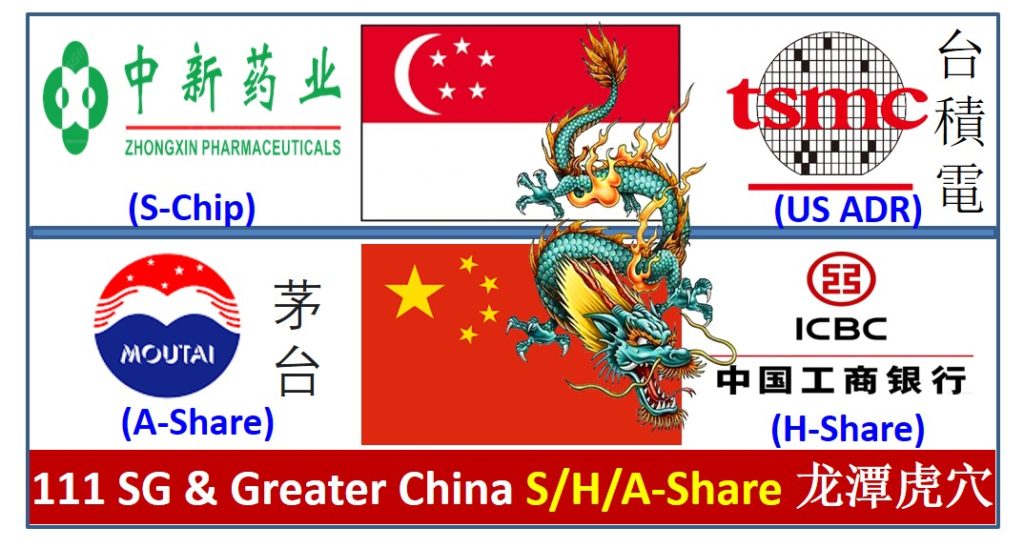

China is world No 2 economy, therefore there are many China business related stocks in the world (Singapore, China, Hong Kong, Taiwan, US). The quality of China related stocks could vary significantly, including 111 S-Chip stocks in Singapore with 20% weak stocks are suspended and also some strong China stocks could double the share price in a short period.

In this article, you will learn from Dr Tee on 4 China related Giant Stocks which are efficient in making money with strong business growth in Greater China market (China, Hong Kong, Taiwan). Bonus for readers who could read every words of the entire article, learning unique strategy for each giant stock.

1) Singapore All-Rounded Giant Stock (S-Chip / A-Share)

– Tianjin Zhongxin Pharmaceutical Group (SGX: T14 / China Shanghai: 600329, 天津中新药业)

2) China / Hong Kong Giant Bank Stock (H-Share / A-Share)

– Industrial And Commercial Bank Of China, ICBC (China Shanghai: 601398 / HKEX: 1398, 中國工商銀行)

3) China F&B Giant Stock (A-Share)

– Kweichow Moutai (China Shanghai: 600519, 貴州茅台酒)

4) Taiwan Technology Giant Stock (ADR)

– Taiwan Semiconductor Manufacturing, TSMC (Taiwan: 2330 / NYSE: TSM, 台積電)

After China joining WTO since 2001, it has opened up its door to the world, including many global stocks in different stock markets, eg. Singapore (S-Chip), China (A-Share), Hong Kong (H-Share), US (ADR), etc. Greater China market includes China, Hong Kong, Macao and Taiwan, which is a fast rising region, attracting global investors.

In fact, reputation of S-Chip (China business with stock listed in Singapore) is relatively low as 20% of these stocks (24 / 111 stocks) have been suspended as of now due to various reasons, including poor businesses, not following SGX codes of business practices, potential scandals, etc. This concern is also observed in global stock exchanges for other China related stocks in Hong Kong (H-Share) or even in US, eg. Luckin Coffee (NASDAQ: LK) with “excellent” financial report but proven was not reported truthfully. Greed could make a business choose shortcut to achieve the goal. So, a stock investor has to make an integrated analysis of China related stocks, taking calculated risks to ride the uptrend wave of businesses.

There are 111 S-chip or China related Stocks in Singapore, making money with businesses in Greater China (龙潭虎穴):

AnAn International (SGX: Y35), Anchun International Holdings (SGX: BTX), AnnAik Limited (SGX: A52), ARA LOGOS Logistics Trust (SGX: K2LU), BM Mobility (SGX: I9T), Bund Center Investment Ltd (SGX: BTE), CapitaLand Retail China Trust (SGX: AU8U), Chasen Holdings (SGX: 5NV), China Aviation Oil Singapore Corp (SGX: G92), China Environment (SGX: 5OU), China Everbright Water (SGX: U9E), China Fishery (SGX: B0Z), China Great Land (SGX: D50), China Haida (SGX: C92), China Hongxing Sports (SGX: BR9), China International Holdings (SGX: BEH), China Jishan Holdings (SGX: J18), China Mining (SGX: BHD), China Paper Holdings (SGX: C71), China Real Estate Group (SGX: 5RA), China Sky Chem (SGX: E90), China Sports (SGX: FQ8), China Yuanbang Property Holdings (SGX: BCD), China Kangda Food Company (SGX: P74), China Kunda Technology Holdings (SGX: GU5), , Combine Will International Holdings (SGX: N0Z), COSCO Shipping International Singapore (SGX: F83), Courage Investment Group (SGX: CIN), Darco Water Technologies (SGX: BLR), Debao Property Development (SGX: BTF), Dukang Distillers Holdings (SGX: BKV), Dutech Holdings (SGX: CZ4), Emerging Towns & Cities Singapore (SGX: 1C0), Fabchem China (SGX: BFT), First Sponsor Group (SGX: ADN), Full Apex (SGX: BTY), Fuxing China Group (SGX: AWK), Global Invacom Group (SGX: QS9), Green Build Technology (SGX: Y06), Guoan International (SGX: G11), Healthway Medical Cor (SGX: 5NG), Hi-P International (SGX: H17), Hutchison Port Holdings Trust SGD (SGX: P7VU), Hutchison Port Holdings Trust USD (SGX: NS8U), Hu An Cable Holdings (SGX: KI3), Hyflux Limited (SGX: 600), IEV Holdings (SGX: 5TN), Japfa Limited (SGX: UD2), Jason Marine Group (SGX: 5PF), JES International Holdings (SGX: EG0), Jiutian Chemical Group (SGX: C8R), Joyas International Holdings (SGX: E9L), KOP Limited (SGX: 5I1), LCT Holdings (SGX: BJL), Leader Environmental Technologies Limited (SGX: LS9), Lion Asiapac Limited (SGX: BAZ), Luzhou Bio-chem Technology Limited (SGX: L46), Mapletree North Asia Commercial Trust (SGX: RW0U), Memstar Technology (SGX: 5MS), Mercurius Capital Investment (SGX: 5RF), Midas Holdings (SGX: 5EN), Mirach Energy Limited (SGX: AWO), MMP Resources Ltd (SGX: F3V), Malaysia Smelting Corp (SGX: NPW), Natural Cool Holdings (SGX: 5IF), Net Pacific Financial Holdings (SGX: 5QY), Nordic Group (SGX: MR7), Ouhua Energy Holdings (SGX: AJ2), Pacific Andes Resources Development (SGX: P11), Pacific Century Regional Developments (SGX: P15), Pan Hong Holdings Group (SGX: P36), PEC Limited (SGX: IX2), Plastoform Holdings (SGX: AYD), Raffles Infrastructure Holdings (SGX: LUY), Sapphire Corp (SGX: BRD), SBI Offshore Limited (SGX: 5PL), SembCorp Industries Limited (SGX: U96), Shanghai Turbo Enterprises (SGX: AWM), Shangri-La Asia Limited (SGX: S07), SIIC Environment Holdings (SGX: BHK), Sinarmas Land Limited (SGX: A26), Sincap group (SGX: 5UN), Sing Holdings (SGX: 5IC), Sinjia Land Limited (SGX: 5HH), Sino Grandness Food Industry Group (SGX: T4B), Sinopipe Holdings (SGX: X06), Sinostar PEC Holdings (SGX: C9Q), Starland Holdings (SGX: 5UA), Straco Corporation (SGX: S85), Sunpower Group (SGX: 5GD), Suntar Eco City (SGX: BKZ), SunVic Chemical Holdings (SGX: A7S), Swing Media Technology Group (SGX: BEV), Thakral Corporation (SGX: AWI), Tianjin Zhongxin Pharmaceutical Group (SGX: T14), Tiong Seng Holdings (SGX: BFI), United Food Holdings (SGX: AZR), USP Group Limited (SGX: BRS), Valuetronics Holdings (SGX: BN2), Willas-Array Electronics Holdings (SGX: BDR), Wilmar International (SGX: F34), World Precision Machinery (SGX: B49), Yamada Green Resources (SGX: BJV), Yanlord Land Group (SGX: Z25), Yongmao Holdings (SGX: BKX), Yunnan Energy International (SGX: T43), Yangzijiang Shipbuilding YZJ CNY (SGX: SO7), Yangzijiang Shipbuilding YZJ SGD (SGX: BS6), Zhongmin Baihui Retail Group (SGX: 5SR).

From the table sorted below for 111 China related stocks in Singapore, only half are profitable (62 / 11 stocks were making money in businesses last year). Therefore, careful choices of giant China stocks are critical, some are at lower optimism share prices due to either stock market fear or actual business is affected during COVID-19 pandemic.

Most China related stocks in Singapore don’t pay dividend (only 41 / 11 stocks pay dividend). Even if they do, for example, Hutchison Port Holdings Trust (SGX: P7VU / NS8U) with over 9% dividend yield, are not good dividend stocks (despite backed by Li Ka-shing, Hong Kong richest man) due to weaker business fundamental.

Many S-Chip stocks (81 / 11) have Price-to-Book ratio ($ / NAV = PB) < 1 with discount over asset but majority do not have high quality asset related to cash or properties. “Buy Low” may get lower in share prices, a common mistake by beginner investor to buy a stock cheaply (eg. at historical low price) without considering the business fundamental and economic moat.

For most local and global China related stocks, main strategy would be cyclic investing or swing trading, therefore understanding of business and stock market cycle is much more important than undervalue price or dividend payment.

| No | Name | Code | ROE (%) | Dividend Yield (%) | PB = Price /NAV |

| 1 | Alibaba Pictures Group | S91 | – | – | 1.80 |

| 2 | AnAn International | Y35 | – | – | 1.23 |

| 3 | Anchun International Holdings | BTX | 3.94 | 10.5 | 0.04 |

| 4 | AnnAik Limited | A52 | 3.34 | 4.7 | 0.31 |

| 5 | ARA LOGOS Logistics Trust | K2LU | – | 8.8 | 1.07 |

| 6 | BM Mobility | I9T | – | – | 4.38 |

| 7 | Bund Center Investment Ltd | BTE | 6.35 | 1.9 | 0.94 |

| 8 | CapitaLand Retail China Trust | AU8U | 8.83 | 8.3 | 0.72 |

| 9 | Chasen Holdings | 5NV | – | – | 0.39 |

| 10 | China Aviation Oil Singapore Corp | G92 | 11.96 | 5.1 | 0.70 |

| 11 | China Environment | 5OU | – | – | 0.36 |

| 12 | China Everbright Water | U9E | 9.46 | 6.0 | 0.39 |

| 13 | China Fishery | B0Z | 5.13 | – | 0.15 |

| 14 | China Great Land | D50 | – | – | -0.19 |

| 15 | China Haida | C92 | – | – | 0.05 |

| 16 | China Hongxing Sports | BR9 | – | – | -383.33 |

| 17 | China International Holdings | BEH | 5.61 | – | 0.32 |

| 18 | China Jishan Holdings | J18 | – | – | 1.81 |

| 19 | China Mining | BHD | – | – | 0.41 |

| 20 | China Paper Holdings | C71 | 3.24 | – | 0.13 |

| 21 | China Real Estate Group | 5RA | – | – | 0.77 |

| 22 | China Sky Chem | E90 | – | – | 0.06 |

| 23 | China Sports | FQ8 | – | – | 0.13 |

| 24 | China Yuanbang Property Holdings | BCD | 5.99 | – | 0.09 |

| 25 | China Kangda Food Company | P74 | 0.68 | – | 0.19 |

| 26 | China Kunda Technology Holdings | GU5 | – | – | 1.20 |

| 27 | China Sunsine Chemical Holdings | QES | 15.182 | 3 | 0.6385 |

| 28 | Combine Will International Holdings | N0Z | 8.11 | 5.051 | 0.26 |

| 29 | COSCO Shipping International Singapore | F83 | 1.38 | – | 0.77 |

| 30 | Courage Investment Group | CIN | 0.41 | – | 0.18 |

| 31 | Darco Water Technologies | BLR | – | – | 0.29 |

| 32 | Debao Property Development | BTF | – | – | 0.10 |

| 33 | Dukang Distillers Holdings | BKV | – | – | 0.03 |

| 34 | Dutech Holdings | CZ4 | 7.98 | 3.9 | 0.45 |

| 35 | Emerging Towns & Cities Singapore | 1C0 | 5.76 | – | 0.19 |

| 36 | Fabchem China | BFT | – | – | 0.23 |

| 37 | First Sponsor Group | ADN | 10.43 | 1.851 | 0.78 |

| 38 | Full Apex | BTY | – | – | 0.08 |

| 39 | Fuxing China Group | AWK | – | – | 0.10 |

| 40 | Global Invacom Group | QS9 | – | – | 0.39 |

| 41 | Green Build Technology | Y06 | – | – | 0.30 |

| 42 | Guoan International | G11 | – | – | 2.24 |

| 43 | Healthway Medical Cor | 5NG | – | – | 0.79 |

| 44 | Hi-P International | H17 | 13.51 | 2.473 | 1.47 |

| 45 | Hutchison Port Holdings Trust SGD | P7VU | 2.04 | 9.294 | 0.39 |

| 46 | Hutchison Port Holdings Trust USD | NS8U | 2.04 | 9.403 | 0.40 |

| 47 | Hu An Cable Holdings | KI3 | – | – | 0.78 |

| 48 | Hyflux Limited | 600 | – | – | -0.16 |

| 49 | IEV Holdings | 5TN | 14.10 | – | 5.28 |

| 50 | Japfa Limited | UD2 | 13.62 | 1.479 | 0.90 |

| 51 | Jason Marine Group | 5PF | 8.80 | 3.497 | 0.60 |

| 52 | JES International Holdings | EG0 | -44.12 | – | -2.77 |

| 53 | Jiutian Chemical Group | C8R | – | – | 1.28 |

| 54 | Joyas International Holdings | E9L | – | – | 3.75 |

| 55 | KOP Limited | 5I1 | – | – | 0.36 |

| 56 | LCT Holdings | BJL | 1.00 | – | 0.68 |

| 57 | Leader Environmental Technologies Limited | LS9 | – | – | 4.27 |

| 58 | Lion Asiapac Limited | BAZ | 0.75 | – | 0.41 |

| 59 | Luzhou Bio-chem Technology Limited | L46 | – | – | -0.75 |

| 60 | Mapletree North Asia Commercial Trust | RW0U | 2.62 | 7.688 | 0.66 |

| 61 | Memstar Technology | 5MS | – | – | -1.67 |

| 62 | Mercurius Capital Investment | 5RF | – | – | 6.25 |

| 63 | Midas Holdings | 5EN | – | – | -7.71 |

| 64 | Mirach Energy Limited | AWO | 52.17 | – | 0.18 |

| 65 | MMP Resources Ltd | F3V | – | – | -0.48 |

| 66 | Malaysia Smelting Corp | NPW | 9.01 | 2.532 | 0.90 |

| 67 | Natural Cool Holdings | 5IF | – | – | 0.60 |

| 68 | Net Pacific Financial Holdings | 5QY | – | – | 0.59 |

| 69 | Nordic Group | MR7 | 9.87 | 4.06 | 0.95 |

| 70 | Ouhua Energy Holdings | AJ2 | 7.48 | – | 0.27 |

| 71 | Pacific Andes Resources Development | P11 | 8.47 | – | 0.09 |

| 72 | Pacific Century Regional Developments | P15 | 2.97 | 8.63 | 0.81 |

| 73 | Pan Hong Holdings Group | P36 | 15.44 | 3.722 | 0.37 |

| 74 | PEC Limited | IX2 | – | 1.25 | 0.56 |

| 75 | Plastoform Holdings | AYD | – | – | -0.34 |

| 76 | Raffles Infrastructure Holdings | LUY | 15.32 | – | 0.87 |

| 77 | Sapphire Corp | BRD | 4.55 | – | 0.22 |

| 78 | SBI Offshore Limited | 5PL | – | – | 0.55 |

| 79 | SembCorp Industries Limited | U96 | 3.07 | 3.786 | 0.41 |

| 80 | Shanghai Turbo Enterprises | AWM | – | – | 1.81 |

| 81 | Shangri-La Asia Limited | S07 | 2.46 | 1.218 | 0.54 |

| 82 | SIIC Environment Holdings | BHK | 7.19 | 5.495 | 0.28 |

| 83 | Sinarmas Land Limited | A26 | 15.14 | 2.332 | 0.25 |

| 84 | Sincap group | 5UN | 1.03 | – | 0.04 |

| 85 | Sing Holdings | 5IC | 15.35 | 4.868 | 0.51 |

| 86 | Sinjia Land Limited | 5HH | – | – | 0.58 |

| 87 | Sino Grandness Food Industry Group | T4B | 6.35 | – | 0.03 |

| 88 | Sinopipe Holdings | X06 | – | – | -31.71 |

| 89 | Sinostar PEC Holdings | C9Q | 13.64 | – | 0.52 |

| 90 | Starland Holdings | 5UA | 1.05 | 30 | 0.60 |

| 91 | Straco Corporation | S85 | 13.21 | 5.057 | 1.62 |

| 92 | Sunpower Group | 5GD | 7.96 | 0.476 | 1.07 |

| 93 | Suntar Eco City | BKZ | 0.03 | – | 2.47 |

| 94 | SunVic Chemical Holdings | A7S | 24.63 | – | 0.13 |

| 95 | Swing Media Technology Group | BEV | 4.76 | – | 0.09 |

| 96 | Thakral Corporation | AWI | 6.71 | 9.524 | 0.39 |

| 97 | Tianjin Zhongxin Pharmaceutical Group | T14 | 11.61 | 5.373 | 0.79 |

| 98 | Tiong Seng Holdings | BFI | 3.99 | 3.596 | 0.24 |

| 99 | United Food Holdings | AZR | – | – | 0.13 |

| 100 | USP Group Limited | BRS | – | – | 0.25 |

| 101 | Valuetronics Holdings | BN2 | 14.53 | 6.48 | 1.08 |

| 102 | Willas-Array Electronics Holdings | BDR | – | – | 0.31 |

| 103 | Wilmar International | F34 | 7.72 | 2.839 | 1.22 |

| 104 | World Precision Machinery | B49 | 1.85 | 5.364 | 0.34 |

| 105 | Yamada Green Resources | BJV | 2.25 | – | 0.99 |

| 106 | Yanlord Land Group | Z25 | 11.86 | 6.018 | 0.39 |

| 107 | Yongmao Holdings | BKX | 7.68 | 0.283 | 0.40 |

| 108 | Yunnan Energy International | T43 | – | – | 0.91 |

| 109 | Yangzijiang Shipbuilding YZJ CNY | SO7 | 9.99 | 4.414 | 0.66 |

| 110 | Yangzijiang Shipbuilding YZJ SGD | BS6 | 9.99 | 4.612 | 0.62 |

| 111 | Zhongmin Baihui Retail Group | 5SR | 28.57 | 4.84 | 2.86 |

Due to globalization, most of the 30 STI component stocks have significant businesses in Greater China market (eg. Wilmar, Hongkong Land, etc), although they are not commonly labelled as S-Chip (such as Yangzijiang Shipbuilding, YZJ):

DBS Bank (SGX: D05), Singtel (SGX: Z74), OCBC Bank (SGX: O39), UOB Bank (SGX: U11), Wilmar International (SGX: F34), Jardine Matheson Holdings JMH (SGX: J36), Jardine Strategic Holdings JSH (SGX: J37), Thai Beverage (SGX: Y92), CapitaLand (SGX: C31), Ascendas Reit (SGX: A17U), Singapore Airlines (SGX: C6L), ST Engineering (SGX: S63), Keppel Corp (SGX: BN4), Singapore Exchange (SGX: S68), HongkongLand (SGX: H78), Genting Singapore (SGX: G13), Mapletree Logistics Trust (SGX: M44U), Jardine Cycle & Carriage (SGX: C07), Mapletree Industrial Trust (SGX: ME8U), City Development (SGX: C09) , CapitaLand Mall Trust (SGX: C38U), CapitaLand Commercial Trust (SGX: C61U), Mapletree Commercial Trust (SGX: N2IU), Dairy Farm International (SGX: D01), UOL (SGX: U14), Venture Corporation (SGX: V03), YZJ Shipbldg SGD (SGX: BS6), Sembcorp Industries (SGX: U96), SATS (SGX: S58), ComfortDelGro (SGX: C52).

An investor has to be selective in investing as some China related stocks in Singapore are weak (buy low may get lower in share price due to weak business, especially in a bearish stock market), despite some may have a beautiful Chinese name or belong to a promising China market but the competition is too intense, only giant China stocks could be profitable in longer term.

Here, let’s focus on 4 China related giant stocks in 4 different stock exchanges (Singapore, Hong Kong / China, Taiwan / US).

1) Singapore All-Rounded Giant Stock (S-Chip / A-Share)

– Tianjin Zhongxin Pharmaceutical Group (SGX: T14 / China Shanghai: 600329, 天津中新药业)

Despite Tianjin Zhongxin is much smaller than other pharmaceutical companies in China, it is a little giant stock. It is an all-rounded stock with many unique characteristic, eg cyclic, growth, dividend and even undervalue. This implies an investor or a trader would have more options but need to choose the right strategy aligning with own personality.

The stock is currently as lower optimism level, possible for long term cyclic investing to Buy Low but requires years of holding power before could sell high, supporting by steady business growth, even during COVID-19 pandemic. The company also distributes high dividend (about 5% dividend yield), suitable for holding but weakness is cyclic share prices may result in losses for shorter term traders, therefore trend-following strategy may be considered. The stock is listed in both Singapore (S-Chip) and China Shanghai (A-Share) with some differences in short term prices due to different market responses (eg. China stock market is relatively more bullish than Singapore stock market over the past 1 year).

Tianjin Zhongxin is a giant Singapore / China healthcare stock, much stronger than most of other 37 Singapore healthcare stocks in Singapore:

Accrelist Ltd (SGX: QZG), Alliance Healthcare (SGX: MIJ), Aoxin Q & M Dental (SGX: 1D4), Asia Vets Holdings (SGX: 5RE), AsiaMedic (SGX: 505), Asian Healthcare Specialists (SGX: 1J3), Beverly JCG (SGX: VFP), Biolidics (SGX: 8YY), Cordlife (SGX: P8A), First Reit (SGX: AW9U), Haw Par Corporation (SGX: H02), HC Surgical Specialists (SGX: 1B1), Healthway Medical Corporation (SGX: 5NG), Hyphens Pharma International (SGX: 1J5), IHH Healthcare (SGX: Q0F), ISEC Healthcare (SGX: 40T), IX Biopharma (SGX: 42C), Lonza Group (SGX: O6Z), Medinex (SGX: OTX), Medtecs International Corporation (SGX: 546), OUE Lippo Healthcare (SGX: 5WA), ParkwayLife Reit (SGX: C2PU), Pharmesis International (SGX: BFK), Q&M Dental Group (SGX: QC7), QT Vascular (SGX: 5I0), Raffles Medical Group (SGX: BSL), RHT Health Trust (SGX: RF1U), Riverstone Holdings (SGX: AP4), SingMedical Group (SGX: 5OT), Suntar Eco-City (SGX: BKZ), TalkMed (SGX: 5G3), Thomson Medical Group (SGX: A50), Tianjin Zhong Xin Pharmaceutical Group (SGX: T14), Top Glove Corporation (SGX: BVA), Trendlines Group (SGX: 42T), UG Healthcare Corporation (SGX: 41A), Vicplas International (SGX: 569).

2) China / Hong Kong Giant Bank Stock (H-Share/A-Share)

– Industrial And Commercial Bank Of China, ICBC (China Shanghai: 601398 / HKEX: 1398, 中國工商銀行)

ICBC is the world largest bank based on asset size, listed in both China Shanghai (A-Share) and Hong Kong (H-Share). It has steady business performance but the growth is limited over the past few years (transition from growth to mature company). It has attracted support of global funds including Temasek of Singapore as a major shareholder (8.4%).

The share price is at long term and medium term low optimism, could be considered for cyclic investing with Buy Low Sell High strategy but current bearish short term prices (sharp falling knife) could result in losses for a trader. In addition, the stock pays consistent dividend in the past, currently dividend yield is about 7%, reasonable for passive income investor.

ICBC is a giant China / Hong Kong bank stock, much stronger than most of 30 Singapore Banking & Finance stocks in Singapore:

AMTD IB OV (SGX: HKB), B&M Hldg (SGX: CJN), DBS Bank (SGX: D05), Edition (SGX: 5HG), G K Goh (SGX: G41), Global Investment (SGX: B73), Great Eastern (SGX: G07), Hong Leong Finance (SGX: S41), Hotung Investment (SGX: BLS), IFAST Corporation (SGX: AIY), IFS Capital (SGX: I49), Intraco (SGX: I06), Maxi-Cash Finance (SGX: 5UF), MoneyMax Finance (SGX: 5WJ), Net Pacific Finance (SGX: 5QY), OCBC Bank (SGX: O39), Pacific Century (SGX: P15), Prudential USD (SGX: K6S), Singapore Exchange (SGX: S68), SHS (SGX: 566), Sing Investments & Finance (SGX: S35), Singapore Reinsurance (SGX: S49), Singapura Finance (SGX: S23), TIH (SGX: T55), Uni-Asia Group (SGX: CHJ), UOB Bank (SGX: U11), UOB-KAY HIAN HOLDINGS (SGX: U10), UOI (SGX: U13), ValueMax (SGX: T6I), Vibrant Group (SGX: BIP).

3) China F&B Giant Stock (A-Share)

– Kweichow Moutai (China Shanghai: 600519, 貴州茅台酒)

Kweichow Moutai is a famous Chinese liquor stock, also the largest in the world, surpassing Diageo (LSE: DGE) since 2017, mainly supported by high growth share prices. Competitor, Wuliangye Yibin (Shenzhen: 000858, 宜宾五粮液), is also an alternative stock investment option, having strong business fundamental but growth is relatively slower than Moutai.

Moutai is a strong growth stock in long term and also a strong momentum stock in short term. So, either an investor or a trader may apply “Buy & Hold” strategy, with timeframe following own personality. The brand is a strong intangible asset for the company.

The liquor industry could be cyclic in longer time especially when there is any major change in China government policy, eg. about 10 years, due to anti-corruption campaign (eg. consumption or giving high price liquor as gift could be a common practice for decades), growth of Moutai Wuliangye was slow but start to gain momentum over the past few years. In a longer term, premium alcoholic beverages of Moutai and Wuliangye would have sustainable growth, supported by rising middle class population in China with stable growing economy.

Kweichow Moutai and Wuliangye Yibin are giant China F&B stocks, much stronger than most of 48 Singapore F&B stocks in Singapore:

Abterra (SGX: L5I), Acma (SGX: AYV), Amara Holdings (SGX: A34), Bonvests Holdings (SGX: B28), ChasWood Resources (SGX: 5TW), China Fishery (SGX: B0Z), China Kangda Food (SGX: P74), Dairy Farm International (SGX: D01), Del Monte Pacific (SGX: D03), Delfi (SGX: P34), Dukang (SGX: BKV), Envictus (SGX: BQD), Food Empire Holdings (SGX: F03), Fraser and Neave F&N (SGX: F99), Hosen Group (SGX: 5EV), Japan Foods Holding (SGX: 5OI), Japfa (SGX: UD2), JB Foods (SGX: BEW), Jumbo Group (SGX: 42R), Katrina Group (SGX: 1A0), Khong Guan (SGX: K03), Kimly (SGX: 1D0), Koufu (SGX: VL6), Luzhou Bio-Chem (SGX: L46), Mewah International (SGX: MV4), Neo (SGX: 5UJ), No Signboard Holdings (SGX: 1G6), Old Chang Kee (SGX: 5ML), OneApex (SGX: 5SY), Pacific Andes (SGX: P11), Pavillon (SGX: 596), QAF (SGX: Q01), Sakae (SGX: 5DO), SATS (SGX: S58), Sheng Siong (SGX: OV8), Shopper360 (SGX: 1F0), Sino Grandness (SGX: T4B), Soup Restaurant (SGX: 5KI), ST Group Food (SGX: DRX), SunMoon Food (SGX: AAJ), Thai Beverage (SGX: Y92), Tung Lok Restaurants (SGX: 540), United Food (SGX: AZR), Wilmar International (SGX: F34), Yamada Green Resources (SGX: BJV), Yeo Hiap Seng (SGX: Y03), Zhongxin Fruit (SGX: 5EG).

4) Taiwan Technology Giant Stock (ADR)

– Taiwan Semiconductor Manufacturing, TSMC (Taiwan: 2330 / NYSE: TSM, 台積電)

Taiwan is one of “4 Small Dragons” in Asia (South Korea, Taiwan, Singapore and Hong Kong), also a strong technology hub, especially for semiconductor industry leading by TSMC, world largest IC chip manufacturing company. TSMC is very advanced in IC technology development, currently the only player for 5nm technology, far ahead of competitor, Samsung. With rising demand for 5G and internet related applications globally, TSMC has a monopoly of such advanced IC technology, able to sustain the growth with profits over the next decade.

TSMC is a strong growth investing stock and strong momentum stock, share price is doubled over the past few months, riding the wave of uptrend semiconductor industry and unique position as world semiconductor leader. The long term optimism level of TSMC is relatively high, more suitable for short term position trading to “Buy & Hold” with trend-following strategy, supported by strong business growth.

TSMC is a giant Taiwan technology stock, much stronger than most of 53 Electronics stocks and 28 IT stocks, total 81 Technology Stocks in Singapore:

AEM Holdings (SGX: AWX), Accrelist Limited (SGX: QZG), Acma Limited (SGX: AYV), Adventus Holdings (SGX: 5EF), Allied Technologies Limited (SGX: A13), Amplefield Limited (SGX: AOF), Avi Tech Electronics (SGX: BKY), Ban Leong Technologies (SGX: B26), CDW Holding (SGX: BXE), CFM Holdings (SGX: 5EB), CPH Limited (SGX: 539), Chuan Hup Holdings (SGX: C33), Creative Technology (SGX: C76), Datapulse Technology (SGX: BKW), Dragon Group International (SGX: MT1), Dutech Holdings (SGX: CZ4), Ellipsiz Limited (SGX: BIX), Excelpoint Technology (SGX: BDF), Frencken Group (SGX: E28), Global Invacom Group (SGX: QS9), GP Industries (SGX: G20), Global Testing Corporation (SGX: AYN), Grand Venture Technology (SGX: JLB), HGH Holdings (SGX: 5GZ), Hu An Cable Holdings (SGX: KI3), JEP Holdings (SGX: 1J4), Jadason Enterprises (SGX: J03), Karin Technology Holdings (SGX: K29), Libra Group (SGX: 5TR), Manufacturing Integration Technology (SGX: M11), Maruwa Yen1k (SGX: M12), MeGroup Limited (SGX: SJY), Micro-Mechanics Holdings (SGX: 5DD), Plastoform Holdings (SGX: AYD), Polaris Limited (SGX: 5BI), Powermatic Data Systems (SGX: BCY), Renaissance United (SGX: I11), SEVAK Limited (SGX: BAI), SUTL Enterprise (SGX: BHU), Serial System (SGX: S69), Shinvest Holding (SGX: BJW), Sunright Limited (SGX: S71), Sunrise Shares Holdings (SGX: 581), TT International (SGX: T09), Thakral Corporation (SGX: AWI), The Place Holdings (SGX: E27), Trek 2000 International (SGX: 5AB), Valuetronics Holdings (SGX: BN2), Venture Corporation (SGX: V03), Willas-Array Electronics Holdings (SGX: BDR), World Precision Machinery (SGX: B49). Alpha Energy Holdings (SGX: 5TS), Alset International (SGX: 40V), Artivision Technologies (SGX: 5NK), Asiatravel.com Holdings (SGX: 5AM), A-Smart Holdings (SGX: BQC), Azeus Systems Holdings (SGX: BBW), Boustead Singapore Limited (SGX: F9D), Captii (SGX: AWV), Challenger Technologies (SGX: 573), CSE Global (SGX: 544), DISA (SGX: 532), International Press Softcom (SGX: 571), ISDN Holdings (SGX: I07), Keppel DC Reit (SGX: AJBU), Koyo International (SGX: 5OC), M Development (SGX: N14), Mapletree Industrial Trust (SGX: ME8U), New Silkroutes Group (SGX: BMT), New Wave Holdings (SGX: 5FX), PEC (SGX: IX2), Plato Capital (SGX: YYN), Procurri Corporation (SGX: BVQ), Rich Capital Holdings (SGX: 5G4), Silverlake Axis (SGX: 5CP), SinoCloud Group (SGX: 5EK), Stratech Group (SGX: BRR), Synagie Corp (SGX: V2Y), YuuZoo Networks Group Corp (SGX: AFC).

===================================

Both China (Oct 1) and Taiwan (Oct 10) celebrate respective national days in the month of October, moon is the roundest on 1 Oct 2020 (Mid-Autumn Festival), implying peaceful political world could share the fortune but requiring investing in giant stocks. Both Big and 4 Small Dragons (including Singapore) are global economic growth engines, in transition from manufacturing to higher value technology development.

===================================

There are over 1500 giant stocks in the world based on Dr Tee criteria, choice of 10 Dream Team giant stocks have to align with one’s unique personality, eg. for shorter term trading (eg. momentum or swing trading) or longer term investing (cyclic investing, undervalue investing or growth investing). Readers should not just “copy and paste” any stock (What to Buy, When to Buy/Sell) as successful action taking requires deeper consideration (LOFTP strategies – Level / Optimism / Fundamental / Technical / Personal Analysis) which you could learn further from Dr Tee Free 4-hr Webinar.

Drop by Dr Tee free 4hr webinar (learning at comfort of home with Zoom) to learn how to position in global giant stocks during COVID-19 stock crisis with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Zoom will be started 30 min before event, bonus talk (Q&A on any investment topics from readers) for early birds. There are many topics we will cover in this 4hr webinar, Dr Tee can have more time for Q&A if you could stay later after the webinar.

Dr Tee will cover over 20 case studies, Singapore giant stocks, eg. CapitaLand Mall Trust (SGX: C38U), Singapore Exchange (SGX: S68), Keppel Corp (SGX: BN4), Top Glove (SGX: BVA), Jardine Matheson Holdings JMH (SGX: J36), Vicom (SGX: WJP) and many others, Malaysia giant stocks, Hong Kong giant stocks and US giant stocks, both long term investing and short term trading.

There are limited tickets left for this 4hr free webinar, please ensure 100% you could join when register: www.ein55.com