IU), Dairy Farm International (SGX: D01), UOL (SGX: U14), Venture Corporation (SGX: V03), YZJ Shipbldg SGD (SGX: BS6), Sembcorp Industries (SGX: U96), SATS (SGX: S58), ComfortDelGro (SGX: C52).

Price to book ratio (PB) of Hongkong Land is around 0.26 based on my memory (presented in yesterday workshop), implying 74% discount of price below net asset value which mostly is property. This is the lowest PB or most undervalue stage of Hongkong Land history over the past 10+ years.

If one could buy a giant stock with 50% discount in high quality asset (property or cash), even the company go bankrupt immediately, still can make money as the person only pays for 50% of the value, could get at 70% of remaining asset when company go under liquidation.

Of course, Jardine Group with nearly 200 years of history may disappoint investor for not able to go bankrupt immediately (it is a game of patience), Hongkong Land buildings still stand firm despite Hong Kong protesters 1 year ago and current with Coronavirus or global stock market meltdown.

It is not easy to be a contrarian investor (Be greedy when others are fearful; Be fearful when others are greedy), one needs to have independent thinking (eg. many people point fingers at Warren Buffett for wrong move to buy airline stocks with falling in prices and businesses). Alternatively, one has to switch off all the channels (eg. social media, news, newspaper, etc) to prevent the noises. Investment journey is lonely, especially for this group of rare contrarian investors, only 5% of investors may have this personality.

Most investors are more suitable for trend-following trading or investing as it is human nature to investor making money, not making loss (even it may be for a limited period of time). Either contrarian investors or trend-following traders are fine, more importantly one needs to align with own personality, do not force oneself to copy another expert’s best method (eg. Warren Buffett styles), ending up regret for life as could not follow through.

There are 140 property & construction stocks in Singapore including Hongkong Land (47 of them are undervalue with PB<1):

3Cnergy (SGX: 502), A-Smart (SGX: BQC), AEI^ (SGX: AWG), AIMS Property (SGX: BVP), APAC Realty (SGX: CLN), Abterra (SGX: L5I), Acromec (SGX: 43F), Amara (SGX: A34), Amcorp Global (SGX: S9B), AnnAik (SGX: A52), Astaka (SGX: 42S), BBR (SGX: KJ5), BRC Asia (SGX: BEC), BlackGoldNatural (SGX: 41H), Boldtek (SGX: 5VI), Bonvests (SGX: B28), Boustead (SGX: F9D), Boustead Projects (SGX: AVM), Bukit Sembawang (SGX: B61), Bund Center (SGX: BTE), CSC (SGX: C06), CapitaLand (SGX: C31), Casa (SGX: C04), Chemical Industries (SGX: C05), China Great Land (SGX: D50), China International (SGX: BEH), China Real Estate (SGX: 5RA), China Yuanbang (SGX: BCD), Chip Eng Seng (SGX: C29), City Development (SGX: C09), DISA (SGX: 532), Debao Property (SGX: BTF), ETC Singapore (SGX: 1C0), Edition (SGX: 5HG), EnGro Corporation (SGX: S44), Fraser and Neave F&N (SGX: F99), Far East Orchard (SGX: O10), Figtree (SGX: 5F4), First Sponsor (SGX: ADN), Fragrance (SGX: F31), Frasers Property (SGX: TQ5), GYP Properties (SGX: AWS), Gallant Venture (SGX: 5IG), Golden Energy (SGX: AUE), Goodland (SGX: 5PC), GuocoLand (SGX: F17), HL Global Enterprises (SGX: AVX), Hatten Land (SGX: PH0), Heeton (SGX: 5DP), Hiap Hoe (SGX: 5JK), Hiap Seng (SGX: 510), Ho Bee Land (SGX: H13), Hock Lian Seng (SGX: J2T), Hong Fok (SGX: H30), Hong Lai Huat (SGX: CTO), Hong Leong Asia (SGX: H22), Hongkong Land USD (SGX: H78), Hor Kew (SGX: BBP), Huationg Global (SGX: 41B), Hwa Hong (SGX: H19), IPC Corp (SGX: AZA), ISOTeam (SGX: 5WF), Imperium Crown (SGX: 5HT), Jasper Investments (SGX: FQ7), KOP (SGX: 5I1), KSH (SGX: ER0), Keong Hong (SGX: 5TT), Keppel Corp (SGX: BN4), Keppel Reit (SGX: K71U), King Wan (SGX: 554), Koh Brothers (SGX: K75), Koon (SGX: 5DL), Kori (SGX: 5VC), LHN (SGX: 41O), Ley Choon (SGX: Q0X), Lian Beng (SGX: L03), Low Keng Huat (SGX: F1E), Lum Chang (SGX: L19), MMP Resources (SGX: F3V), MYP (SGX: F86), Metro (SGX: M01), OIO (SGX: KUX), OKH Global (SGX: S3N), OKP (SGX: 5CF), OneApex (SGX: 5SY), Oxley (SGX: 5UX), PSL (SGX: BLL), Pacific Century (SGX: P15), Pacific Star Development (SGX: 1C5), Pan Hong (SGX: P36), Pavillon (SGX: 596), Perennial Holdings (SGX: 40S), Pollux Properties (SGX: 5AE), PropNex (SGX: OYY), Raffles Infrastructure (SGX: LUY), Regal International (SGX: UV1), Renaissance United (SGX: I11), Rich Capital (SGX: 5G4), Roxy-Pacific (SGX: E8Z), Ryobi Kiso (SGX: BDN), SHS (SGX: 566), SLB Development (SGX: 1J0), SP Corporation (SGX: AWE), Sasseur Reit (SGX: CRPU), Second Chance (SGX: 528), Sin Heng Mach (SGX: BKA), Sinarmas Land (SGX: A26), SingHaiyi (SGX: 5H0), SingHoldings (SGX: 5IC), Singapore-eDev (SGX: 40V), Sinjia Land (SGX: 5HH), Soilbuild Construction Group (SGX: S7P), Starland (SGX: 5UA), Straits Trading (SGX: S20), Swee Hong (SGX: QF6), Sysma (SGX: 5UO), TA (SGX: PA3), TTJ (SGX: K1Q), Tai Sin Electric (SGX: 500), Thakral (SGX: AWI), Thomson Medical Group (SGX: A50), Tiong Seng (SGX: BFI), Top Global (SGX: BHO), Tosei (SGX: S2D), Transcorp (SGX: T19), Tritech (SGX: 5G9), UIC (SGX: U06), UOA (SGX: EH5), UOL (SGX: U14), USP Group (SGX: BRS), Vibrant Group (SGX: BIP), Wee Hur (SGX: E3B), Wing Tai (SGX: W05), Yanlord Land (SGX: Z25), Yeo Hiap Seng (SGX: Y03), Ying Li International (SGX: 5DM), Yoma Strategic (SGX: Z59), Yongmao (SGX: BKX), Yongnam (SGX: AXB), Yorkshine (SGX: MR8).

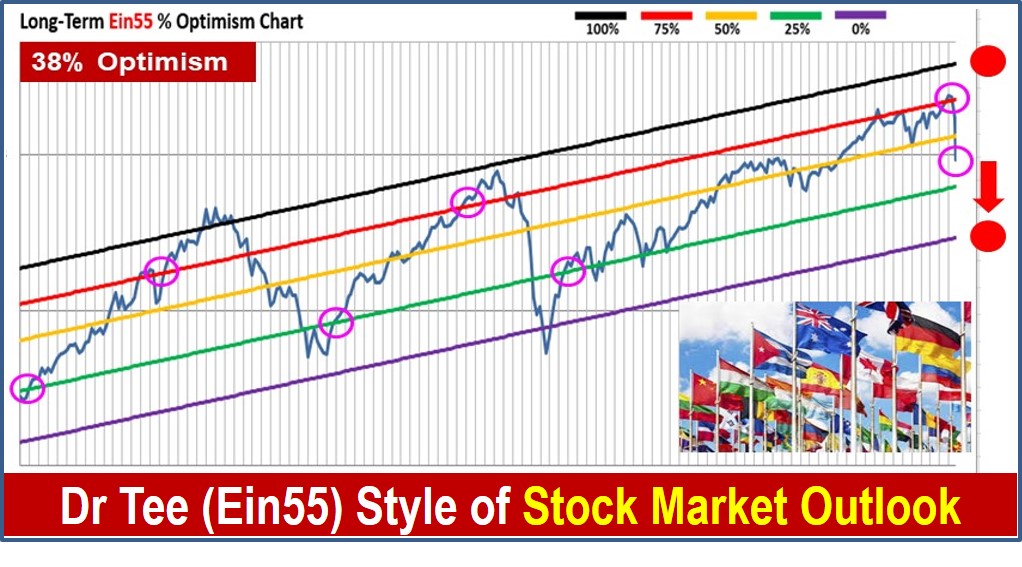

Learn from Dr Tee free 4hr investment course to apply 10 different strategies for 10 unique personalities for stock trading or investing, including contrarian investing and trend-following trading. Register Here: www.ein55.com

You are invited to join Dr Tee private investment forum (educational platform, no commercial is allowed) to learn more investment knowledge, interacting with over 9000 members:

https://www.facebook.com/groups/ein55forum/